August 2024

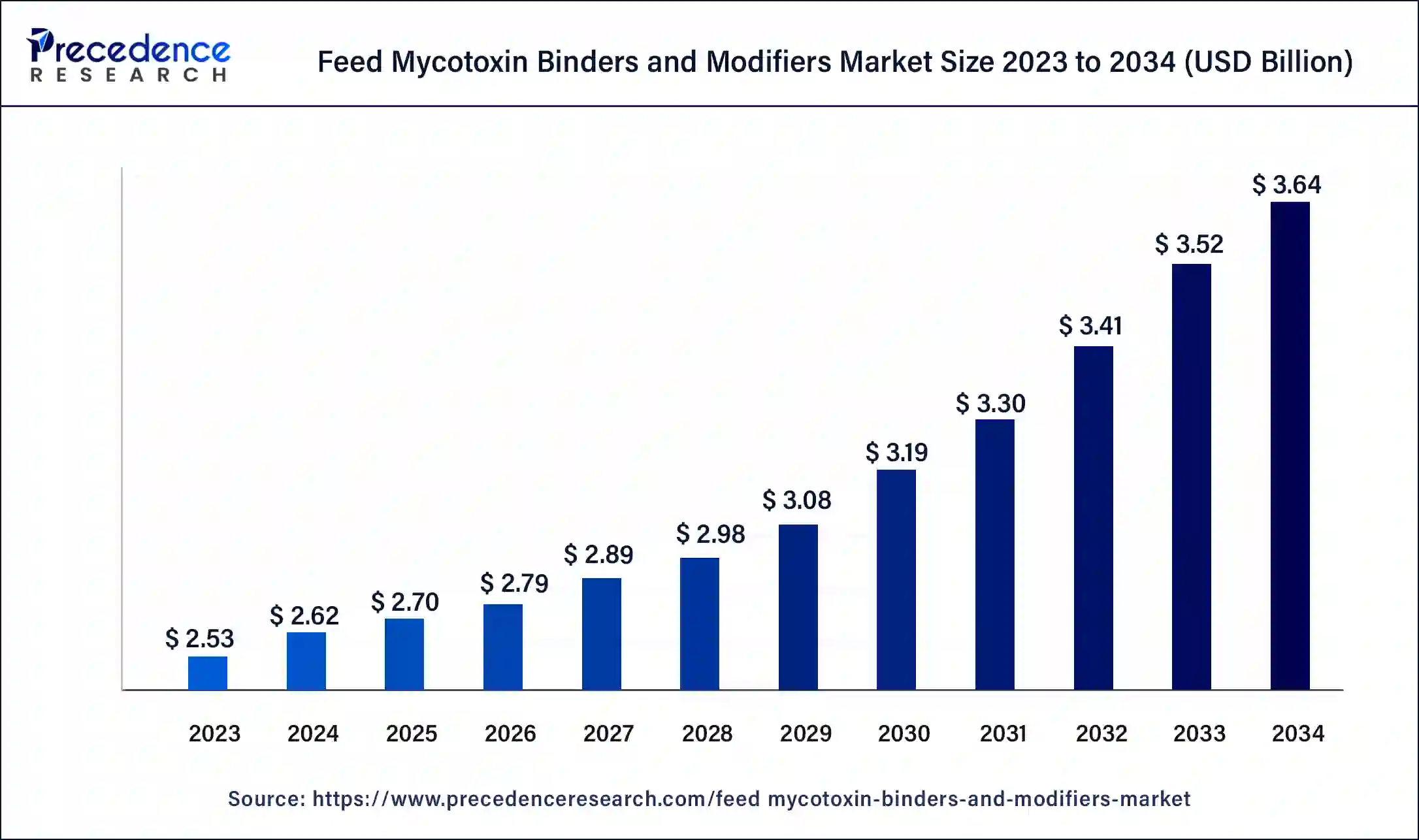

The global feed mycotoxin binders and modifiers market size was USD 2.53 billion in 2023, calculated at USD 2.62 billion in 2024 and is expected to be worth around USD 3.64 billion by 2034. The market is slated to expand at 3.36% CAGR from 2024 to 2034.

The global feed mycotoxin binders and modifiers market size is projected to reach around USD 3.64 billion by 2034 from USD 2.62 billion in 2024, at a CAGR of 2.62% from 2024 to 2034. The feed mycotoxin binders and modifiers market are driven by the mycotoxin contamination in animal feed is becoming more common.

Feed Mycotoxin Binders and Modifiers Market Overview

This market includes goods and services meant to lessen the harmful effects of mycotoxins found in animal feed. Certain fungi create harmful mycotoxins, infecting crops and feed components. Additives called "mycotoxin binders" are mixed into animal feed to absorb mycotoxins and stop them from being absorbed by the animals' digestive systems. Conversely, modifiers change the chemical structure of mycotoxins to make them less harmful.

