October 2024

Electronic Adhesives Market (By Resin Type: Epoxy, Acrylics, Polyurethane, Silicone, Others; By Form: Liquid, Paste, Solid; By Application: Conformal Coatings, Surface Mounting, Encapsulation, Wire Tacking, Others; By End-user Industry: Consumer Electronics, IT Hardware, Automotive, Medical, Aerospace & Defense, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

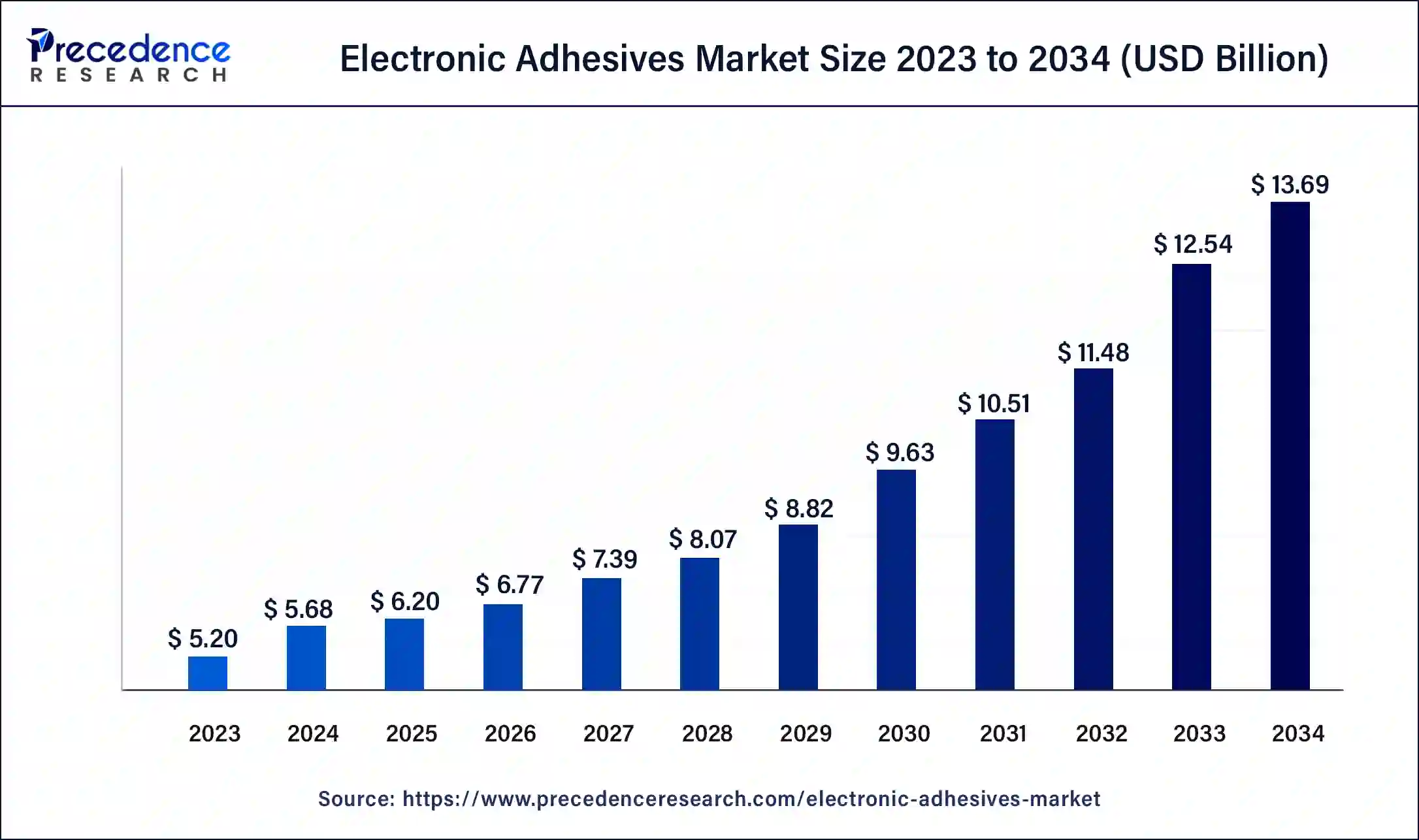

The global electronic adhesives market size was USD 5.20 billion in 2023, accounted for USD 5.68 billion in 2024, and is expected to reach around USD 13.69 billion by 2034, expanding at a CAGR of 9.2% from 2024 to 2034.

