December 2024

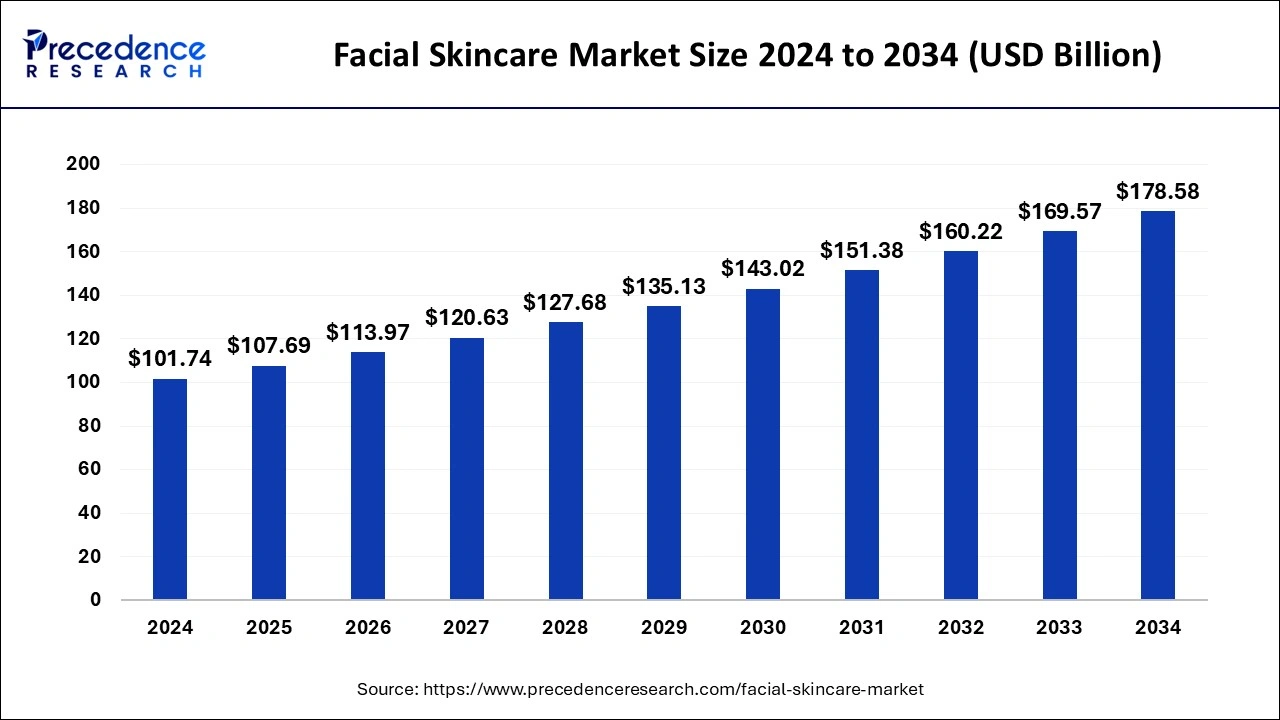

The global facial skincare market size is accounted at USD 107.69 billion in 2025 and is forecasted to hit around USD 178.58 billion by 2034, representing a CAGR of 5.79% from 2025 to 2034. The North America market size was estimated at USD 37.64 billion in 2024 and is expanding at a CAGR of 5.93% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global facial skincare market size was calculated at USD 101.74billion in 2024 and is predicted to increase from USD 107.69 billion in 2025 to approximately USD 178.58 billion by 2034, expanding at a CAGR of 5.79%.

The U.S. facial skincare market size was exhibited at USD 28.23 billion in 2024 and is projected to be worth around USD 50.56 billion by 2034, growing at a CAGR of 6.00% from 2025 to 2034.

