January 2025

Energy Efficient Motor Market (By Type: Super Premium-IE4, Premium-IE3, High-IE2, Standard-IE1; By Product Type: AC Motor, DC Motor; By Power Output Rating: < 1 kW, 1 - 2.2 kW, 2.2 - 375 kW, 375 kW; By Application: Pumps, Fans, Compressed Air, Refrigeration, Material Handling, Material Processing; By End-user: Industrial, Commercial, Residential, Agriculture Sector, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

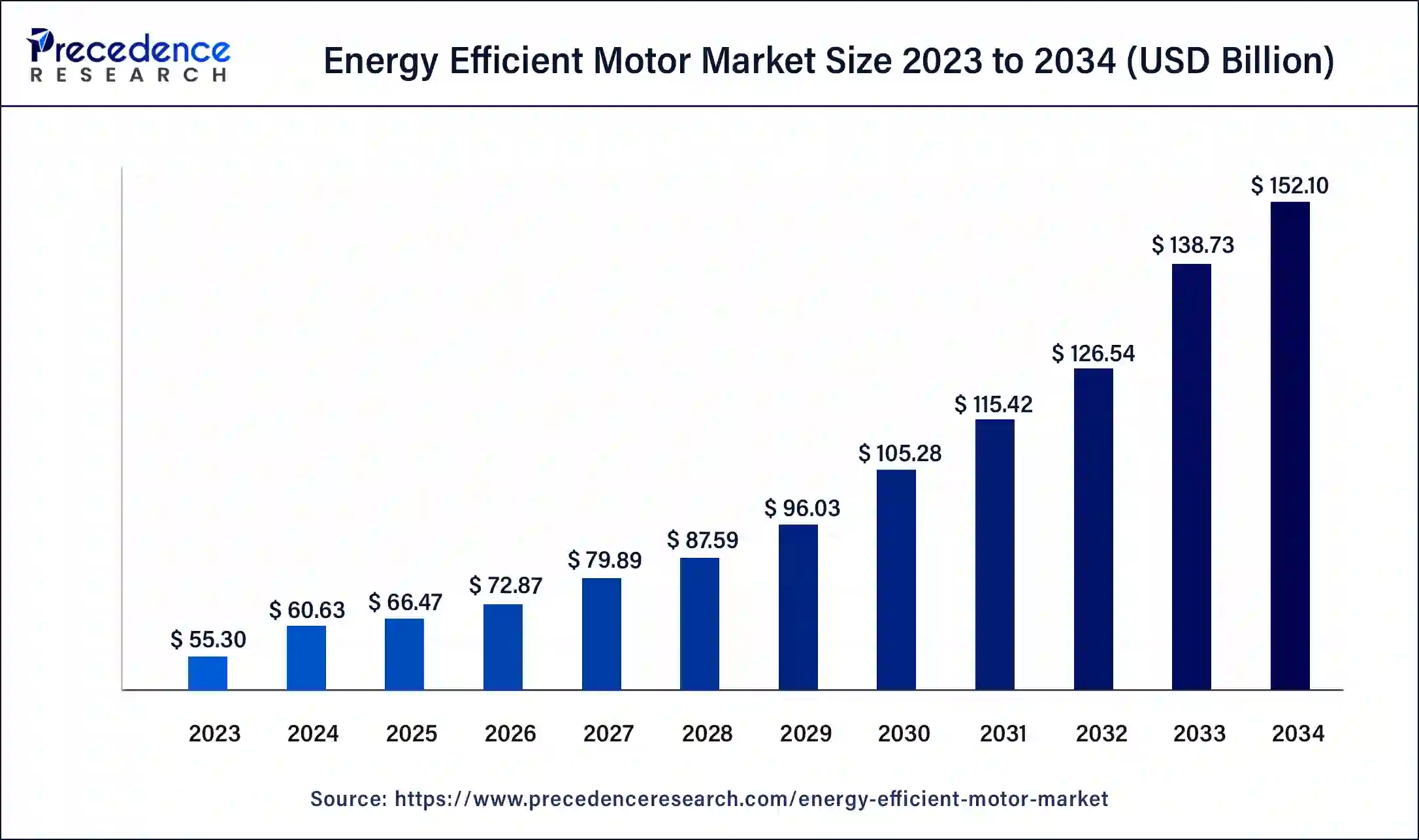

The global energy efficient motor market size was USD 55.30 billion in 2023, calculated at USD 60.63 billion in 2024 and is expected to reach around USD 152.10 billion by 2034. The market is expanding at a solid CAGR of 9.63% over the forecast period 2024 to 2034. The energy efficient motor market is driven by increasingly strict rules set forth by the government.

