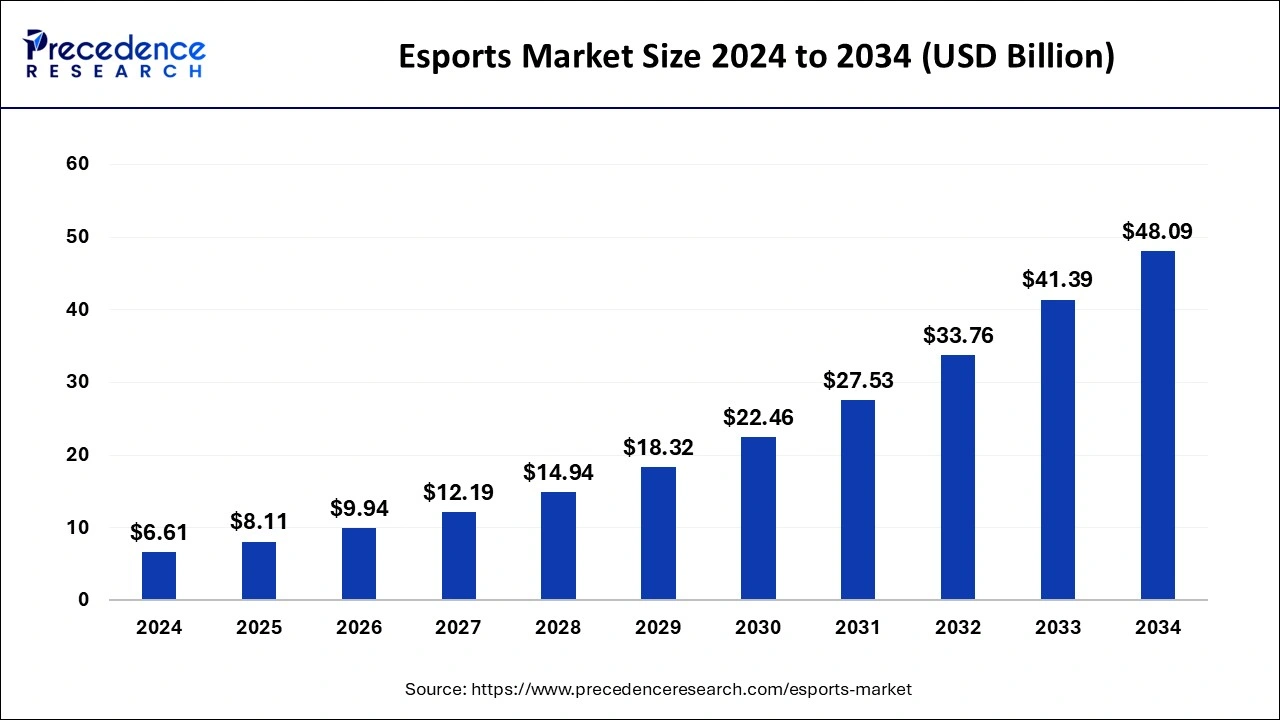

The global eSports market size is calculated at USD 8.11 billion in 2025 and is forecasted to reach around USD 48.09 billion by 2034, accelerating at a CAGR of 21.95% from 2025 to 2034. The North America eSports market size surpassed USD 2.58 billion in 2024 and is expanding at a CAGR of 21.98% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global eSports market size was calculated at USD 6.61 billion in 2024 and is expected to reach around USD 48.09 billion by 2034. The market is expanding at a solid CAGR of 21.95% over the forecast period 2025 to 2034.