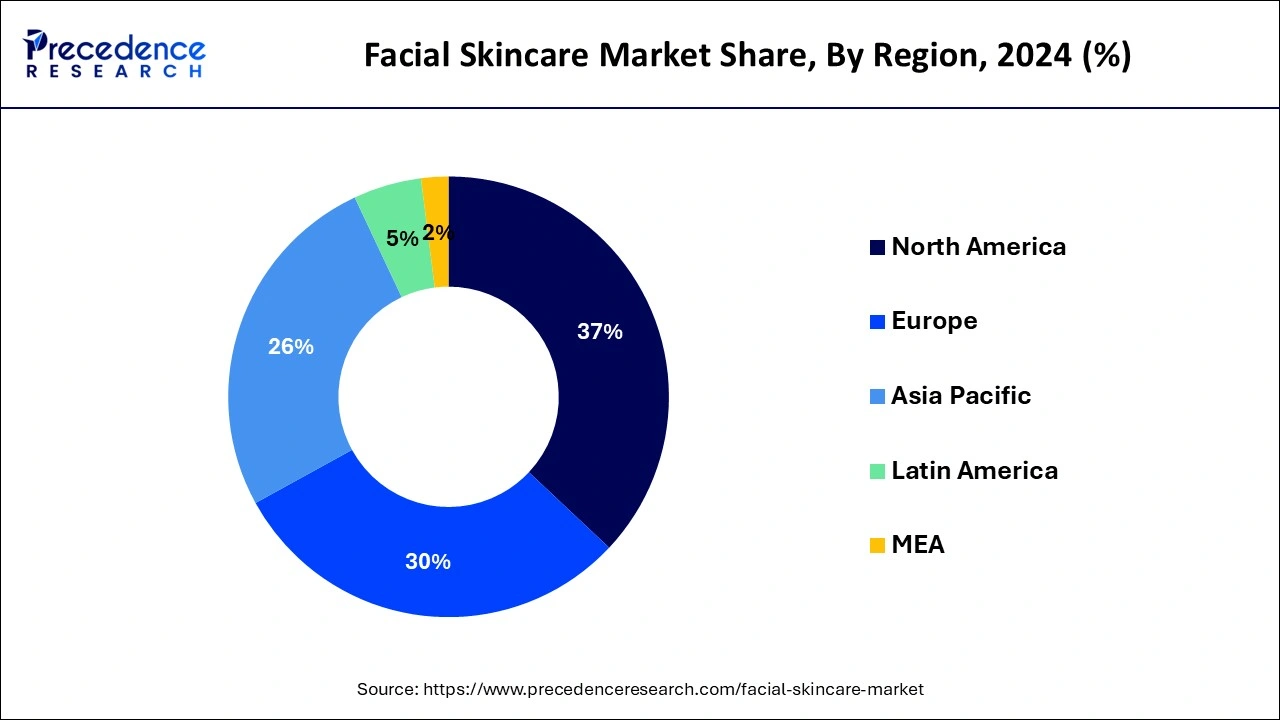

North America held the largest market share of 37% in 2024. The U.S. dominated the North American market, followed by Canada in 2023. Acne is among the most common skin conditions across the U.S. and affects nearly 50 million Americans every year. Approximately 85% of people between 12 and 24 years of age experience at least minor acne in the U.S.

Asia Pacific is expected to grow at the highest rate during the forecast period. The introduction of integrated skin care products caters to the growth of the facial skincare market in the Asia Pacific (APAC) region. India is expected to account for a larger share of the market in the APAC region during the study period.

Germany is expected to hold a higher share of the European market during the study period. Females in Britain spend around £1.15 billion ($1.45 billion) on facial skincare annually. Considering the presence of nations with high spending capacity, early adoption of the latest facial skincare products, and development of new face care skin solutions, the facial skincare market is estimated to grow notably in the European region in the coming years.

Facial skincare treatment includes using various facial products such as lotions, creams, facial masks, and peels. Facial masks are used for different purposes, such as deep cleansing, healing acne scars or hyper-pigmentation, and brightening. Facial skincare treatments are normally performed across various beauty salons.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.79% |

| Market Size in 2025 | USD 107.69 Billion |

| Market Size by 2034 | USD 178.58 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Products, Gender, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Launch of new facial skincare products

Day by day, new products and companies are launched in the market, which drives the market’s growth. People are invested and interested in the new products because they solve their skin, and in many cases, the products are better than the existing ones.

Side effects of skin whitening

Lybrate, Inc. has stated that if a person is undergoing laser whitening treatment, they may experience side effects such as skin dryness, bruising, tightness, sensitivity to sunlight, scarring, swelling, skin texture difference, skin infections, pigmentation, skin redness, and irritation. It is also observed that deep chemical peel treatments can also cause permanent damage, such as hypopigmentation (skin lightening) or hyperpigmentation (skin darkening). If a person undergoes aggressive skin whitening treatments, it may become ooze and raw, forming crusts all over. Various drawbacks and risks associated with skin whitening solutions are restraining the growth of the facial skincare market to a considerable extent.

Increasing R&D activities for facial skincare

A lot of effort is put into skincare product development. To develop better products that will provide better results than the existing products creates opportunities for the growth of the market.

An article shared by ScienceDaily in January 2024 stated that an experimental study has exhibited that a kind of skin bacterium can be engineered efficiently to produce a protein to regulate sebum production. This application is expected to treat acne without compromising the homeostasis of the entire skin microbiome.

The facial creams segment held a significant market share in 2024. As per a November 2022 survey of more than 1,000 people from Advanced Dermatology, on average, Americans spend around $722 on their appearance each year. Owing to increasing affordability and rising inclination towards good looks, the demand for various facial creams is growing notably across multiple countries of the world.