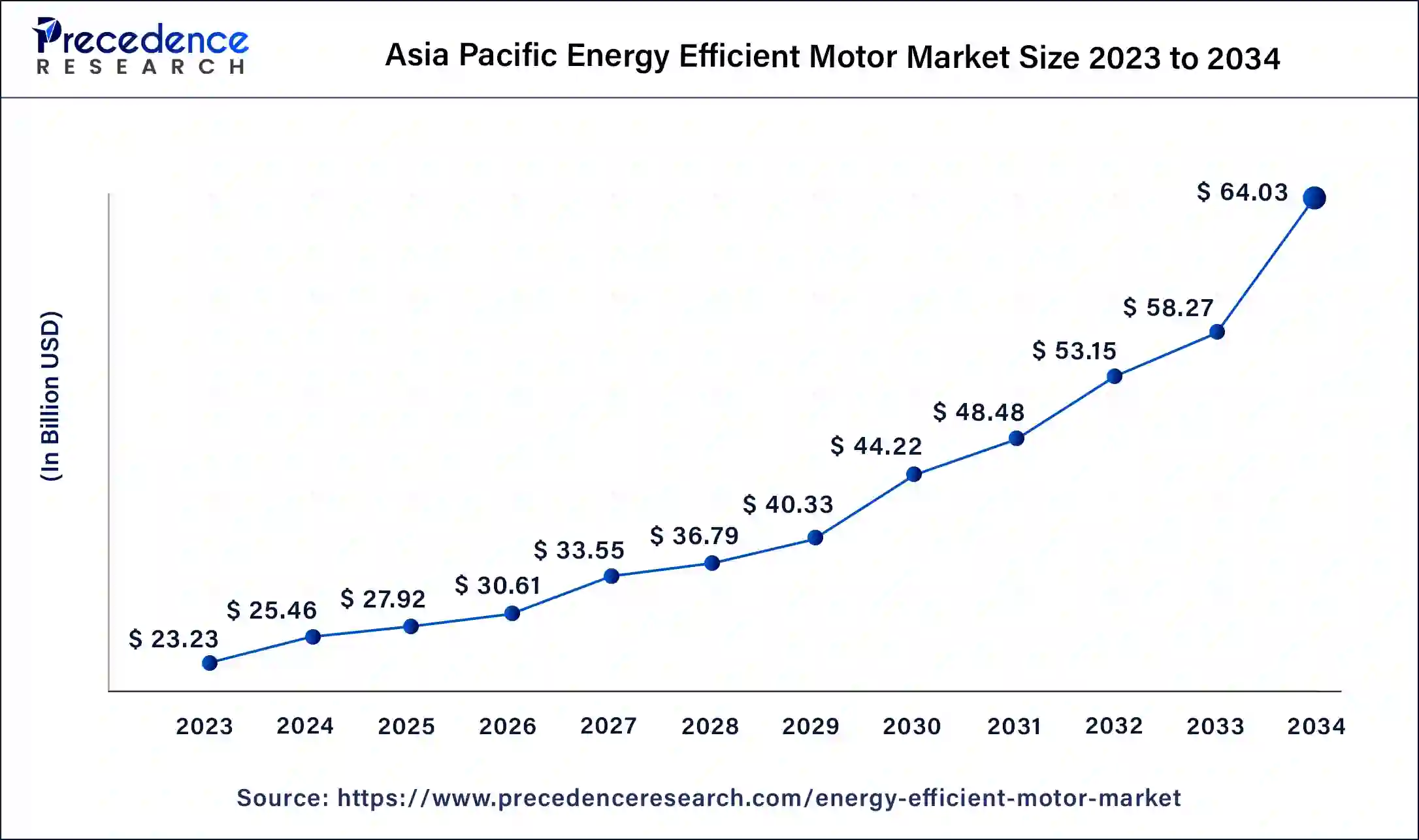

The Asia Pacific energy efficient motor market size was exhibited at USD 23.23 billion in 2023 and is projected to be worth around USD 64.03 billion by 2034, poised to grow at a CAGR of 9.65% from 2024 to 2034.

