July 2024

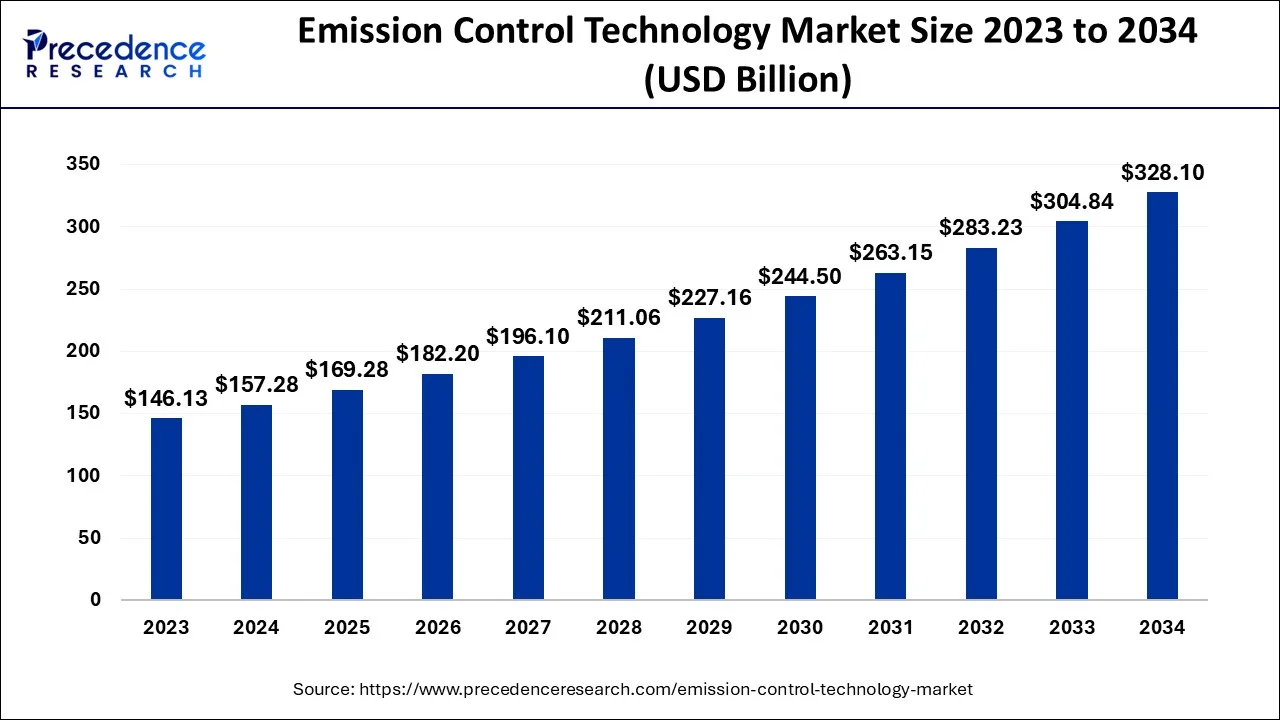

The global emission control technology market size is predicted to increase from USD 157.28 billion in 2024, grew to USD 169.28 billion in 2025 and is anticipated to reach around USD 328.1 billion by 2034, poised to grow at a CAGR of 7.63% between 2024 and 2034. The North America emission control technology market size is calculated at USD 55.05 billion in 2024 and is estimated to grow at a fastest CAGR of 7.78% during the forecast year.

The global emission control technology market size accounted for USD 157.28 billion in 2024 and is predicted to surpass around USD 328.1 billion by 2034, expanding at a CAGR of 7.63% between 2024 and 2034.

