December 2024

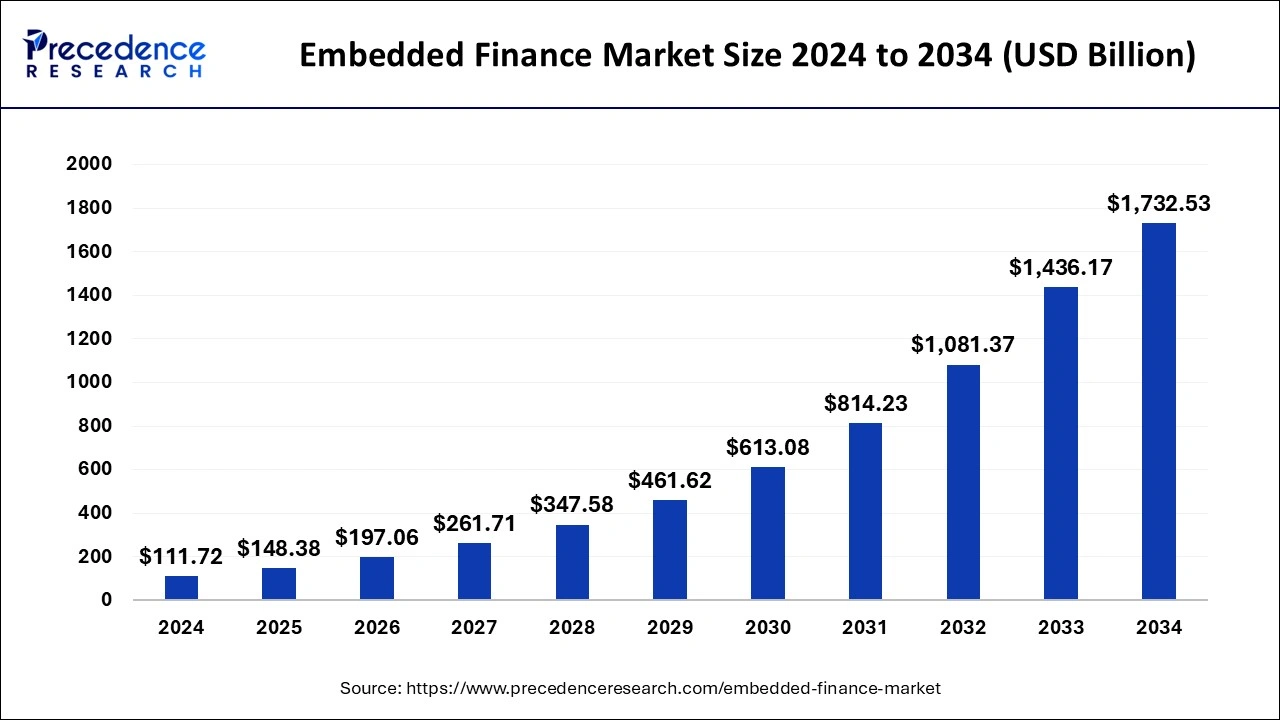

The global embedded finance market size is calculated at USD 148.38 billion in 2025 and is forecasted to reach around USD 1,732.53 billion by 2034, accelerating at a CAGR of 31.53% from 2025 to 2034. The North America embedded finance market size surpassed USD 36.87 billion in 2024 and is expanding at a CAGR of 31.53% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global embedded finance market size wwas estimated at USD 111.72 billion in 2024 and is predicted to increase from USD 148.38 billion in 2025 to approximately USD 1,732.53 billion by 2034, expanding at a CAGR of 31.53% from 2025 to 2034. The embedded finance market is driven by the growing inclination among consumers for convenience.

