February 2025

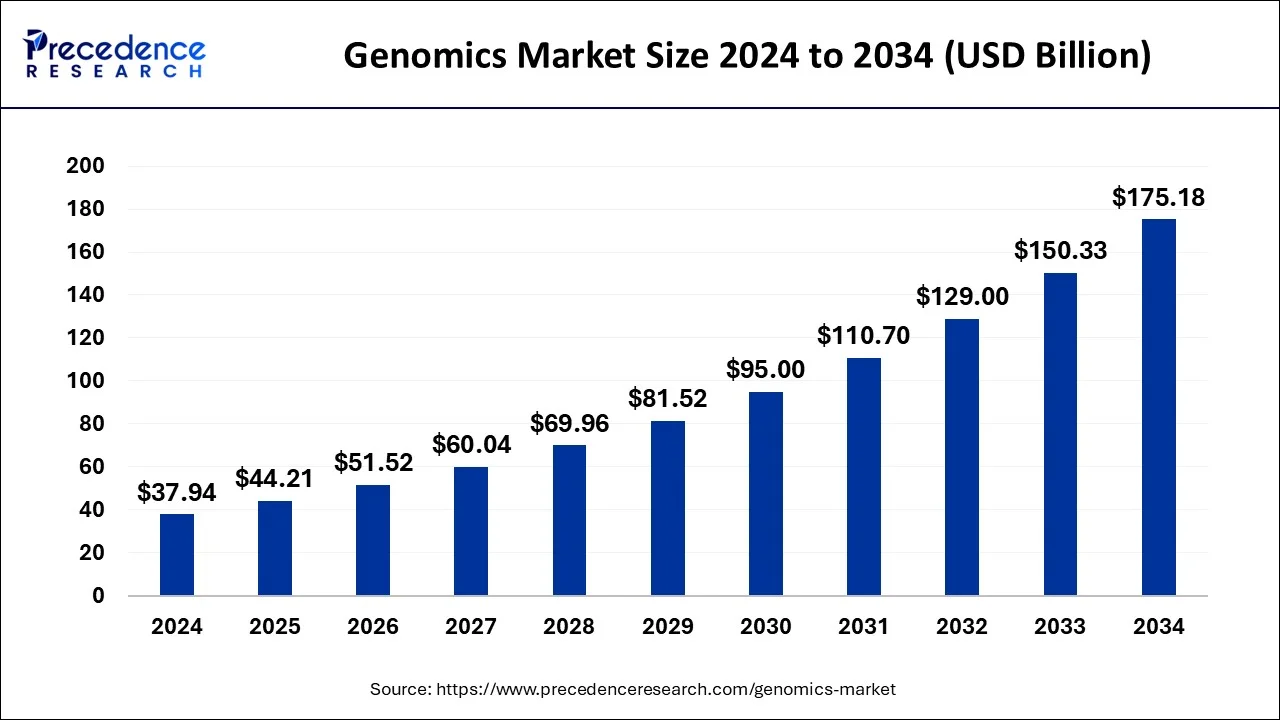

The global genomics market size is calculated at USD 44.21 billion in 2025 and is forecasted to reach around USD 175.18 billion by 2034, accelerating at a CAGR of 16.53% from 2025 to 2034. The North America genomics market size surpassed USD 14.39 billion in 2024 and is expanding at a CAGR of 16.54% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global genomics market size was estimated at USD 37.94 billion in 2024 and is anticipated to reach around USD 175.18 billion by 2034, expanding at a CAGR of 16.53% from 2025 to 2034. The rising demand in the genomics market is observed owing to having a better understanding of the evolution and to protect the biological ecosystem which helps in the development of new diagnostics, therapeutics, and vaccines.

Integration of artificial intelligence and machine learning in genomics is essential due to the increasing number of DNA sequencing and other biological techniques along with the complexity of the data sets, AL/ML-based computation tools facilitate handling, extracting, and interpreting valuable information. Researchers are benefiting from this integration in programs such as identifying genetic disorders, identifying primary causes of cancer, cancer progress, disease source and improving the function of gene editing. The AI/ML integration helps in predicting and identifying hidden patterns of genomic data. Scientists are using it to predict the future variation of various diseases to help public health.

