January 2025

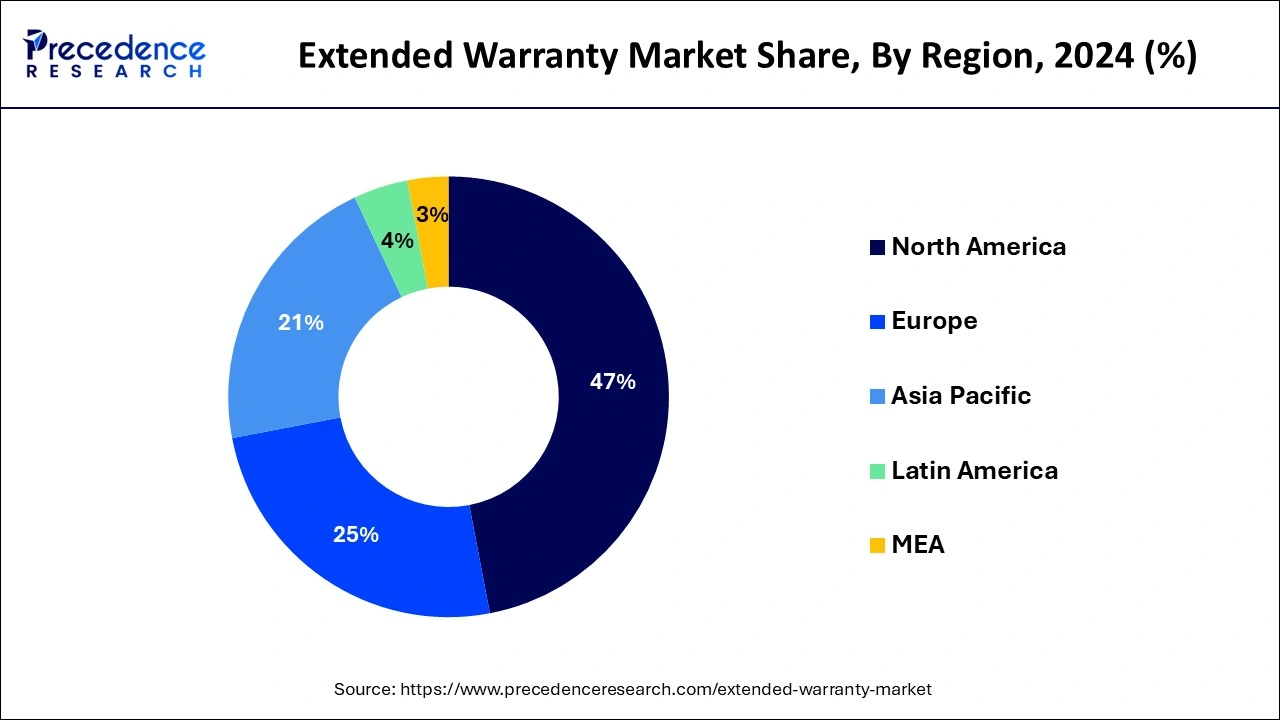

The global extended warranty market size is estimated at USD 160.83 billion in 2025 and is forecasted to worth around USD 347.26 billion by 2034, accelerating at a CAGR of 8.92% from 2025 to 2034. The North America extended warranty market size crossed USD 69.48 billion in 2024 and is expanding at a CAGR of 8.95% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global extended warranty market size was estimated at USD 147.82 billion in 2024 and is foreseen to reach USD 347.26 billion by the end of 2034 and poised to grow at a compound annual growth rate (CAGR) of 8.92% during the forecast period 2025 to 2034.