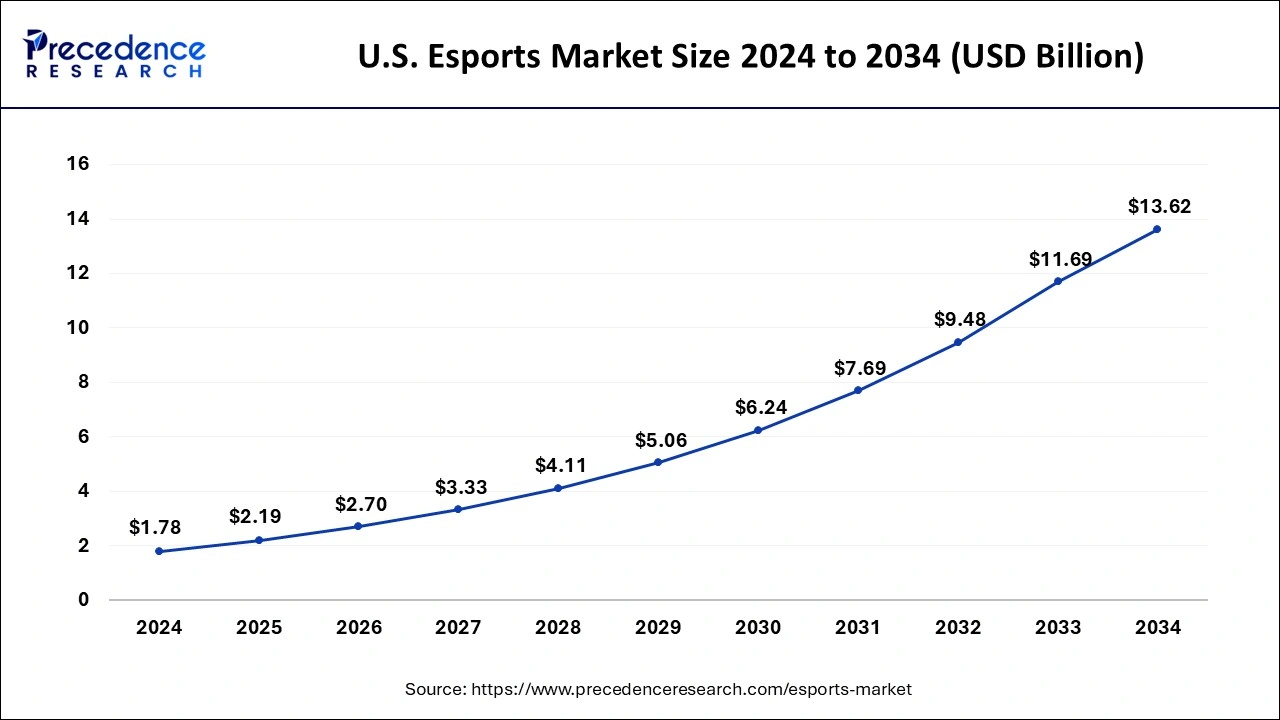

The U.S. eSports market size was estimated at USD 1.78 billion in 2024 and is predicted to be worth around USD 13.62 billion by 2034, at a CAGR of 22.57% from 2025 to 2034.

