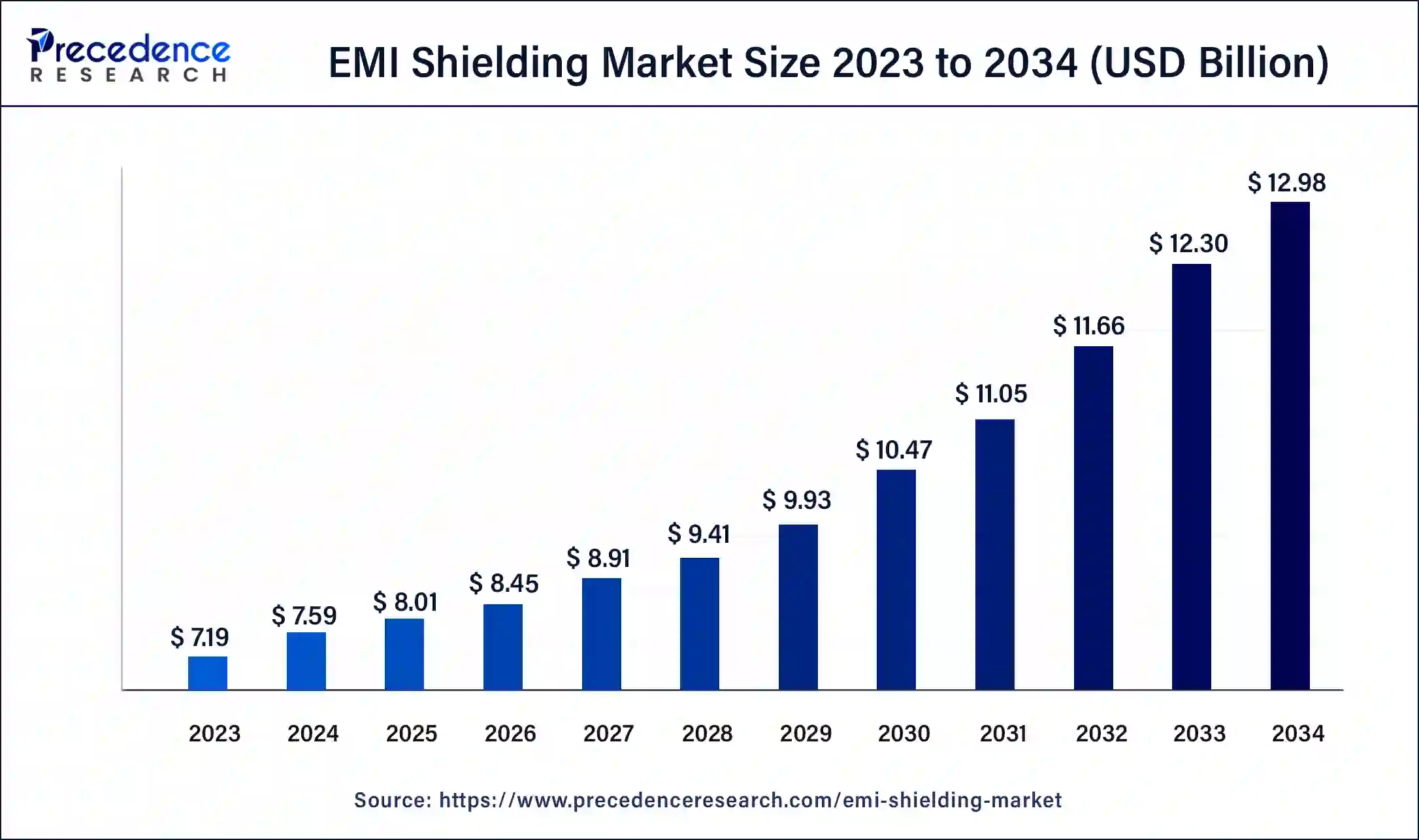

The global EMI shielding market size was USD 7.19 billion in 2023, calculated at USD 7.59 billion in 2024 and is expected to be worth around USD 12.98 billion by 2034. The market is slated to expand at 5.52% CAGR from 2024 to 2034.

