May 2024

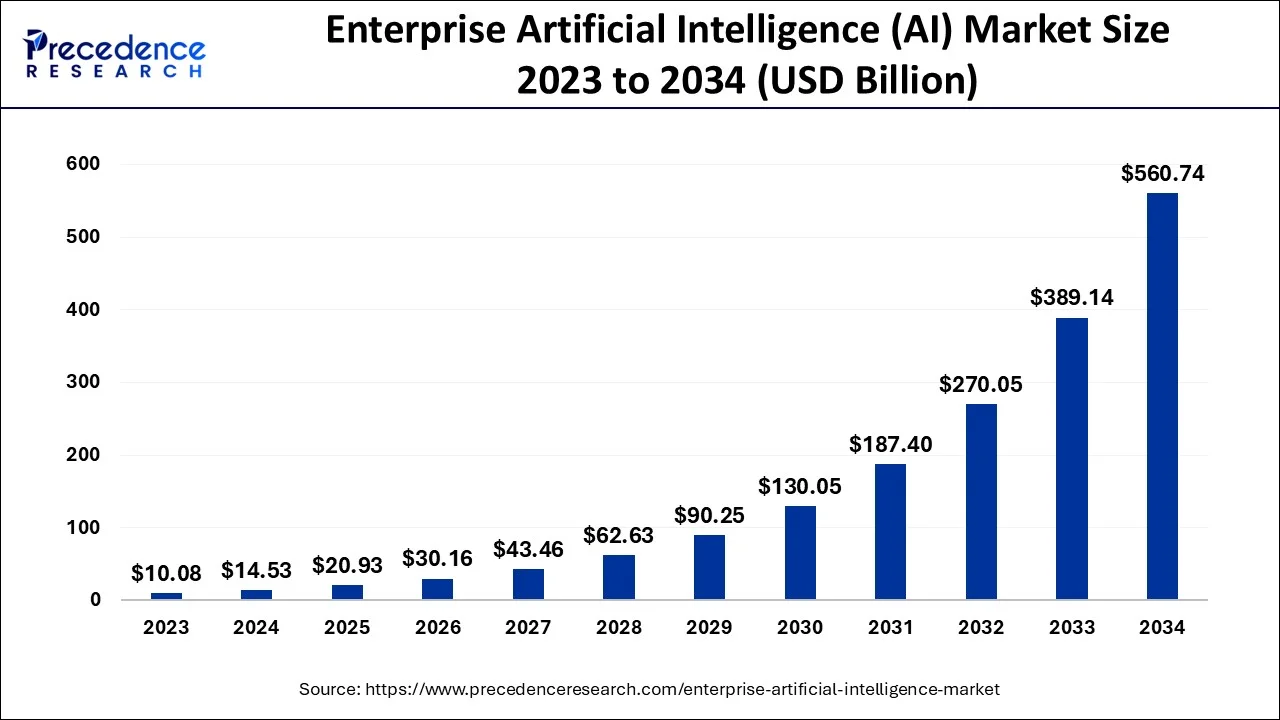

The global enterprise artificial intelligence (AI) market size accounted for USD 14.53 billion in 2024, grew to USD 20.93 billion in 2025 and is projected to surpass around USD 560.74 billion by 2034, representing a healthy CAGR of 44.10% between 2024 and 2034. The North America enterprise artificial intelligence (AI) market size is calculated at USD 5.67 billion in 2024 and is expected to grow at a fastest CAGR of 44.27% during the forecast year.

The global enterprise artificial intelligence (AI) market size is estimated at USD 14.53 billion in 2024 and is anticipated to reach around USD 560.74 billion by 2034, expanding at a CAGR of 44.10% between 2024 and 2034. Enterprise artificial intelligence (AI) is the capacity to use AI methodologies that integrate human learning, perception, and interaction abilities at a degree of complexity that will aid businesses in forecasting financial results.