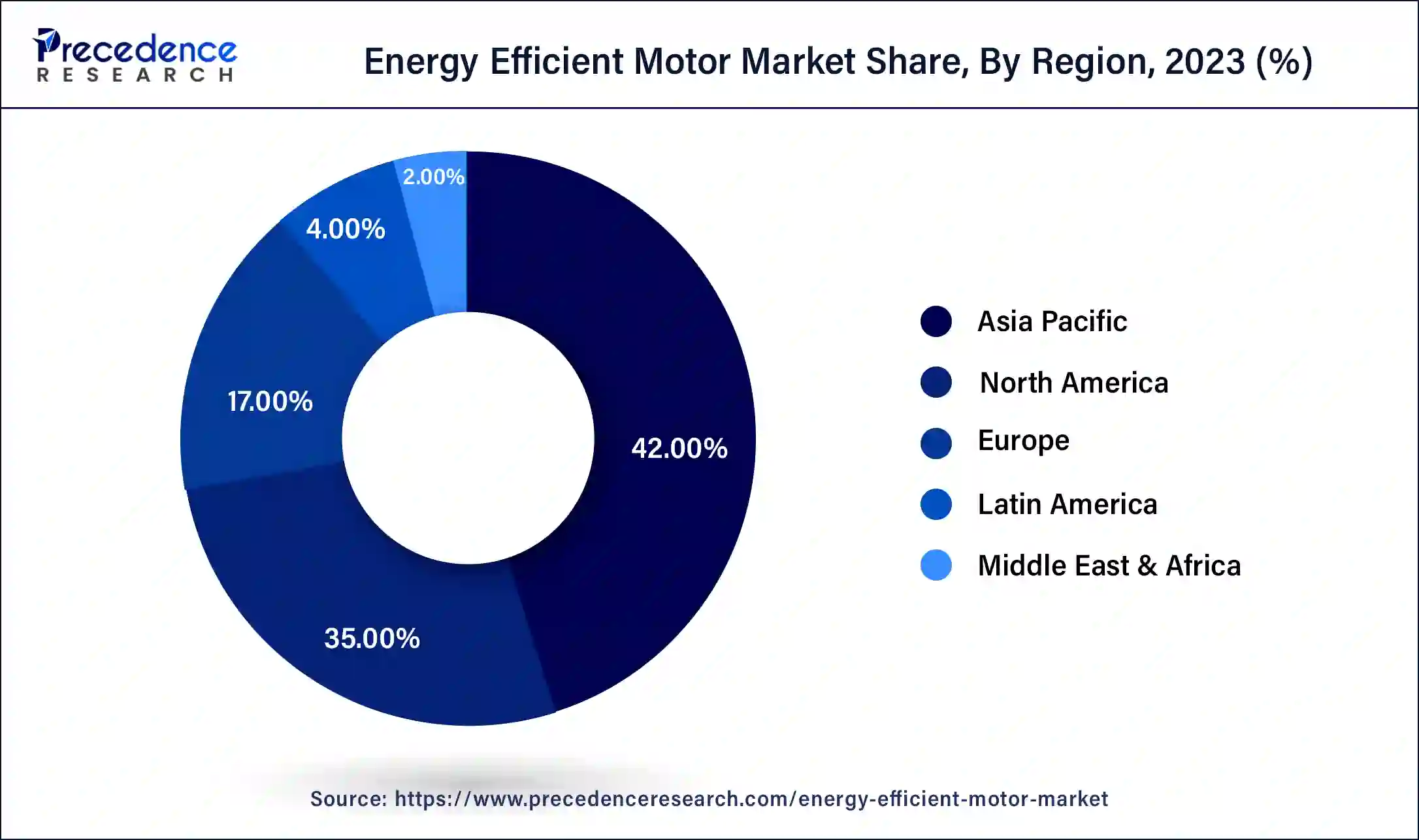

Asia-Pacific dominated the energy efficient motor market in 2023. The global manufacturing capacity is largely concentrated in the Asia-Pacific. Due to this concentration of manufacturing activity, energy-efficient motors are becoming more widely produced and used. These motors are essential for cutting operating costs and satisfying environmental regulations. Many countries provide tax breaks, subsidies, and other incentives to promote the use of energy-efficient devices. These financial incentives partially cover the upfront expenses of switching to energy-efficient motors.

North America is observed to be the fastest growing in the energy efficient motor market during the forecast period. Rising energy costs drive businesses and consumers to look for energy-efficient ways to lower their energy expenses. Energy-efficient motors appeal due to fluctuating energy prices and provide long-term cost savings. The need for energy-efficient motors is fueled by increasing investments in industrial and infrastructure projects brought about by North America's economic expansion.

The industry that produces, distributes, and uses electric motors made to run more energy-efficiently than conventional motors is known as the energy efficient motor market. These motors help reduce electric motors emissions and other pollutants by using less energy, which aligns with international initiatives to mitigate climate change and advance sustainability. Energy-efficient motors frequently offer improved performance attributes like increased torque, longer lifespans, and less maintenance requirements. This may result in less downtime and more dependable operations in industrial applications.

| Report Coverage | Details |

| Market Size by 2034 | USD 152.10 Billion |

| Market Size in 2023 | USD 55.30 Billion |

| Market Size in 2024 | USD 60.63 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.63% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Product Type, Power Output Rating, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Lower life cycle costs than traditional motors

Energy-efficient motors are made to use less electricity than conventional motors. As energy expenses usually account for most of a motor's overall life cycle costs, cutting energy use can result in significant savings. Lower electricity bills eventually result from less energy use, which can drastically cut operating expenses for enterprises. This is especially crucial in manufacturing, HVAC, and water treatment, where motors are utilized extensively.

