January 2025

Enteral Feeding Formulas Market (By Product: Standard Formula, Disease-specific Formulas; By Flow Type: Intermittent Feeding Flow, Continuous Feeding Flow; By Stage: Adults, Pediatrics; By Indication: Alzheimer’s, Nutrition Deficiency, Cancer Care, Diabetes, Chronic Kidney Diseases, Orphan Diseases, Dysphagia, Pain Management, Malabsorption/GI Disorder/Diarrhea, Others; By End-use; By Sales Channel) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

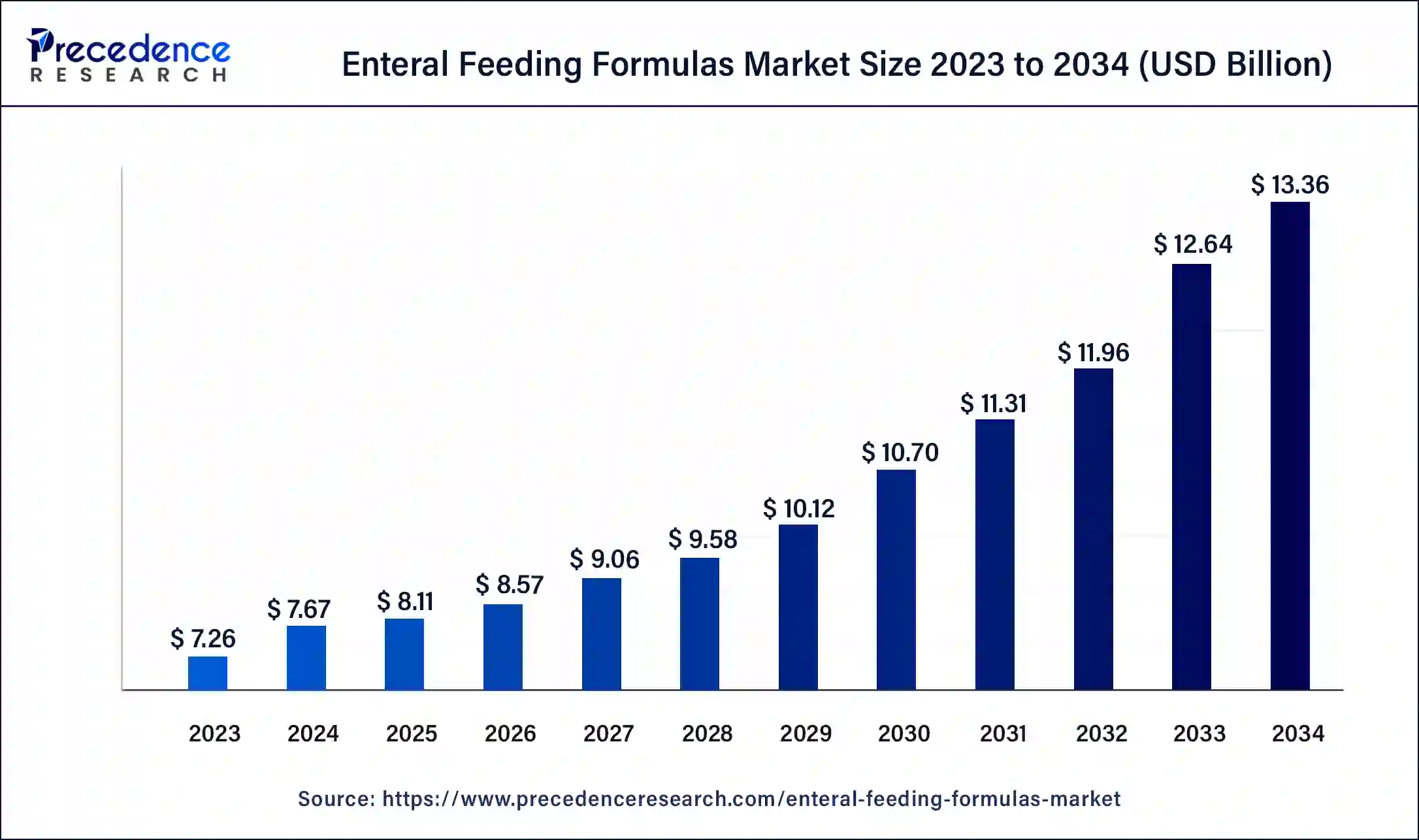

The global enteral feeding formulas market size was USD 7.26 billion in 2023, accounted for USD 7.67 billion in 2024, and is expected to reach around USD 13.36 billion by 2034, expanding at a CAGR of 5.7% from 2024 to 2034. The North America enteral feeding formulas market size reached USD 2.32 billion in 2023. The rise in the aging population and the incidence of chronic diseases, which put individuals at a higher risk of life-threatening disorders are the key factors expected to drive the acceptance of enteral feeding formulas and boost market growth in upcoming years.

