May 2025

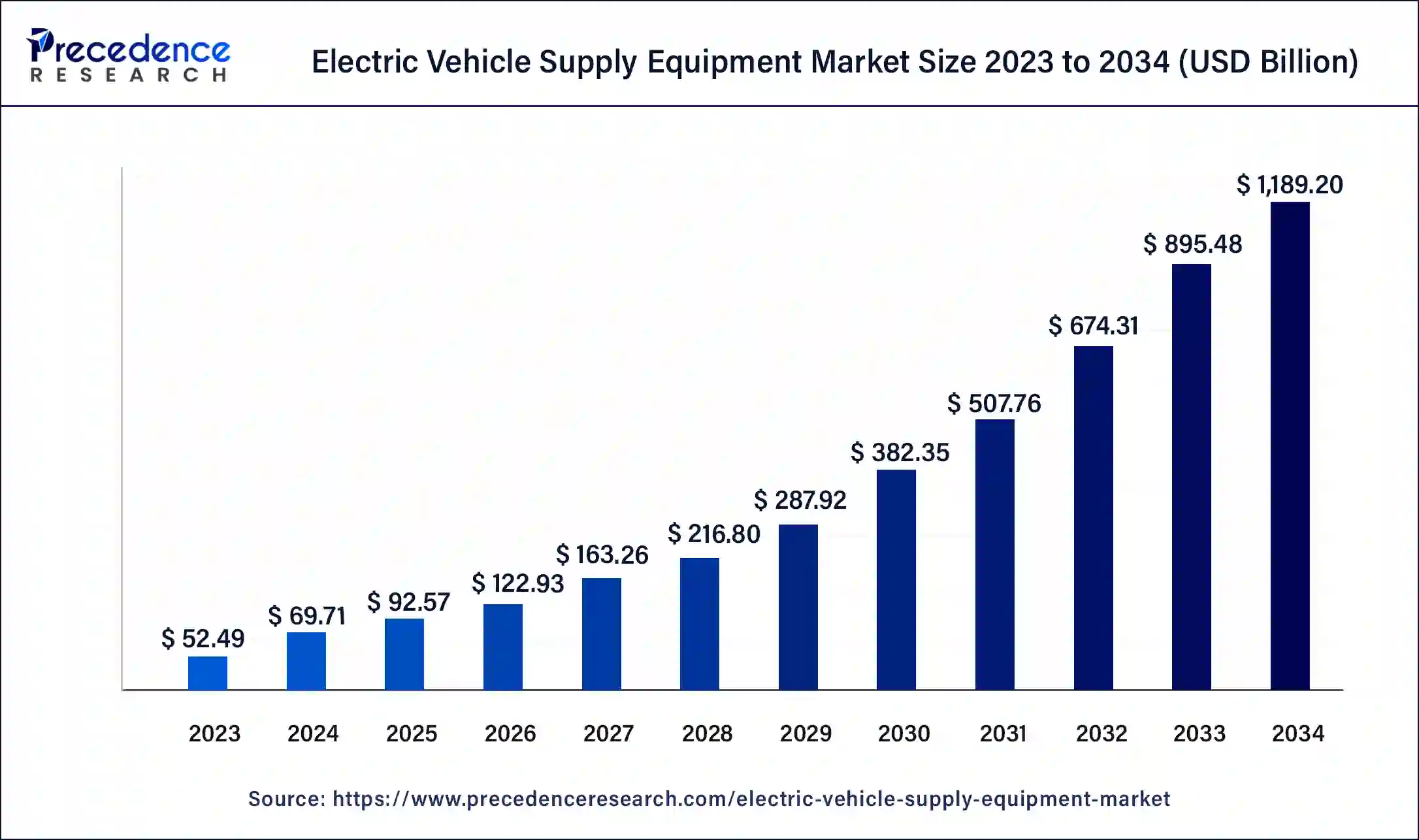

The global electric vehicle supply equipment market size accounted for USD 52.49 billion in 2023, calculated at USD 69.71 billion in 2024 and is expected to reach around USD 1,189.20 billion by 2034, expanding at a CAGR of 32.8% from 2024 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The electric vehicle supply equipment market size was recorded at USD 69.71 billion in 2024 and is expected to reach around USD 1,189.20 billion by 2034, expanding at a CAGR of 32.8% from 2024 to 2034.

