January 2025

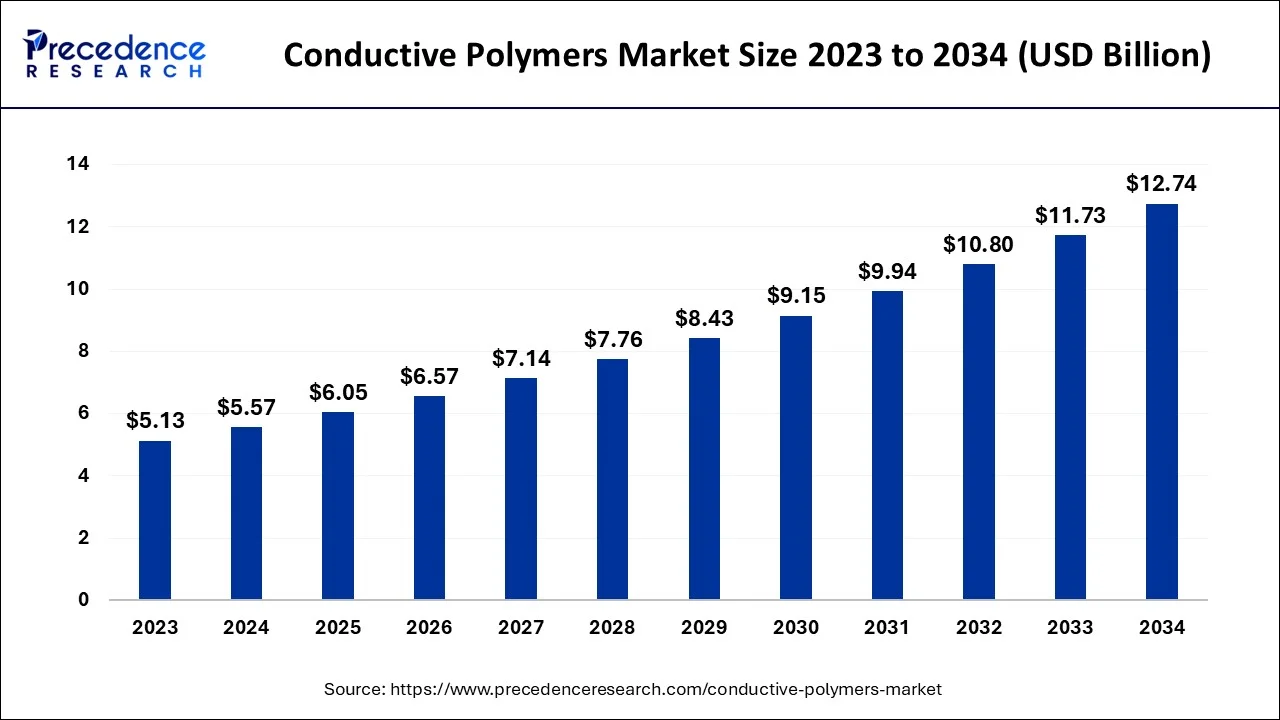

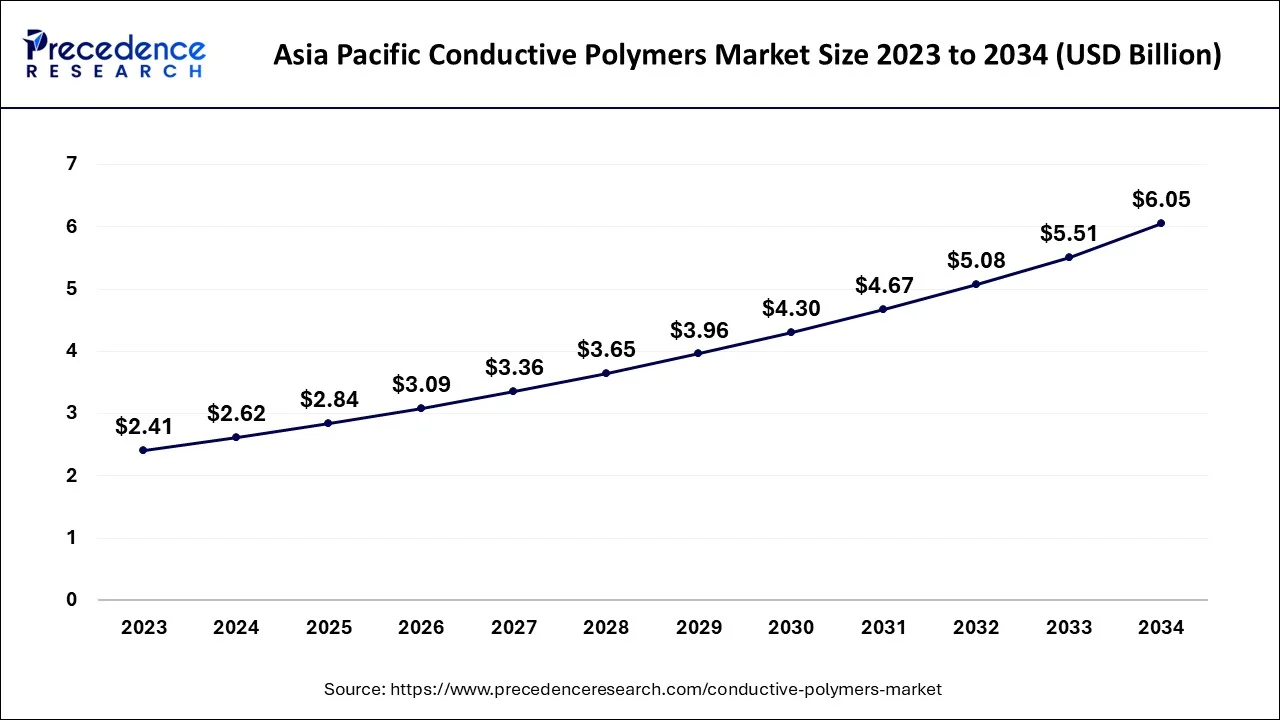

The global conductive polymers market size is calculated at USD 5.57 billion in 2024, grew to USD 6.05 billion in 2025 and is projected to reach around USD 12.74 billion by 2034. The market is expanding at a CAGR of 8.62% between 2024 and 2034. The Asia Pacific conductive polymers market size is evaluated at USD 2.62 billion in 2024 and is representing a healthy CAGR of 8.72% during the forecast period.

The global conductive polymers market size is accounted for USD 5.57 billion in 2024 and is estimated to surpass around USD 12.74 billion by 2034, growing at a CAGR of 8.62% from 2024 to 2034.

The Asia Pacific conductive polymers market size is exhibited at USD 2.62 billion in 2024 and is expected to be worth around USD 6.05 billion by 2034, growing at a CAGR of 8.72% from 2024 to 2034.

