May 2024

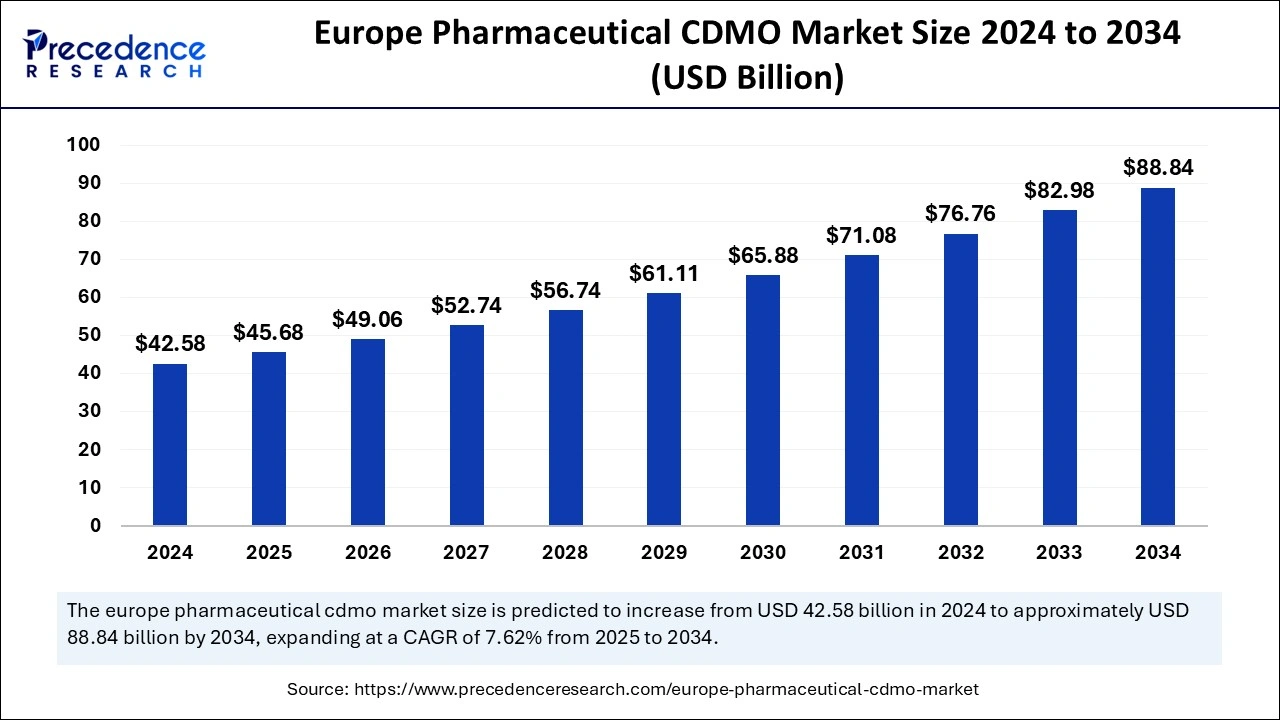

The Europe Pharmaceutical CDMO market size is evaluated at USD 45.68 billion in 2025 and is forecasted to hit around USD 88.84 billion by 2034, growing at a CAGR of 7.62% from 2025 to 2034. The Germany market size was accounted at USD 12.68 billion in 2024 and is expanding at a CAGR of 7.32% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The Europe Pharmaceutical CDMO market size was estimated at USD 42.58 billion in 2024 and is predicted to increase from USD 45.68 billion in 2025 to approximately USD 88.84 billion by 2034, expanding at a CAGR of 7.62% from 2025 to 2034. The market is gaining traction as it allows pharmaceutical companies to have access to specialized expertise, advanced manufacturing facilities, and regulatory compliance support, which are essential components for developing and producing new drugs.

The integration of artificial intelligence into European pharmaceutical CDMOs is expected to improve efficiency, streamline processes, and enhance product quality. AI facilitates drug discovery, formulation, testing, and manufacturing. AI has the potential to identify drug candidates by analyzing its biological data, which includes genomics and proteomics; it also helps in the prediction of drug efficacy and safety profiles. Furthermore, AI plays a crucial part in the manufacturing process by monitoring process parameters such as metabolites and raw material concentrations, along with monitoring production process performance without the need to take manual samples.