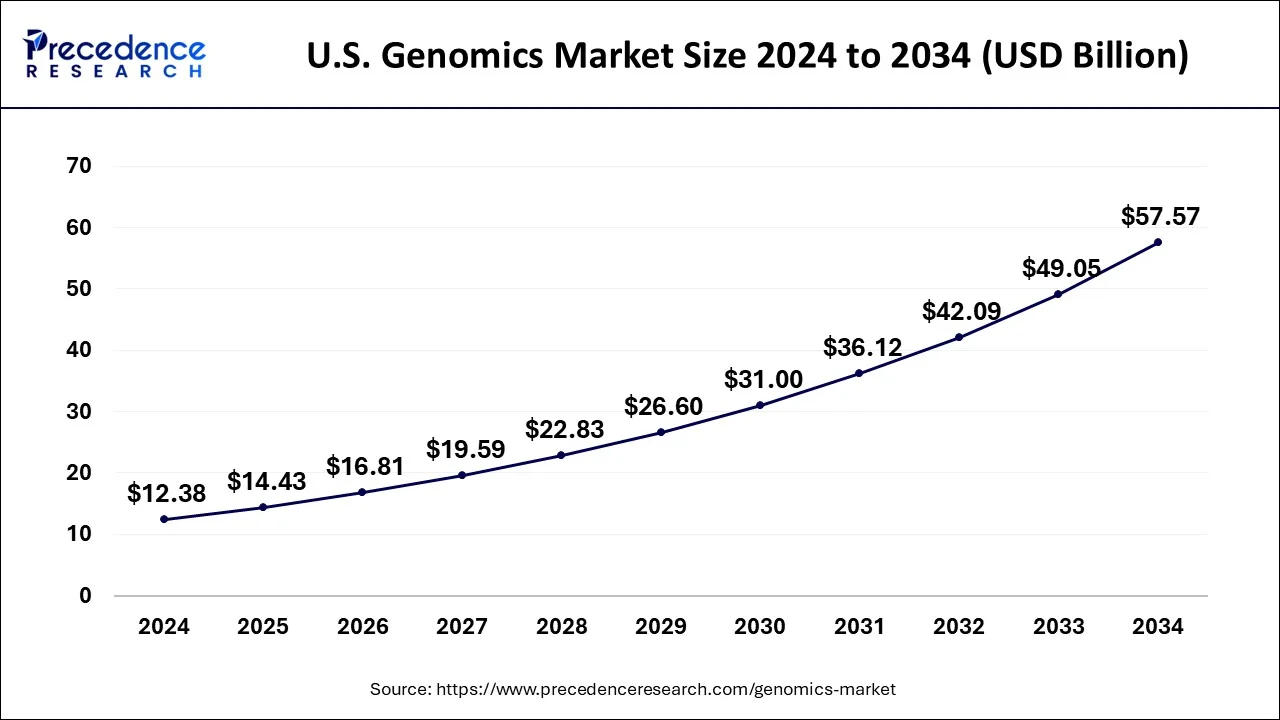

The U.S. genomics market size was evaluated at USD 12.38 billion in 2024 and is predicted to be worth around USD 57.57 billion by 2034, rising at a CAGR of 16.61% from 2025 to 2034.