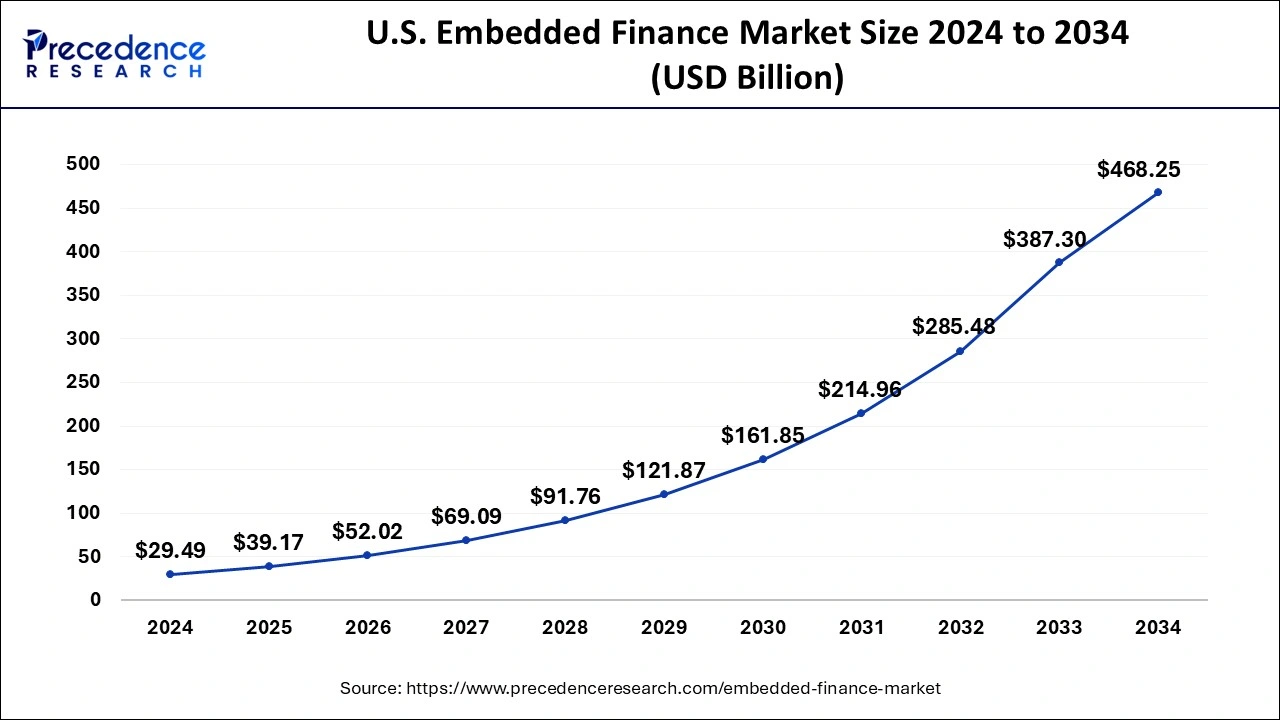

The U.S. embedded finance market size surpassed USD 29.49 billion in 2024 and is projected to attain around USD 468.25 billion by 2034, poised to grow at a CAGR of 31.85% from 2025 to 2034.

