April 2025

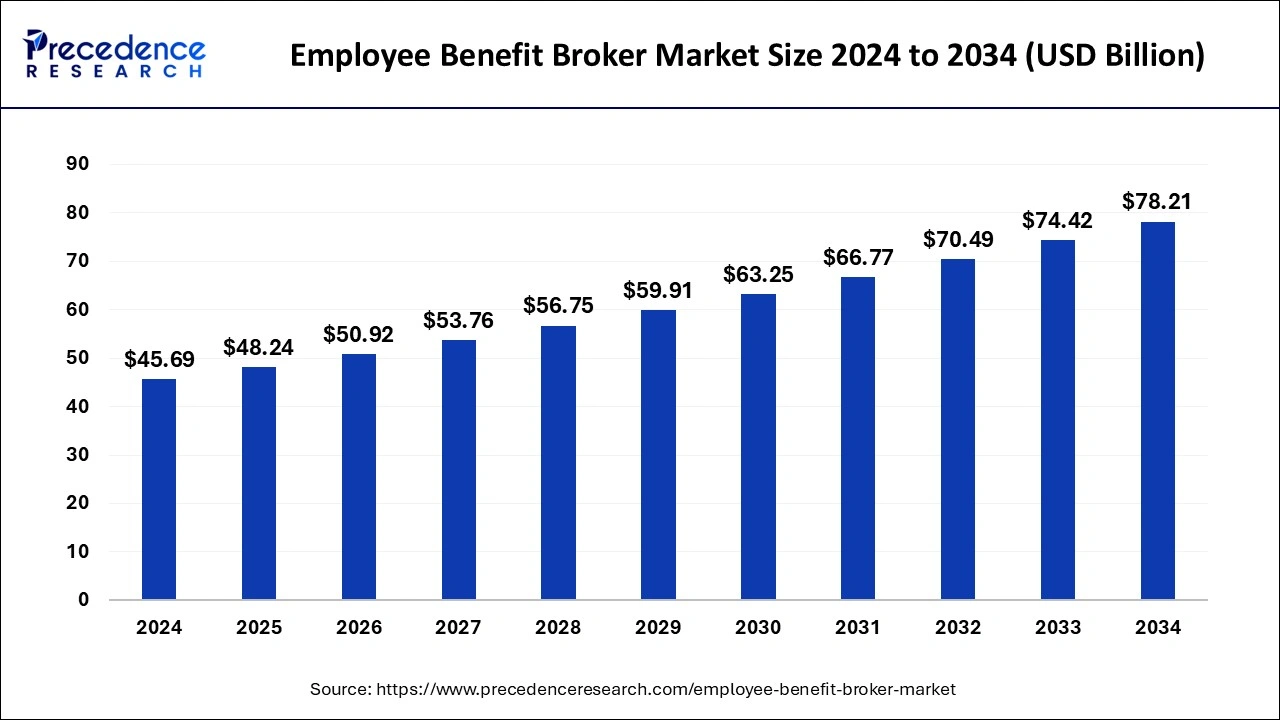

The global employee benefit broker market size is calculated at USD 48.24 billion in 2025 and is forecasted to reach around USD 78.21 billion by 2034, accelerating at a CAGR of 5.52% from 2025 to 2034. The North America employee benefit broker market size surpassed USD 14.62 billion in 2024 and is expanding at a CAGR of 5.55% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global employee benefit broker market size was estimated at USD 45.69 billion in 2024 and is predicted to increase from USD 48.24 billion in 2025 to approximately USD 78.21 billion by 2034, expanding at a CAGR of 5.52% from 2025 to 2034. Brokers are adapting to meet the different needs of employers and employees, offering a range of services from healthcare and retirement planning to wellness programs and voluntary benefits are major drivers of the global market.

