January 2025

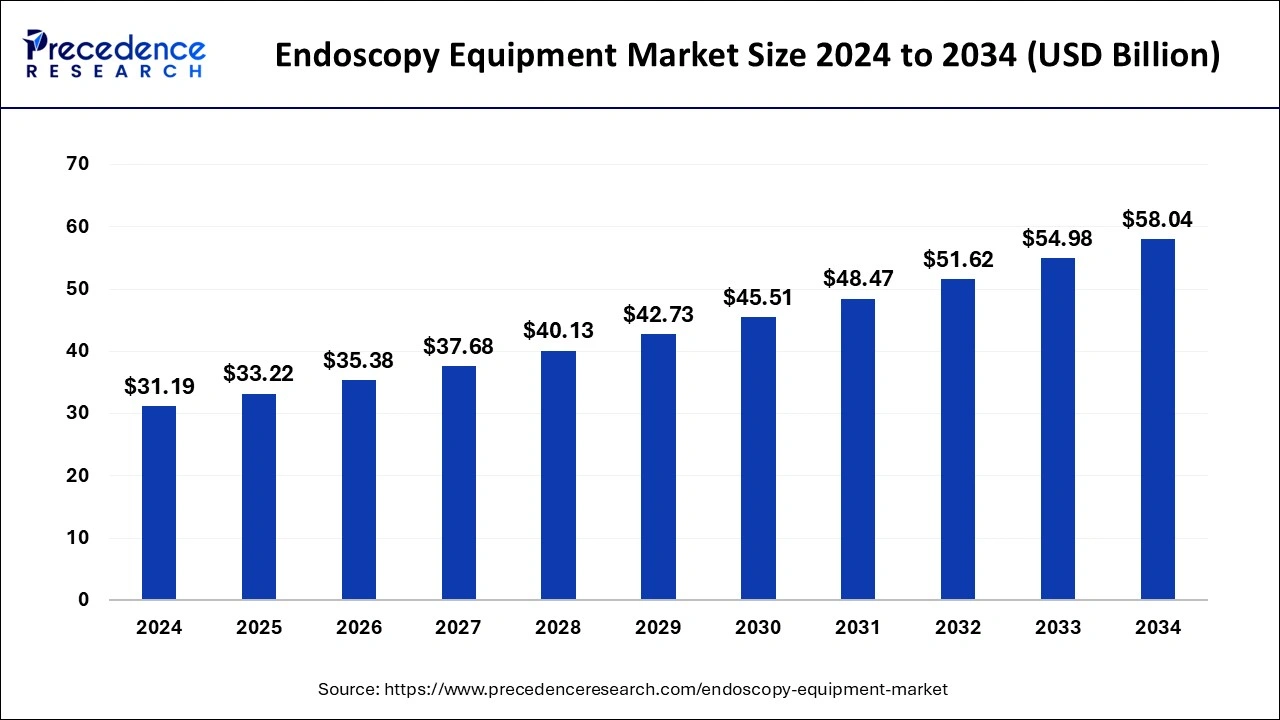

The global endoscopy equipment market size is calculated at USD 33.22 billion in 2025 and is forecasted to reach around USD 58.04 billion by 2034, accelerating at a CAGR of 6.41% from 2025 to 2034. The North America endoscopy equipment market size surpassed USD 8.42 billion in 2024 and is expanding at a CAGR of 6.45% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global endoscopy equipment market was valued at USD 31.19 billion in 2024 and is expected to reach over USD 58.04 billion by 2034 with a registered CAGR of 6.41% from 2025 to 2034.