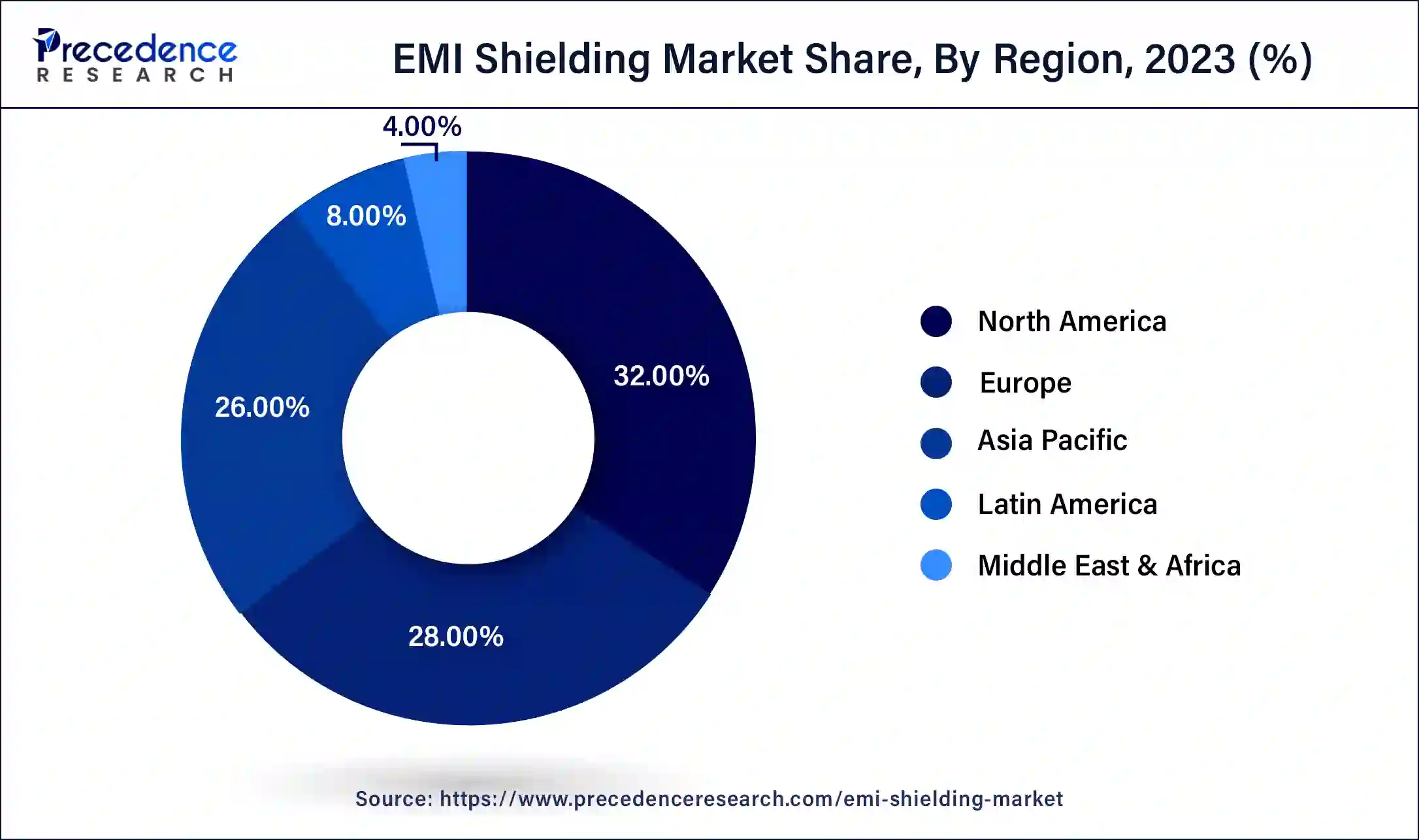

The global EMI shielding market size is worth around USD 7.59 billion in 2024 and is anticipated to reach around USD 12.98 billion by 2034, growing at a CAGR of 5.52% over the forecast period 2024 to 2034. North America EMI shielding market size reached USD 2.30 billion in 2023. The increasing use of electronic devices and their dependency across various fields ranging from healthcare to telecommunication are the major drivers propelling the EMI shielding market on a broader scale.