Comparing energy-efficient motors to conventional motors, superior performance features are frequently offered. These motors can increase productivity by providing more dependable and consistent performance. Variable speed drives (VSDs), one of the more sophisticated characteristics of many energy-efficient motors, enable precise control over motor speed and torque, maximizing energy consumption and enhancing process efficiency.

Increasing adoption of energy efficient motors in industrial sector

To counteract climate change and reduce energy usage, governments and regulatory agencies around the world enforce strict energy efficiency requirements and regulations. High-efficiency motors must be used in industrial applications according to rules like the U.S. Department of Energy's efficiency standards and the European Union's Ecodesign Directive. Industries must use energy-efficient motors to comply with these laws, avoid fines, and take advantage of incentives. This drives for the growth of the energy efficient motor market.

Initial high investment costs

Premium components, including rare-earth magnets, copper windings, and high-grade electrical steel, are frequently used in energy-efficient motors. These parts cost more than regular motors, but they improve performance. Modern manufacturing processes, which include laser cutting and specialty insulating, guarantee accuracy and excellent performance, raising production costs.

Limited awareness about benefits of energy efficient motors

Due to their higher initial purchase cost, there is a common misconception that energy-efficient motors are more expensive. Stakeholders may be reluctant to invest if they are unaware of the total cost of ownership (TCO), which includes lower energy bills, fewer maintenance costs, and extended operating life. Industries and businesses that prioritize short-term financial planning may prioritize short-term cost savings ahead of long-term efficiency improvements. This short-term perspective might discourage them from implementing energy-saving solutions. This limits the growth of the energy efficient motor market.

Growth of robotics and automation

Automation and robotics are commonly employed in the manufacturing industry for material handling, welding, painting, and assembly jobs. Automation lowers labor expenses, speeds production, and enhances accuracy and caliber. Drones, robotic arms, and automated guided vehicles (AGVs) boost operational efficiency by streamlining picking, sorting, and inventory management procedures. Robotic exoskeletons, automated diagnostic instruments, and robotic-assisted surgeries are revolutionizing medical operations and patient care. This opens an opportunity for the growth of the energy efficient motor market.