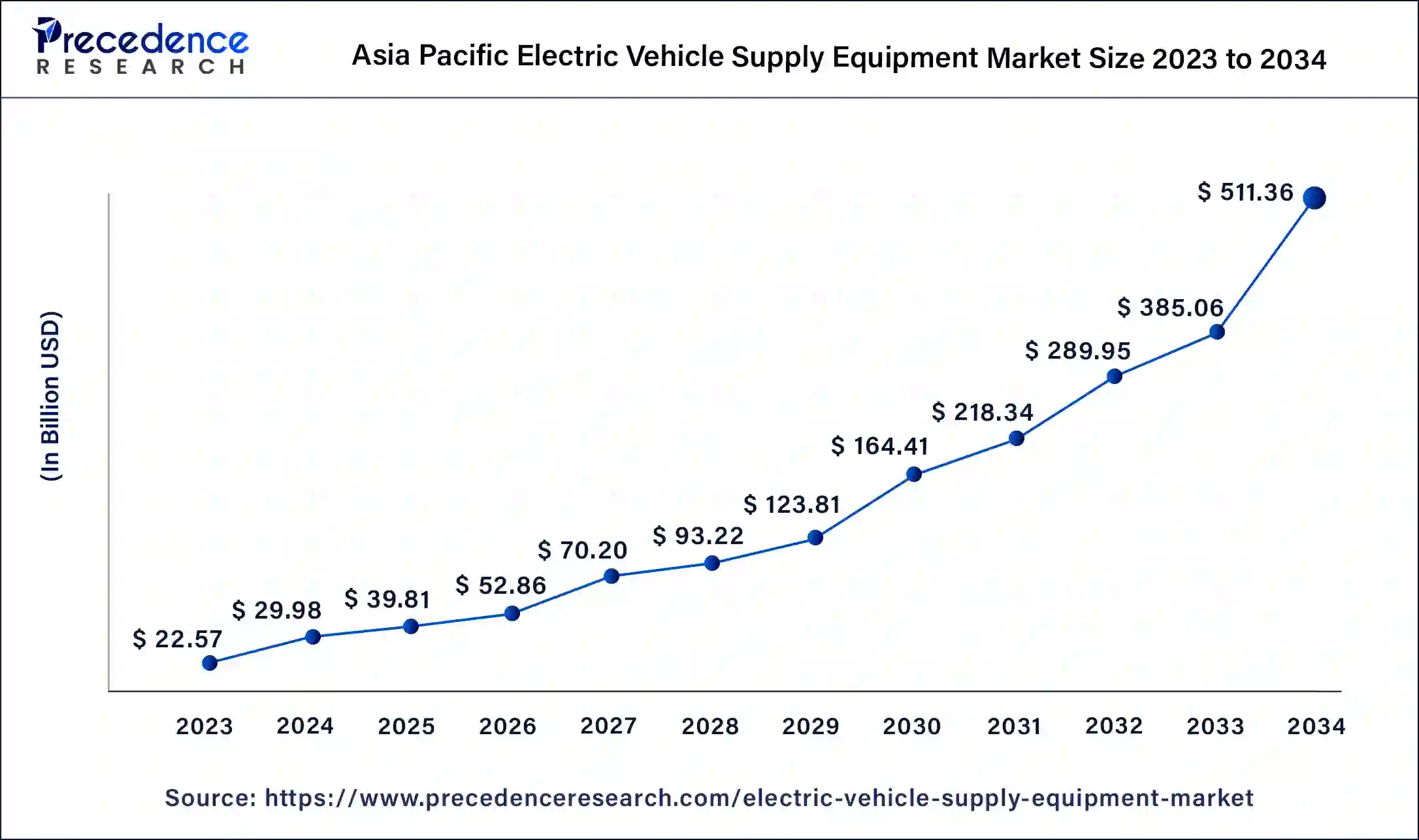

The Asia Pacific electric vehicle supply equipment market size was estimated at USD 22.57 billion in 2023 and is predicted to be worth around USD 511.36 billion by 2034, at a CAGR of 33% from 2024 to 2034.