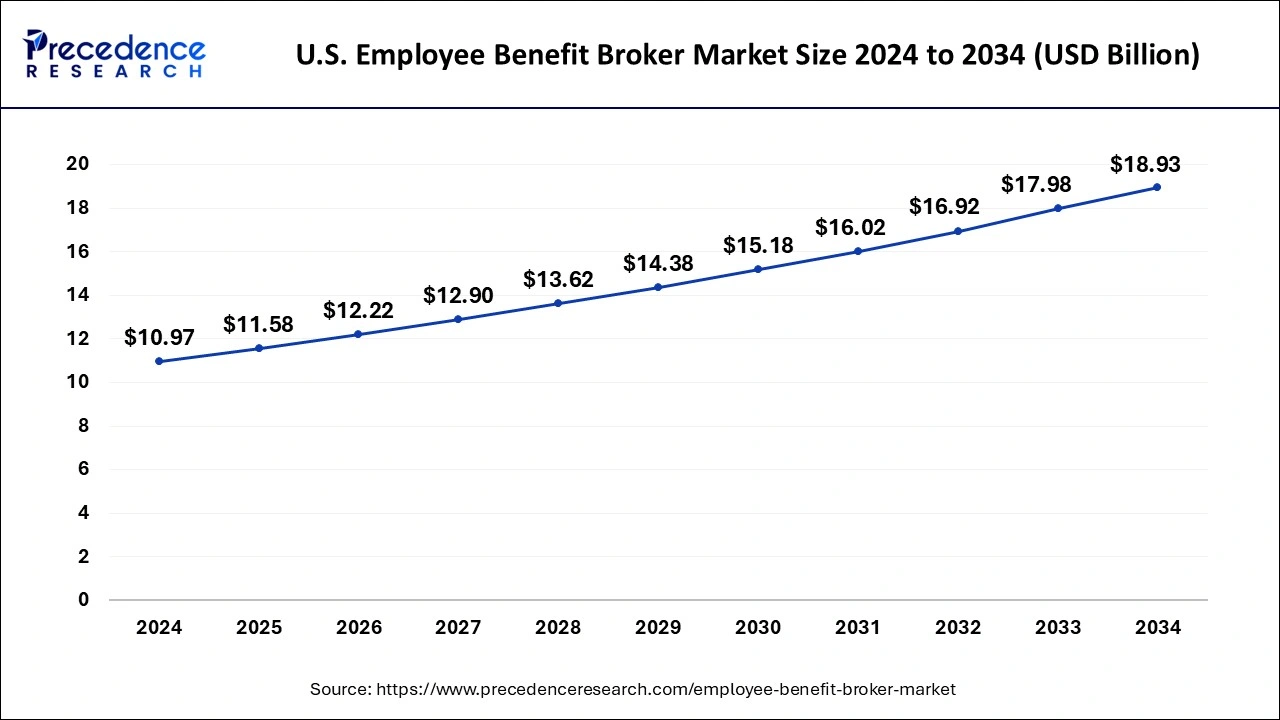

The U.S. employee benefit broker market size was estimated at USD 10.97 billion in 2024 and is predicted to be worth around USD 18.93 billion by 2034, at a CAGR of 5.61% from 2025 to 2034.