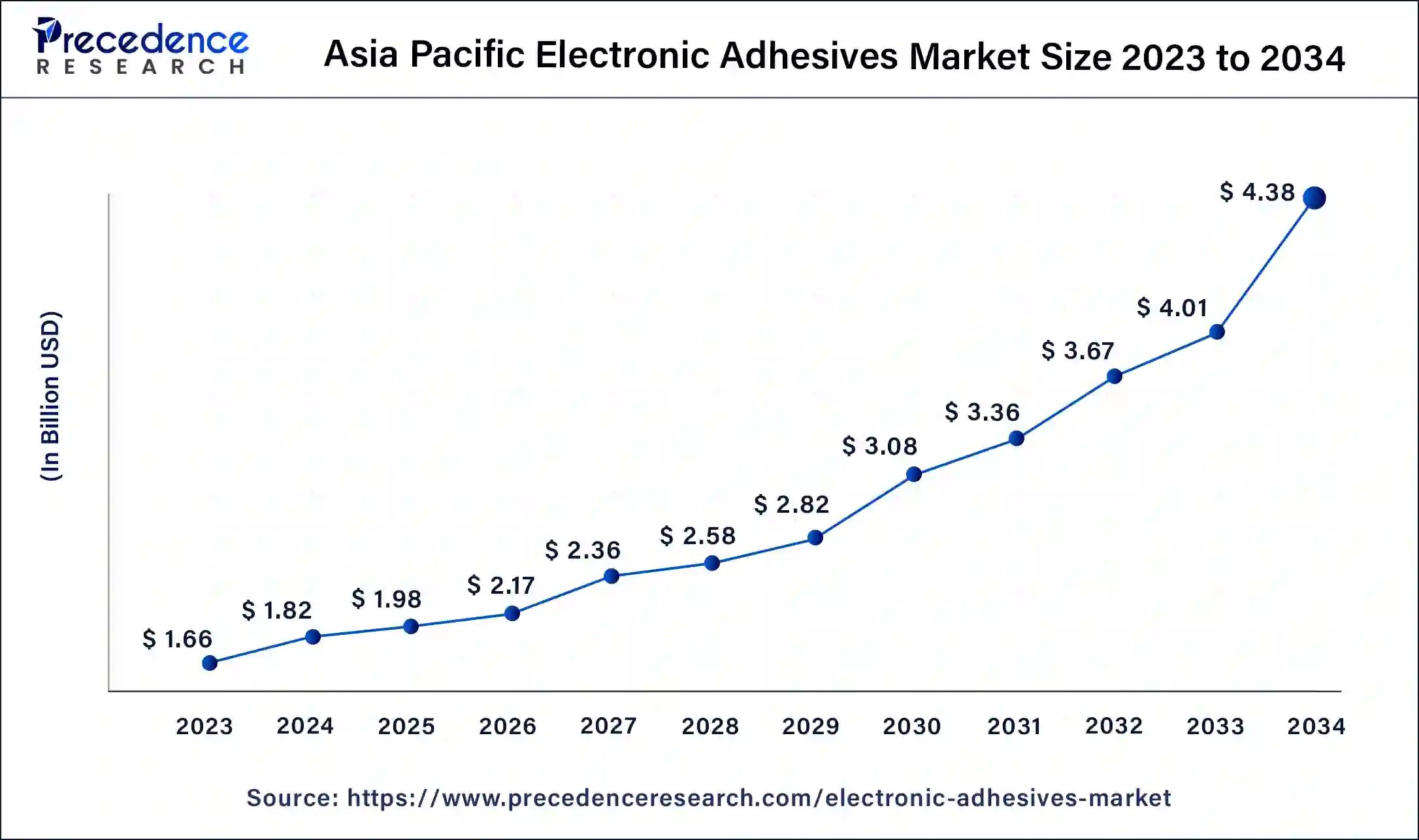

The Asia Pacific electronic adhesives market size was estimated at USD 1.66 billion in 2023 and is predicted to be worth around USD 4.38 billion by 2034, at a CAGR of 9.2% from 2024 to 2034.