Rising industrialization and decarbonization initiatives

The need for machinery and equipment in various industries, including manufacturing, construction, the automobile industry, and others, is growing as industrialization advances. These devices are not complete without energy-efficient motors, which provide better performance and lower running costs. Many businesses have set high standards for sustainability to lessen their environmental effect. Installing energy-efficient motors is an easy and effective approach to meet these goals. The need for these motors is predicted to increase as businesses work to achieve their sustainability goals.

The super premium-IE4 segment dominated the energy efficient motor market in 2023. Improvements in the motors' design and production have resulted in more efficient IE4 motors. In IE4 designs, technologies that offer improved performance and energy savings, like synchronous reluctance motors and permanent magnets, are frequently employed.

Using better components and higher-quality materials, such as rare-earth magnets, has increased the performance of IE4 motors. These materials help to improve efficiency and reduce energy losses.

The premium-IE3 segment is observed to be the fastest growing in the energy efficient motor market during the forecast period. Compared with motors in lesser efficiency classes, IE3 motors are more expensive up front, but they save a lot of money during their operational life. Because these motors use less electricity, your energy costs will go down. IE3 motors are economically attractive since the reduction in energy usage quickly outweighs the original investment. Energy-intensive sectors get higher returns on investment (ROI) for these motors because operational effectiveness has a direct financial impact.