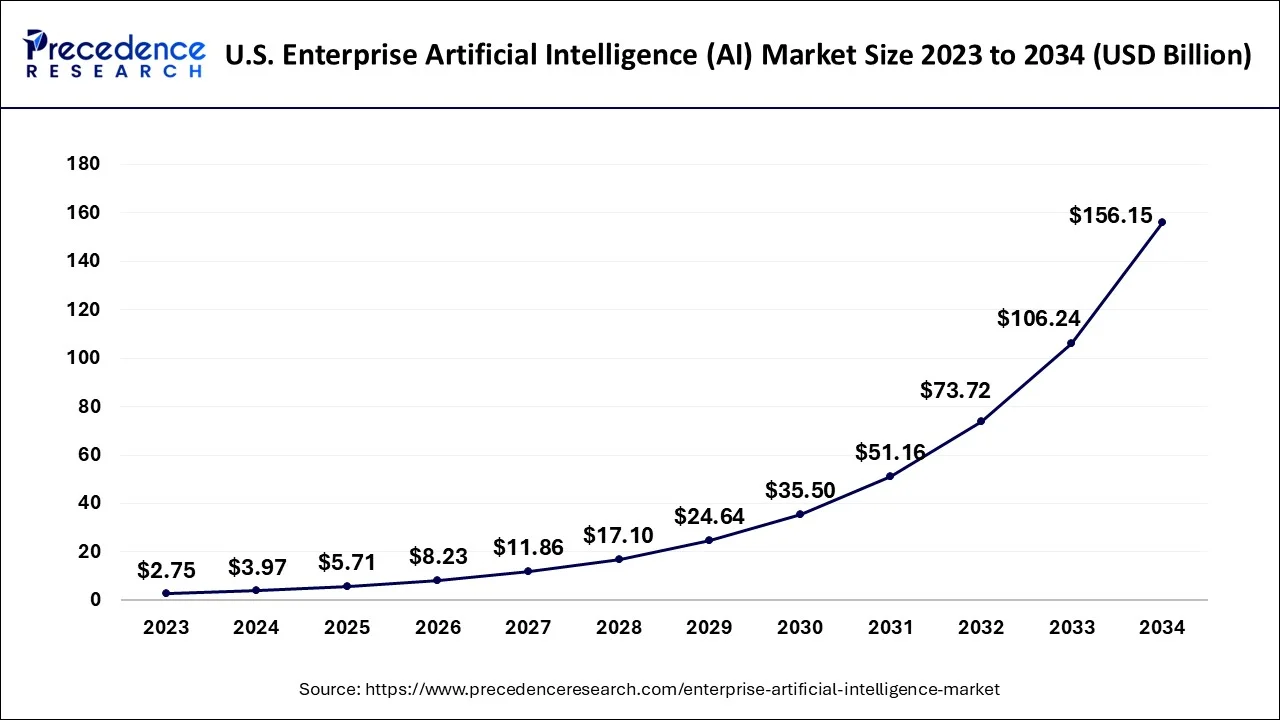

The U.S. enterprise artificial intelligence (AI) market size accounted for USD 3.97 billion in 2024 and is expected to be worth around USD 156.15 billion by 2034, growing at a CAGR of 44.37% between 2024 and 2034.

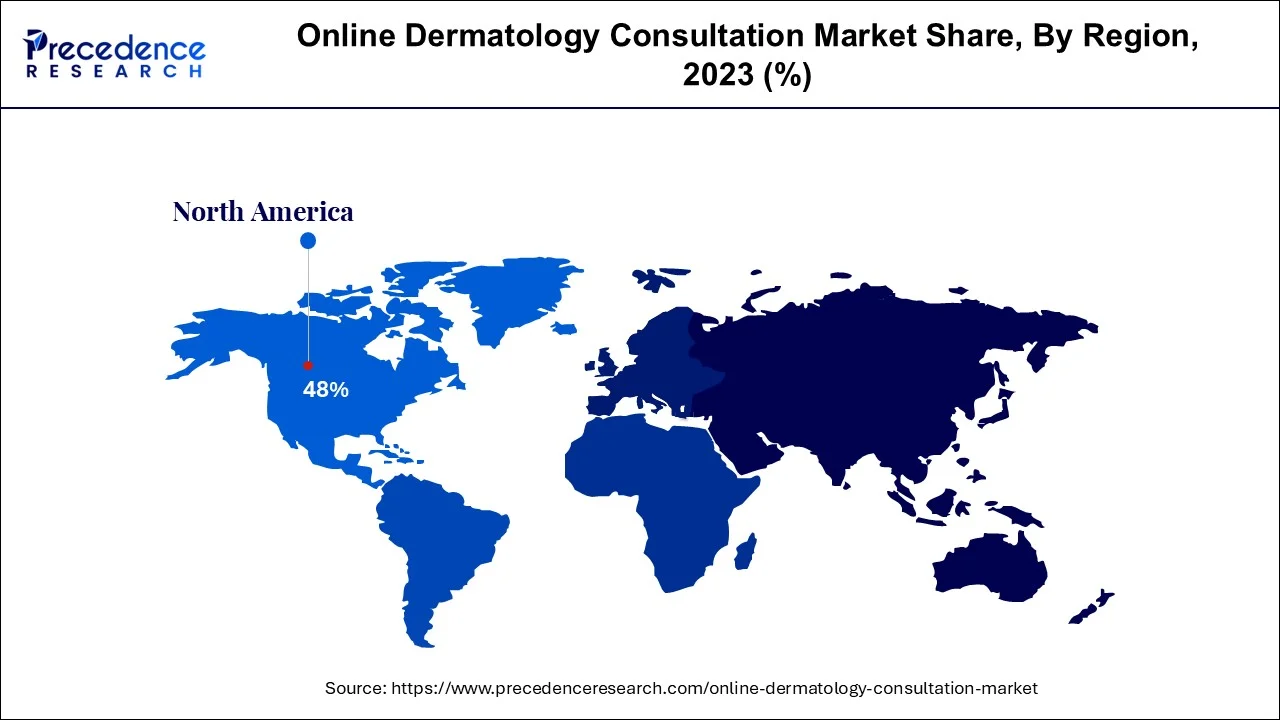

North America, which accounted for 38.50% of global revenue in 2022, is expected to grow at a CAGR of more than 33.0% over the projected period. The existence of leading companies that develop AI solutions and services, technical infrastructure facilities, and the significant number of end users using data management devices are all factors that are driving the market in the region.