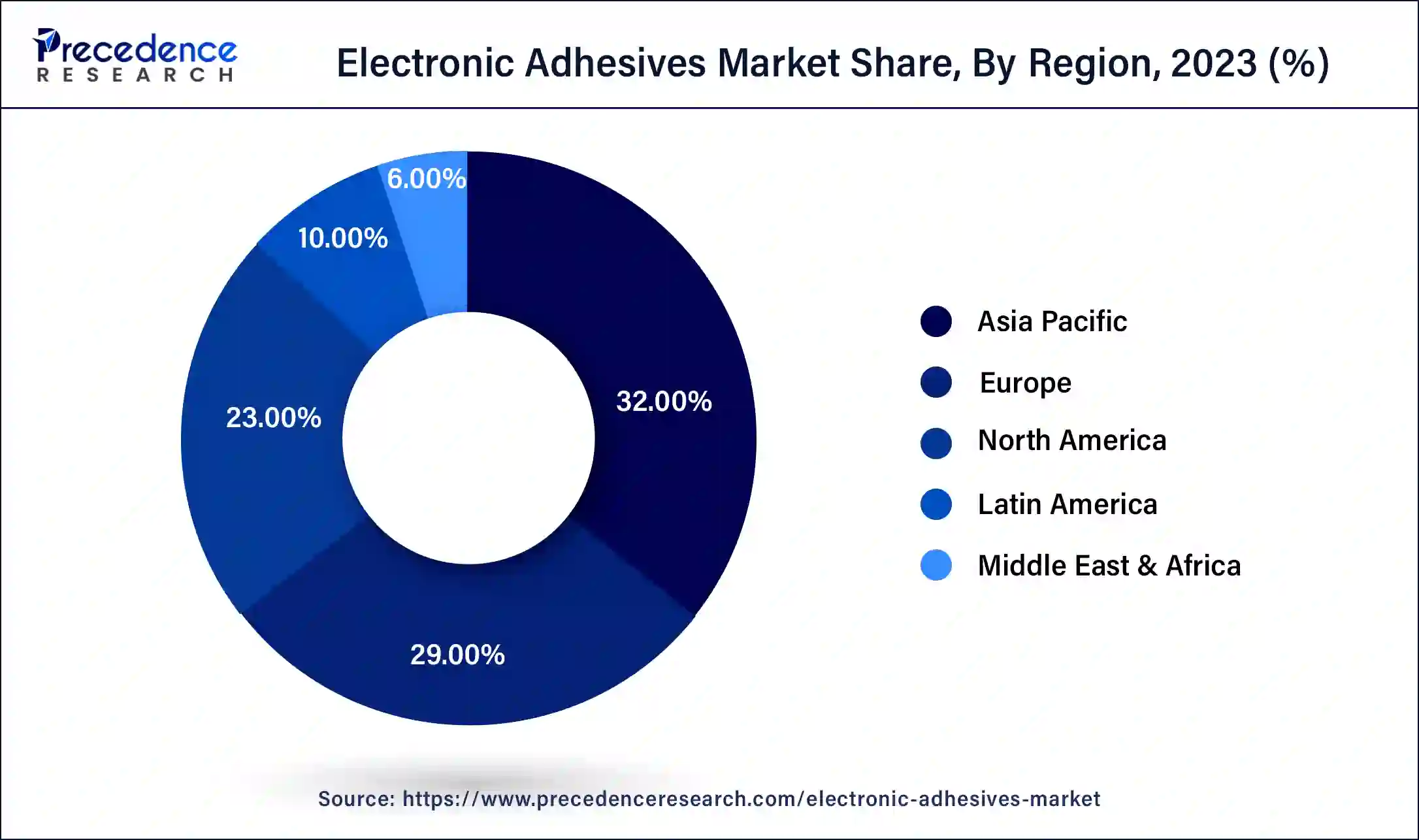

Asia Pacific dominated the electronic adhesives market in 2023. This is because China, Japan, and Taiwan have a rising demand for electronic products. China is home to some of the best producers of electronic adhesives, like Shanghai Hansi, Briture, Shenzhen Jinhua, DeepMaterial, and many more. These companies are leading in the production of electronic adhesives to be used in diverse technical fields, which include aerospace, automotive, construction, and insulation. They ensure that high-quality glues are delivered, which can be used in a wide range of electronic goods, including LED strips, etc. Taiwan, too, is a holder of a large share of electronic adhesives manufacturers, with prominent key players like Dymax, Hitachi Chemical Co, 3M Company, Dow Chemicals Company, etc.

North America is the fastest-growing region in the electronic adhesives market. It contributed a large revenue share, and in particular, the U.S. has contributed largely to the revenue share in North America. There is a rising need for electronic goods. Advancements in technology are happening at a rapid pace because of research and development. There is constant innovation in the electronics industry, and the electric vehicle market is on a boom. There is a high demand for smart devices, and this will take the electronic adhesives market in a positive direction.

Electronic devices have become an extremely important part of our lives. In almost every household, at least one electronic device is used. These devices have several small parts that need to be bonded together to ensure that they are safe to operate. Adhesives used for bonding electronic parts are called electronic adhesives. They help in proper bonding and heat dissipation in the device and are manufactured to possess qualities of high-temperature resistance and conductivity. Electronic adhesives also offer thermal and electrical conductivity to the device.

