January 2025

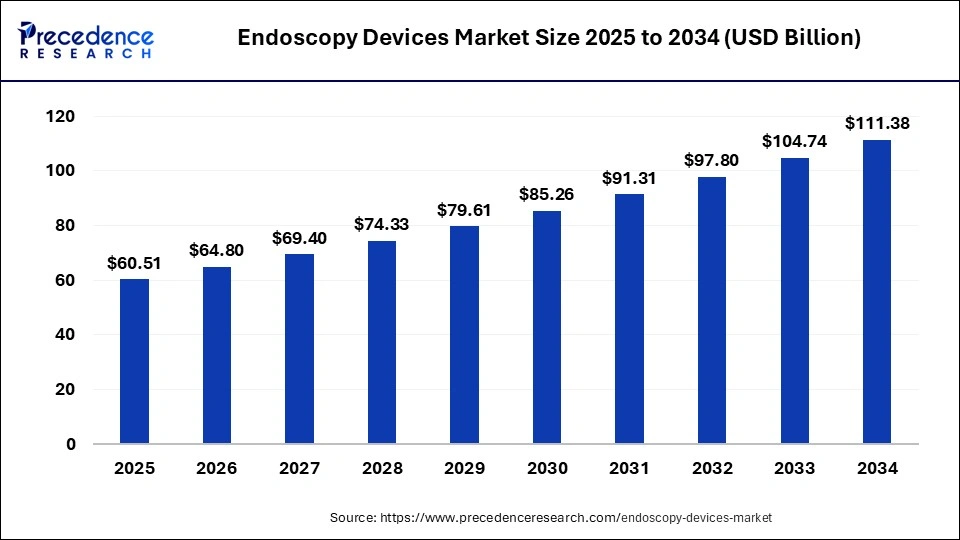

The global endoscopy devices market size is calculated at USD 60.51 billion in 2025 and is forecasted to reach around USD 111.38 billion by 2034, accelerating at a CAGR of 7.10% from 2025 to 2034. The North America market size surpassed USD 24.30 billion in 2024 and is expanding at a CAGR of 7.14% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global endoscopy devices market size accounted for USD 56.50 billion in 2024 and is expected to exceed USD 111.38 billion by 2034, growing at a CAGR of 7.10% from 2025 to 2034.

