January 2025

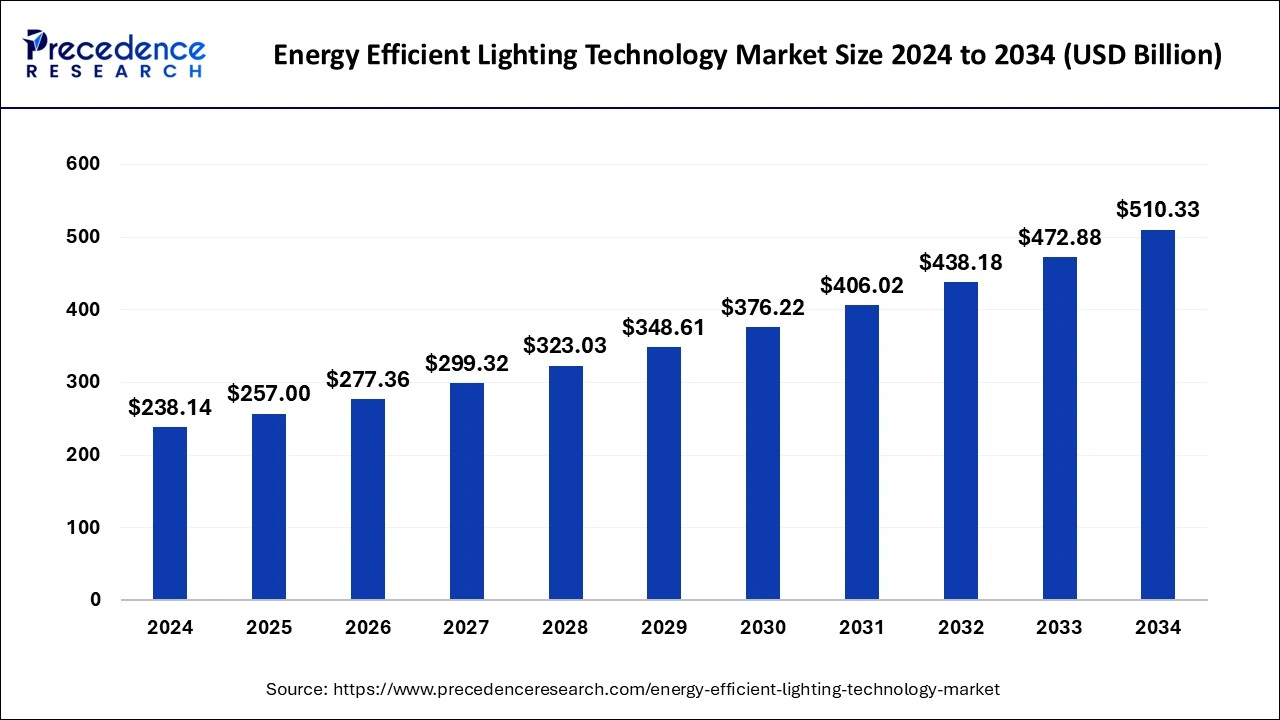

The global energy efficient lighting technology market size is calculated at USD 257 billion in 2025 and is forecasted to reach around USD 510.33 billion by 2034, accelerating at a CAGR of 7.92% from 2025 to 2034. The North America energy efficient lighting technology market size surpassed USD 90.49 billion in 2024 and is expanding at a CAGR of 7.98% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global energy efficient lighting technology market size was accounted for USD 238.14 billion in 2024 and is anticipated to reach around USD 510.33 billion by 2034, growing at a CAGR of 7.92% from 2025 to 2034. The growing demand for environmental sustainability, rising adoption in household and industrial areas, and favorable government policies promote the energy efficient lighting technology market.

Artificial intelligence (AI) can be used to design novel lighting technology based on user preferences and usage patterns. Based on environmental factors, AI-based algorithms and sensors can optimize light settings in real-time. AI can also adjust brightness and color through various software or mobile applications. Thus, AI aids personalized lighting experience, enhancing user comfort and energy efficiency. Additionally, AI can also provide data about the energy consumption of light, resulting in reduced costs. AI can enable dimming or switching off lights in unoccupied spaces, conserving more energy and expanding the lifespan of light bulbs. Moreover, AI-driven natural light patterns can improve sleep quality, mood, and overall well-being of an individual.