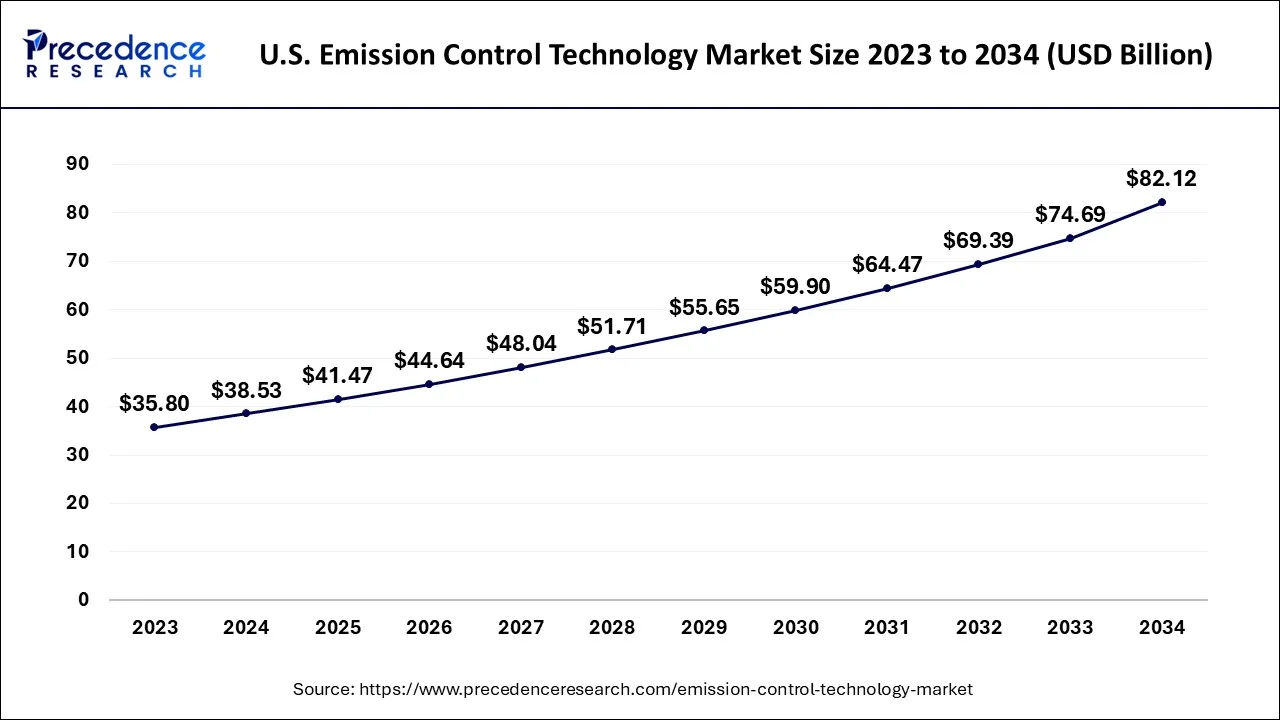

The U.S. emission control technology market size is estimated at USD 157.28 billion in 2024 and is expected to be worth around USD 82.12 billion by 2034, expanding at a CAGR of 7.86% between 2024 and 2034.