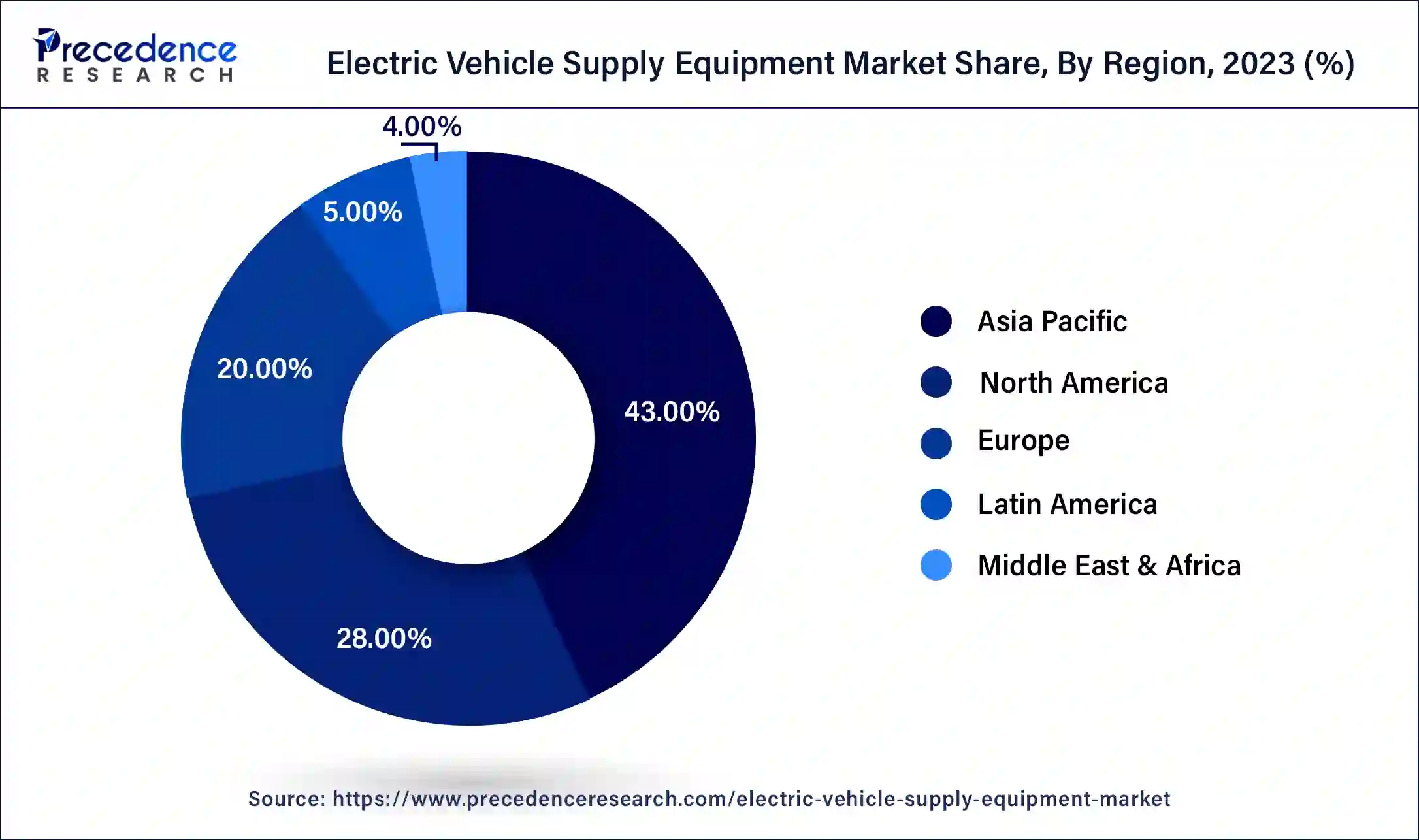

Based on region the electric vehicle supply equipment market is segmented into North America, Asia Pacific, Europe, Latin America, and MEAN.