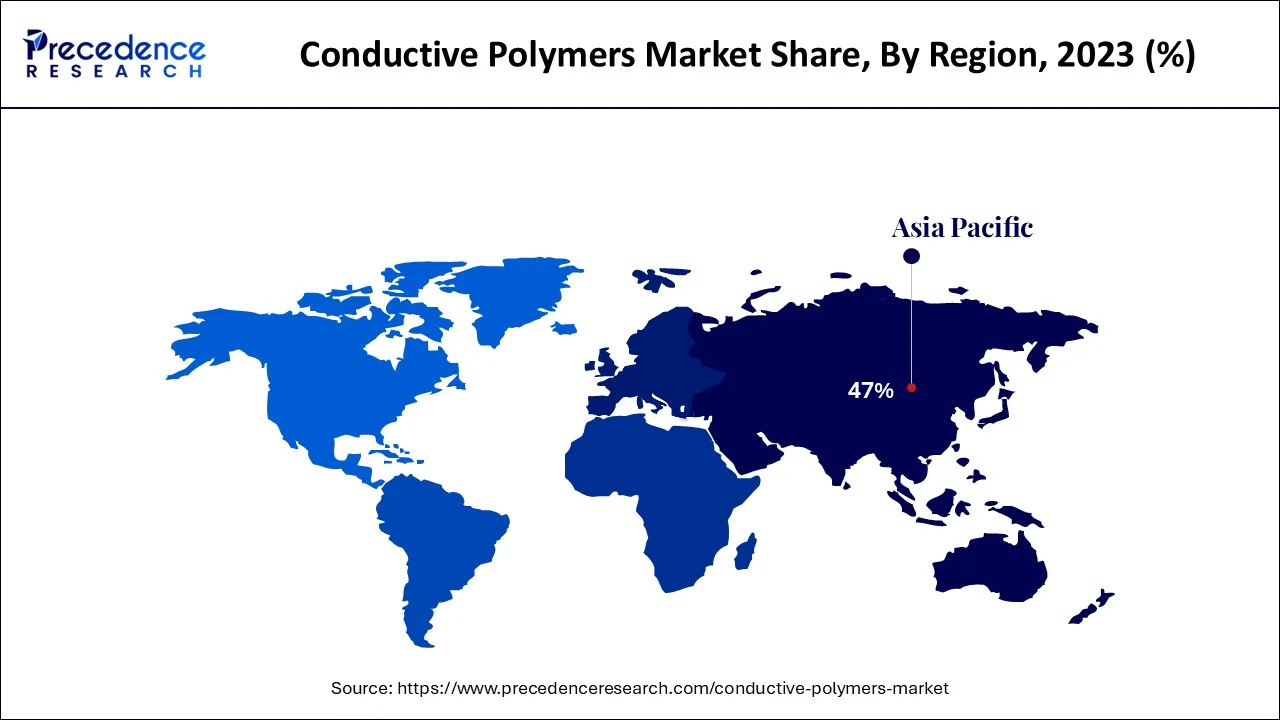

Asia Pacific held the dominant share of the conductive polymers market in 2023 and is observed to witness notable growth during the forecast period. The region is a major manufacturing hub for electronic components. The growth of the region is characterized by the expanding population, presence of original equipment manufacturers (OEMs), rising demand for growing lightweight automobiles, rapid urbanization, rising disposable income, improving economic conditions, significant R&D expenditure, the presence of original equipment manufacturers, and a rising trend of miniaturization in the electronics sector.

The increasing demand for tablets, smartphones, portable speakers, laptops, and AI-assisted electronics is expected to positively impact the growth of the market. The increasing production of electric vehicles, batteries, actuators, sensors, LEDs, and circuit boards led to a rising use of conductive polymer, which in turn fuels the market's expansion throughout Asia Pacific.

China is a leading contributor to the market owing to technological innovation and research capabilities, as well as a supportive regulatory environment and advanced infrastructure. China has a booming electronics and automotive industry. Additionally, the energy transition towards cleaner energy has resulted in increasing the demand for solar cells.

North America is anticipated to grow notably in the conductive polymers market during the forecast period. The region is observed to witness notable growth during the forecast period. The growth of the region is attributed to the strong presence of electronics and semiconductor industries, robust economic conditions, advanced technological infrastructure, rising adoption of solar energy, and rapid expansion of the automotive sector. The region has a strong network of academic and research institutions collaborating with prominent market players, which has significantly resulted in the development of cutting-edge technologies.

The increasing demand for miniaturized electronic devices, such as rechargeable batteries, integrated circuits (ICs), and others, is likely to impact the growth of the market positively during the forecast period. The United States is the major contributor to the market owing to the rising technological innovation in the electronics sector, which includes smartphones, laptops, televisions, automotive electronics, and wearables. In the automotive industry, lightweight materials made with conductive polymers have gained immense popularity as they have resulted in reducing emissions and fuel efficiency.

Conducting polymers are organic polymers that conduct electricity. They offer a flexible and lightweight alternative to conventional metals and inorganic conductors. Such compounds may have metallic conductivity or may be semiconductors. Conducting polymers are extensively used in batteries, microelectronics, photovoltaic devices, LEDs, electrochromic displays, bio-implants, and others. They act as current carriers in electronic components and are considered more eco-friendly than traditional materials like metals. The major advantage conductive polymers market products over conventional metals is their low cost, lightweight, ease of processing, and robustness.

Technological Advancement Impacting the Growth of the Conductive Polymers Market

The conductive polymers market has gained immensely from rapid technological innovation. Conductive polymers (CPs) possess significant electrical, electronic, magnetic, and optical properties. The rapid advancements in nanotechnology and materials science have led to the development of more efficient conductive polymer coatings. These remarkable innovations are enabling manufacturers to cater to a broader range of applications. In biosensing, conducting polymers are most widely utilized as they offer the benefit of being flexible, lightweight, and easily mass-produced.