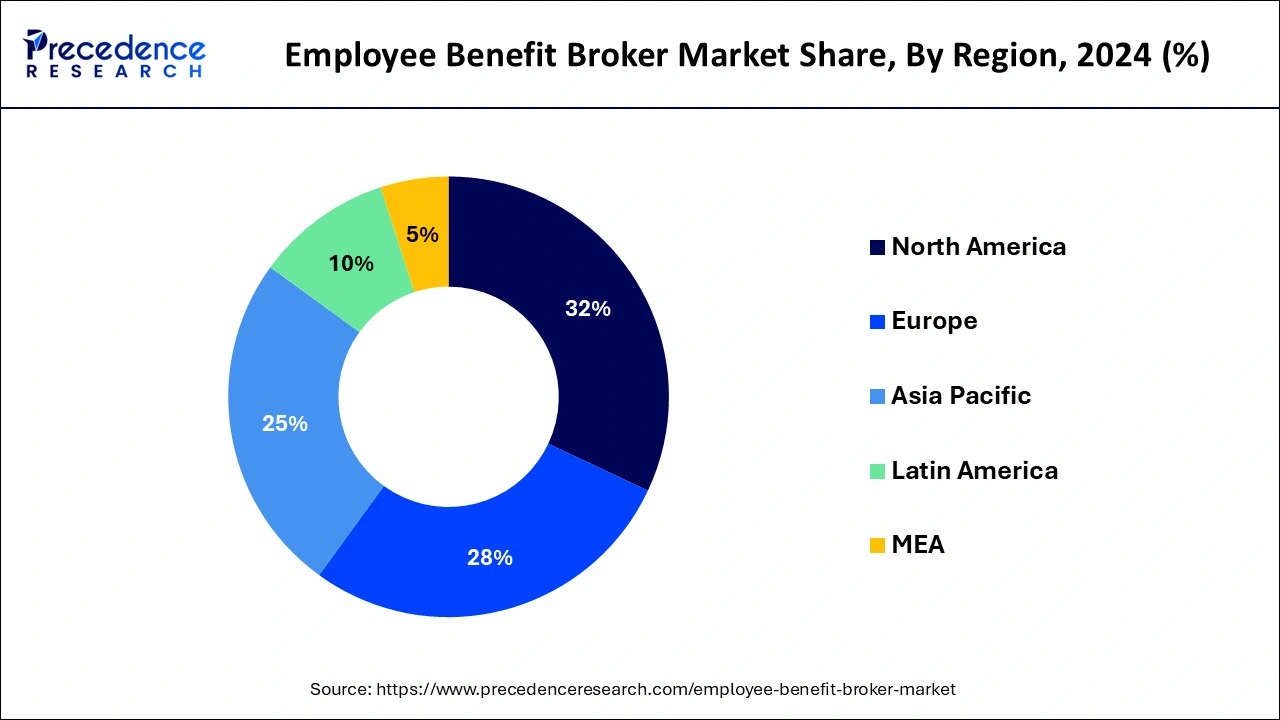

North America accounted for the highest share of the global employee benefit broker market. This is due to advanced technological infrastructure facilitates the adoption of digital platforms for benefit administration, communication, and data analytics, enhancing the efficiency and effectiveness of broker services.

North America emerged as the dominant segment in the global employee benefit broker market, driven by its strong economic landscape, technological advancements, and regulatory environment. The region comprises major economies such as the United States, Canada, and Mexico, each contributing to the market's dominance.

The United States, with its large and diverse workforce, accounts for a significant portion of the market share. Employers in the U.S. prioritize comprehensive benefits packages to attract and retain talent, fueling the demand for broker services. Also, prominent market players such as Evconnect and Chargepoint are major drivers for the dominance of the North American region in the global employee benefit broker market. Due to their fierce competitiveness, especially in the finance and technology sector, companies are looking for top-tier talent while offering them a beneficial scheme. Such a competitive landscape aids in the proliferation of continuous innovation and broadens the benefits for employees.

Canada's stable economy and well-established social welfare system contribute to the region's dominance. Canadian employers seek innovative benefit solutions to support their employees' well-being and navigate regulatory requirements, driving demand for broker services.

Asia Pacific is expected to grow at the fastest CAGR during the foreseen period. This expansion is fueled by rapid economic development, expanding workforce needs, and increasing adoption of employee benefit programs. Moreover, the adoption of digital technologies is accelerating in the region, facilitating the delivery of broker services through online platforms, mobile applications, and data analytics tools. This technological advancement enhances the efficiency and accessibility of benefit solutions, further driving market growth.

With countries such as China, India, and Japan leading the way, the region presents immense opportunities for market growth. As economies in Asia Pacific continue to grow, businesses are increasingly recognizing the importance of providing competitive benefit packages to attract and retain talent. This heightened focus on employee well-being drives demand for expert guidance and support from benefit brokers.

Additionally, the growth of this region is attributed to the sudden rise in e-commerce activities as the region is incorporated with growing economies such as India and China. These countries' business sectors have continuously recognized that attractive beneficial packages play a vital role in staying in the competition in the global employee benefit broker market. Therefore, Asia Pacific's fast-growing economy and evolving business landscape position it as a key growth segment in the employee benefit broker market.

The employee benefit broker market continues to evolve, driven by shifting workplace dynamics and regulatory changes. Brokers are adapting to meet the different needs of employers and employees, offering a range of services from healthcare and retirement planning to wellness programs and voluntary benefits.