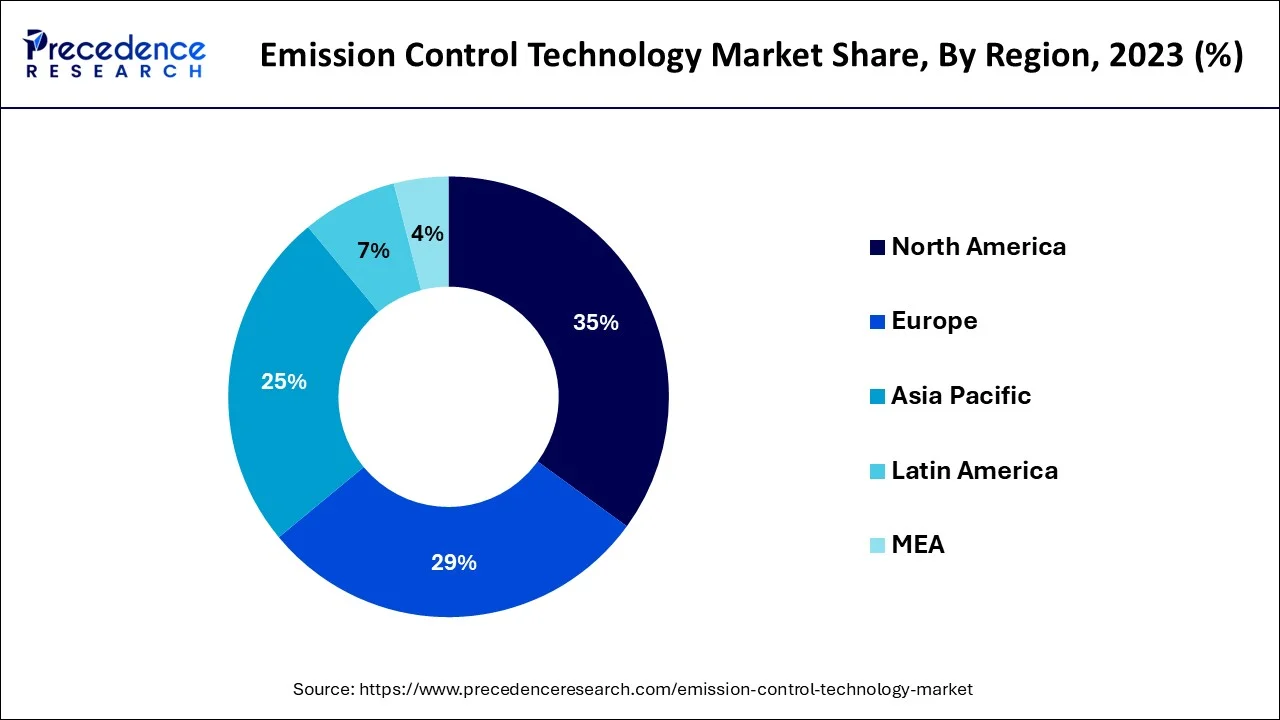

North America dominates the market, primarily driven by stringent emission regulations, technological advancements, a strong automotive industry, and the region's focus on environmental sustainability. North America has implemented stringent emission regulations to curb air pollution and reduce greenhouse gas emissions. These regulations have mandated using advanced emission control technologies in various industries, including automotive, marine, aerospace, and industrial sectors. The Environmental Protection Agency (EPA) in the United States and regulatory bodies in Canada have set emission standards that drive the demand for emission control technologies in the region.

Europe is a significant market for emission control technology, with Germany, the United Kingdom, and France being the major contributors to the market's growth. This is because Europe has significantly committed to reducing greenhouse gas emissions under the Paris Agreement and its climate targets. These commitments necessitate the adoption of emission control technologies across different industries. The European Green Deal and other sustainability initiatives promote the transition to cleaner technologies, driving the demand for emission control solutions.

The region in Asia-Pacific is anticipated to have the greatest CAGR due to its large population, expanding industries, and increasing environmental concerns. With governments' focus on air quality improvement and sustainability, the demand for emission control technologies is expected to grow significantly in the region. Furthermore, governments in the Asia-Pacific region are actively promoting environmental sustainability and low-carbon development. Initiatives such as the National Clean Air Program in India, the Green Growth Strategy in South Korea, and China's efforts to combat air pollution drive the demand for emission control technologies. Governments provide incentives and subsidies to encourage the adoption of clean technologies, creating opportunities for the emission control technology market.

Emission control technology refers to a range of techniques, systems, and technologies designed to reduce or eliminate the release of harmful pollutants into the environment. These technologies are employed in various sectors, including industrial processes, transportation, and energy production, to mitigate air, water, and soil pollution. These technologies target different types of pollutants, such as greenhouse gases (e.g., carbon dioxide), nitrogen oxides (NOx), sulfur oxides (SOx), particulate matter (PM), volatile organic compounds (VOCs), and other toxic substances. By implementing these technologies, the emission levels of these pollutants can be minimized or effectively treated before release, helping to protect human health, ecosystems, and the overall environment.