The most often utilized CPs for biosensing include Poly(thiophene), PEDOT, Poly (acetylene), PPV, Polyaniline (PANI), and Poly (Pyrrole). The rapid advancement of electronics and artificial intelligence (AI) tools has opened interesting opportunities for the development of technologies for a wide range of applications. Organic and printed electronics have the potential to complement traditional electronics with new technologies and applications. Conductive polymers (CPs) are commonly utilized for anti-static purposes as electrodes and functional coatings in liquid crystal displays and OLED displays, as well as in organic photovoltaics (PV).

| Report Coverage | Details |

| Market Size by 2034 | USD 12.74 Billion |

| Market Size in 2024 | USD 5.57 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.62% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

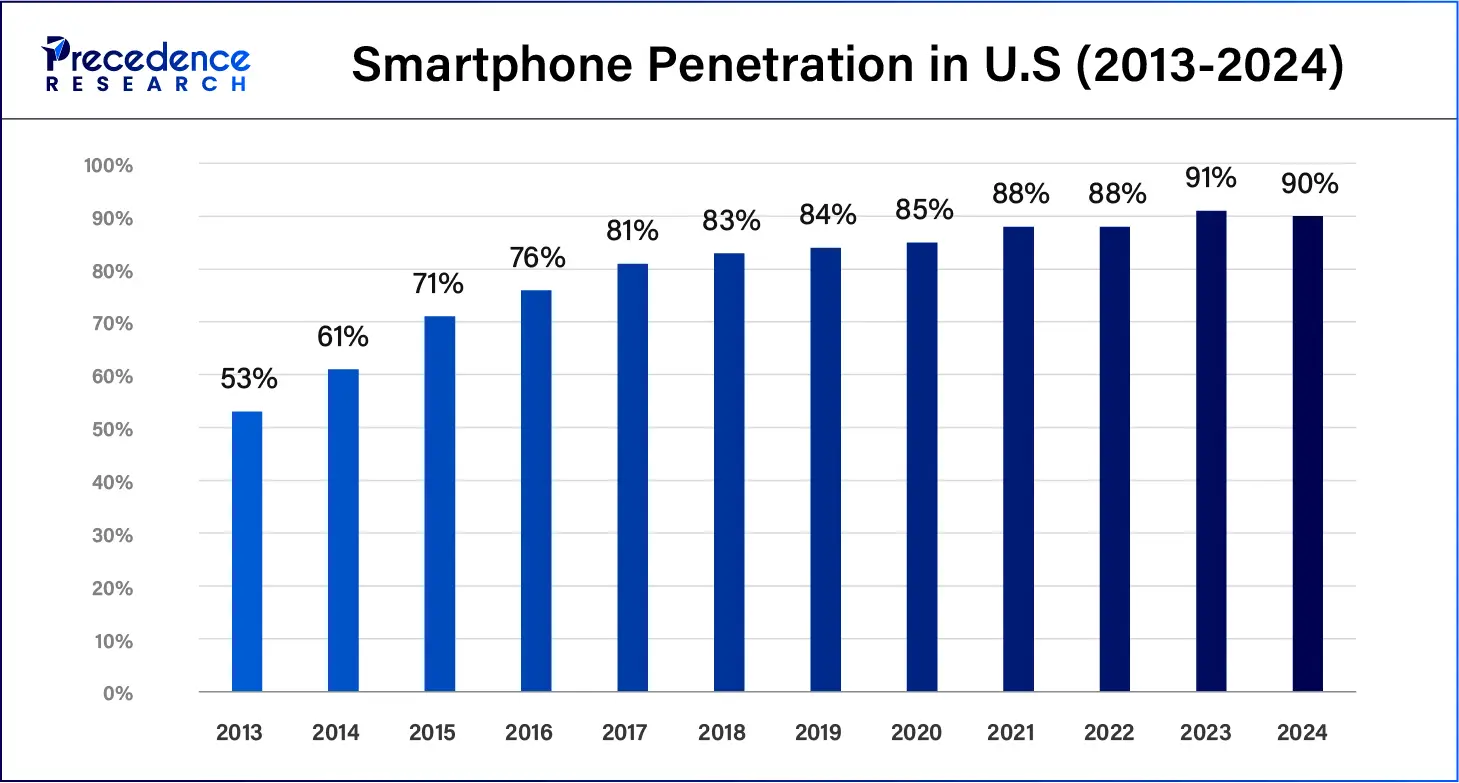

Increasing demand for consumer electronics

The rising demand for consumer electronics is expected to boost the growth of the conductive polymers market. Conductive polymers are primarily used in the electronics sector owing to their low thermal conductivity and capacity to provide thermal insulation. The continuous advancement in technology and the growing consumer demand for lightweight, flexible, smaller or compact, and high-performance electronic devices led to an increasing need for conductive polymers.