Technology integration is key, with brokers leveraging digital platforms for enrollment, communication, and data analytics. Market consolidation is also noticeable as larger firms acquire smaller players to expand their service offerings and geographic reach. With employers increasingly prioritizing employee well-being and cost containment, brokers face the challenge of providing innovative solutions while navigating a complex regulatory landscape. Overall, the global employee benefit broker market remains dynamic, with opportunities for growth and differentiation amidst ongoing industry transformations.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.52% |

| Market Size in 2025 | USD 48.24 Billion |

| Market Size by 2034 | USD 78.21 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Benefit Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Technological advancements

Technological advancements serve as a major driver for the employee benefit broker market, revolutionizing how brokers engage with clients and deliver services. Digital platforms streamline processes such as enrollment, communication, and data analytics, enhancing efficiency and improving client experiences.

With the integration of artificial intelligence and machine learning, brokers can offer personalized recommendations and predictive analytics, empowering employers to make informed benefit decisions. Moreover, technology enables brokers to reach a wider audience and provide remote assistance, breaking geographical barriers and expanding market reach.

Complex regulatory environment

The complex regulatory environment poses a significant restraint on the employee benefit broker market. Evolving healthcare regulations and privacy laws create a challenging landscape for brokers to navigate. Keeping up with regulatory changes requires substantial resources and expertise, increasing operational costs and administrative burdens for brokers. Non-compliance can lead to penalties and reputational damage, further exacerbating the challenges. As regulations continue to evolve, brokers must invest in continuous training and regulatory compliance measures to ensure adherence and mitigate risks.

Comprehensive wellness programs

An emerging opportunity in the employee benefit broker market lies in the heightened focus on employee well-being. Employers increasingly recognize the importance of supporting their employees' physical, mental, and financial health. Benefit brokers can capitalize on this trend by offering comprehensive wellness programs, mental health resources, and financial planning services. By partnering with innovative service providers and leveraging data analytics, brokers can tailor solutions to meet the diverse needs of employers and employees.

Additionally, promoting well-being initiatives can enhance employee engagement and productivity; as the demand for holistic benefit solutions continues to grow, brokers have the opportunity to position themselves as trusted advisors and strategic partners in supporting employee well-being initiatives.

The healthcare insurance segment held the largest share of the global employee benefit broker market in 2024. With rising healthcare costs and complex regulatory environments, employers rely heavily on benefits brokers to navigate the intricacies of insurance plans and negotiate favorable terms. Brokers play a pivotal role in helping employers select the right insurance plans, manage costs, and ensure employee access to quality healthcare services.

The retirement savings plan segment is expected to witness the fastest growth in the forecasted years. This growth is fueled by shifting demographics and changing retirement landscapes. As populations age and individuals place greater emphasis on financial security in retirement, employers are increasingly prioritizing retirement savings options as part of their benefits packages. Benefit brokers play a crucial role in assisting employers. Additionally, as retirement planning becomes more personalized and tailored to individual needs, brokers leverage digital tools and data analytics to offer customized solutions. It further drives the growth of this segment within the market.

The IT & telecom segment registered for the largest share of the employee benefit broker market in 2024. In the employee benefit broker market, the information technology (IT) and Telecommunications sector emerges as the dominant segment by application. This industry relies heavily on attracting and retaining top talent, making comprehensive benefit packages a strategic imperative. With the rapid evolution of technology and communication systems, employers within this sector seek specialized benefit solutions to meet the unique needs of their workforce. Benefit brokers play a crucial role in navigating the complex landscape of IT and telecommunications benefits, including healthcare plans, retirement savings options, and specialized perks such as flexible work arrangements and professional development opportunities.

The retail segment is anticipated to witness the fastest growth over the foreseen period. Benefit brokers play a crucial role in assisting retail businesses in designing tailored benefit solutions that address the diverse needs of their workforce, including healthcare coverage, retirement savings plans, and employee wellness programs. Moreover, as retail businesses adapt to shifts in consumer behavior and operational models, brokers provide expertise in navigating regulatory requirements. The dynamic nature of the retail industry presents significant growth opportunities for benefit brokers catering to this segment.

By Benefit Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

July 2024