The emission control technology market is driven by government regulations and environmental policies aimed at reducing emissions and growing public awareness and demand for cleaner and sustainable solutions. With growing concerns over environmental pollution and the impact of greenhouse gas emissions on climate change, there has been an increased focus on implementing emission control measures across various sectors. As the need for emissions reduction continues to grow, the emission control technology market is expected to expand, providing opportunities for innovation and investment in cleaner and more sustainable solutions.

Furthermore, increasing concerns about climate change and its environmental impacts have led to a global focus on reducing greenhouse gas emissions. Governments, international agreements (such as the Paris Agreement), and sustainability initiatives drive the demand for emission control technologies. These technologies help industries, transportation, and energy sectors reduce their carbon footprint and contribute to global efforts in mitigating climate change.

However, high implementation costs, technological complexity, and compatibility, limited awareness, and education are anticipated to impede the market growth. Emission control technologies often require integrating existing infrastructure, systems, or equipment. Compatibility issues may arise when retrofitting older facilities or vehicles with new emission control technologies. Technical complexities, such as the need for customizations or modifications, can pose challenges and increase implementation costs. Ensuring seamless integration and compatibility across different industries and sectors can restrain market growth.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have disruptions in supply chains and manufacturing, leading to a slowdown in economic activity and delays or cancellations of planned emission control projects. Industries in aviation, tourism, and manufacturing sectors experienced reduced activity and financial constraints, which limited their capacity to invest in emission control technologies. As a result, the market for emission control technologies experienced a slowdown during the pandemic.

| Report Coverage | Details |

| Market Size in 2024 | USD 157.28 Billion |

| Market Size by 2034 | USD 328.1 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.63% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2024 To 2034 |

| Segments Covered | By Technology, By Fuel Type, and By End-User Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Government regulations and policies to brighten the market prospect

With increasing concerns about environmental sustainability and the need to mitigate climate change, governments worldwide have implemented stringent regulations to limit pollutant emissions and promote cleaner practices. These regulations create a market demand for emission control technologies as industries, vehicles, and power plants must adopt measures that reduce emissions and meet specific environmental standards. Governments set emission standards for various sectors, including industrial processes, power generation, transportation, and commercial buildings. These standards define the maximum allowable levels of pollutants that can be emitted, compelling industries and businesses to implement emission control technologies to meet the prescribed limits. For instance, in April 2023, U.S. Environmental Protection Agency announced new, more ambitious proposed standards to further reduce harmful air pollutant emissions from light-duty and medium-duty vehicles starting with the model year 2027.

In addition, governments provide financial incentives to encourage the adoption of emission control technologies. These incentives include tax credits, grants, subsidies, or favorable financing options, offset initial costs, and promote investment in cleaner technologies. Financial support programs encourage industries, vehicle manufacturers, and power plants to adopt emission control technologies and accelerate market adoption. Moreover, governments may establish market-based mechanisms such as emissions trading systems or carbon pricing schemes. These mechanisms create economic incentives for emissions reductions by putting a price on carbon emissions. Industries can reduce emissions and potentially lower compliance costs or generate revenue through emissions trading by implementing emission control technologies.

Climate change mitigation

The increasing recognition of the urgent need to reduce greenhouse gas (GHG) emissions and combat climate change, there is a growing demand for innovative solutions that can effectively control and minimize emissions across various sectors. Emission control technologies are vital in meeting these goals by enabling industries, transportation systems, and power generation facilities to reduce their environmental impact. The global commitment to climate change mitigation, as evidenced by international agreements like the Paris Agreement, has prompted governments and organizations to implement regulations and policies that encourage the adoption of emission control technologies. These technologies help industries transition to cleaner and more sustainable practices, significantly reducing GHG emissions.