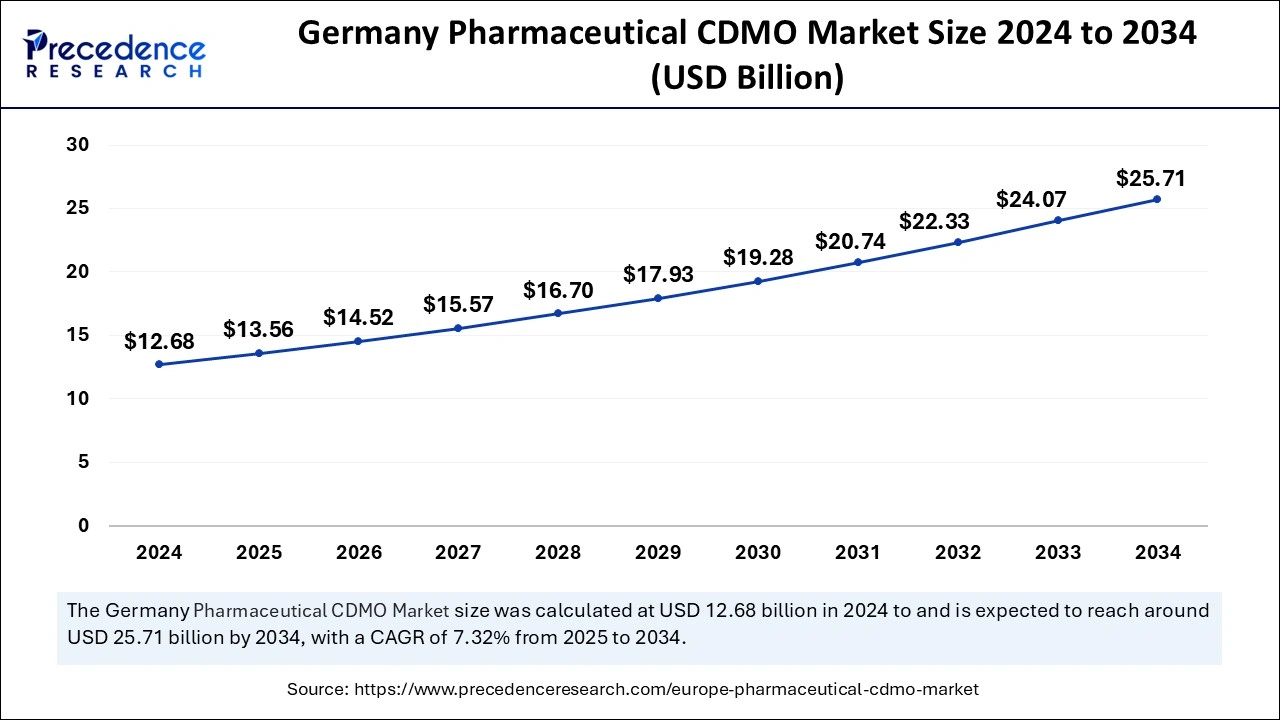

The German pharmaceutical CDMO market size was exhibited at USD 12.68 billion in 2024 and is projected to be worth around USD 25.71 billion by 2034, growing at a CAGR of 7.32% from 2025 to 2034.