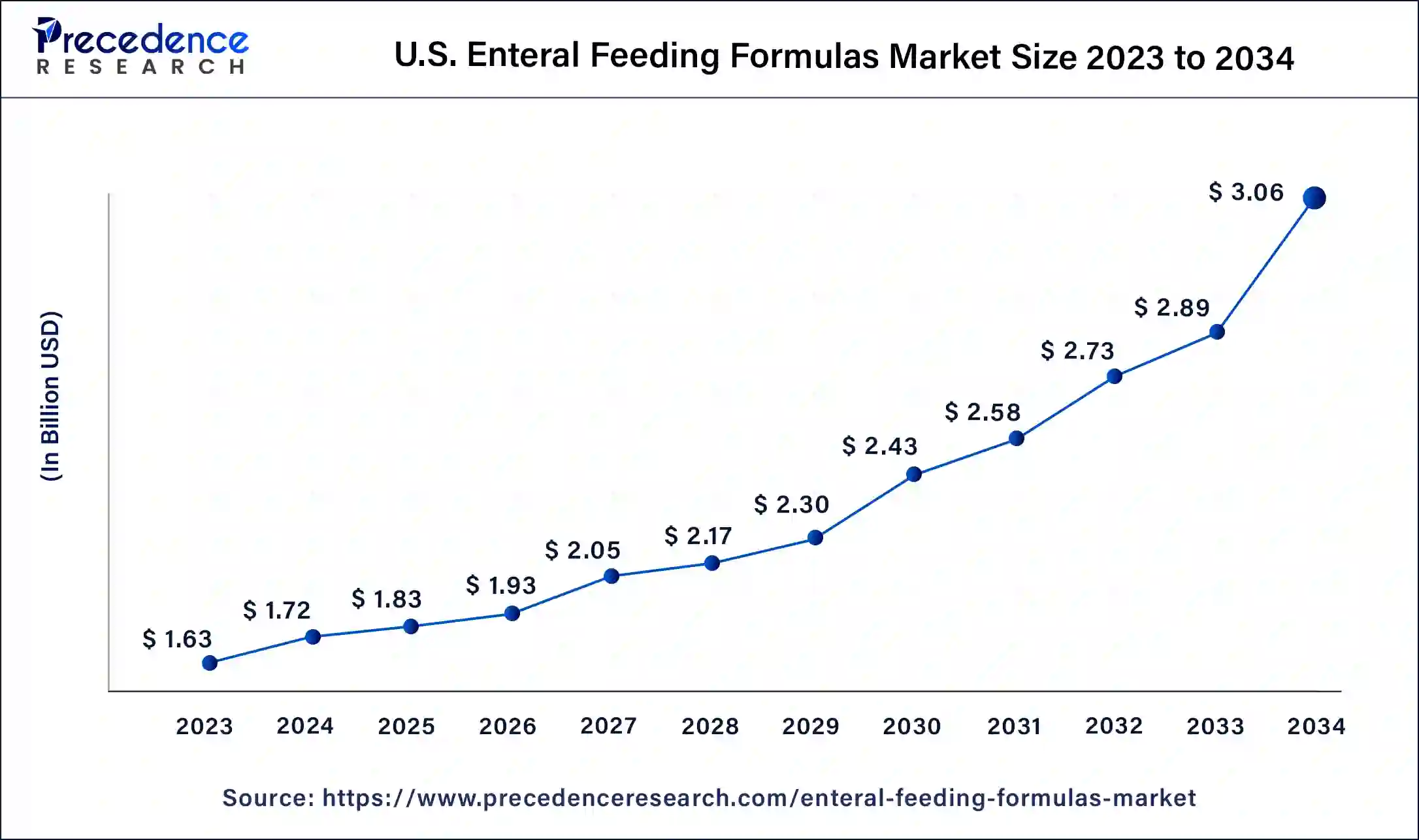

The U.S. enteral feeding formulas market size was estimated at USD 1.63 billion in 2023 and is predicted to be worth around USD 3.06 billion by 2034, at a CAGR of 5.9% from 2024 to 2034.