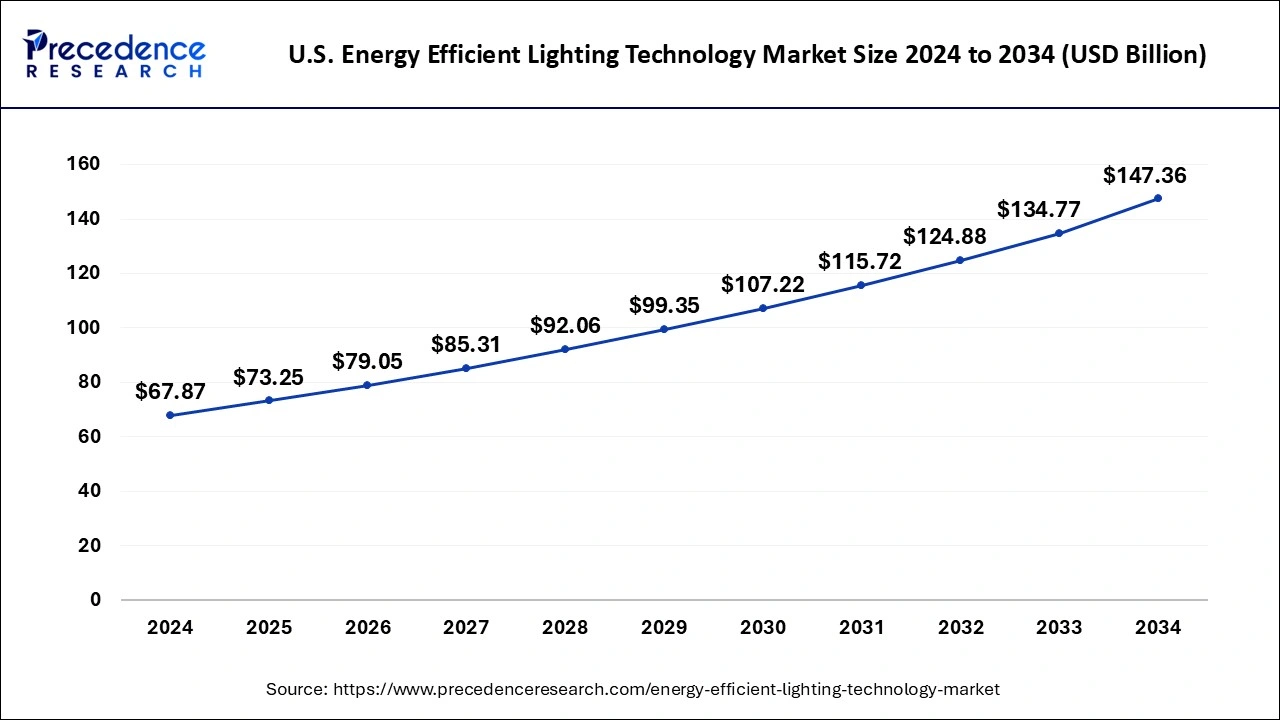

The U.S. energy efficient lighting technology market size was evaluated at USD 67.87 billion in 2024 and is predicted to be worth around USD 147.36 billion by 2034, rising at a CAGR of 8.06% from 2025 to 2034.