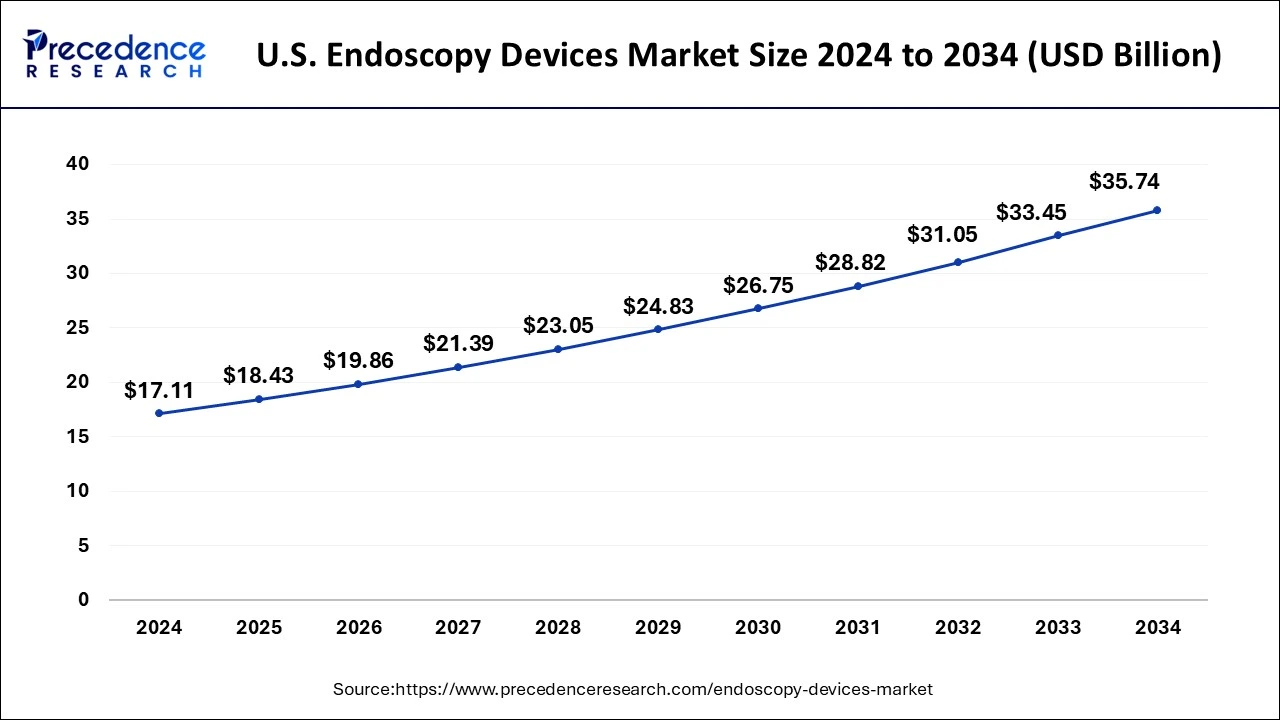

The U.S. endoscopy devices market size was exhibited at USD 17.11 billion in 2024 and is projected to be worth around USD 35.74 billion by 2034, growing at a CAGR of 7.64% from 2025 to 2034.