The market has witnessed an increasing demand for smartphones, tablets, television, fitness trackers, medical sensors, laptops, portable speakers, AI-assisted electronics, smartwatches, and others, which supports the growth of the conductive polymers market. Therefore, the rising use of consumer electronics as a result of rising living standards bolsters the market’s growth.

Rising cost of raw material

The rising cost of raw materials is projected to hamper the growth of the global conductive polymers market. Conductive polymers are made from materials that are expensive polymers, leading to increasing production costs, which may, in turn, result in the slow adoption of conductive polymers, particularly in price-sensitive industries.

Expansion of the automotive industry

The increasing demand for lightweight materials from the automotive industry is projected to offer immense growth opportunities for the growth of the conductive polymers market in the coming years. The use of conductive polymers in automobiles makes the vehicle fuel efficient and lighter. The conductive polymers find various applications in the automotive industry, including sensors, LED lighting, batteries, printed circuit boards, and others.

Rising demand for electric cars and the incorporation of technology in the automobile industry are anticipated to boost the demand for embedded sensors that use conductive polymers as raw materials. Therefore, the use of conductive polymers offers various opportunities for weight reduction in automotive applications and, in particular, in electric vehicles.

Polyacetylene (PA) held a significant share of the conductive polymers market in 2023. The main chain of polyacetylene is made up of a linear polyene chain. Polyacetylene (PA) is widely employed in electrochemical biosensors and bioelectrodes. Owing to its exceptionally high electrical conductivity, the doped polyacetylene can be extensively used as an electrode material in lightweight rechargeable batteries and electrical wiring. Thereby fuelling the segment’s growth.

The Poly(Phenylenevinylene) (PPV) segment is expected to grow at a notable rate in the conductive polymers market over the forecast period. The growth of the segment is driven by the rising construction of optoelectronic devices. Due to their high optical property, Poly(phenylenevinylene) (PPV) can be utilized in a wide range of applications, including light-emitting diodes (LED), photodetectors, sensors, photovoltaic devices, and others. Thus, boosting the segment’s growth.

The actuators & sensors segment accounted for the dominating share of the conductive polymers market in 2023 and is also projected to continue this dominance over the forecast period. The segment's growth is driven by the increasing demand for conductive polymer-based sensors in various industries such as electronics, textile, automotive, aerospace, energy, and others. In the Automotive industry, the rising demand for lightweight automobiles is driving the growth of the conductive polymers market. Conductive polymers are also used to enhance fuel efficiency and curb carbon emissions. The use of these polymers offers extensive design flexibility, which assists market players in creating customized solutions such as actuators and sensors.

The solar energy segment will witness considerable growth in the conductive polymers market over the forecast period. The segment’s rapid growth is mainly characterized by the increasing adoption of solar panels. Conducting polymers have valuable properties of organic polymers as well as semiconductors that make them useful for advanced energy applications. Conducting polymers are widely used in the manufacturing of solar panels. The ongoing research activities to improve solar technology with more efficient solar panels are likely to propel the need for conducting polymers as electrical components. Solar panels made with conductive polymers are increasingly adopted in residential, commercial, and utility-scale projects around the world. Additionally, conductive polymers have gained significant importance in transparent solar cells.

| Rank | Name | Country | Capacity (GW) |

| 1 | Bhadla Solar Park | India | 2.25 |

| 2 | Huanghe Hydropower Hainan Solar Park | China | 2.2 |

| 3 | Shakti Sthala Solar Project | India | 2.05 |

| 4 | Benban Solar Park | Egypt | 1.65 |

| 5 | Tengger Desert Solar Park | China | 1.55 |

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

February 2025

July 2024