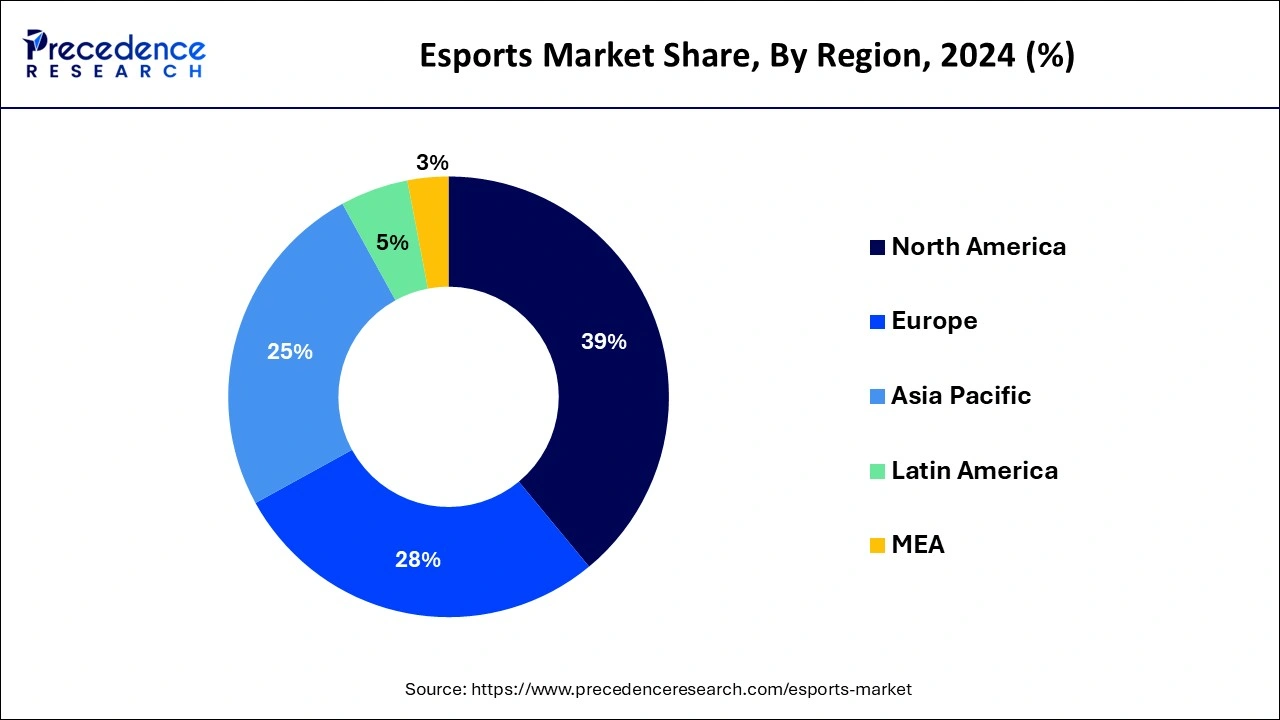

North America held the largest revenue share of 39% in 2024. The US dominated the North America region in 2023. This is owing to the availability of a significant number of online gamers in the region. The increasing research & development activities and strategic moves by various key players such as Activision Blizzard, Inc., X1 Esports and Entertainment Ltd., and Riot Games, Inc., among others to obtain a competitive edge is also likely to support the growth of the market in the region. Additionally, the early adoption of advanced technologies is also likely to create immense growth opportunities for the market in the region.

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. This is attributable to the increasing internet penetration and smart devices across developing economies such as India and China in the region. Additionally, the increasing shift towards digital platforms is also expected to support the regional growth of the market in the years to come. Further, rapid urbanization and advances in IT infrastructure in the region is also expected to support the growth of the market within the estimated timeframe.

Online gaming is turned into a spectator event through the phenomenon known as "esports," or "electronic sports." Watching video gamers fight against one another in a virtual setting is analogous to watching a professional sporting event, except there is no physical competition to watch. Competent video gamers compete in esports, a developing global sector. In the same way that there are games played in football, basketball, and other traditional sports, there are games played in esports as well.

Contrary to popular belief, esports is not only a fad taking place in the unemployed 20-somethings' basements; the sector is legitimate, expanding globally, and investable. In addition to more commonplace sports-related video games like NBA 2K and FIFA, this sector also contains games like Counter-Strike, League of Legends, and Dota. This ecosystem is surrounded by several technology platforms, events, services, analytics platforms, and significant investor capital as it grows.

Electronic sports, sometimes known as "esports," have become a worldwide sensation in recent years. The esports industry has expanded as a result of increasing video game demand over time. From being only leisure to the professional competitions that now command worldwide interest, gaming has gone a long way. The accessibility of new technology is enhancing the potential of video products, content, and virtual reality, enhancing game tournament excitement, and attracting a steadily expanding fan following. The way that people consume entertainment has changed as a result of how deeply ingrained video games are in the life of the current generation.