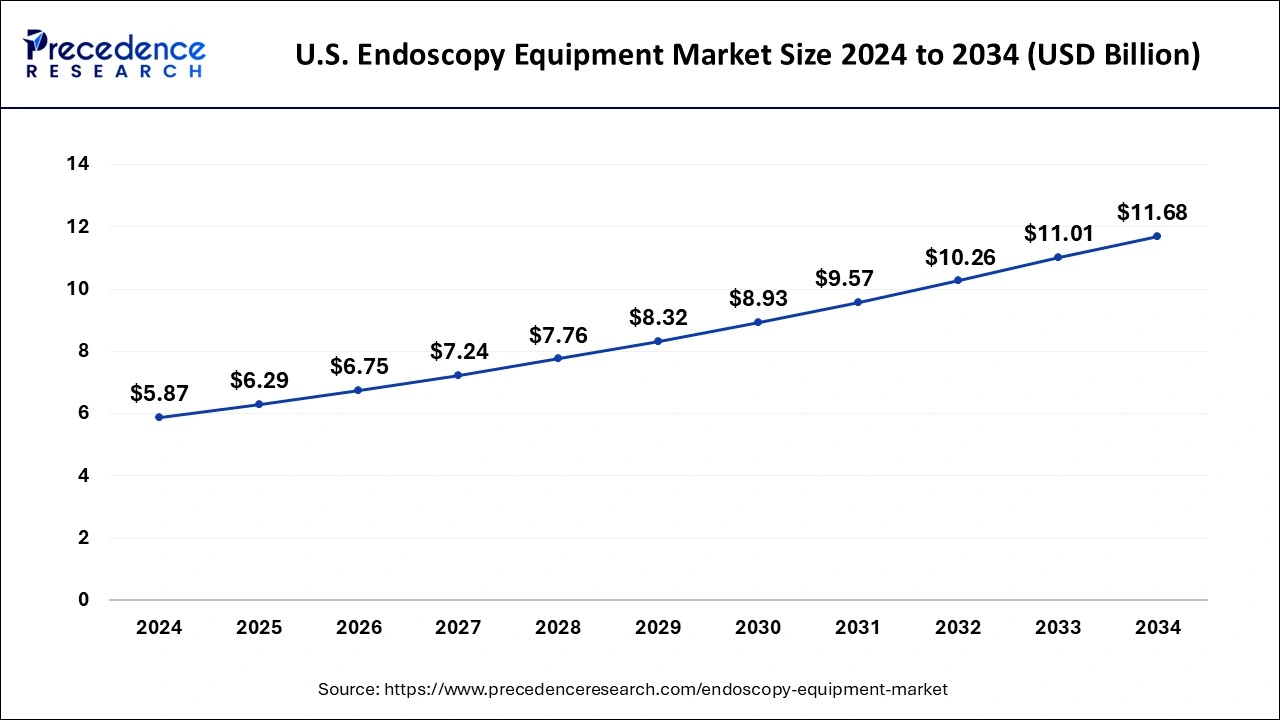

The U.S. endoscopy equipment market size was estimated at USD 5.87 billion in 2024 and is predicted to be worth around USD 11.68 billion by 2034, at a CAGR of 7.12% from 2025 to 2034.

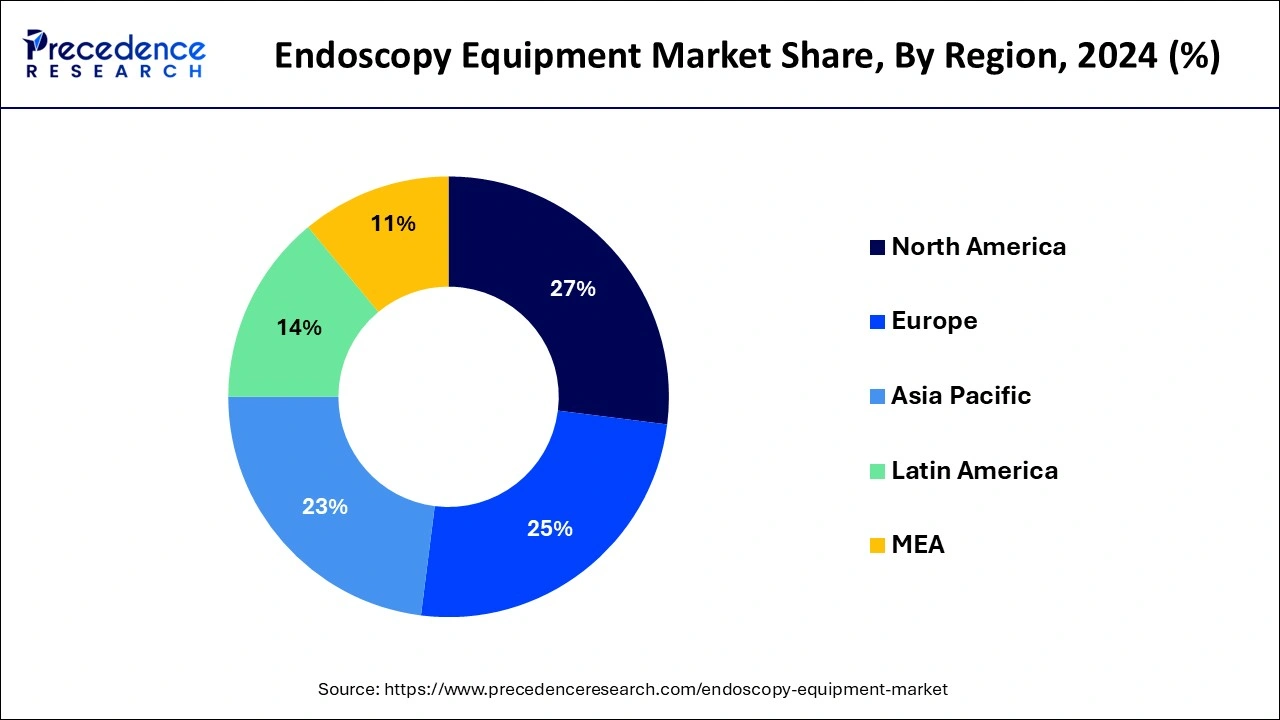

North America dominated the endoscopy equipment market with revenue share of 27% in 2024. Due to growing preference for minimally invasive surgeries, rising adoption of advanced technologies, and improved healthcare infrastructure, the North America dominated the global endoscopy equipment market.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. This is due to the region’s increasing need for endoscopy-related technologies. Other factors include an ageing population and improved health infrastructure.