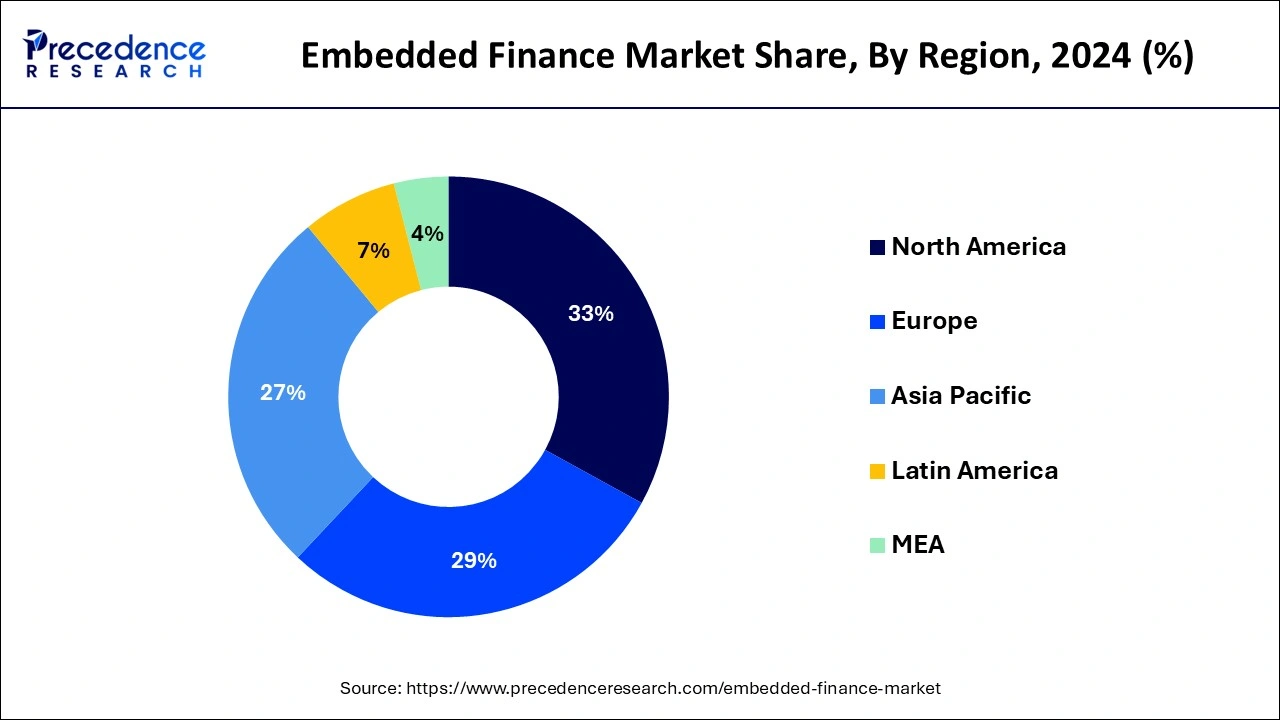

North America had dominated in the embedded finance market in 2024. North America has a significantly developed fintech sector, especially in the United States. Financial technology companies that propel innovation in embedded finance are concentrated in cities such as San Francisco, New York, and Toronto because of the advanced digital infrastructure in the area, which includes cloud computing capabilities, high-speed internet, and broad mobile adoption, implanted financial services may be developed and implemented more efficiently. Due to the integration of artificial intelligence and smart data analytics, businesses can now offer individualized financial services that are smoothly linked to non-financial platforms.

Asia-Pacific is the fastest growing in the embedded finance market during the forecast period. The adoption of mobile financial services is aided by high smartphone penetration rates, especially in China, India, Indonesia, and Vietnam. Payment apps and mobile wallets are becoming essential to day-to-day purchases. APAC's governments and regulatory agencies back financial developments. Frameworks and policies are being created to guarantee consumer safety while promoting the expansion of embedded finance.

By incorporating financial services into non-financial platforms or services, businesses can provide banking-like services without opening banks. This practice is known as embedded finance. This involves providing goods and services directly to customers of a non-financial company, such as lending, investment management, insurance, and payment processing. By incorporating financial services into common platforms, these clients utilize embedded finance, enabling businesses to reach underbanked or underserved communities and promote financial inclusion. Globally operating non-financial businesses can use embedded finance to provide customized financial services suited to the demands of many markets.

The demand for more integrated and effective financial solutions, growing digitization, and the widespread use of mobile devices will propel the embedded finance market's growth. The emergence of embedded finance encourages competition and innovation in the financial and non-financial sectors, creating new goods and services that are advantageous to customers.

| Report Coverage | Details |

| Market Size in 2025 | USD 148.38 Billion |

| Market Size in 2034 | USD 1,732.53 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 31.53% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Business Model, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased adoption of digital payments

The streamlined and user-friendly experience provided by digital payments decreases transaction friction. As customers grow accustomed to the convenience of digital payments, they expect more seamless financial services linked to many platforms. By offering services like quick loans, insurance, and investment alternatives inside the same ecosystem where customers carry out other activities like shopping or service booking, embedded finance lives up to this promise. The growth of digital payments has sparked innovation in financial technology.

To remain competitive, businesses constantly create new payment methods and combine them with other financial services. This innovation is the foundation of embedded finance, which propels the industry forward by providing cutting-edge financial solutions integrated into various platforms, such as social media and ride-sharing apps. This drives the embedded finance market growth.