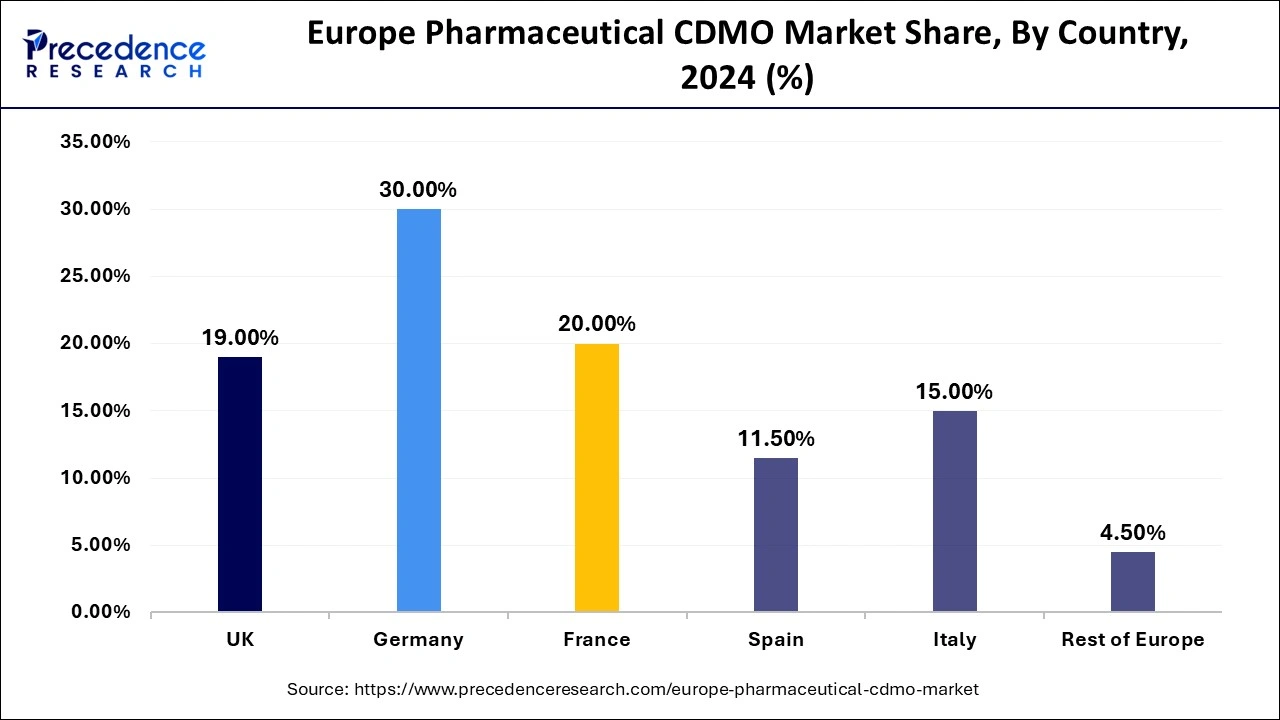

Germany held the largest share of the European pharmaceutical CDMO market in 2024. The dominance of Germany is credited to the strong reputation it holds for providing high-quality manufacturing, a robust regulation landscape, a skilled workforce, and a focus on research and development. All these factors direct a strategic approach to boosting the market in Europe.

Germany is a leading pharmaceutical CDMO market in Europe, with a total revenue of 69 million euros in 2023. Germany has incorporated a large pool of highly qualified scientists and researchers in the pharmaceutical industry who extensively bring innovative drug development and complex manufacturing processes.

France is observed to expand at a CAGR in the European pharmaceutical CDMO market during the forecast period. France is the second leading country in Europe, with extensive pharmaceutical companies generating revenue of around 46 billion euros. France also has a strong research and development (R&D) team. The region is also supported by government regulations that aim to improve healthcare access. The presence of some leading players, such as Sanofi, Servier, and Janssen, brings great revenue growth to the country.

Pharmaceutical companies use contract development and manufacturing organizations (CDMOs) to outsource their product development and manufacturing. The European pharmaceutical CDMO market is anticipated to expand as small and large pharmaceuticals and consumer health companies continue to externalize manufacturing to emphasize research and commercialization. The Western part of Europe is increasingly entering into investment in biological and specialist ingredients; this will offer a differentiated and secure demand for specialized drugs. CDMO companies are rapidly changing their commercial strategies for successful competition in the market. This is achieved by exacting the desired values of the product and service into the prices.

| Report Coverage | Details |

| Market Size by 2034 | USD 88.84 Billion |

| Market Size in 2025 | USD 45.68 Billion |

| Market Size in 2024 | USD 42.58 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.62% |

| Dominating Country | Germany |

| Fastest Growing Country | France |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Research Phase, and Countries |

| Countries Covered | Germany, UK, France, Italy, Spain, Sweden, Denmark, and Norway |

Small molecules and drug products

The European pharmaceutical CDMO market is majorly driven by the increasing demand for small molecules and drug products, which includes drug development, manufacturing, and regulatory support. For formulation development, CDMO aids in designing formulation for drugs, which consists of prototype formulation and developmental stability studies.

Manufacturing for clinical trials and commercial-scale products of drugs in bulk quality is observed in Europe. Regulatory support comprises regular filings, compliance, and audits conducted by the FDA and other regulatory bodies. Drug discovery plays a crucial part in the development of small-molecule drugs, which involves intricate stages and innovative technologies to create effective therapies.

Cost competitiveness

The emerging European pharmaceutical CDMO market is grappling with cost competitiveness against countries like China and India, which are known for their lower production costs. This situation pressures European CDMOs to enhance operations and remain price-competitive. Cost optimization in Europe has resulted from the ization of pharmaceutical processes, which involves strategically leveraging favorable economic conditions in various regions.