Mycotoxin contamination can cause decreased animal performance, higher veterinarian expenses, and crop loss, resulting in significant economic losses. By mitigating the effects of mycotoxins, these products support more environmentally friendly farming methods.

What is the role of AI in the Feed Mycotoxin Binders and Modifiers Industry?

Artificial intelligence powered technologies such as predictive modelling and machine learning are being used to understand the occurrence of mycotoxins in livestock and develop feed additives to mitigate their effects. Data about environmental factors such as temperature, soil type, insect activity as well as factors such cultural farming methods are being analyzed to prevent and manage mycotoxin risk. Predictive learning models are also being used to design protocols for detecting fungal infections early and taking timely action if necessary, to prevent their growth and spread. Researchers are training neural networks to detect mycotoxin by looking for certain biomarkers, and to simulate in vitro results of mycotoxin absorption-deabsorption in the gastrointestinal tract.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.64 Billion |

| Market Size in 2023 | USD 2.53 Billion |

| Market Size in 2024 | USD 2.62 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.36% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Source, Form, Livestock, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Improved animal health and productivity

Mycotoxins are harmful secondary metabolites that fungi create that seriously endanger the well-being and production of livestock. If consumed, they contaminate feed and can cause serious health problems, decreased productivity, and financial losses. The market for feed mycotoxin binders and modifiers has grown, propelled by the pressing need to protect animal health and optimize output.

Mycotoxins in animal feed can drastically lower production in several ways. For example, contaminated feed frequently does not appetize, which reduces feed intake and results in slower development rates. Mycotoxin-exposed animals may grow more slowly and gain less weight, affecting their ability to produce meat. This drives the growth of the feed mycotoxin binders and modifiers market.

Consumer demand for safe animal products

Customers are better aware of the dangers of contaminated food, especially mycotoxins. Certain fungi can create harmful mycotoxins, contaminating animal feed and products, including meat, milk, and eggs. Significant dangers to human health exist from mycotoxins, which can have immunosuppressive, neurotoxic, and carcinogenic consequences. Governments and health groups enforce stricter regulations and stricter food safety standards to guarantee that food products are safe to eat. Because of this, farmers have started implementing safeguards against mycotoxin contamination in animal feed.

High costs of products

Mycotoxin binders and modifiers can be costly due to their essential components' rarity or specific handling. Price fluctuations for raw materials may also affect the cost of the finished product. The entire cost is influenced by the intricacy of the manufacturing processes and the requirement for dependable and effective distribution networks. It will cost more to ensure products are provided in the best possible way to preserve efficacy.

Supply chain disruptions

Activated charcoal, clay minerals, and other adsorbents are among the raw ingredients for mycotoxin binders and modifiers. Production may be hampered by shortages of these essential inputs caused by supply chain interruptions. Manufacturers may be forced by inconsistent supply to get raw materials from untrustworthy suppliers, which could jeopardize the end product's effectiveness and quality.

Disruptions in the supply chain can stop or slow down production lines. This impacts the capacity to promptly satisfy consumer needs, which could result in a decline in sales and market share. Even small disturbances might result in significant bottlenecks. A hiccup at just one link in the supply chain can delay the entire production and distribution process. This limits the growth of the feed mycotoxin binders and modifiers market.

Growth in the animal feed industry

Mycotoxins are harmful substances that fungi create. They can contaminate animal feed, endangering animals' health and adversely affecting their development, reproduction, and general productivity. More people are becoming aware of the adverse effects of mycotoxins on animal health and the resulting financial losses, including farmers, veterinarians, and feed makers. Feed additives that can lessen the impact of mycotoxins, like binders and modifiers that can absorb or deactivate these toxins, are in greater demand. The need to protect animal health, increase feed efficiency, and improve livestock production results drives this demand. This opens an opportunity for the growth of the feed mycotoxin binders and modifiers market.

The clay sub segment dominated the feed mycotoxin binders and modifiers market in 2023. Many mycotoxins, including aflatoxins, ochratoxins, and zearalenone, can be effectively bound by clays, particularly those with a high cation exchange capacity and surface area. Their ability to adsorb mycotoxins on their surfaces or within their structures, a process that keeps the toxins from entering the bloodstreams of animals, is what gives them their effectiveness.

These features are both physical and chemical. Because of its versatility and ability to be utilized in various forms, such as powders, granules, and pellets, clays can be used in multiple feed compositions. They offer flexibility in application across different animal husbandry types, such as aquaculture, swine, poultry, and cattle, when utilized in compound feeds and premixes.