For instance, as part of a goal to expand leadership in artificial intelligence, the president unveiled the American AI Initiative in February 2019. Additionally, as part of these programs, federal authorities have established criteria for the development and deployment of AI-based systems in the real world across a variety of industrial sectors. During the projection period, Asia-Pacific is anticipated to experience the quickest CAGR of 36.60%. The usage of AI is growing, and data management systems are being installed. These developments address problems with privacy and security, teamwork, and the setting of moral standards for businesses. The main growth drivers are the development of AI technology, rising government investment spending, and the adoption of cutting-edge technologies across many industries.

For instance, the Asia Pacific Artificial Intelligence Association (AAIA), located in Hong Kong, was founded in 2021 by 663 academics from across the world. Its major goal is to support scientists working in the fields of AI and other related disciplines. Through academic research and interactions, the group seeks to advance AI development and application.

Through Artificial Intelligence, computer systems are able to construct and carry out activities like speech recognition, decision-making, visual perception, and language translation that would otherwise require human intervention and assistance. Enterprise artificial intelligence (AI) is the capacity to use AI methodologies that integrate human learning, perception, and interaction abilities at a degree of complexity that will aid businesses in forecasting financial results. Enterprise artificial intelligence (AI) integration serves as a crucial organizational resource for business performance at all levels of the organization. Some businesses use artificial intelligence (AI) technology to analyze their consumers, spot fraud and other hazards and use machine learning to take preventive action.

The deployment of AL apps in businesses is rising in popularity. Businesses and businesses are rapidly seeing the benefits of integrating AI into daily operations. AI has shown to be helpful to businesses in a variety of ways that alter how businesses interact, innovate, and improve their operations. Government, retail, financial services, manufacturing, the automobile industry, and advertising are just a few of the main end-use industries that employ artificial intelligence services.

AI is capable of effectively handling tasks including natural language creation, social intelligence thinking, and problem-solving. Another reason driving the expansion of the sector is the organizations' control over data and the data-driven nature of AI technologies.

| Report Coverage | Details |

| Market Size in 2024 | USD 14.53 Billion |

| Market Size by 2034 | USD 560.74 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 44.1% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Rising adoption of digitalization in organization

A small number of AI specialists

Increasing investment in artificial intelligence technologies

The cloud sector, which accounted for 62.9% of total revenue in 2023, is anticipated to grow at the greatest CAGR of more than 36.40% throughout the projection period. The rise might be ascribed to elements like rising technological investments and the desire to lower the price of on-premise infrastructure upkeep. Businesses may use cloud deployment to upgrade their current systems with AI-based technologies without having to spend in their capital expenditures.

Over the projection period, the on-premise category is anticipated to expand at a CAGR of 31.80%. The rise in worries over the security of data pertaining to research, account transactions, personal information, and other kinds of data can be ascribed to the expansion of the on-premise sector.

Technology such as planning, scheduling, and optimization, robots, and expert systems are also included in the other sub-segment. Natural language processing (NLP) is expected to increase at a CAGR of 33.40% throughout the projection period, accounting for the biggest revenue share of over 33.40% in 2023. The rise in business adoption of virtual support services and increased investments in AI technology by several industry verticals are both factors contributing to the expansion of this market. The need for NLP technology among businesses is also being driven by the capability to produce and extract intent from a document in a legible, grammatically accurate, and stylistically natural manner. However, computer vision is predicted to develop at a CAGR of more than 36.6% over the next few years, making it the fastest-growing market.

With a USD 2.98 billion revenue share in 2023, the IT & telecom category is expected to increase at a CAGR of more than 32.40% throughout the projection period. The development is linked to an increase in investments made in AI solutions by various IT and telecom firms. Additionally included in the other sub-segment are manufacturing, aerospace & military, and academics. With a USD 2.98 billion revenue share in 2022, the IT & telecom category is expected to increase at a CAGR of more than 32.40% throughout the projection period. The development is linked to an increase in investments made in AI solutions by various IT and telecom firms.

Large firms held the biggest revenue share of 64% in 2023, and it is anticipated that they will continue to hold that position throughout the projection period. This market's expansion may be attributable to factors including the growing need for productivity improvements, infrastructure cost savings, and an increase in flexibility and agility through the elimination of duplicate jobs.

Over the projection period, the small and medium businesses category is anticipated to experience the quickest CAGR of 38.6%. The surge in small and medium-sized businesses use of AI to speed up laborious tasks, boost decision-making, and increase scalability, productivity, and cost-efficiency is credited with the segment's expansion.

Segment Covered in the Report

By Deployment Type

By Technology

By Organization Size

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

November 2024

November 2024

February 2025