A Wall Street investment bank and other industry professionals have declared that the competitive gaming and esports industries have finally reached the mainstream as a result of the remarkable growth of competitive gaming and the increasing popularity of esports. Nevertheless, the recent rapid growth in the popularity of competitive gaming and the enormous sums of money attracted by these events has all but propelled esports into the major league. The esports sector, which is dominated by a young, digital, and international audience, is powered by financial potential measured by merchandise, sponsorships, advertising, ticket sales, and media rights.

| Report Coverage | Details |

| Market Size in 2025 | USD 8.11 Billion |

| Market Size by 2034 | USD 48.09 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 21.95% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Streaming Type, By Revenue Streams, and By Gaming Genre |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growth of mobile eSports

The increase in mobile eSports is expected to fuel the growth of the eSports market during the forecast period and this trend is likely to continue in the future. The growth is being driven by the increasing number of people playing games on their smartphones and tablets. This is owing to the emergence of 5G technology which offers gamers with more reliable and faster mobile internet speeds. More mobile eSports tournaments and events are expected to occur in the coming years.

Among the mobile Esports games that have generated a lot of excitement are Call of Duty Mobile, Fortnite, PUBG New State, Free Fire, and many others. The affordability and accessibility of smartphones as well as fast internet have led to a significant increase in the popularity of gaming across the globe. Mobile gaming offers freedom since it allows players to play whenever and wherever they want. This is not a possibility for PC gamers, making mobile gaming more widely available. Thus, the surge in mobile eSports is expected to support the market growth during the forecast period.

Lack of regulation

In the esports sector, regulation is still in its infancy. Some see this as a benefit, arguing that it permits cybersport organizations to actively develop with little intervention in their operations. This point, however, has a drawback. The absence of a regulatory framework also means the lack of an efficient process for resolving conflicts and comprehending the overall game rules. Naturally, this has a detrimental impact on the growth of the sector.

Esports require proper regulation just like any other sport. This is required to establish common guidelines for setting up and running competitions as well as to make the esports industry transparent and appealing to investors. Participants in the eSports market only need to embrace the restrictions that have proven effective in traditional sports, such as signing contracts outlining the parties' rights and obligations, abiding by laws and regulations, and strictly adhering to standards that have been independently verified. Thus, this is likely to limit the growth of the market in the years to come.

Introduction of metaverse immersion

The introduction of metaverse immersion is likely to offer growth opportunities for the market in the years to come. The trend at hand is the most radical and uncommon one. The metaverse presents an enormous potential for both the gaming sector and brands in general by allowing users to immerse them in an action-packed, realistic (yet unreal) environment. As a side note, this type of technology is so promising that it is starting to slow down the development of traditional consoles. UCAM eSports is among the most cutting-edge of these initiatives. Through the use of VR headsets, the Universidad Católica de Murcia has developed a gaming environment.

It is so comprehensive that it even has its own space where participants may socialize during breaks. In the years to come, there will be a significant transformation in the eSports industry. For what lays ahead, developers, IT firms, players, and viewers are preparing. Due to the current and firm dedication towards modernization, the previously notable numbers are anticipated to set new benchmarks.

Also, consumers may already experience virtual reality and, soon, the metaverse, due to headsets made by a number of technological companies, including Sony, Meta and Apple. Although it will take time to develop this integrated virtual experience, businesses that capitalize on it right away will have an advantage in the market and create opportunities for the growth of the market in the future.

On the basis of streaming type, the live segment held the largest revenue share of 41% in 2024. The demand for live electronic sports events is projected to increase as the emphasis on fan participation increases. Additionally, the use of smartphones is anticipated to increase interest in live electronic sports competitions. The increasing popularity of esports has led to greater demand for live events, with more people willing to attend in-person events to watch their favorite players and teams compete. Further, a significant increase in investment in recent years, with major brands and organizations investing in live events to reach new audiences and build brand awareness is also likely to augment the segmental growth of the eSports market during the forecast period.

Based on revenue streams, the advertising segment is expected to grow at a significant CAGR during the forecast period. Advertising includes the revenue from esports viewers' targeted commercials, such as those broadcast during livestreams on internet platforms, on esports video-on-demand, or on esports TV. The esports audience is already being targeted by companies like Intel, Coca-Cola, Samsung, Arby's, and Redbull—especially given their significant purchasing power. Currently, advertising on the numerous esports platforms is still far less expensive than it is on more conventional sports. Exposure to this fan demographic will become more expensive as esports popularity and viewership grow.

By Streaming Type

By Revenue Streams

By Gaming Genre

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client