Tackling this issue requires diversifying operational bases, allowing European countries to pinpoint locations with more competitive production expenses. This strategy not only boosts overall cost efficiency but also aids budget considerations and increases the competitiveness of European pharmaceutical firms.

Expansion

Europe has set a target of expansion to bring the presence of pharmaceutical companies all over the world. This initiative has brought and is expected to bring valuable opportunities to expand the European pharmaceutical CDMO market reach beyond the region. The expansion allows the healthcare industry to address the demands of diverse populations and positions European companies strategically to capitalize on the growth potential of regions with evolving medical needs.

Furthermore, the ization initiative has brought significant avenues to pharmaceutical operations in European companies, extending the market. For instance, Novartis, a Swiss-based pharmaceutical leader, is tactically expanding its footprint by venturing into fulfilling unmet healthcare requirements. Novartis is attending to a diverse patient population and evolving medical requirements.

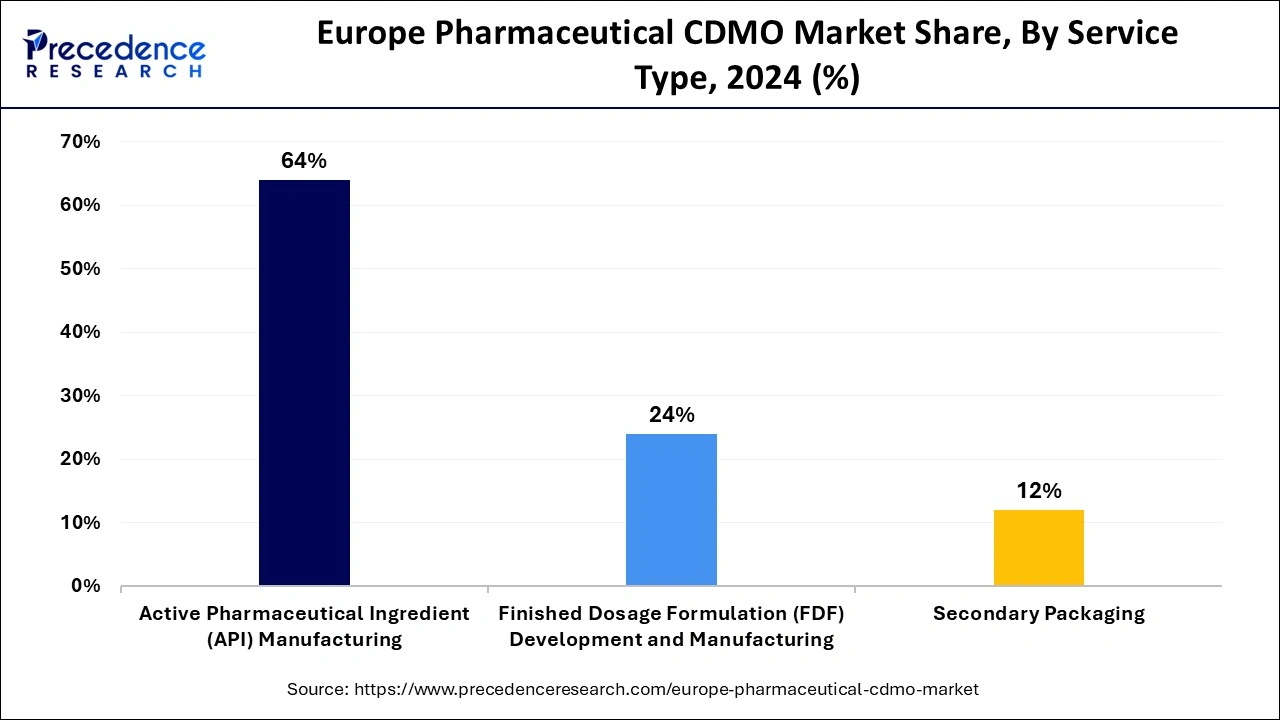

In 2024, the API segment held the dominating position in the European pharmaceutical CDMO market. The rising demand for pharmaceutical and biotechnology applications of complex, small molecule programs from preclinical to Phase III and commercial usage contributes to boosting the contract development & manufacturing organization network of companies that provide active pharmaceutical ingredients (API).