Endoscopy is a type of imaging that allows doctors to look within the body’s organs and veins. This technique is useful not only for detecting damage, but also for surgical and therapeutic procedures. The endoscopy equipment market is being driven by factors such as an ageing population with an increase in the prevalence of cancer, gastrointestinal, and other chronic disorders, an increase in the number of hospitals, and technological advancements in endoscopy.

Endoscopes are one of the most commonly used medical imaging instruments. Endoscopes are introduced directly into the organ by a clinician or surgeon, as opposed to other imaging instruments. The endoscope has a camera and light on one end and the doctor may view the visual on a screen in real time. Instead of cameras, ultrasound endoscopes employ sound waves to produce detailed views of the intestinal wall and adjacent organs. This endoscopy equipment can be used for more than just imaging. They can also be used to place endoscopic implants.

During the projected period, the endoscopy equipment market is expected to rise due to an increase in the incidence of age-related disorders and an increase in the need for endoscopic equipment in diagnostic and therapeutic operations. The increased use of the endoscopy equipment for the diagnosis and treatment of a variety of illnesses is significant because it allows for less intervention and recovery time. As a result, the endoscopy equipment market expansion is expected. The rise in the senior population, who are more susceptible to a variety of medical disorders requiring endoscopic operations, such as gall stones and endometriosis, is fueling the endoscopy equipment market expansion.

On the other hand, the endoscopy equipment market is expected to be hampered by the high cost of endoscopic equipment and procedures, as well as inadequate compensation in developing countries. In the approaching years, factors such as product recalls and infections caused by endoscopes are projected to stifle the endoscopy equipment market growth. The healthcare industry in developing economies is expected to grow at a rapid pace, providing several chances for the endoscopy equipment market expansion.

Furthermore, biopsy instruments are frequently employed to obtain tissue samples for diagnostic testing. During the projected period, the endoscopy equipment market is expected to be driven by the rising adoption of low-cost disposable endoscopes. The endoscopy equipment market is expected to grow slowly in some locations due to a dearth of qualified endoscope operators.

Due to the growing need for endoscopy equipment for various therapeutic and diagnostic procedures, there is fierce competition among the existing manufacturers. Furthermore, prominent market players’ technological developments in the field of endoscopy equipment are raising the stakes even higher during the forecast period.

| Report Coverage | Details |

| Market Size in 2025 | USD 33.22 Billion |

| Market Size by 2034 | USD 58.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.41% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Application, and By End User, |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The endoscopy visualization systems segment dominated the endoscopy equipment market in 2024. This is due to the advantages of high-definition visualization systems for the treatment and diagnosis of complex health conditions like gastrointestinal disorders, urinary disorders, cancer, and lung disorders, as well as the growing preference of healthcare professionals for using endoscopy visualization systems for better treatment and diagnosis.

The endoscopes segment is fastest growing segment of the endoscopy equipment market in 2024. This is attributed to an increase in endoscopic procedures and biopsies, as well as the availability of various types of endoscopes for improved diagnostics and treatment.

The gastrointestinal endoscopy segment dominated the endoscopy equipment market in 2024. Due to the increased incidence of gastrointestinal disorders and the growing elderly population, the gastrointestinal endoscopy segment had the biggest revenue share in 2023.

The urology endoscopy segment, on the other hand, is predicted to develop at a rapid rate over the projection period. The increased burden of urological diseases, as well as an increase in urology surgeries, is predicted to fuel demand for urology endoscopies.

In 2024, the hospitals segment dominated the endoscopy equipment market. This is due hospitals having a much higher uptake and utilization of endoscopic devices than other healthcare systems, as well as advantageous payment rules. In addition, because hospitals are often the primary healthcare providers in many nations, the number of surgeries performed in hospitals is higher, indicating high adoption and demand.

The ambulatory surgery centers segment, on the other hand, is predicted to develop at the quickest rate in the future years. Some of the important aspects that are boosting the need for endoscopic interventions or procedures in ambulatory surgery centers include little discomfort due to microscopic surgeries, the shorter time required for endoscopy, and faster recovery time. As a result, endoscopy equipment market growth is influenced positively.

By Product

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

July 2024

February 2025