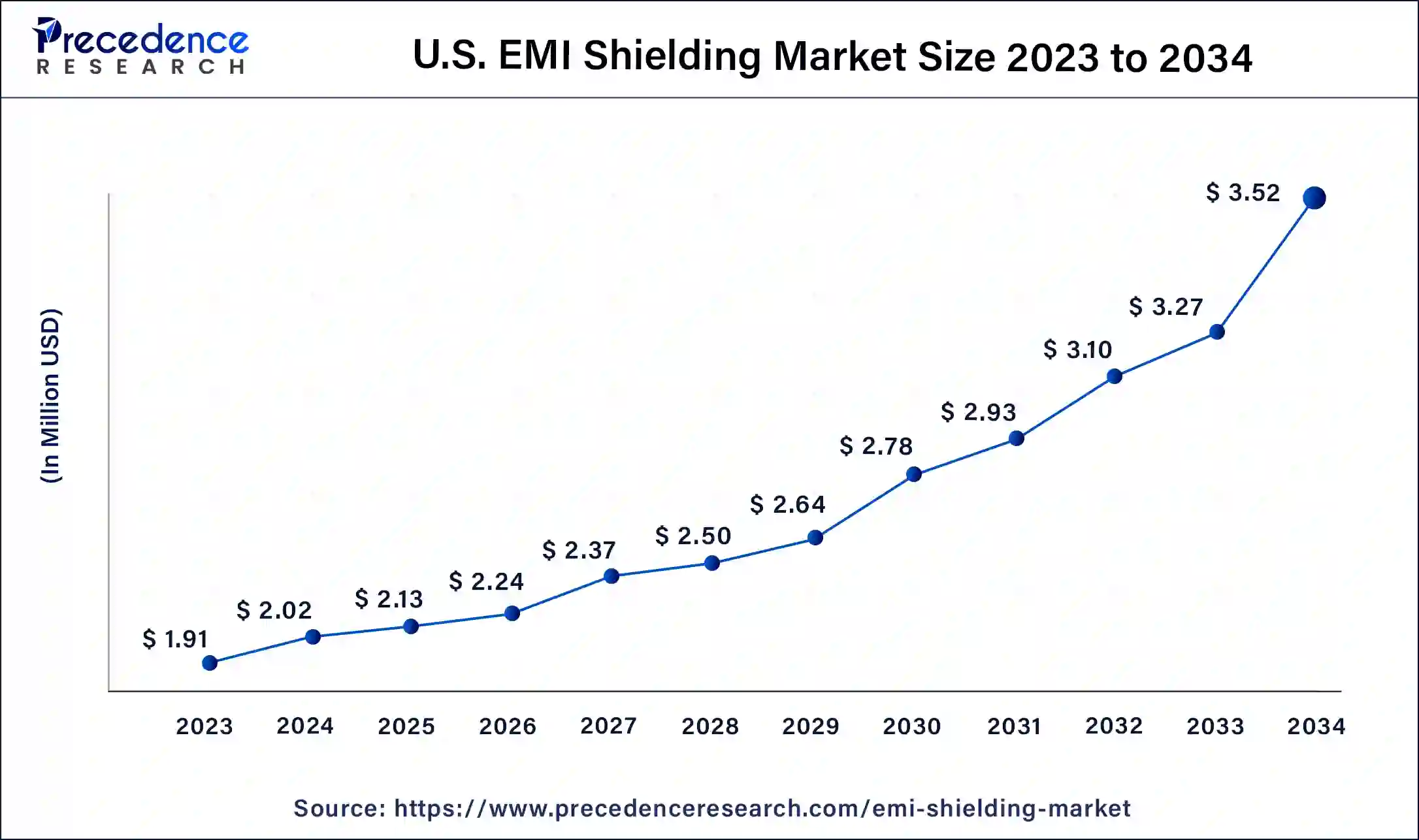

The U.S. EMI shielding market size was valued at USD 1.91 billion in 2023 and is expected to be worth around USD 3.52 billion by 2034, at a CAGR of 5.71% from 2024 to 2034.

North America held the highest share of the EMI shielding market in 2023. The growth of this region is due to the presence of major key players in North America, along with the proliferation of the electronics sector, which essentially requires EMI shielding to operate efficiently. Moreover, the increasing adoption of cutting-edge technologies like IoT and 5G is the significant reason that is propelling the region's growth on a larger scale. North America holds stringent government regulations regarding electronic devices, which again helps in proliferating the global EMI shielding market.

Asia Pacific is expected to witness the fastest growth in the EMI shielding market during the foreseeable period. The market for EMI shielding in Asia Pacific is expanding majorly due to the technological innovations and products launched by China, which is completely dependent on electronics, thereby registering itself as the largest manufacturer of electronic devices and products in the Asia Pacific. Additionally, the rising pervasion of internet of things (IoT) and 5G technology across various sectors highlights the need for EMI shielding to avoid interferences among electronic devices. On the other hand, India is also growing notable in the EMI shielding market due to the prevalence of electronic devices and their applications across diverse sectors, which aids in market expansion.

The EMI shielding market is expected to proliferate and hold its dominance over forecasted years due to innovations in electronics devices and its applications in various fields across the globe. It's essential to prevent EMI interference for the optimal performance of the electronic devices. The increasing use of wireless technology and adverse effect of electromagnetic radiation have again highlighted the importance of the EMI shielding.

Moreover, rising global awareness about negative impact of the electromagnetic pollution on human health encourages marketers to launch innovative materials that helps in EMI shielding fosters the market on a wider scale. Electronic devices are becoming more compact in terms of convenience provision, and their operating frequencies are increasing with respect to the compactness, thereby EMI shielding is becoming paramount. These factors are fuelling the EMI shielding market exponentially on a global scale.

