January 2025

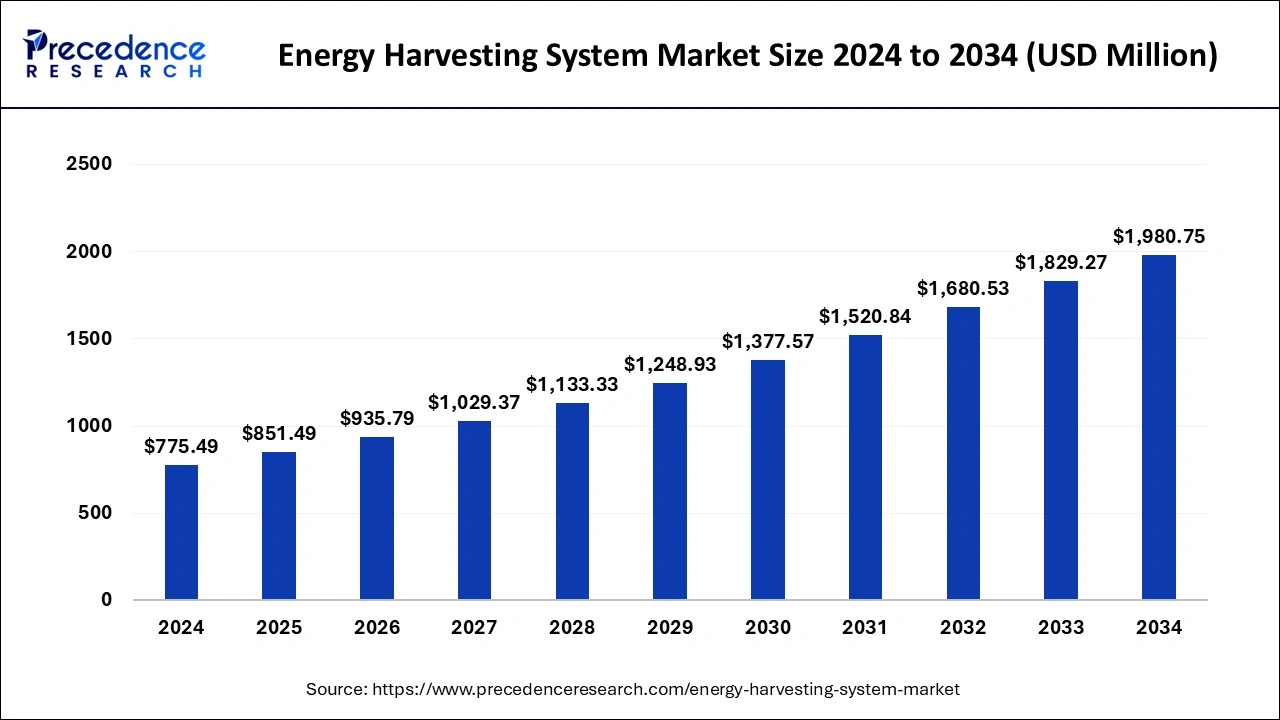

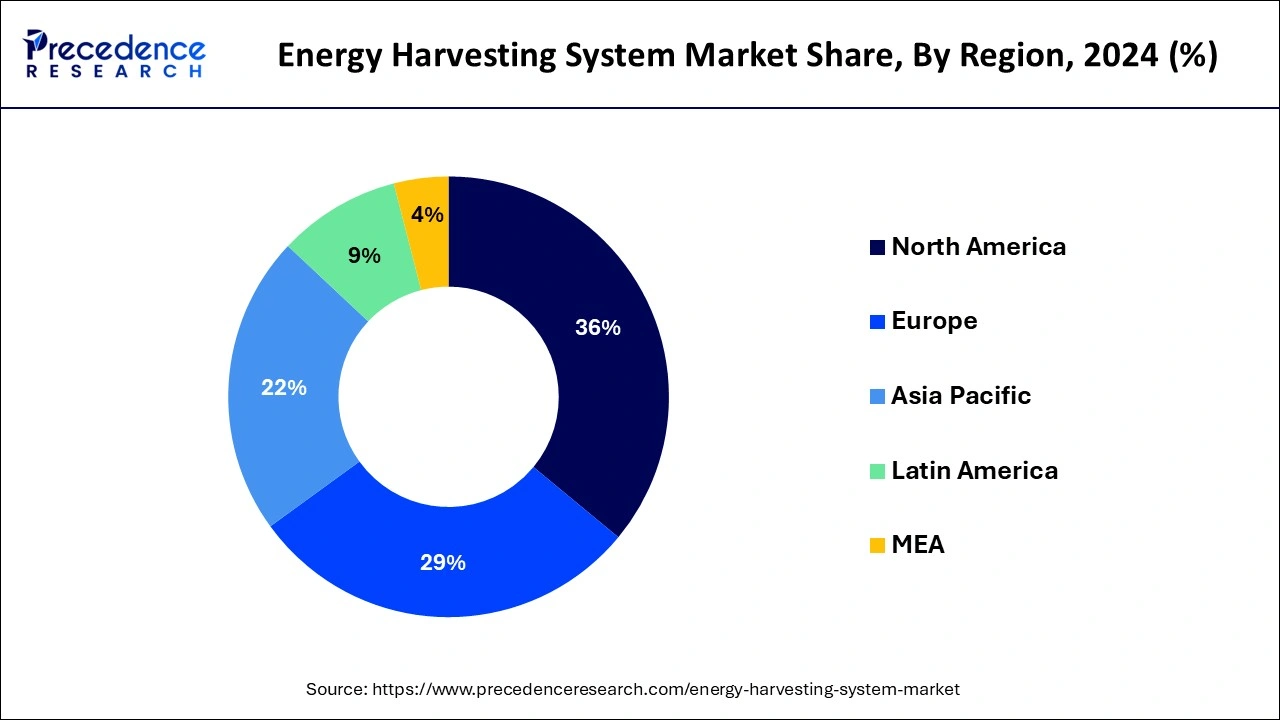

The global energy harvesting system market size is estimated at USD 851.49 million in 2025 and is forecasted to reach around USD 1,980.75 million by 2034, accelerating at a CAGR of 9.83% from 2025 to 2034. The North America energy harvesting system market size surpassed USD 279.18 million in 2024 and is expanding at a CAGR of 9.98% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global energy harvesting system market size was accounted for at USD 775.49 million in 2024 and is expected to hit USD 1,980.75 million by 2034, growing at a CAGR of 9.83% from 2025 to 2034.