The skin-whitening & anti-aging segment is predicted to grow at a notable compounded annual growth rate (CAGR) during the study period. Considering the capability to lessen facial spots, penetrate skin pigments, minimize wrinkles, and lighten skin, other face products such as anti-aging creams and skin-whitening solutions are becoming popular.

The female segment held the largest share of the facial skincare market in 2024. The high share of the female segment is attributable to increasing financial independence and growing spending on personal care items. The rising count of working women is also contributing to the growing demand for facial skincare products. As per a SkinStore survey, women are using about $8 worth of products on their faces per day. Females are more inclined toward the use of skincare products due to beauty standards, stereotypes, and high beauty expectations.

The men segment is observed to grow at a significant rate during the forecast period. In the case of males, only in recent years have people started focusing on skincare. Many companies have launched skincare products like facewash, fairness creams, and other products that are suitable for males.

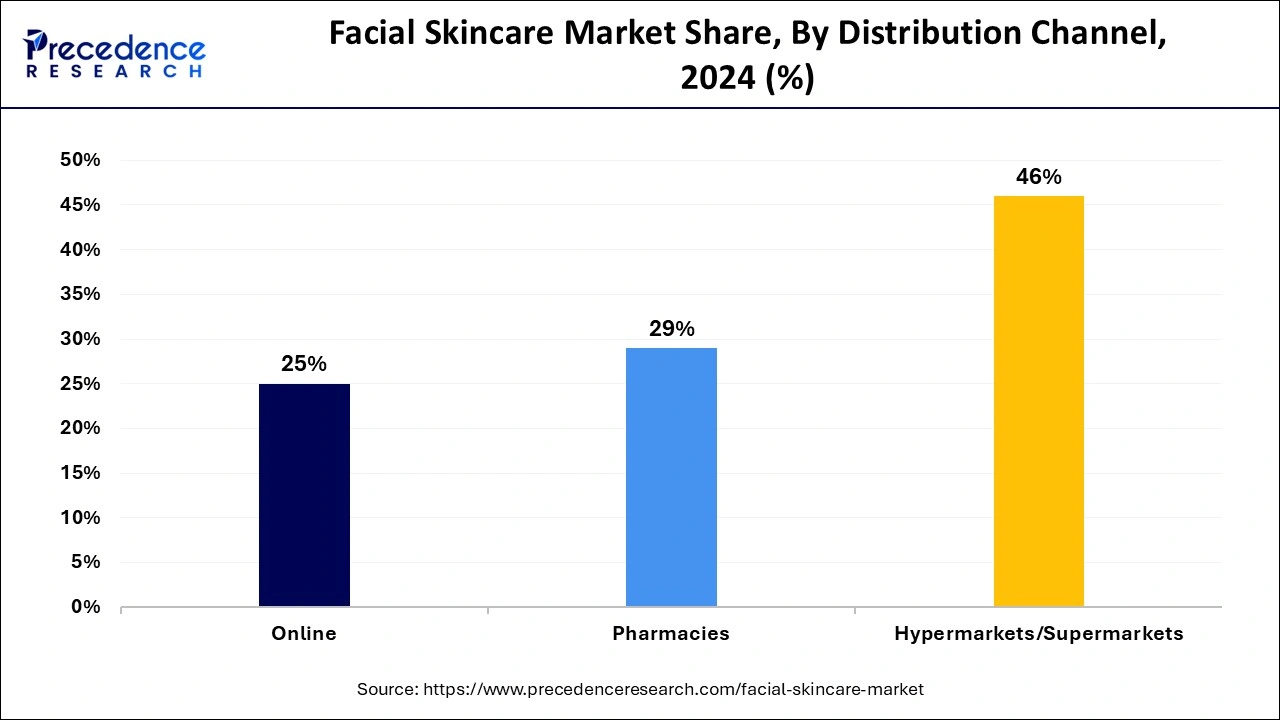

The hypermarkets/supermarket segment held the largest share of the facial skincare market in 2024. Hypermarkets and supermarkets offer a vast array of facial skincare products, including cleansers, moisturizers, serums, and masks, from various brands and price points. This extensive product selection allows consumers to compare options, explore new products, and find skincare solutions that meet their specific needs and preferences.

Hypermarkets and supermarkets often offer competitive pricing on facial skincare products, leveraging their bulk purchasing power and economies of scale to negotiate favorable deals with suppliers. Additionally, these retailers frequently run promotions, discounts, and sales events to attract customers and drive sales volume, making skincare products more affordable and accessible to a wider audience.

By Products

By Gender

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

August 2024

January 2025