The global ePharmacy market size was valued at USD 113.66 billion in 2025 and is expected to reach around USD 443.01 billion by 2034, expanding at a CAGR of 16.4% from 2024 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

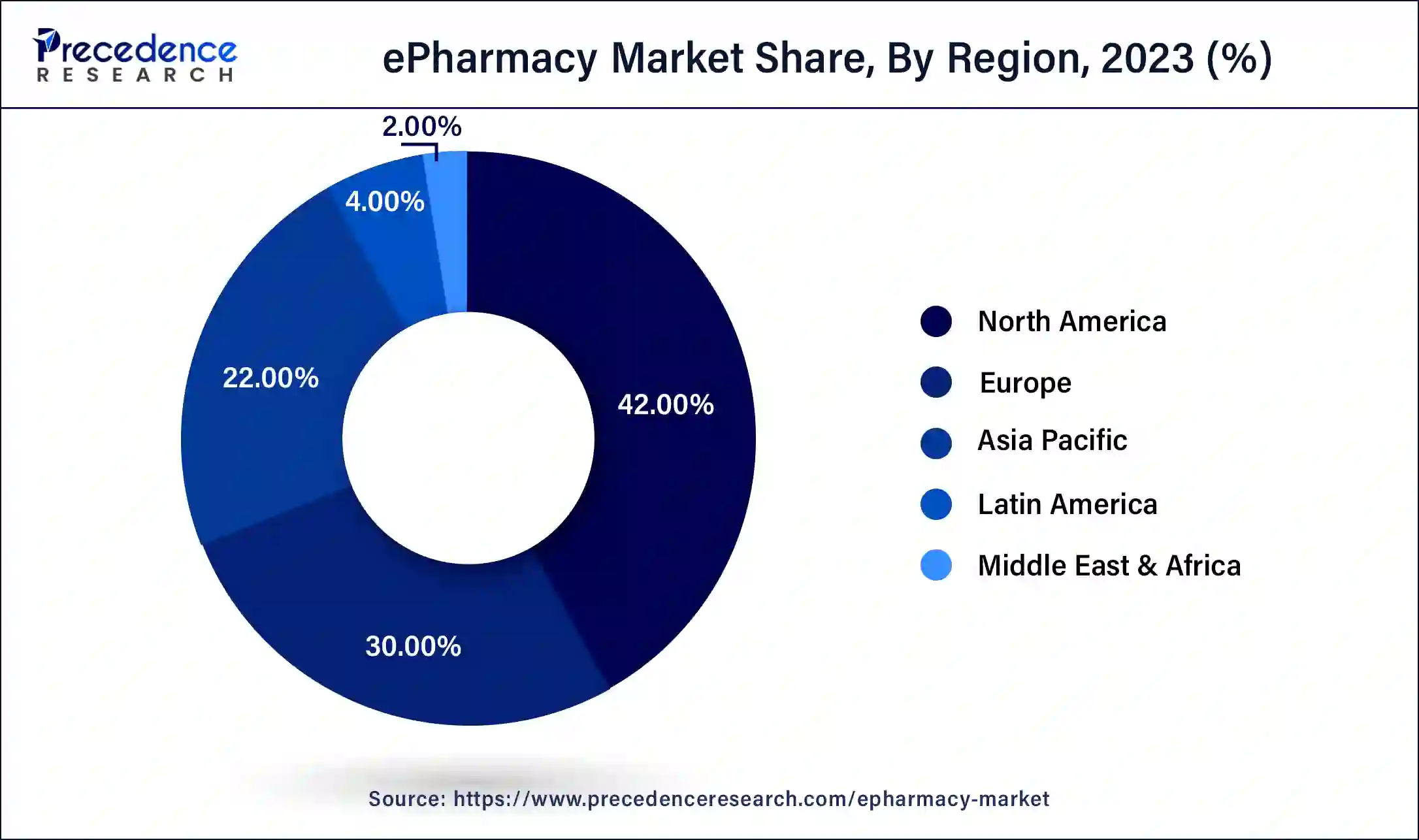

The global ePharmacy market size accounted for USD 96.89 billion in 2024 and is expected to reach around USD 443.01 billion by 2034, expanding at a CAGR of 16.4% from 2024 to 2034. The North America ePharmacy market size reached USD 34.69 billion in 2023.