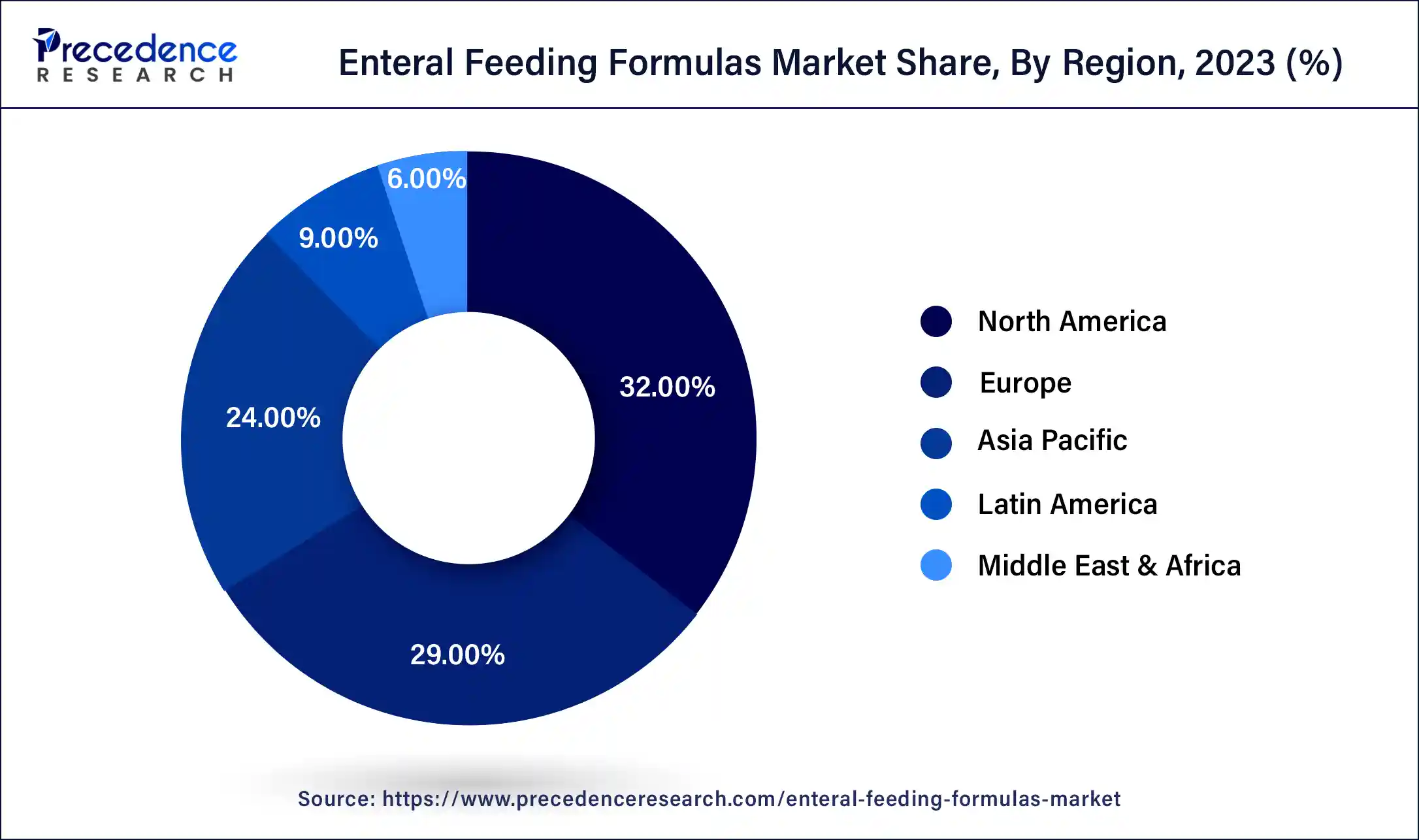

North America held the largest market share in the enteral feeding formulas market in 2023. North America has a high prevalence of chronic diseases such as cancer, gastrointestinal disorders, neurological conditions, and metabolic disorders. These conditions often require long-term enteral nutrition support, driving the demand for enteral feeding formulas in the region. The aging population in North America is increasing, leading to a higher prevalence of age-related conditions such as malnutrition, dysphagia, and neurodegenerative diseases. Enteral feeding formulas play a crucial role in meeting the nutritional needs of elderly individuals, contributing to the market dominance in the region.

Asia Pacific is expected to register the fastest growth rate over the coming years. The region is witnessing advancements in enteral feeding formulas, including the development of specialized formulas for specific medical conditions and patient populations. These innovations cater to the diverse healthcare needs of the Asia Pacific population and contribute to market dominance. Enteral feeding formulas are becoming more culturally accepted in Asia Pacific countries, with a shift towards embracing modern healthcare practices and dietary preferences. This cultural acceptance encourages healthcare professionals and patients to consider enteral nutrition as a viable treatment option.

Enteral feeding involves providing nutrition through the gastrointestinal (GI) tract, which includes the mouth, intestines, stomach, and esophagus. It is used when individuals cannot eat for various reasons like illness, stroke, injury, or cancer. Enteral feeding can be administered orally or through a tube inserted directly into the stomach or small intestine. In medical settings, it typically refers to tube feeding.

The global enteral feeding formulas market offers solutions in the form of formulas, primarily derive energy from carbohydrates, with standard formulas containing 30-60% of energy from carbohydrates. These formulas vary in caloric density from 1.0 to 2.0 kcal/mL and contain a combination of fats, carbohydrates, proteins, and micronutrients. Enteral feeding can be used as a supplement or as the sole source of nutrition. Enteral feeding devices are widely used in critical care units (CCU), operating theaters (OT), intensive care units (ICU), and for home care of severely ill patients.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.7% |

| Global Market Size in 2023 | USD 7.26 Billion |