The feed mycotoxin modifiers segment to grow at a substantial rate during the forecast period. The detrimental consequences of mycotoxins on cattle, such as decreased feed intake, stunted growth, and increased susceptibility to illnesses, are becoming increasingly well-recognized among farmers and feed producers. Increased use of mycotoxin management techniques, such as feeding mycotoxin modifiers, results from this understanding. Mycotoxin contamination in feed may be identified more quickly and accurately thanks to developments in analytical technologies and mycotoxin detection techniques. These developments aid in creating and applying mycotoxin modifiers that are more effective, therefore bolstering market expansion.

The inorganic segment dominated the feed mycotoxin binders and modifiers market in 2023. Mycotoxins can be effectively adsorbed by inorganic mycotoxin binders, which stop the mycotoxins from entering the bloodstreams of animals. These binders have a great affinity for different kinds of mycotoxins. They are typically made of materials like activated charcoal and clays (such as bentonite and montmorillonite). Their chemical and physical characteristics enable them to bind and attract mycotoxins, counteracting their harmful effects, which accounts for their effectiveness. There is a steady supply chain because the raw materials for inorganic binders, including clays, are widely accessible and plentiful. These goods are a dependable option for the feed business because of their availability, which lowers the risk of supply shortages and price volatility.

The organic segment is observed to be the fastest growing in the feed mycotoxin binders and modifiers market during the forecast period. Many nations have imposed strict laws governing the use of synthetic chemicals in animal feed due to the possible health dangers associated with them. This has led feed makers to look for natural and organic substitutes, which has led to a rise in the use of organic mycotoxin modifiers and binders. These goods frequently meet the requirements for organic certification and are thought to be safer for both people and animals.

The dry segment dominated the feed mycotoxin binders and modifiers market in 2023. According to their liquid equivalents, dry mycotoxin binders and modifiers are simpler to handle and store. They are more practical for distribution and long-term storage because they are less likely to spoil and don't need certain storage conditions like refrigeration. This is especially crucial in areas with erratic weather patterns or inadequate infrastructure for storing energy.

The shelf life of dry items is generally more significant than that of liquid formulations. The decreased risk of microbiological contamination and dry-form chemical breakdown guarantees the product's prolonged effectiveness. The effectiveness of the binders and modifiers depends on this stability, which is necessary to keep feed free of mycotoxin contamination.

The liquid segment shows a significant growth in the feed mycotoxin binders and modifiers market during the forecast period. Unlike their solid equivalents, liquid mycotoxin binders and modifiers have several advantages. They are simpler to measure, handle, and evenly combine into feed, which is crucial for large-scale production. Additionally, the liquid form improves the active components' bioavailability and absorption, which increases how well they bind and neutralize mycotoxins. Liquid formulations can also be effortlessly mixed with other feed additives, such as vitamins, probiotics, and enzymes, to offer an all-inclusive animal nutrition solution.

The poultry segment dominated the feed mycotoxin binders and modifiers market in 2023. Mycotoxins, hazardous substances generated by specific fungi types that can contaminate feed ingredients, are dangerous to poultry species. Poultry exposed to these chemicals may have various health problems, including immune system suppression, slower growth rates, and decreased egg production. Poultry's high susceptibility to mycotoxins makes mycotoxin binders and modifiers necessary to reduce these dangers. Poultry farmers are increasingly likely to utilize mycotoxin binders and modifiers as a prophylactic tool as awareness of the risks associated with mycotoxins grows. This proactive strategy guarantees adherence to food safety rules while preserving the birds' well-being and productivity.

North America had dominated in the feed mycotoxin binders and modifiers market in 2023. North America is renowned for its cutting-edge agricultural techniques, especially in the US and Canada. Examples are large-scale farming operations, complex supply chains, and the broad use of biotechnology. These methods produce large grains and feed that are prone to mycotoxin contamination. The demand for mycotoxin binders and modifiers is driven by the necessity to shield cattle from the detrimental effects of mycotoxins.

The need for domestic and international animal protein drives the North American feed industry. Large amounts of dairy, meat, and other animal products are exported from the area. Using safe and high-quality feed, including mycotoxin binders and modifiers, is a top priority for North American producers to achieve international quality standards and secure market access.

Asia Pacific is observed to be the fastest growing in the feed mycotoxin binders and modifiers market during the forecast period. Farmers and feed manufacturers are becoming more conscious of the negative impacts that mycotoxins have on the well-being and output of their animals. Mycotoxins can cause poor growth rates, decreased feed intake, problems with reproduction, and, in extreme situations, even death.

Regional governments are enforcing more stringent standards and regulations concerning the permissible thresholds of mycotoxins in animal feed. To meet these requirements and stay out of trouble, feed manufacturers have been forced to use mycotoxin binders and modifiers. Mycotoxin contamination can occur in crops that are essential animal feed components, such as corn, wheat, and soy. For this reason, using mycotoxin binders and modifiers is necessary to ensure feed safety.

Segments Covered in the Report

By Type

By Source

By Form

By Livestock

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

January 2025

July 2024