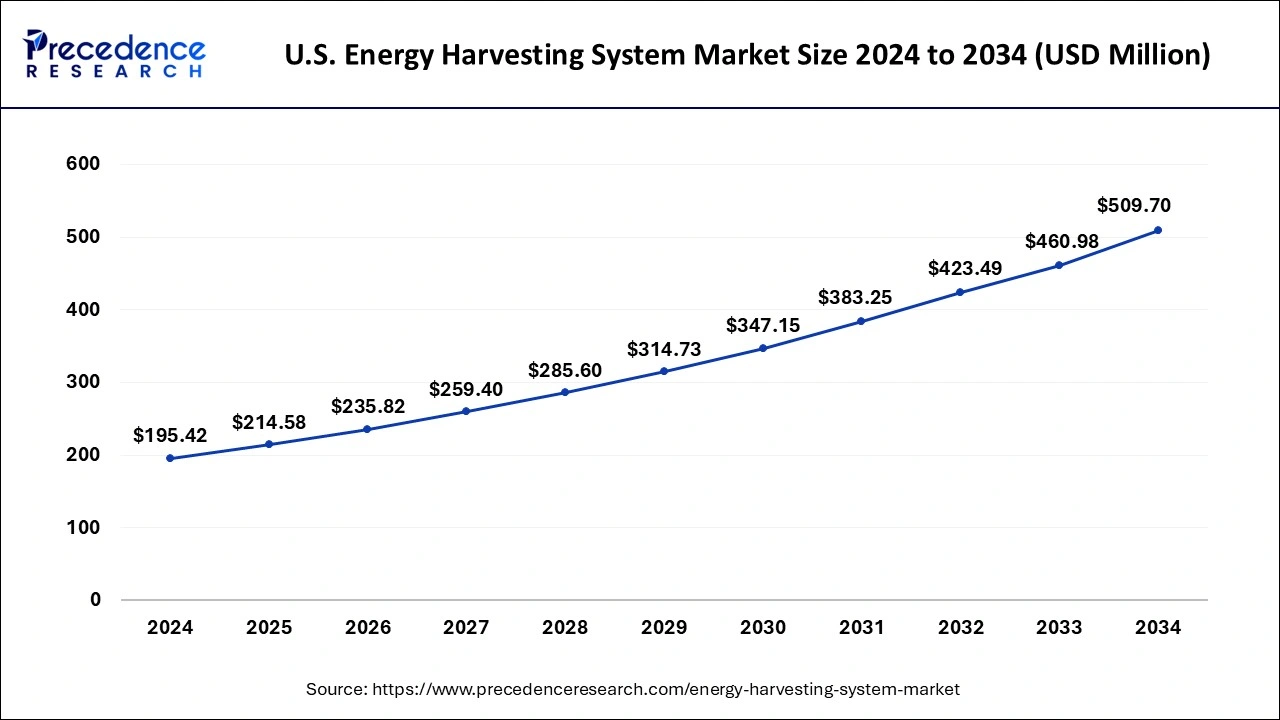

The U.S. energy harvesting system market size was valued at USD 195.42 million in 2024 and is predicted to reach USD 509.70 million by 2034 with a CAGR of 10.06% between 2025 and 2034.

The largest market for this sector is North American region, due to rapid technological developments in the field of energy harvesting and building in home automation investments. There is a boost in this technology in North America. The current technological advancements in North American region have become a very important factor for the growth of this technology for building and home automation investments. The maximum amount of revenue was generated in United States, due to a flourishing industrial and transportation sector.

The market is expected to grow substantially because of low operational and labor cost, many industry players are thinking of changing their manufacturing facilities and locating them in Asia Pacific market is expected to grow owing to the techno savvy population and high purchasing power. The Internet of Things has spread across the region from smart grids to smart homes/buildings. The increasing implementation of the Internet of Things-enabled technology to meet the infrastructure and supply challenges leads to the growth of smart cities, boosting the market across the region. Technology vendors in the industry are progressively developing connected devices and are undergoing innovations and rigorous tests.

The energy harvesting system is the process of producing usable energy electrical energy by capturing the energy from one or more renewable energy sources. Energy harvesting is very important solution in order to power the IoT that are installed in accessible areas and require battery maintenance. In places where there are no power sources, energy harvesting is a very important tool in such cases. It helps in making the inaccessible devices self sufficient by capturing the energy from the Renewable sources. The devices used for harvesting the energy are known as the energy harvesting system.

Globally, the market is growing for durable systems that are power efficient and safe, which require very less maintenance. There is a rise in the adoption of wireless sensor networks due to automation in the houses and the green technology that is adopted by the various nations. There is wastage of the environmental energy. The systems that help in capturing this energy and converting it to electrical energy are a boon. Various research and development activities in the energy harvesting system is leading to the growth of this market. Supportive government policies and increased awareness about the environment. Also, the reduction in the emission of the greenhouse gases has helped in rising the demand for such technologies. An increasing trend of using renewable resources across many nations has created a need for improvement in this technology. In order to supplement the primary source of power to reduce the power interruptions and to increase the reliability of an electronic system, this technology is a boon.

Europe and USA are the major hubs for energy harvesting system market. The accurate impact of COVID-19 cannot be estimated. But there has been a disruption due to the shortage of semiconductors. The key application area for energy harvesting is building and home automation. The various climatic changes and changing rainfall patterns are increasing the demand for energy harvesting systems. Self powered wireless sensors are introduced by EnOcean to integrate the energy harvesting solutions. In order to decline the carbon footprints various nations are explaining the positive impact of this technology. Energy harvesting schemes will be introduced in smart cities in order to conserve energy and reduce the dependency on the service provider. Hong Kong is promoting the use of renewable energy by installing the harvesting devices on the roofs of the buildings.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.83% |

| Market Size in 2025 | USD 851.49 Million |

| Market Size by 2034 | USD 1,980.75 Million |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Technology, By Components, By Application, By Vibration Technology, by End-use System, and By Energy Source |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

AVAILABILITY OF R&D FUNDS THROUGH ORGANIZATIONS AND INVESTORS

R&D for energy harvesting devices has been on a rise owing to the requirement of innovative solutions to power wireless sensors and low power electronics. Further, the presence of funds through associations such as the U.S. Department of Energy and the European Commission results to enhance the development of innovative technologies.