| Global Market Size in 2024 | USD 7.67 Billion |

| Global Market Size by 2034 | USD 13.36 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Flow Type, By Stage, By Indication, By End-use, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The growing prevalence of diabetes

The incidence of diabetes is on the rise globally. due to unhealthy lifestyles, including poor dietary regimes in the risk of microvascular and macrovascular diseases in an elderly population with type 2 diabetes Dietetic patient who have a healthy GI system, but insufficient oral intake needs enteral nutrition formulas to maintain their blood sugar levels. The rise in the prevalence of diabetes in the geriatric population helps the enteral feeding formulas market to grow.

Constant risk of clogging

Clogging often occurs when large meals, bulking agents, and medications are delivered through relatively small PEG tubes. There are two main types of tube occlusion: internal lumen occlusion and mechanical tube failure. Feeding tube clogging can happen in up to 25% of cases, particularly when thick meals and medications are delivered through narrow feeding lines. The acidic pH of stomach juice can lead to protein coagulation, making repeated gastric aspiration undesirable. Tube obstructions have been associated with poor nutrition and clinical outcomes, risking inadequate nutritional intake for patients. Tube replacement is costly, both financially and in terms of resources. Radiographic confirmation is a commonly used method for verifying enteral feeding tube placement, but it comes with time, financial, and patient exposure costs. Thereby, the enteral feeding formulas market is observed to get impacted by the risk of clogging of tubes.

Increase in government investments

The development of cost-effective and efficient diabetes therapy and growing government investments in healthcare propel the growth of the enteral feeding formulas market growth. The rise in healthcare expenditures with effective health interventions increases labor supply and productivity. which then increases GDP which helps to stimulate market growth. The increase in the use of diagnostic labs and healthcare units in emerging markets is helping the market to grow during the forecast period. Moreover, a rise in awareness among hospital workers about hospital-linked malnutrition and the growth in several neonatal intensive care units along with the rise in demand for personalized medicine are anticipated to boost the market growth.