Electronic adhesives with good thermal conductivity help in dispensing heat and prevent the device from overheating. Heat sinks collect the excess heat of the device. When heat is dispensed properly, a device works at optimal temperature and gets a long life. Electrical conductivity in the electronic adhesives ensures that there is a free flow of electric energy in the device.

Electric adhesives are made of silver or nickel to increase electrical conductivity. Silver-based adhesives have the best electrical conductivity but come at exorbitant prices. Graphite also shows excellent electrical conductivity, and hence, graphite-based electronic adhesives offer an economical solution.

Some devices also come in contact with water or moisture, and hence, it becomes important that the bonds created are waterproof and moisture-proof. Poor moisture resistance can lead to current leakage, corrosion, or short circuits. A good moisture resistance protects the device from all these hazards and increases its life. Additionally, the adhesives also have a good resistance against chemical exposure. Some devices tend to heat up during usage. Hence, adhesives also need to have a high heat resistance.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 9.07% |

| Global Market Size in 2023 | USD 5.20 Billion |

| Global Market Size in 2024 | USD 5.68 Billion |

| Global Market Size by 2034 | USD 13.69 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Resin Type, By Form, By Application, and By End-user Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased production and usage of electronic devices

Increased production and usage of electronic devices will positively impact the electronic adhesives market. With a rise in consumerism and developed technology, people prefer high-quality mobile phones, laptops, headphones, and other electronic devices. These devices need their body parts to be bonded properly using high-quality adhesives. The devices are getting smaller and smaller every day. Who knew that a computer could ever fit into our pockets? Compact devices are also being added with many functions.