Top companies offering EMI shielding across the globe

| Company Name | Headquarter | Product |

| Sealing Devices Inc. | Lancaster, New York, United States | O-rings, seals, gaskets, protective tapes, adhesives, and sealants. |

| Captor Corporation | United States. | DC EMI filters EMI 3 phase filters, circuit card assembly (CCA) mounted electromagnetic interference (EMI) filters. |

| Seal Science, Inc. | Irvine, California, United States. | EMI conductive gaskets and seals. |

AI Impact on the EMI Shielding Market

The increasing impact of artificial intelligence (AI) in various sectors is likely to propel the EMI shielding market. AI-based design tools will be helpful to simulate the possible effect of EMI pollution, and hence, it is possible to customize shielding solutions for particular applications like industrial, healthcare, consumer electronics, and more, based upon the need and environment. AI-based tools can simulate electromagnetic fields, and by analyzing them using data analytics, they can predict the efficiency and performance of shielding materials. Hence, it becomes easy to gather data and build a model before implementing the EMI solutions in practice.

| Report Coverage | Details |

| Market Size by 2034 | USD 12.98 Billion |

| Market Size in 2024 | USD 7.59 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Applications, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Industrialization world widely

One of the significant drivers for the EMI shielding market is the increasing pace of industrialization across the globe. Despite the multiple benefits provided by electronic and wireless devices, the denser electromagnetic environment can be propelled in the industrial region due to the proliferation of electronic machinery and equipment. Since a number of electronic devices work synchronously, they cause electromagnetic pollution, which creates interference in other electronic devices in the form of unexpected noise.

EMI can disturb the functioning of crucial electronic equipment, which will lead to potential operational failure, causing corruption in data and security concerns. Industries are becoming more digitally dependent, which increases the frequent use of electronic and wireless devices for efficiency and automation. To reduce these drawbacks for uninterrupted industrial workings, EMI shielding becomes crucial, thus fuelling the demand for various types of efficient shielding to combat EMI pollution.

Increased miniaturization

A major restraint that the EMI Shielding market holds is the increased miniaturization of electronic components. For better use and convenience purposes, electronic devices are getting smaller and more compact in size, and again, the addition of shielding materials into them might make them bulky and broader in size, which is out of demand these days. The compactness of electronic devices often creates challenges in identifying and reducing EMI disruptions within these devices.

Traditional EMI shielding is not suitable for such compact devices as they cannot be perfectly integrated within these devices, so other solutions and designs of EMI shielding are needed. Such a constant need for innovative shielding causes hindrances in the global market due to the rapid evolution of electronic devices, creating challenges to keep pace with it.

Innovative electronic devices in the healthcare sector

A significant opportunity that the EMI shielding market holds is the widespread adoption of electronic devices in the healthcare sector, fuelling the expansion of the globally. A rising prevalence of digital solutions for the healthcare sector, like medical devices such as MRI scanners, is creating a larger space for EMI shielding providers.

EMI shielding plays a crucial role in safeguarding patients' safety and data privacy as the healthcare sector is increasingly depending upon electronic systems to gather data about the health condition of patients; hence, it is essential to have a robust system for EMI shielding to mitigate the electromagnetic interference and pollution caused by it.

The tapes & laminates segment accounted for the largest share of the EMI shielding market in 2023. The tapes and laminates segment is proliferating due to the rising demand for flexible and lightweight EMI shielding products for compact electronic devices. Tapes and laminates provide excellent thermal management for efficient EMI shielding, and hence, they have become the most used and integral part of electronic devices in recent times.

The conductive polymers segment is anticipated to witness growth at an increasing CAGR in the EMI shielding market during the forecasted years. The growth of this segment is attributed to various factors, including the need for anti-corrosive and lightweight EMI shielding, which has increased in recent years. Conductive polymers have excellent shielding properties that would not add an extra layer to the shielding, making it more lightweight to use and integrating with recently launched compact electronic devices without compromising on their aesthetics, propelling the demand for conductive polymers for EMI shielding.

The consumer electronics segment accounted for the largest share of the EMI shielding market in 2023. The growth of this segment is due to the extensive use of EMI shielding to avoid interference with other devices. Additionally, rising demand for user-friendly, reliable, and high-performance electronic devices is a notable breakthrough in the consumer electronic sector, fuelling this segment's growth globally. Rising adoption of EMI shielding in electronic devices like smartphones and laptops again fuelling the market's demand on a larger scale.

The automotive segment is anticipated to witness rapid growth in the EMI shielding market during the forecasted years. The growth of this segment is related to the increasing integration of electronics with the automotive sector, giving rise to drawbacks like electromagnetic interference in-vehicle systems, which need to be resolved by using EMI shielding, proliferating the automotive segment's growth in the global EMI shielding market. Major market players are also contributing to the growth by launching innovative solutions for the automotive segment.

Segments Covered in the Report

By Type

By Applications

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client