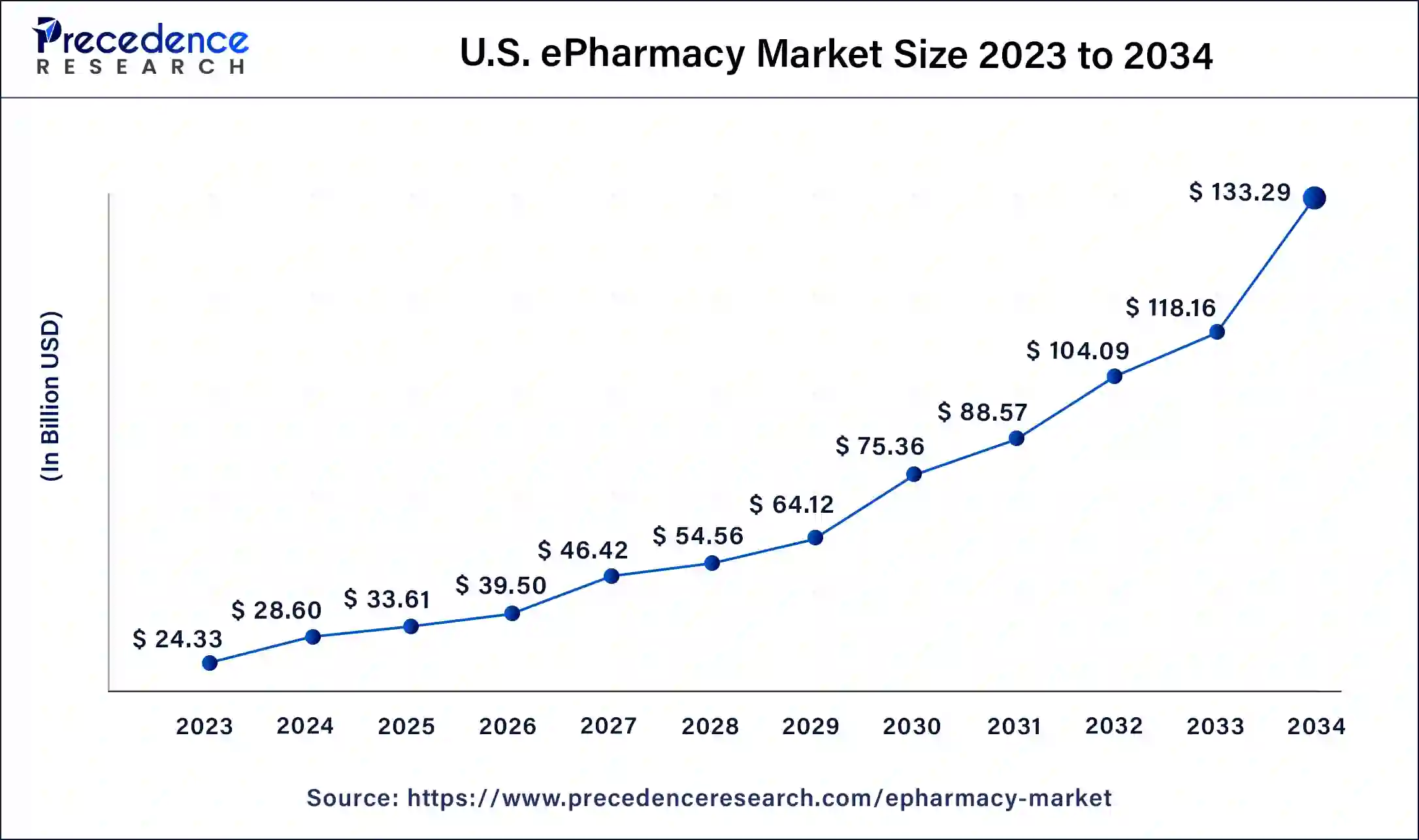

The U.S. ePharmacy market size was estimated at USD 24.33 billion in 2024 and is predicted to be worth around USD 133.29 billion by 2034, at a CAGR of 16.6% from 2024 to 2034.

North America captured the largest share of the market in 2024 due to the surging adoption of e-commerce, the rising geriatric population, the growing prevalence of chronic diseases, and the high acceptance of healthcare technologies. It is estimated that the geriatric population will constitute around 24% of the total US population by 2060. Moreover, more than half of the US population is suffering from one or more chronic diseases. The rising adoption of telehealth platforms and the growing popularity of ePrescription has supported the growth of the ePharmacy market in the region. Around 80% of the population in the US use ePharmacy. The rising shift toward the direct-to-patient model is expected to foster the market in North America during the forecast period.