Handling sensitive financial data

Since the financial sector involves a lot of valuable data, it is a significant target for hackers. To avoid unwanted access, businesses engaged in embedded finance must have firewalls, intrusion detection systems, encryption, and secure APIs like multi-factor authentication (MFA). to recognize and address vulnerabilities. Maintaining such a high degree of protection might be too expensive and complex, especially for smaller businesses.

Innovations in fintech such as APIs and digital payments

The foundation of embedded finance is APIs. They make it possible for disparate software systems to connect and communicate with one another, making it possible to integrate financial services into various non-financial platforms. Using APIs, e-commerce websites, for example, can seamlessly connect payment gateways, loan services, or insurance products. Financial institutions can engage with non-financial businesses to offer services to a broader audience through APIs.

This will greatly benefit reaching underbanked or unbanked populations, people who may not have access to regular banking services but use digital platforms for other purposes.

The embedded payment segment dominated the embedded finance market in 2024. The emergence of mobile payments, enabled by integrated financial solutions, has revolutionized consumer transactional behavior. Users can now conveniently pay with a tap or scan of their smartphone thanks to services like Apple Pay, Google Pay, and Samsung Pay, which directly integrate payment functions into their devices. These mobile payment options are quite popular and widely used since they are safe and convenient. Numerous companies have combined embedded payment methods with reward programs and loyalty schemes to encourage clients to use their services.

This integration contributes to the growth of the embedded payment segment by increasing transaction frequency and improving client retention.

The embedded lending segment shows significant growth in the embedded finance market during the forecast period. One of the most important contributions to embedded lending has been the creation of Application Programming Interfaces, or APIs. APIs make lending services more effective and accessible by enabling seamless integration of financial services into non-financial platforms. Convenience and seamless experiences are top priorities for modern consumers. Embedded lending eliminates the requirement for clients to follow conventional banking procedures by providing an integrated service within well-known platforms (such as e-commerce websites and apps).

The B2B segment dominated in the embedded finance market in 2024. The B2B industry's need for embedded finance has increased due to the emergence of digital platforms and online marketplaces. For these platforms to effectively handle payments, offer financing alternatives, and enable transactions, embedded financial services are necessary. The need for integrated financing, fraud protection, and payment solutions grows as more firms go online. To handle recurrent billing and payment collections, embedded financial solutions are becoming more and more necessary as subscription-based services expand. Supply chain financing provided by embedded finance solutions helps digital marketplaces by allowing suppliers to get paid early and efficiently manage their cash flow.

The B2C segment shows significant growth in the embedded finance market during the forecast period. Embedded finance improves customer convenience by providing financial services directly within the consumer's favorite apps or platforms. Due to this seamless integration, customers may now access financial services without having to navigate between different apps or websites. The increased use of integrated finance solutions in the B2C sector can be attributed to improved customer experience through expedited processes, including immediate payments, embedded lending, and insurance services.

The retail segment dominated in the embedded finance market in 2024. Retailers have been increasingly using embedded financial solutions to speed up the payment process, notably in e-commerce. By immediately integrating banking services into their platforms, retailers can lower cart abandonment rates by providing customers with a more convenient and seamless checkout experience. Applicant programming interfaces, or APIs, facilitate the easier integration of financial services into retail systems. Fintech businesses offer scalable and flexible solutions that can be swiftly adopted, serving as the technological backbone.

The travel & entertainment segment is the fastest growing in the embedded finance market during the forecast period.

There is a growing trend among travel and entertainment organizations to include financial technologies in their offerings. These comprise digital wallets, payment gateways, and Buy Now, Pay Later (BNPL) choices that streamline transactions and improve customer experience. Blockchain technology adoption and using cryptocurrencies for payments and other transactions are becoming more popular. Travelers from outside and tech-savvy people will find this very appealing.

Travel insurance protects against trip cancellations, medical problems, and misplaced luggage and is frequently integrated directly into the booking process. This convenience increases the uptake of insurance products.

By Type

By Business Model

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

October 2024

August 2024

February 2025