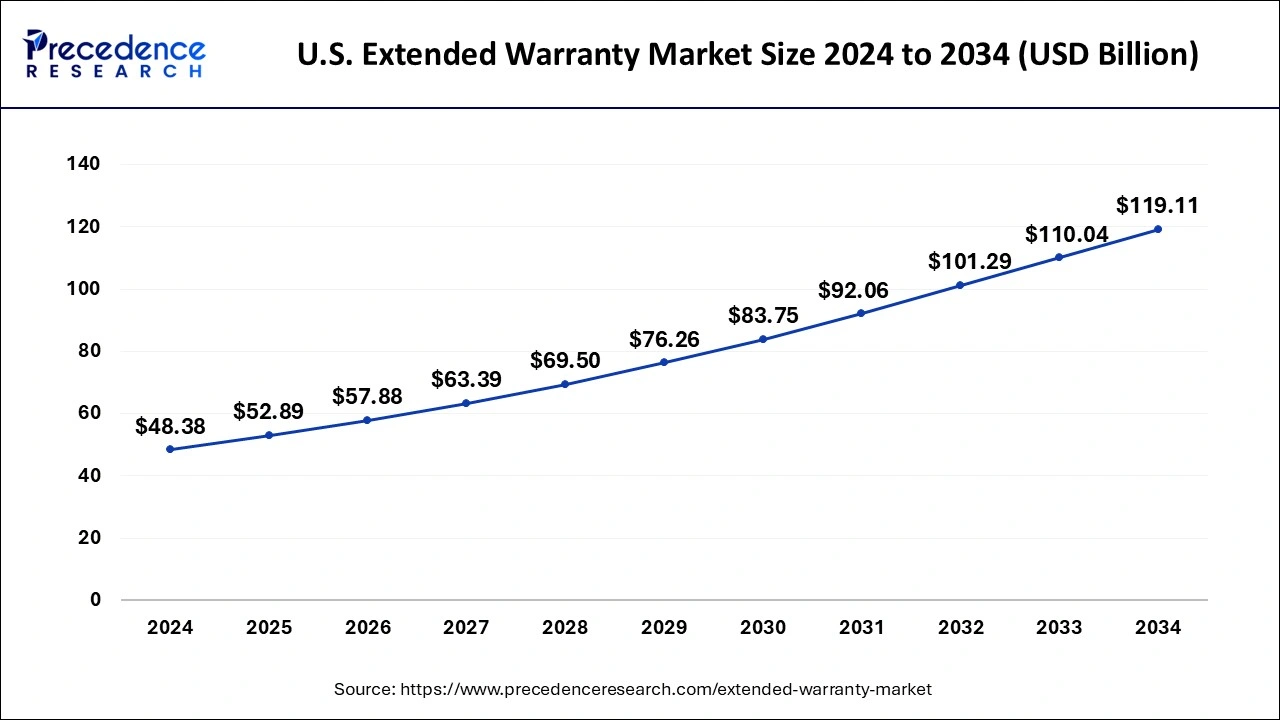

The U.S. extended warranty market size reached USD 48.38 billion in 2024 and is anticipated to be worth around USD 119.11 billion by 2034, poised to grow at a CAGR of 9.43% from 2025 to 2034.

Among all regions, Asia-Pacific dominates the global extended warranty market thanks to the availability of cutting-edge tools and techniques that make it possible to produce advanced and sophisticated equipment. In addition to these advantages, the global extended warranty market has several limitations, including high equipment manufacturing and shipping costs. To solve this problem, many potential companies are looking for possible solutions that can make manufacturing and shipping viable electronic devices.

Europe and North American consumers are already very aware about the benefits of extended warranty and they buy it with every product hence the growth in these regions is expected to remain steady and CAGR will also be among the slow growers.

Extended warranties, or service contracts, refer to an extended warranty period offered to consumers on new items. It usually covers the cost of repairing or replacing the product if the damage is due to a manufacturing defect or poor quality. It is typically provided by manufacturers, or retailers for automotive, electronics, and electrical equipment. While these products usually are covered with one-year warranty, extended warranties can provide extended coverage against various product defects after the expiration of the original warranty. Over the past few years, extended warranty services have boosted due to the cost effectiveness and its features that gives additional protections, such as mechanical and electronic failures of products not covered by the original warranty.

The extended warranty includes routine maintenance and accidental damage including liquid spills, theft or cracked screens. Therefore, the growing concern of consumers about the safety of their electronic devices after the expiration of the original warranty is the main driver for the growth of the market. Additionally, an increasing number of price sensitive customers and shift in consumer preferences to a convenient after-product sales experience is increasing the extended warranty service demand.

Additionally, strong sales of premium vehicles and consumer electronics, such as smartphones, tablets, laptops, and wearable, are driving product adoption. In addition, leading companies are providing value-added services, such as easy replacement and door to door service, while using digitalized technologies for extended warranty claims & resolution, causing the market to rise. Other factors, including growing demand to extend the life and value of goods, inflation of consumer disposable income and high repair and maintenance costs, are also fueling market growth.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.92% |

| Market Size in 2025 | USD 160.83 Billion |

| Market Size by 2034 | USD 347.26 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Coverage, By Application, By End User, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

In 2024, the mobile device segment dominated the global consumer electronics warranty renewal market. More than half of the market share is captured by the smartphone and tablet segment. The growing penetration of premium smartphones, especially in countries like the U.S., the U.K., Germany, France, China, India and others, is driving the growth of the mobile device segment. Furthermore, the growing use of tablets is a key factor in the explosion of the mobile device segment.

The mobile industry is expected to maintain its market leadership over the forecast period, as smartphone and tablet usage continues to grow. In addition, consumers favor high-end, expensive mobile phones accounting for a greater number in total smartphone users in Europe. These users are the forefront buyers of the relevant extended warranties, which is driving the growth of the segment.

Based on coverage type, the standard protection plan segment accounted for the largest market share, contributing about three-fifths of the market. However, the accident protection plan segment is estimated to have the highest CAGR from 2024 to 2033.

On the basis of the distribution channel, the retail segment is expected to grow with the highest CAGR while the manufacture level segment is expected to hold the largest market share.

With many consumers extending their warranty after they buy the product, the retail segment is always a go-to place for the consumers to extend their warranty and claim the added benefits.

By Coverage

By Application

By End User

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024