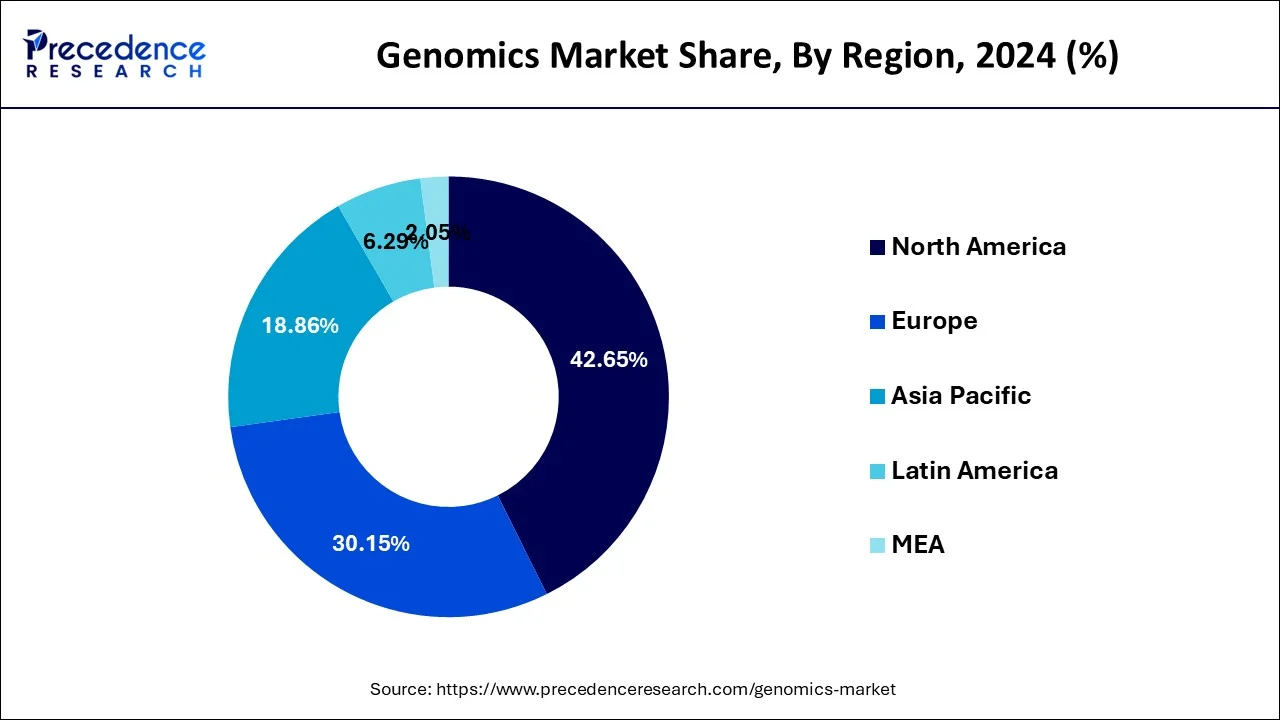

The region segmented into North America, Europe, Asia Pacific, Latin America and the Middle East, and Africa. Amongst all, North America dominated the global genomics market with the largest market share of 42.65% in 2024. In the same region, the U.S. itself captures more than 80% of the market shares. U.S. shows presence of around 70% of startups in the genomic market. Government guidelines following reimbursement policies are the major factor that illuminating the growth of the market in the region.

Major companies like Illumina, Pacific Bioscience, MACROGEN hold the maximum share in the market and such companies are headquartered in the U.S. Qiagen, a Germany based firm holds important market shares in the European market. In the Asia Pacific, South Korea and China offers bright prospects of the market due to presence of largest population and per capita expenditures. Brazil is the major country that holds more than 50% of the share in Latin American Market.

| Report Highlights | Details |

| Market Size in 2024 | USD 33.29 Billion |

| Market Size in 2025 | USD 44.21 Billion |

| Market Size by 2034 | USD 175.18 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 16.53% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Services, Technology, Application, End-Users |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Increasing adoption of genomics in drug discovery and development

Researchers analyze the amount of genomics data with the advancement of genomic technologies to identify disease-associated genes, understand disease mechanisms, and develop targeted therapies. Genomics plays a crucial role by helping to accelerate the drug discovery process by enabling researchers to identify and prioritize drug targets based on genomic data, which leads to more efficient and effective drug development. Genomic information is used to identify genetic mutations, gene expression patterns, and other molecular markers associated with diseases, allowing for the identification of novel drug targets and the development of precision therapies tailored to an individual's genomic profile. In addition, genomics is being utilized in clinical trials to stratify patients based on their genomic profile and optimize treatment strategies. Genomic data is used to identify patient populations that are more likely to respond to a particular drug, leading to more targeted and personalized treatment approaches. This has the potential to improve patient outcomes, reduce adverse effects, and increase the success rate of clinical trials.

Moreover, the use of genomics in pharmacogenomics, which involves studying how individuals’ genes affect their response to drugs, is gaining momentum. Pharmacogenomic testing provides insights into an individual's genetic variations that impact drug metabolism, efficacy, and safety, helping to guide personalized medication dosing and selection. This improves patient outcomes by reducing adverse drug reactions, optimizing drug selection, and minimizing trial-and-error approaches in drug prescribing.