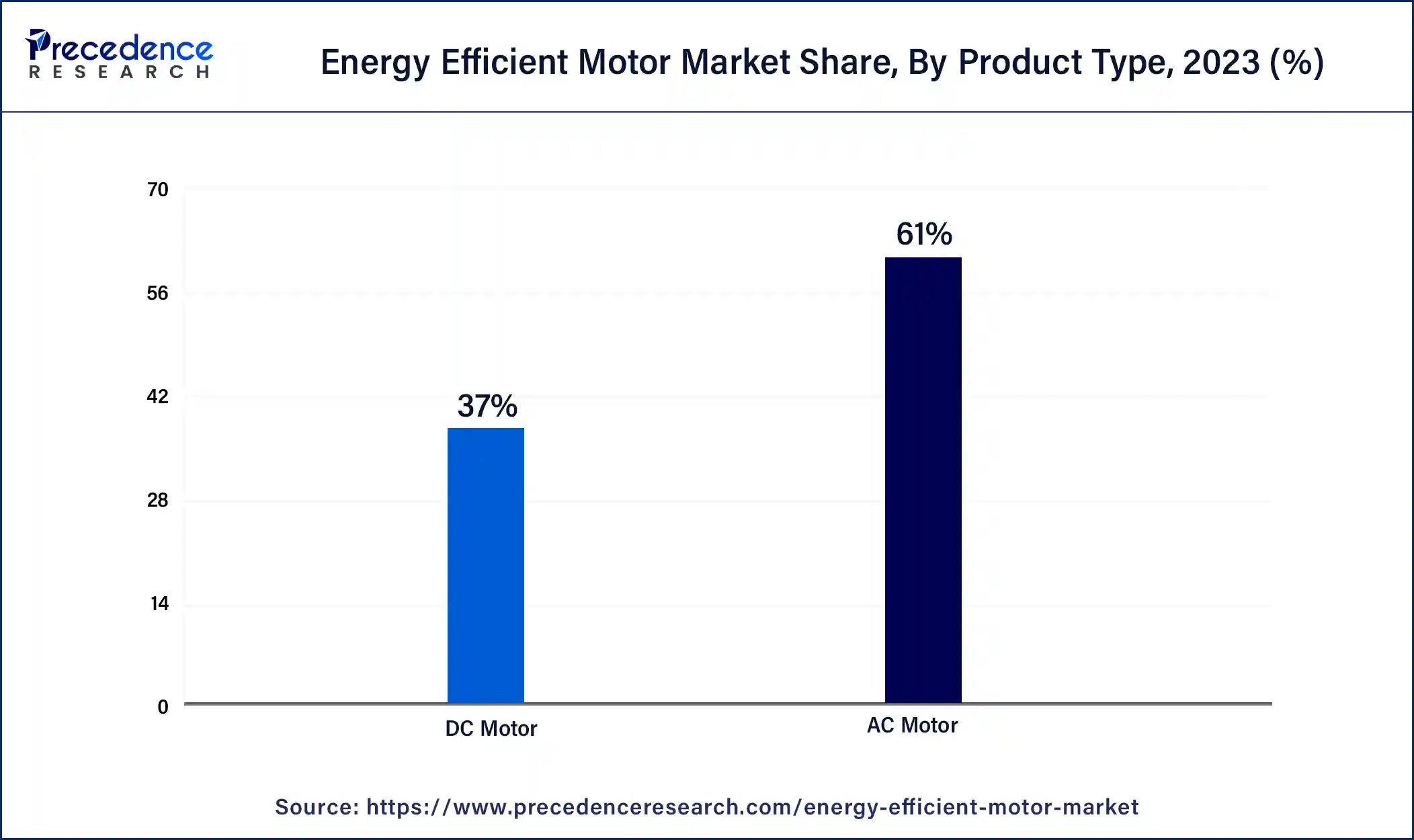

The AC motor segment dominated the energy efficient motor market in 2023. AC motors are essential for many industrial uses, including production, processing, and manufacturing. These industries depend on them to run their compressors, fans, pumps, conveyors, and other gear and equipment. AC motors are used in commercial buildings' escalators, elevators, and HVAC (heating, ventilation, and air conditioning) systems. These components greatly enhance large-scale operations' energy efficiency.

Because they use less energy, AC motors, especially those with higher efficiency ratings, have substantial financial savings throughout their operating life. This is especially advantageous for sectors that use a lot of energy.

The pumps segment dominated the energy efficient motor market in 2023. Pumps are essential in many industries, including manufacturing, oil and gas, and water and wastewater treatment. They make up a sizeable amount of energy in these industries. Pumps use more energy since they are utilized nonstop or for long periods. Therefore, even modest increases in energy efficiency can result in considerable savings.

Organizations and businesses are concentrating more on lessening their environmental impact. Energy-efficient pumps assist companies in achieving their sustainability goals and help reduce greenhouse gas emissions. The adoption of efficient pump systems is further propelled by the push for energy-saving solutions, which aligns with corporate social responsibility (CSR) programs.

The fans segment shows a significant growth in the energy efficient motor market during the forecast period. Both households and businesses are looking for ways to lower their energy expenses as the cost of electricity keeps rising. Energy-efficient fans are an appealing option because they use less electricity than traditional versions, which helps achieve this. The need for energy-efficient fans is driven by the construction sector's growth, particularly in emerging economies. Energy-efficient solutions are increasingly used in new construction and infrastructure projects to comply with current regulations.

The industrial segment dominated the energy efficient motor market in 2023. Since industries run a variety of machinery and equipment, they are significant consumers of electrical energy. Industrial processes require motors to run conveyors, compressors, fans, pumps, and other vital equipment. Industries are encouraged to invest in energy-efficient motors due to their high energy consumption, lowering operating costs and improving overall efficiency.

The commercial segment is observed to be the fastest growing in the energy efficient motor market during the forecast period. The need for energy-efficient motors is fueled by the growth of commercial infrastructure, which includes office buildings, retail establishments, and industrial facilities. Modern energy-saving technology is frequently incorporated into new buildings and renovations. Energy-efficient motors are being added to older commercial buildings undergoing retrofits to increase energy performance and satisfy contemporary norms.

Sustainability is given top priority by many companies when developing their corporate social responsibility (CSR) plans. Using energy-efficient motors enables businesses to meet sustainability objectives and lower their carbon footprint. Energy-efficient certifications such as LEED (Leadership in Energy and Environmental Design) are becoming increasingly sought after by commercial properties. Acquiring these certifications is made possible in part by energy-efficient motors.

Segments Covered in the Report

By Type

By Product Type

By Power Output Rating

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

August 2024