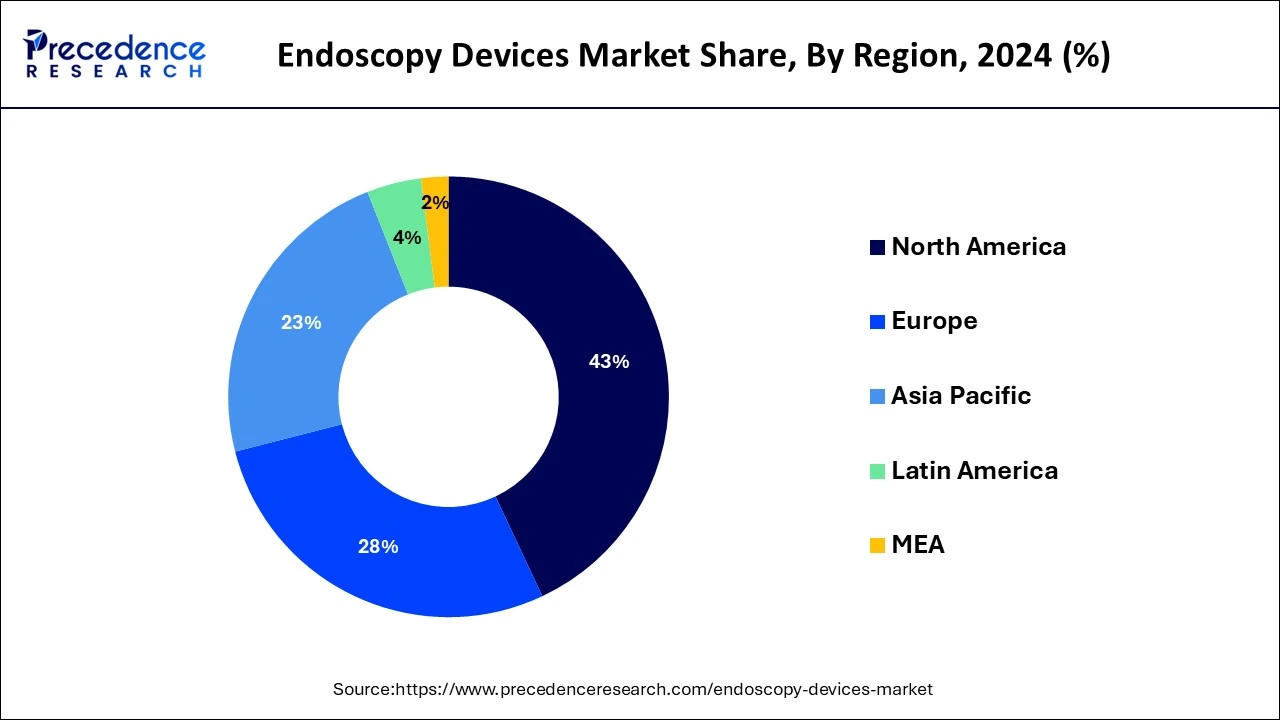

In 2024, North America accounted for the largest revenue share 43% owing to increase in preference for minimally invasive surgeries, rise in the prevalence of diseases such as colon & bladder cancers, and increase in geriatric population. Additionally, rising adoption of robot-assisted endoscopes used for surgical and diagnostic procedures is further positively influencing the market growth in the region. However, the Asia Pacific anticipated as the most opportunistic region during the forecast period. Increasing economies of China and India estimated to be the significant contributors for the market growth in this region.

The Asia Pacific region is projected to witness strong growth over the forecast period 2025 to 2034.

Rise in preference for minimally invasive endoscopic procedures along with an increase global geriatric population are the key factors boosting the demand for endoscopy devices. The market for endoscopes is also being driven by a surge in the prevalence of urological, gastrointestinal, respiratory, and gynecological disorders that requires endoscopic procedures for proper treatment &diagnosis. An increase in the adoption of endoscopes as well as visualization systems in healthcare industry coupled with the technological advancements in the similar field further aids to the growth of the market.

In addition, proliferation in the prevalence of age-related problems together with increase in demand for endoscopy devices in therapeutic & diagnostic procedures is the other important factor that propels the market growth. Implementation of such devices in treatment and diagnosis of health problems is necessary as it allows minimal intervention that further results in shorter recovery time.

Geriatric population is the most common group prone to medical problems that require endoscopic procedures such as gall stones, intestinal perforation, endometriosis, pelvic abscess, and liver abscess. According to a research conducted by Population Reference Bureau, in 2018, there were nearly 52 Million people with age 65 years or above in the United States and projected to cross the number of 95 Million by 2060. The aforementioned factor anticipated to boost the need for endoscopic procedures, thereby escalating the demand for endoscopy devices during the forecast period.

| Report Coverage | Details |

| Market Size in 2025 | USD 60.51 Billion |

| Market Size by 2034 | USD 111.38 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.10% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Hygiene, End User, Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Endoscopy visualization systems captured the highest value share 37% in the year 2024. This is attributed to the rising preference for high definition (HD) visualization system by medical professionals, as it helps in treatment &diagnosis of complex diseases that include GI disorders, cancer, urinary disorders, and lung disorders during minimally invasive surgical procedures. Presently, manufacturers offer HD visualization systems that are capable of switching images from 3D to 2D and vice versa also impact positively on the market growth of segment.

The endoscopes segment projected to exhibits lucrative growth rate of nearly 9.5% over the analysis period. Flexible endoscopes dominated the segment with the highest value share in 2024 due to rising preference of safety, better ergonomics, and efficacy over rigid endoscopes. However, endoscopy visualization components register notable growth over the forecast period, wherein HD monitors accounted for the largest value in 2024.

Hospitals segment encountered to be the largest end-user in the year 2024, as it is the primary health center in majority of countries. Further, the total number of endoscopic surgeries takes place at hospitals is comparatively higher than other healthcare systems, such as specialty clinics or ambulatory surgical centers (ASCs). Consequently, the demand of endoscopy devices at hospitals is higher compared to other end-use segments. Furthermore, the segment expected to maintain its dominance in the forthcoming years owing to rising investment from governments of various regions for the development of hospitals. This subsequently predicted to boost the demand for endoscopy devices in the coming years.

Key Companies & Market Share Insights

The global endoscopy devices market seeks intense competition among the market players. This is mainly because of adoption of various inorganic growth strategies by the industry participants such as merger & acquisition, regional expansion, new product launch & approval.

Segments Covered in the Report

By Product

By Application

By Hygiene

By End-Use

By Regiona

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

July 2024

April 2025