Technology Advancement

The field of genomics has witnessed significant advancements in technology in recent years, with notable breakthroughs such as the revolutionary CRISPR technology, which allows for precise editing of DNA by adding, removing, or altering specific sections of the genome. CRISPR employs an enzyme that cuts DNA at targeted locations, guided by a small RNA molecule. In addition to CRISPR, other technological advancements have greatly simplified and facilitated data-related operations critical to genomics research. Cloud technology and composable infrastructure, for instance, have been widely adopted for data storage, analysis, and manipulation, streamlining data interactions and speeding up research results. Rapid research outcomes enable scientists to accelerate the development of new therapeutic approaches.

In addition, Nanotechnology is also a significant advancement in genomics research, with potential applications in the development of genetically modified organisms (GMOs) and overcoming existing constraints. Nanotechnology has the potential to enhance biotransformation processes and improve the production of genetically engineered plants, among other applications. Furthermore, nanotechnology offers opportunities for coordinated management strategies in diverse areas, including agriculture, thereby reducing uncertainties and expanding possibilities in genomics research.

Cost and Affordability

Despite advancements in DNA sequencing technologies, genomic testing and analysis are expensive, particularly for whole genome sequencing and comprehensive genomic profiling. The high costs associated with genomic testing and interpretation are a restraint on the widespread adoption of genomics in clinical practice, especially in resource-limited settings or for individuals with limited financial resources. Cost considerations also impact the availability and accessibility of genomic products and services, which hinders the growth of the genomics market.

Precision Medicine

Precision medicine involves tailoring medical treatments and interventions based on an individual's genomic information, allowing for personalized and targeted healthcare. As the understanding of the human genome continues to advance, there are increasing opportunities for genomics to play a pivotal role in guiding treatment decisions, optimizing patient outcomes, and reducing healthcare costs. The integration of genomics into precision medicine workflows presents a significant growth opportunity for the genomics market.

Expansion of Genomics in Emerging Markets

While genomics has gained significant traction in developed markets, there is an opportunity for expansion in emerging markets. Emerging markets, such as Asia-Pacific, Latin America, and Middle East & Africa, are witnessing rapid economic growth, improving healthcare infrastructure, and increasing awareness about the benefits of genomics. As a result, there is a growing demand for genomic products and services in these regions, including genetic testing, diagnostics, and personalized medicine. Expanding genomics in emerging markets presents an opportunity for market players to tap into new customer bases and geographical regions and leverage the potential of genomics in diverse populations and healthcare settings.

Global genomics market is classified on the basis of aspects such as product and services, technology, application, and end-users. The products and services are further classified into consumables, services, and systems and software. The market is mostly dominated by consumables segment contributed the largest market share of 40% in 2024. The common product includes in the consumables are channel pipette, PCR plates, assay kit, assay tubes, centrifuge, and many more. Further, service segment is predicted to grow at the highest rate within the forecast period. Growing keen interest by the professionals and better service availability is considered as one of the major driving factors which encourage the development of the market.

The technology-based market of the genome is classified into sequencing, PCR, Microarray, and others. PCR is a widely used method in the industry. The test used in the lab to prepare a number of copies for the specific DNA. The PCR segment has held the major market share in 2024. Reducing the cost of the cell implication is the prime factor for its importance and growth. High incidence of infectious diseases coupled with PCR technology development is one of the major driving factors which promotes the growth of the market.

The diagnostics segment dominated the market in 2024. Diagnostics, drug discovery and development, precision medicine, agriculture, and animal research are few major applications assessed in the genomic market. Research study claims that, diagnostics segment is the fasted growing application in the genomic market and it is expected to mirror this trend during years to come. Decreasing cost in the diagnostic segment is the pointing factor to spur the growth of the market. Furthermore, increasing research and development in genomics assist in synergies the sales of the genomic based product and services.

In terms of end-users, the market is classified into research centers and academic pharmaceutical and biotechnology companies, hospitals & clinics, and other end users. The research centers and academic and government institutes segment led the market in 2024. The largest end-users hold more than half of the global market shares. Increasing practical applicability in academics is boosting the growth of the market.

Some of the significant players in the genomics market include:

By Product and Services

By Technology

By Application

By End-Users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2024

May 2025

February 2025