For instance, European Commission under its Horizon 2020 is funding a project on “Metamaterial Enabled Vibration Energy Harvesting”. The project has commenced in January 2021 and is expected to end by December 2024. The aim of this project is to eliminate the requirement of batteries to power wireless sensors in the future.

In addition, new startups are also able to raise funds from investors to progress innovative product development.

Availability of funds for innovative technologies through organizations and investors aids to fast track the process of new product development. Further, it also provides a better opportunity for new product developers to enter the market with their innovative products. These factors have resulted to drive the market for the development of innovative energy harvesting systems which will result to further boost the growth of energy harvesting systems in the forecast period.

LOW POWER CAPACITY COUPLED WITH HIGH COST

Energy harvesting system are costly, since they perform tasks such as analysis of real-time information, setting up energy scavenging devices, and other integrating equipment. Thus, to gather real-time information, the deployment and servicing of associated infrastructure such as advanced metering systems, smart devices, sensors, transducers, and communication infrastructure are necessary. This is leading to the increasing need for transformation of the infrastructure of utilities, which is expected to drive subsequent investment while hampering market growth over the projection period.

The technology and infrastructure necessary for energy harvesting is still expensive as its R&D involves high costs. The need for large investments and longer payback periods prove to be a major challenge for the market.

Some of the emerging energy harvesting solutions under developed or which are recently launched which have a high growth potential are as follows:

The vibration technology segment accounted for the largest revenue share of around 33% in 2024. During the forecast period, the light energy harvesting segment is expected to generate larger income. A lot of companies are engaged in the production of solar energy based products.

The market for the light energy harvesting segment is rising due to the manufacturing of solar based products along with the increasing efficiency of the photovoltaic cells. The naturally and easily available source of energy is the solar energy, which can be easily converted into electricity. The second largest share of the market will be held by the vibration energy harvesting system, due to the use of piezoelectric devices in various applications in the sector of transportation and industry.

The sensor component segment accounted revenue share of 35% in 2024. The Transducer segment has had a larger market share until now and it is expected to grow during the forecast. The energy harvesting transducer segment is driving the demand of the global market. It is due to the growth in usage of electromechanical transducers to harvest vibration energy.

In energy harvesting system, transducers are primarily used to convert ambient mechanical (vibration) energy into electric energy. Transducers are designed using various technologies such as piezoelectric, photovoltaic, radio frequency, electromagnetic, and thermoelectric. Piezoelectric transducers are commonly placed under the pavements of roads and railways. These transducers convert the vibrations created by the automobiles passing over the transducer into electricity. Solid state thermoelectric transducers are also used in industrial gas pipelines or steam pipeline distribution systems, from which plenty of thermal energy can be harvested. These applications are anticipated to drive the demand for transducers in energy harvesting systems over the forecast period.

The industrial segment hit the largest revenue share of around 31% in 2024. The home automation and building market is anticipated to grow during the forecast. Home automation does not require hard wiring. As there is no disposal of batteries that minimizes the maintenance and the environmental impact to use of energy harvesting systems. In wearable watches, which comes under the domain of consumer electronics is also a very good opportunity. It will help in monitoring the activity of the person and also to manage the health.

The home and building automation segment was the second largest market in 2024. Factors such as the proliferation of the urban population, growing application of IoT components in automation, rising demand for power-efficient, safe, and durable systems for homes & buildings, snowballing trend for renewable energy integration, and penetration of energy harvesting systems in building and home automation applications have gained significant pace. The market is also witnessing the installation and implementation of sensor-based technologies in commercial spaces to achieve energy-efficient power systems, which is anticipated to drive the demand for energy harvesting systems in home and building automation. Companies in the marketspace are focusing on strategic alliances to develop innovative products for home and building automation applications. For instance, WiSilica and EnOcean GmbH agreed to jointly develop self-powered switches and sensors based on IoT solutions for smart energy management for residential and commercial buildings. Such initiatives are anticipated to drive the demand for energy harvesting systems for home and building automation in the near future.

By Technology

By Components

By Application

By Vibration Technology

By End-use System

By Energy Source

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

August 2024