The well-known European API manufacturers include Abbvie IE, Ajinomoto Bio-Pharma Service, Boehringer Ingelheim Pharma, and many more. These reputed companies are responsible for exporting a large portion of API to other regions, promoting ization.

The finished dosage formulation development and manufacturing segment is projected to expand at the fastest CAGR over the projected period. The increasing complexity of drug formulations, including biologics, biosimilars, and specialized therapies, has led to a higher demand for expertise in finished dosage forms. CDMOs in Europe are becoming crucial partners for pharmaceutical companies seeking to bring these complex drugs to market.

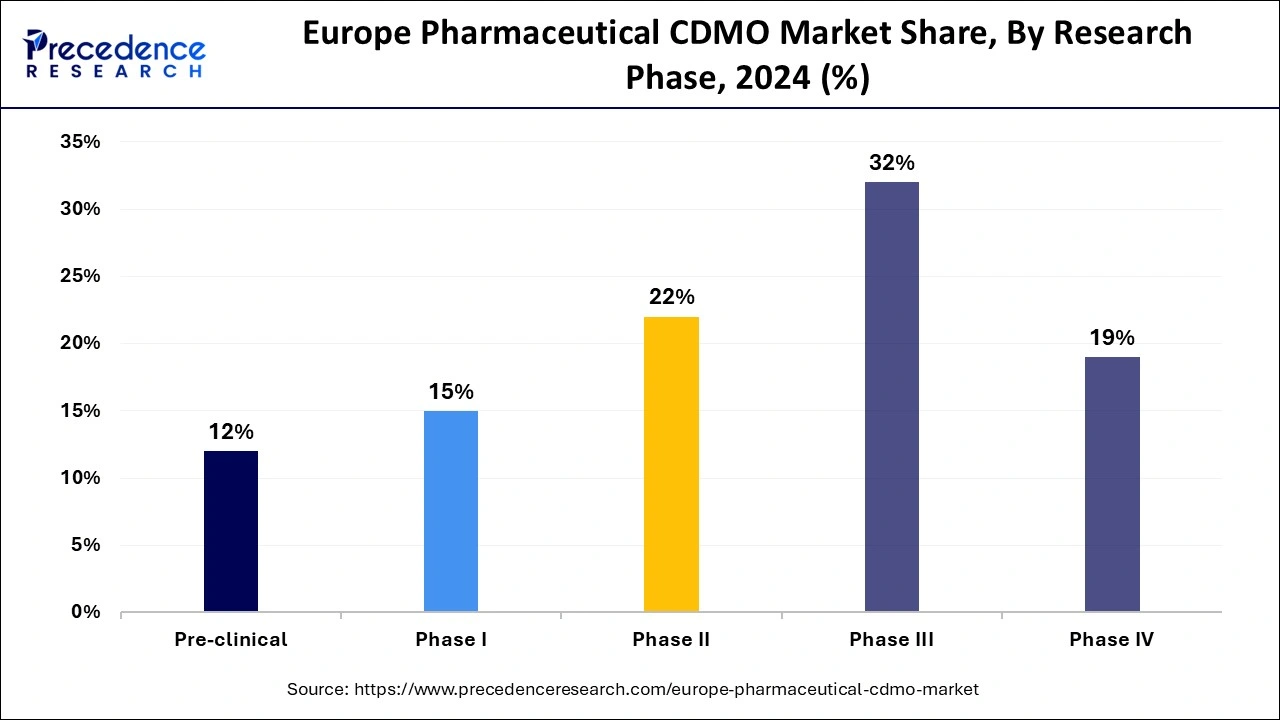

In 2024, the phase III segment held the largest share in Europe pharmaceutical CDMO market. As drugs progress to Phase III, they often require large-scale production for clinical trials involving a substantial number of patients. CDMOs provide the necessary infrastructure, expertise, and capacity to handle these large-scale manufacturing needs. Successful Phase III trials pave the way for regulatory submissions, making this phase critical for pharmaceutical companies. CDMOs in Europe are well-equipped to meet the stringent regulatory requirements in this phase, which further drives demand for their services.

Moreover, the phase II segment is observed to grow at the fastest rate during the forecast period. The increasing development of biologic drugs, vaccines, and gene therapies, which require specialized manufacturing processes, has led to significant growth in the Phase II segment. European CDMOs with expertise in these areas are capitalizing on this trend.

By Service Type

By Research Phase

By Country

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

April 2025

February 2025

September 2024