The electronic adhesives market offers high bond strength while bonding components that are extremely sensitive. This also needs to be done while ensuring that the performance of the device is not hampered. For instance, in a mobile phone or a laptop, certain parts, like a USB portal, are open to the atmosphere and face moisture and humidity. Despite that, it does not lower the performance. This is because of the high quality of electronic adhesives used in these devices. We also find that sometimes, despite the phone getting heated, we don’t see the adhesives melting. This is because the adhesives have a high heat tolerance.

Concerns associated with the quality of adhesives

Poor quality electronic adhesives can hinder the growth of the electronic adhesives market. They can lead to substandard devices. Raw materials of certain adhesives, like metal-based adhesives, have fluctuating costs. Hence, it also becomes difficult to extract profits. These adhesives, when applied to sensitive parts, require extreme care and precision. Irrespective of the quality of the adhesive, if it is not applied properly, the device might not perform at the best level.

Application in automotive industry

The electronic adhesives market will witness new opportunities in several different fields of electronics. Electronics are highly used in automobiles. With a rise in the production of electric vehicles, the sales of electronic adhesives will keep increasing. Televisions and laptops are increasing visual quality.

As the electronic adhesives market produces better products, such devices will be built better, with higher video quality and other features. Compact devices like smartwatches will also boom in sales. Electronic adhesives will also boost government projects like improving public transport, better facilities at railway stations or airports, and even space research projects.

The epoxy segment dominated the market share in 2023, and it is expected to continue growing in the forecast period. Epoxy adhesives have a wide range of applications, like die attachment and solderless interconnections. They have a high resistance to heat and can withstand high mechanical stress.

The adhesion provided by epoxy glues is of a high quality, and the bonds are strong. It is compatible with several materials and shows less shrinkage after drying. It does not require solvents before applying, and the viscosity can be controlled as well.

The acrylic segment is projected to witness the fastest growth during the forecast period. They have several benefits that make them a favorable option. Acrylic adhesives are versatile, and their resistance to environmental factors makes them an excellent option. They have a strong adhesive composition, and the bonds that form are strong.

Apart from their use in electronic goods, the electronic adhesives market also caters to the hardware industries like furniture, load-bearing joints, and other industrial equipment. They are used as substitutes for rivets used in other industries. The binding time is less in acrylic adhesives. Metallic parts in electronic appliances can be joined easily with each other. Acrylic adhesives work well for polar substrates, and hence, they can also be used for glass, neoprene, polycarbonate, etc.

The surface mounting segment dominated the market share in 2023. As devices are undergoing miniaturization, proper adhesion is required, and surface mounting is in increasing demand in this case. Surface mounting technology offers a lot of advantages at a low price and high efficiency. The setup time for surface mounting technology is shorter, and hence, more appliances can be produced. The surface mounting technology offers better functionality.

Because of the vibrations and shaking of a device, there is a possibility that the joints might weaken. Weak joints will cause damage to the instrument or the device. Surface mount technology provides stability to the joints and ensures that the instrument will tolerate the harshest conditions and vibrations. More compact devices can be produced using surface mount technology because it ensures that one needs fewer circuit boards, and there won’t be any compromise with the quality. All these benefits are offered at a low budget, and this makes these adhesives a popular choice.

The consumer electronics segment dominated the electronic adhesives market in 2023 and will continue doing so throughout the forecast period. An increased demand for smartphones, wearables, and smart devices is boosting the sales of adhesives, as they offer strong bonds in compact devices. Almost everywhere around us, we see that the usage of electronic goods has become very common. Consumers want their products to be of high quality and reliable. Electric vehicles are making huge markets, and it is important to have high-quality adhesives while bonding the joints in the vehicle.

Electronic adhesives provide high tolerance to moisture and vibration. Electronic adhesives can show binding properties in a variety of substrates like metal, plastic, glass, etc. They take less time to dry, and hence, the production of consumer electronic goods can happen at a fast pace.

Segments Covered in the Report

By Resin Type

By Form

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

April 2025

October 2024

August 2024