The market in Asia Pacific is expected to expand at a significant growth rate during the forecast period. The market growth in the region is attributed to the rising penetration of internet, growing adoption of smartphones, and the growing popularity of e-commerce. Moreover, the rising government initiatives to boost the adoption of healthcare technologies among the population and support the healthcare industry propel the market. For instance,

ePharmacy or electronic pharmacy refers to online platforms where individuals are able to purchase healthcare products or medicines over the internet. These platforms provide access to a wide range of healthcare products, even to individuals in remote areas with limited physical pharmacies. These platforms often deliver products directly to consumers' doorsteps, saving time visiting a physical pharmacy and providing a convenient way to purchase healthcare products.

The epharmacy market has been expanding at a significant growth rate. With changes in consumer behavior, the COVID-19 pandemic has prompted several industries, including healthcare and pharmaceutical, to turn to the online market. Furthermore, preventive measures imposed by the government during the pandemic forced individuals to adopt digital healthcare technologies to reduce unnecessary hospital visits, accelerating the adoption of online pharmacies across the globe over the past few years. For instance,

The increasing penetration of e-commerce has facilitated the market to gain a wider consumer base. The popularity of e-commerce has increased over the years owing to the widespread availability of well-established transportation infrastructure and logistics solutions, leading to increased adoption of online platforms among people to purchase medicines.

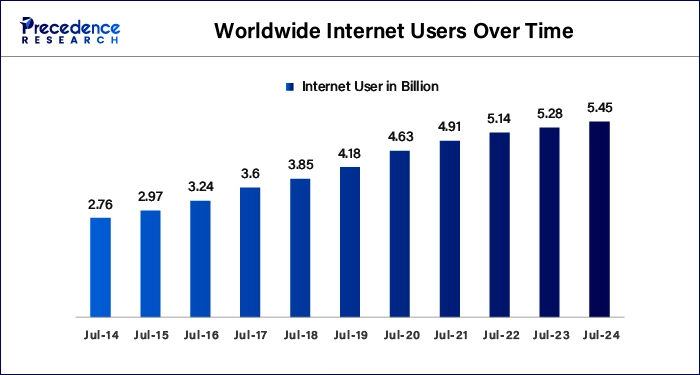

The rising trend of digitization is revolutionizing the healthcare industry, encouraging hospitals, clinics, nursing homes, and pharmacies to adopt digital technologies to streamline their operations. This, in turn, boosts the usage of online platforms to purchase various healthcare products and medicines. Moreover, the increasing proliferation of the internet encourages people to use online platforms to purchase goods, which is likely to fuel the market during the forecast period. For instance,

| Report Coverage | Details |

| Market Size by 2034 | USD 443.01 Billion |

| Market Size in 2025 | USD 113.66 Billion |

| Market Size in 2024 | USD 96.89 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 16.4% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Product Type, End-user, Platform, Payment Method, and Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Convenience and the growing usage of smartphones

One of the key factors driving the epharmacy market is the convenience offered by online pharmacies. These pharmacies allow consumers to order required healthcare products and medicines from the comfort of their homes. This reduces the need to frequently visit physical pharmacies and saves time. Online pharmacies often offer discounts, which make medications more affordable. Additionally, some online pharmacies sell generic medicines at low cost, attracting a large number of low and middle-income consumers. Huge discounts, free home deliveries, easy payment options, and easy replacement and refund policies offered by these pharmacies significantly contribute to the growth of the market.

The growing usage of smartphones is another major factor boosting the growth of the global epharmacy market. The widespread use of smartphones has made it easier for people to access online pharmacies. The proliferation of smartphones led to a significant increase in the number of tech-savvy customers, resulting in an increased demand for online pharmacies. For instance,

Regulations & Compliance

In August 2023, pharmaceutical firms that sell drugs through the internet received CDSCO show-cause notices issued on February 8th and February 9th of 2023. The companies declare they function as simply intermediary platforms that link pharmaceutical customers to licensed pharmacies through their online platform for providing sales facilitation.