In addition, the transition to a sustainable energy system is crucial to climate change mitigation. This transition involves a shift from fossil fuel-based energy sources to renewable energy systems. Emission control technologies, such as energy storage systems, grid optimization solutions, and advanced power generation technologies, are essential for integrating and efficiently utilizing renewable energy sources. The increasing demand for renewable energy and the need to decarbonize the energy sector further drive the demand for emission control technologies. In addition, the promotion of low-carbon transportation, the electrification of vehicles, and the development of sustainable transportation alternatives contribute to the demand for emission control technologies. Advanced emission reduction systems, charging infrastructure, and efficient transportation management solutions are necessary to support the widespread adoption of clean transportation options and reduce emissions from the transportation sector. Thus, climate change mitigation efforts and the global commitment to reduce GHG emissions are key drivers of the demand for emission control technologies.

The high cost of emission control technology is causing hindrances to the market

The upfront investment required to install and integrate these technologies can be substantial, deterring businesses, industries, and governments from embracing them. The initial investment for emission control technologies often includes purchasing specialized equipment, retrofitting existing infrastructure, and upgrading processes. These costs can be especially burdensome for smaller businesses and organizations with limited financial resources. The high capital expenditure required upfront creates a barrier to entry, preventing many potential buyers from investing in emission control technologies. Furthermore, these technologies' return on investment (ROI) may take time to materialize. While emission control technologies can lead to long-term cost savings through reduced energy consumption, lower emissions, and improved operational efficiency, recouping the initial investment may take several years. This delayed ROI can deter organizations, particularly those focused on short-term financial goals, from prioritizing adopting emission control technologies.

Moreover, Financial institutions may perceive emission control technologies as high-risk investments, resulting in stricter lending criteria or higher interest rates. This lack of affordable financing options further exacerbates the implementation cost challenge. It hampers the demand for emission control technologies, particularly for small and medium-sized enterprises (SMEs) or organizations operating in regions with less developed financial markets. Uncertainty surrounding future regulations and policies also plays a role in hindering the demand for emission control technologies. If businesses are unsure about the stability or longevity of emission control regulations, they may hesitate to invest in technologies that address these regulations. The absence of regulatory clarity can create a wait-and-see approach, leading to delayed demand for emission control technologies. Therefore, the high implementation costs associated with emission control technologies significantly restrain their market demand.

On the basis of technology, the emission control technology market is divided into diesel particulate filters (DPF), gasoline particulate filters (GPF), diesel oxidation catalysts (DOC), selective catalytic reduction (SCR), and exhaust gas recirculation (EGR), with the diesel particulate filter (DPF) segment accounting for most of the market. Diesel particulate filters (DPFs) are specifically designed to capture and remove particulate matter (PM) or soot from the exhaust gases emitted by diesel engines. They play a crucial role in reducing emissions of harmful particles and ensuring compliance with stringent environmental regulations. DPFs trap and collect fine particles, preventing them from being released into the atmosphere. Periodic regeneration processes burn off the accumulated particles, maintaining the filter's efficiency.

On the basis of the fuel type, the emission control technology market is divided into gasoline and diesel, with diesel accounting for most of the market. This is because diesel engines are widely used in various sectors, including transportation, industrial applications, and power generation. These engines are known for their efficiency and high torque output, making them preferred in heavy-duty applications. However, diesel engines typically produce higher emissions of pollutants such as nitrogen oxides (NOx) and particulate matter (PM) than gasoline engines. Therefore, the demand for emission control technologies for diesel engines is significant.

On the basis of the end-user vertical, the emission control technology market is divided into automotive, marine, aerospace, off-highway, rolling stock, and industrial, with automotive accounting for most of the market. This is because the automotive industry is a major consumer of emission control technologies. As governments implement stricter emission regulations to reduce air pollution and combat climate change, automakers must adopt effective vehicle emission control technologies. Technologies such as catalytic converters, diesel particulate filters (DPFs), selective catalytic reduction (SCR), gasoline particulate filters (GPFs), and exhaust gas recirculation (EGR) systems are widely used in vehicles to reduce emissions of pollutants like nitrogen oxides (NOx), particulate matter (PM), and greenhouse gases.

Segments Covered in the Report:

By Technology

By Fuel Type

By End-User Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

February 2025

April 2025

January 2025