The increasing demand for feeding equipment

The market is experiencing growth due to factors such as the aging population and the rise in age-related disorders. There's an increased demand for enteral nutrition formulas among elderly patients receiving care at home, driven by greater awareness of balanced diets worldwide. This has led to a rise in the number of manufacturers in the market. Additionally, there's a growing recognition of deficiencies in both macro and micronutrients among hospitalized patients during the pre- and post-surgery periods, further boosting market growth. Moreover, the use of enteral feeding formulas to meet the nutritional needs of newborns is increasing due to the rising prevalence of preterm births, contributing to market expansion.

The standard formula segment dominated the market this growth is linked to their widespread use in patients, specifically chronically tube-fed patients. The broad utilization of standard formulas among all category patients with cost-effectiveness is also boosting the segment's growth. Moreover, high preference and recommendations by doctors to consume this formula for G-tube patients to improve child nutrition is helping segment growth.

Disease-specific formula segment is expected to grow at the fastest rate with a rise in the incidence of several chronic disorders like cancer and diabetes these formulas also provide nutritional support to people suffering from diseases that are characterized by organ dysfunction. These formulas also help patients who are suffering from pulmonary and hepatic diseases. The launch of different nutritional products by manufacturers as per patients' needs is fueling segment growth.

The intermittent feeding flow segment has dominated the enteral feeding formulas market with a substantial market share in 2023. This tube is useful for patients who need nutrition intake at intervals.it is also referred to in cases where a nasogastric feeding tube is used.in older people, dysphagia and malnutrition are common and can lead to nutritional deficiency. thus creates the need for enteral feeding to provide nutrients.

The continuous feeding flow segment is projected to grow at a significant rate during the forecast period. This is due to the rise in the adoption of continuous feeding flow types for severely ill patients. suffering from cancer, severe burns, and heart condition.

The adult segment accounted for the largest share of the enteral feeding formulas market. This growth is driven by the wide availability of tube feeds or products for adults on a commercial scale., the rising use of enteral tube feeding in individuals with various illnesses, including chronic liver disease, diabetes and pulmonary disease (COPD), is contributing to the segment's market expansion.

The pediatric segment is observed to be the fastest growing segment during the forecast period in the enteral feeding formulas market due to the increasing prevalence of malnutrition among hospitalized children. Furthermore, pediatric patients with gastrointestinal disorders, such as severe gastroesophageal reflux, allergies, food refusal behavior, and metabolic disorders, are also candidates for tube feeding.

The cancer care segment led the enteral feeding formulas market with the largest market share in 2023. Cancer patients have unique nutritional requirements that may not be adequately met by regular food alone. Enteral feeding formulas are specially formulated to provide balanced nutrition tailored to the specific needs of cancer patients, including increased protein, vitamins, and minerals to support immune function and aid in recovery.

Enteral feeding formulas are designed to be easily digestible and well-tolerated by patients undergoing cancer treatment. They are often lactose-free, gluten-free, and low in residue, reducing the risk of gastrointestinal complications and promoting optimal nutrient absorption even in patients with compromised digestive function.