Stringent regulations and security concerns

Stringent regulations associated with online pharmacies hinder market growth. Sales of prescription medicines through online pharmacies are highly regulated in some regions, including North America and Europe. Additionally, compliance with varying legal frameworks and licensing requirements create barrier to entry and operation, limiting the growth of the market.

Security concerns related to online transaction and sensitive patient data pose challenges for online pharmacies, as unauthorized access to patient data leads to frauds and cybercrimes. Moreover, the presence of unauthorized pharmacies that sells pharmaceuticals that have not been approved by the FDA further hamper the global market. For instance,

Emergence of mHealth Technologies

The emergence of mHealth technologies creates immense opportunities in the market. The growing adoption of smart and wearable devices for healthcare purposes has influenced the demand for mHealth technologies that provide convenient access to healthcare services from remote locations. These technologies also bridge care gaps by enabling patients to communicate with physicians or pharmacists. Moreover, the rising trend of ePrescription in the healthcare industry is propelling the market. ePrescribing allows doctors to send prescriptions directly to pharmacists, improving overall patient care and medication adherence.

The over-the-counter (OTC) drugs segment held a large share of the market in 2024 and is anticipated to grow at a considerable CAGR during the forecast period. Along with the rising trend of self-care and self-medication, the demand for over-the-counter (OTC) medicines is increasing. OTC medicines are readily available, making them a popular choice for consumers seeking quick solutions for their healthcare need. These medicines allow people to manage common health issues without requiring a prescription. This convenience factor boosts the segment. Furthermore, the easy availability of a wide range of OTC products for common ailments, such as cold, flu, and fever, is expected to drive the growth of the segment.

The prescription drugs segment is projected to grow significantly during the forecast period due to the rising prevalence of chronic diseases and growing geriatric population. Some chronic diseases require frequent medical checkup and ongoing medication, thereby boosting the demand for prescription medicines. Moreover, the growing aging population is expected boost the demand for prescription medicines, as geriatric people often take prescribe medicines to manage age-related health conditions. For instance,

The dental segment accounted for major market share in 2024. The segment is projected to hold the largest share of the market in the coming years due to the rising awareness and importance of oral health. Convenience of purchasing dental products through websites of online platforms and the availability of a wide range of products encourage people to access online pharmacies. Moreover, several epharmacies are offering teledentistry services, attracting more consumers. The increasing instances of oral diseases are also boosting the segment. For instance,

The primary care centers segment held the largest share of the market in 2024 owing to the increasing adoption of e-prescriptions among primary care providers in developed countries, such as the US and Canada. Primary care providers often purchase large amounts of stock. However, online pharmacies offer discounts and doorstep delivery, making them suitable for primary care providers to buy products from these pharmacies. Several primary care institutions are partnering with online pharmacies to provide services in remote locations. The convenience of accessing primary care services through online pharmacies is further boosting the segment.

The home care settings segment is anticipated to grow rapidly during the forecast period. The growth of the segment is attributed to the rising trend of self-medication. Advancements in technology have made home care possible. Patients are seeking ways to manage their health from the comfort of their homes. However, online pharmacies allow patients to directly communicate with pharmacists, making them viable options for home care.

The app-based segment is projected to expand at a high CAGR during the forecast period due to the rising adoption of smartphones. App-based platforms place a plethora of pharmaceutical products at users' fingertips, allowing users to gain instant access to a variety of medications and healthcare products. Pharmacy apps provide personalized recommendations based on previous purchases, enhancing the shopping experience. Furthermore, the rising number of pharmacy apps is expected to boosts the segment. For instance,

The online payment segment dominated the market in 2024 and is expected to expand at a significant pace in the coming years owing to the growing trend of go cashless and digital transactions. Consumers are becoming more accustomed to paying for goods online, including healthcare products. The availability of various payment options, such as digital wallets and online banking, enhances the flexibility and ease of making purchases. Additionally, online payment options often come with discounts, thereby fueling the segment.

There is significant growth in the potential of the ePharmacy industry in emerging economies such as India, due to its large population and fast digital transformation. The growth, a combination of government initiatives to encourage and promote digital technology adoption, and internet penetration and smartphone usage, is rapidly increasing the number of online healthcare services. E-commerce has accelerated ePharmacy expansion through its provision of convenient shopping with vast medication availability and delivery without human contact.

By Drug Type

By Product Type

By End-user

By Platform

By Payment Method

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client