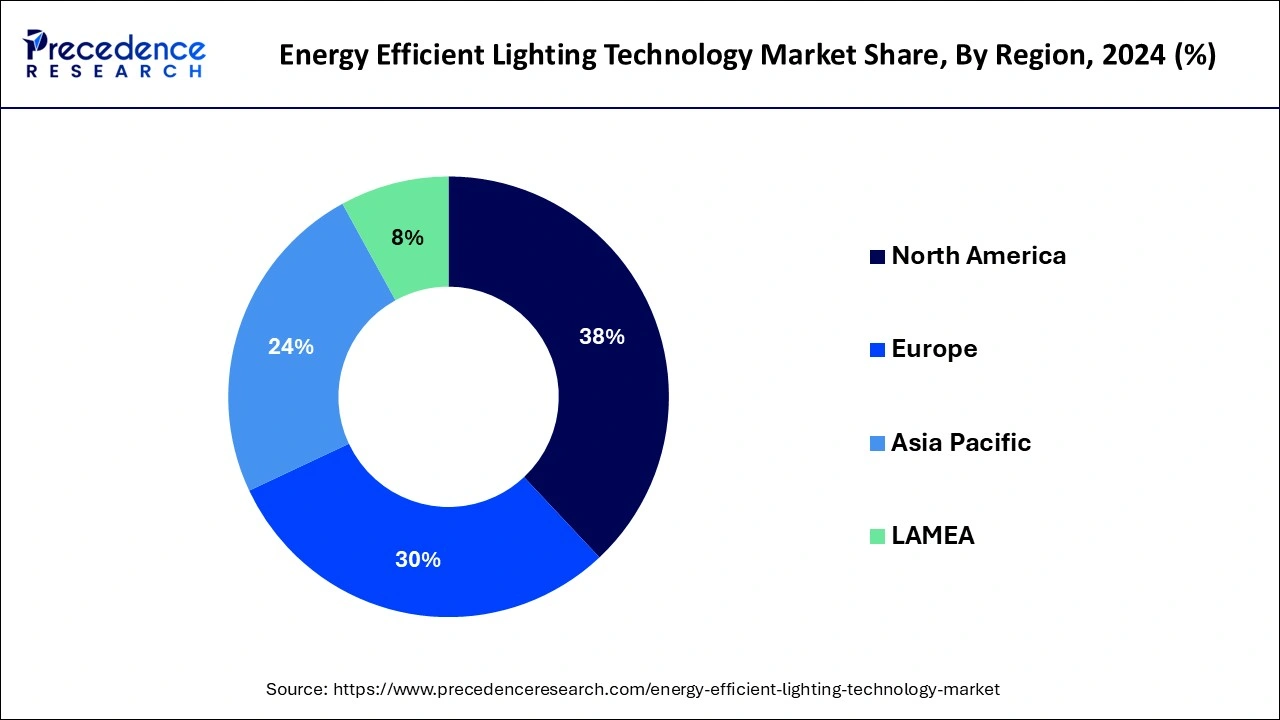

North America dominated the global energy efficient lighting technology market with the largest market share of 38% in 2024. The major growth factor driving market growth in North America is favorable government policies. The U.S. General Services Administration has recommended federal buildings to use cost-effective and energy-efficient lighting products. The U.S. Department of Energy also promotes the use of LEDs and estimates that the majority of lighting installations will be LEDs by 2035 in the U.S. Suitable regulatory frameworks facilitate the approval of advanced and more efficient lighting technology. The presence of key players leads to the development of lighting technology, contributing to the market. Moreover, increasing funding by government and private organizations favor market growth.

On the other hand, Asia Pacific is estimated to be the most opportunistic market during the forecast period. Asia Pacific is witnessing rapid industrialization, rapid urbanization, increased FDIs, and growing government initiatives to deploy sustainable and energy efficient solutions. The growing focus on the electrification of the rural areas in the nations like India, China, and Indonesia is presenting lucrative growth opportunities to the market players. Furthermore, rising government initiatives to promote the adoption of the energy efficient lighting technology is estimated to have a significant impact on the market growth. For instance, the Government of India invested around US$ 132 million in 2017 in EESL program, an energy efficient building program to encourage the adoption of the energy efficient lighting technology across the nation.

Energy-efficient lighting technology is a light that uses much less energy than conventional incandescent lights. This can save up to 90% of energy, resulting in lower carbon dioxide emissions. However, the brightness and light quality of these lights are not hampered. There are generally two different types of energy-efficient lights such as compact fluorescent lights (CFLs) and light-emitting diodes (LEDs). LEDs can be further classified into industrial and commercial lighting, under-cabinet lighting, recessed downlights, LED replacement bulbs, and holiday lights. The selection of the lights depends on their purpose. Apart from saving energy, these lights also have a longer lifespan compared to incandescent bulbs. Additionally, they do not release heat while lighting, making it more efficient.

| Report Coverage | Details |

| Market Size in 2025 | USD 204.06 Billion |

| Market Size by 2034 | USD 204.06 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 7.90% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing Demand for Sustainability

The growing demand for sustainability is a major growth factor in the energy efficient lighting technology market. Several government organizations impose stringent regulations to promote environmental sustainability. The World Health Organization has also launched the “UN 2020-2030 Strategy for Sustainability Management” to enhance environmental sustainability. Such initiatives promote the use of energy efficient lighting technology as they reduce energy consumption by 90% and release less carbon dioxide emissions. The increasing construction of green buildings globally necessitates the use of energy efficient lighting technology. Such lighting technology minimizes light pollution and significantly reduces electricity costs.

High Costs

The major challenge of the energy efficient lighting technology market is the high costs of such lighting technology. Compared to conventional incandescent, energy-inefficient bulbs, LEDs or CFLs are more expensive. This limits the affordability of many low- and middle-income groups or population globally, hindering market growth.

Latest Innovations

The future of the energy efficient lighting technology market is promising, owing to growing research and development activities to drive the latest innovations in lighting technology. The development of organic light-emitting diodes (OLEDs) presents superior advantages over conventional LEDs. OLEDs emit light from a flexible thin film, enabling more creative designs and enhanced energy efficiency potential. Several researchers are also investigating to development of lights by harvesting organisms such as fireflies, fungi, bacteria, etc. as they can emit light. They do not emit heat or release carbon and are natural sources of light. Integrating advanced technologies such as AI and the Internet of Things (IoT) results in smart lights, enabling enhanced security.

The light emitting diode segment dominated the global energy efficient lighting technology market in 2024, in terms of revenue. The LED lightings has gained immense traction among the global population as it saves around 75% energy. It deployment of the LEDs can significantly reduce the energy consumption and can lead to low operational costs as compared to the traditional lighting technologies. Moreover, the toxicity of the CFL bulbs that contains harmful gases and chemicals, which has an adverse effect on the environment is compelling the consumers to opt for the safer and cheaper alternatives. Therefore, the demand for the LED segment is expected to grow significantly in the upcoming years and hence this segment is also expected to be the fastest-growing segment during the forecast period.

The commercial segment accounted largest revenue share in 2024. This can be attributed to the increased adoption of the energy efficient lighting technology in the commercial spaces. The energy efficient lighting technology helps the commercial units to reduce the energy consumption and reduce the overall operational costs, which provide better opportunities to increase profits. The rising industrialization and rising number of business across the globe has significantly contributed towards the growth of the commercial segment.

On the other hand, the residential is estimated to be the most opportunistic segment during the forecast period. This is mainly due to the rising government expenditure on the electrification of rural areas and villages. Moreover, rapid urbanization, rapidly growing urban population, growing number of residential real estate projects, and rising awareness regarding the benefits of the energy efficient lighting technology are the major factors that are expected to boost the growth of this segment during the forecast period.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

August 2024

October 2023