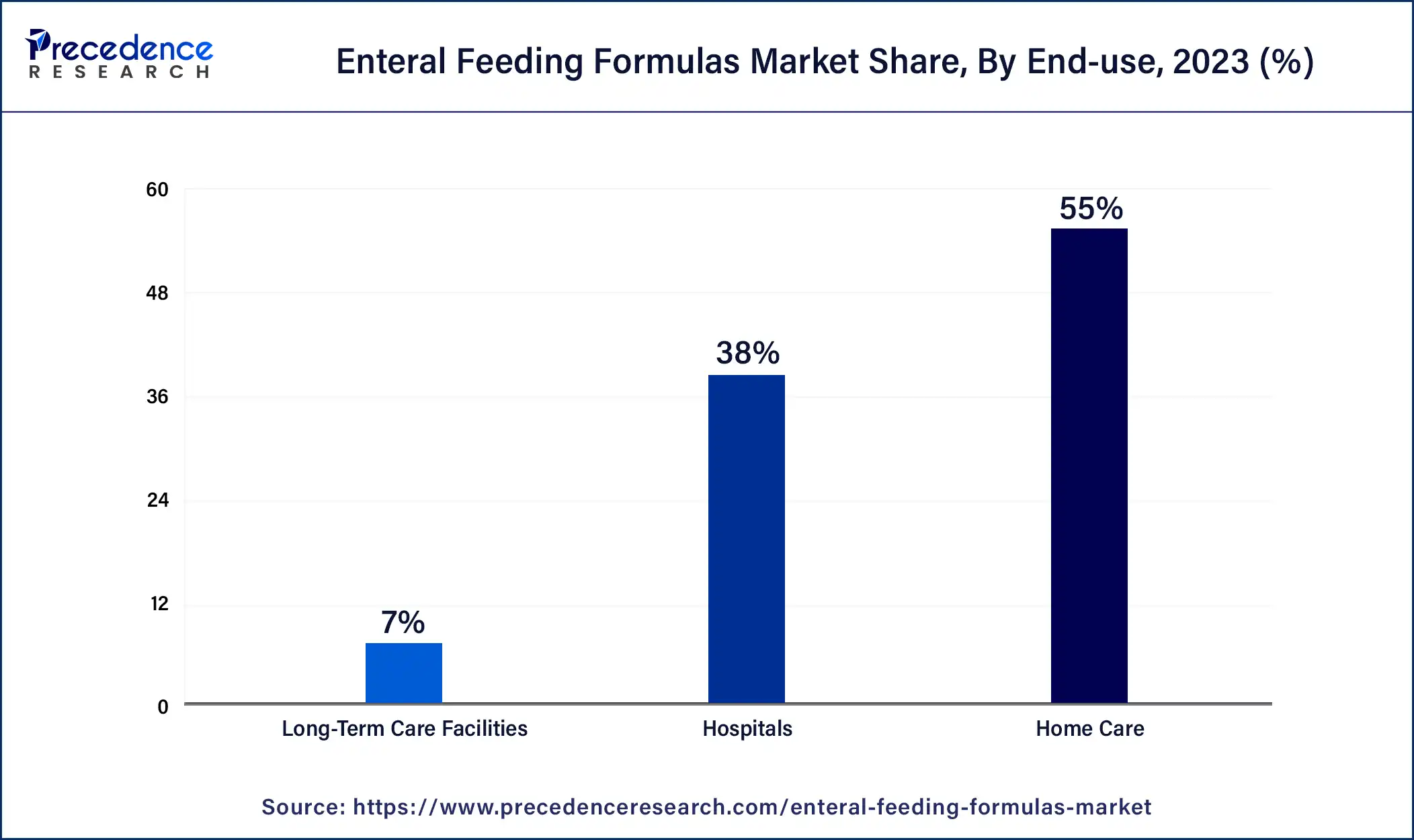

The institutional segment dominated the enteral feeding formulas market in 2023. Institutions, including hospitals, long-term care centers, and disability facilities, accounted for most enteral nutrition product purchases in 2023. Doctors play a significant role in influencing the decision to purchase these formulas. The segment is experiencing growth due to the increasing number of healthcare institutions, both private and public, and the rising population of patients with chronic diseases worldwide.

The online sales channel segment is expected to grow at the fastest CAGR over the estimated period. There is a shift toward direct selling to consumers via different e-commerce platforms which can contribute to segment growth. The availability of online pharmacies, especially in urban areas, acts as a major driver for the segment’s expansion.

The home care segment is expected to show the fastest growth over the forecast period. It includes different subtypes such as home health agencies, nursing homes, hospices, adult day care, etc. The rising popularity of home healthcare systems, especially after the COVID-19 pandemic is observed to promote the segment’s expansion in the upcoming period.

Post-surgery patients, especially those who are under home-care systems require formulas to meet nutritional values in order to recover from the ongoing health issues.

Segments Covered in the Report

By Product

By Flow Type

By Stage

By Indication

By End-use

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025