The Asia Pacific emerged as the leader in the global electric vehicle supply equipment market capturing more than 43% of revenue share in the year 2023 and predicted to grow at a prominent rate during the upcoming years. Increasing adoption of electric vehicles across various Asian countries such as Japan, China, Australia, India, and many others is one of the most supporting factors that trigger the market growth in the region. For instance, the government of China planned to convert its mobility into green mobility by the end of year 2030. Besides this, the government of other countries such as Japan and South Korea are investing significantly for the installation of electric vehicle charging infrastructure. This results in the prominent growth of electric vehicle supply equipment market over the analysis time frame.

With the rising concern for environment protection along with alarming rate of rise in pollution primarily from the passenger vehicles have promoted the adoption of electric vehicles across various countries in the world, this in turn, anticipated to drive the market growth for global electric vehicle supply equipment over the upcoming years.

In support of the rising adoption of electric vehicles, various public transport agencies that include GöteborgEnergi of Sweden, the Warsaw Public Transport Authority of Poland, and GVB of the Netherlands focus largely on signing collaboration agreement with different bus manufacturers such as AB Volvo, VDL Bus & Coach, and Mercedes Benz in order to develop charging stations for buses. Besides this, government of various countries are also investing significantly for the fast development of charging stations. For example, in June 2019,MIEJSKI ZAKÅAD KOMUNIKACJI SP. Z O.O. W KUTNIE signed a contract with Ekoenergetyka - Polska S.A. for installing 20 fast-charging stations for electric buses across the city of Warsaw, Germany.

In addition, several hotel management companies are also collaborating with electric vehicle supply equipment (EVSE) players for the deployment of electric vehicle charging stations for their guests. For instance, Tesla Inc. had deployed over 3,137 electric vehicle charging stations for various hotels that were owned by Marriot International, Inc.

On the other hand, sudden outbreak of COVID-19 in the early 2020 has disrupted the operation of various industries including automotive industry. Slow sales growth in the automotive sector has also impacted the market for electric vehicles and thus a steep decline has been registered in the growth of electric vehicle supply equipment in the year 2020. However, the market expected to grow gradually during the upcoming years owing to rising preference for green mobility solutions across the world.

| Report Highlights | Details |

| Market Size in 2023 | USD 52.49 Billion |

| Market Size in 2024 | USD 69.71 Billion |

| Market Size by 2034 | USD 1,189.20 Billion |

| Growth Rate from 2024 and 2034 | CAGR of 32.8% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Charging Station, Application, Power |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, South America |

On the basis of application, the commercial segment led the global electric vehicle supply equipment market in terms of revenue in the year 2024 and exhibits gradual growth during the forecast time period. This is mainly because of favorable government initiatives that include the Norway to Italy Electric Highway, Trans-Canada highway project, and West Coast Electric Highway (WCEH), and many others.

Based on product, the EV charging kiosk segment dominated the global electric vehicle supply equipment market in the year 2024 owing to increasing demand for self-service charging stations such as advanced, interactive and intelligent kiosks for EV charging. Moreover, technological advancement in the charging kiosks for example integration of Near Field Communication (NFC) and Radio-Frequency Identification (RFID) in the electric vehicle supply equipment has enhanced and upgraded the performance of digital payments for customers using EV charging infrastructure.

The onboard charging stations witness the fastest growth in the global electric vehicle supply equipment market over the upcoming years owing toincreasing emphasis of various government bodies of different countries on long-term contracts for the development, operation, installation, and maintenance of onboard charging stations. Further, their increasing demand in lift trucks as they cover long distances estimated to proliferate the market growth.

By charging station type, normal charging dominated the global electric vehicle supply equipment market with a share of more than 50% in the year 2024 and anticipated to rise at a significant rate during the forthcoming years. This is mainly attributed to the increasing installation of public charging station across various cities some of them include Melbourne, Amsterdam, and Beijing.

However, inductive charging segment exhibit the fastest growth during the forecast period because of increasing research & development activities for wireless charging technologies. In addition, increasing adoption of ridesharing, driverless, and electric vehicles are expected to flourish the growth of inductive charging technology during the upcoming time frame.

By Power Type

By Product

By Charging Station Type

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

May 2025

January 2025

September 2024