May 2025

Animal Feed Market (By Additives: Antibiotics, Vitamins, Antioxidants, Amino Acid, Feed Enzymes, Feed Acidifiers, Others; By Animal Type: Poultry, Cattle, Swine, Pet, Others; By Mode of Delivery: Premixes, Oral Powder, Oral Solutions; By End User: Feed Manufacturers, Contract Manufacturers, Livestock Producers, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

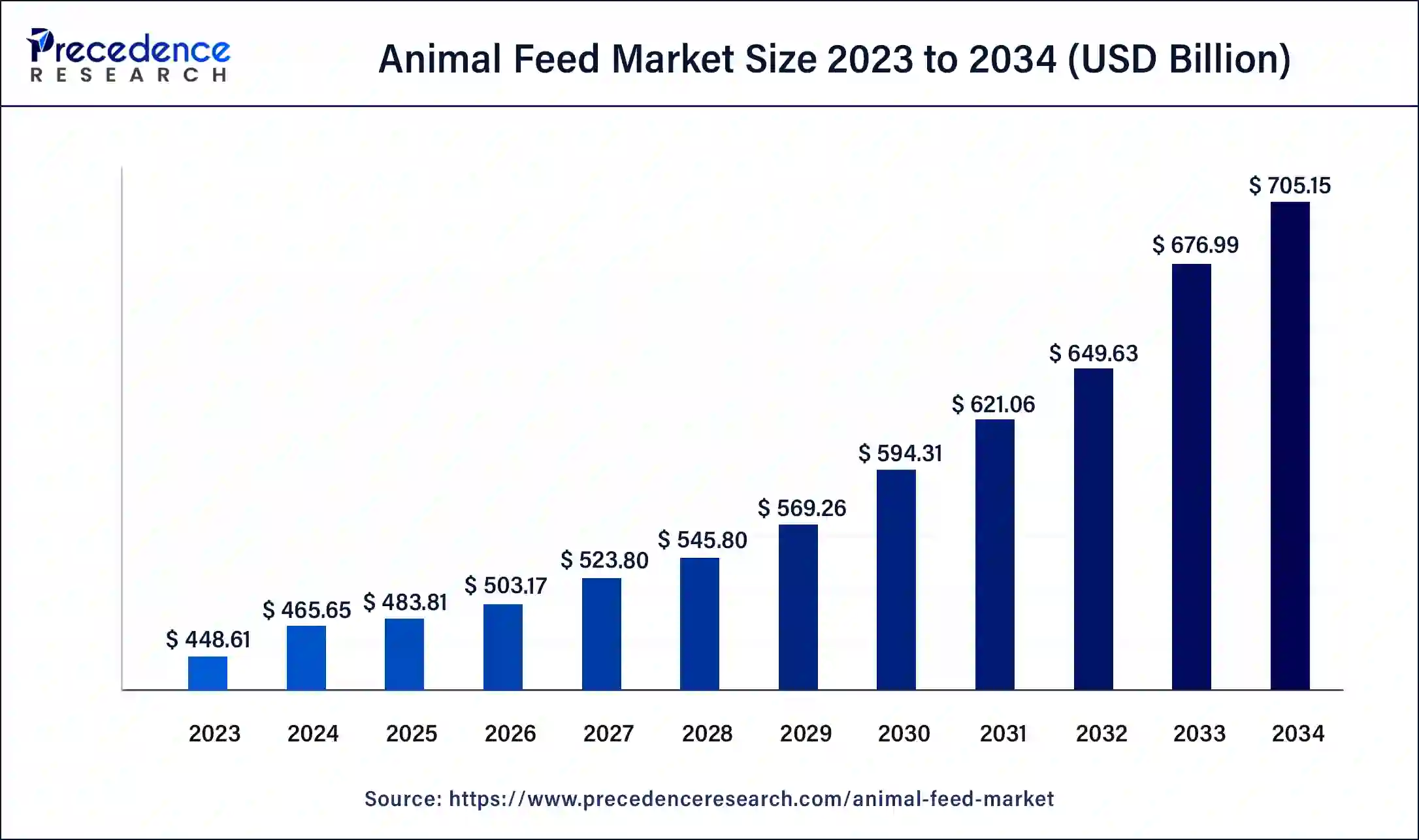

The global animal feed market size was USD 448.61 billion in 2023, calculated at USD 465.65 billion in 2024 and is expected to reach around USD 705.15 billion by 2034, expanding at a CAGR of 4% from 2024 to 2034.

The animal feed market is a global industry responsible for producing and supplying feed and nutritional products for livestock, poultry, and aquaculture. It plays a crucial role in ensuring animal health and optimizing their growth and productivity. Key components in animal feed formulations include grains, protein sources, vitamins, and minerals. Additionally, the animal feed market is evolving with a focus on improving feed efficiency, reducing environmental impact, and ensuring food safety.

Research into ingredients and additives, like probiotics and enzymes, aims to enhance animal nutrition and overall agricultural sustainability. This industry is characterized by constant innovation to meet the challenges of feeding a growing world population. Sustainability and the development of alternative protein sources are emerging trends as the industry seeks more environmentally responsible and efficient feed solutions to meet the growing demands of animal agriculture.

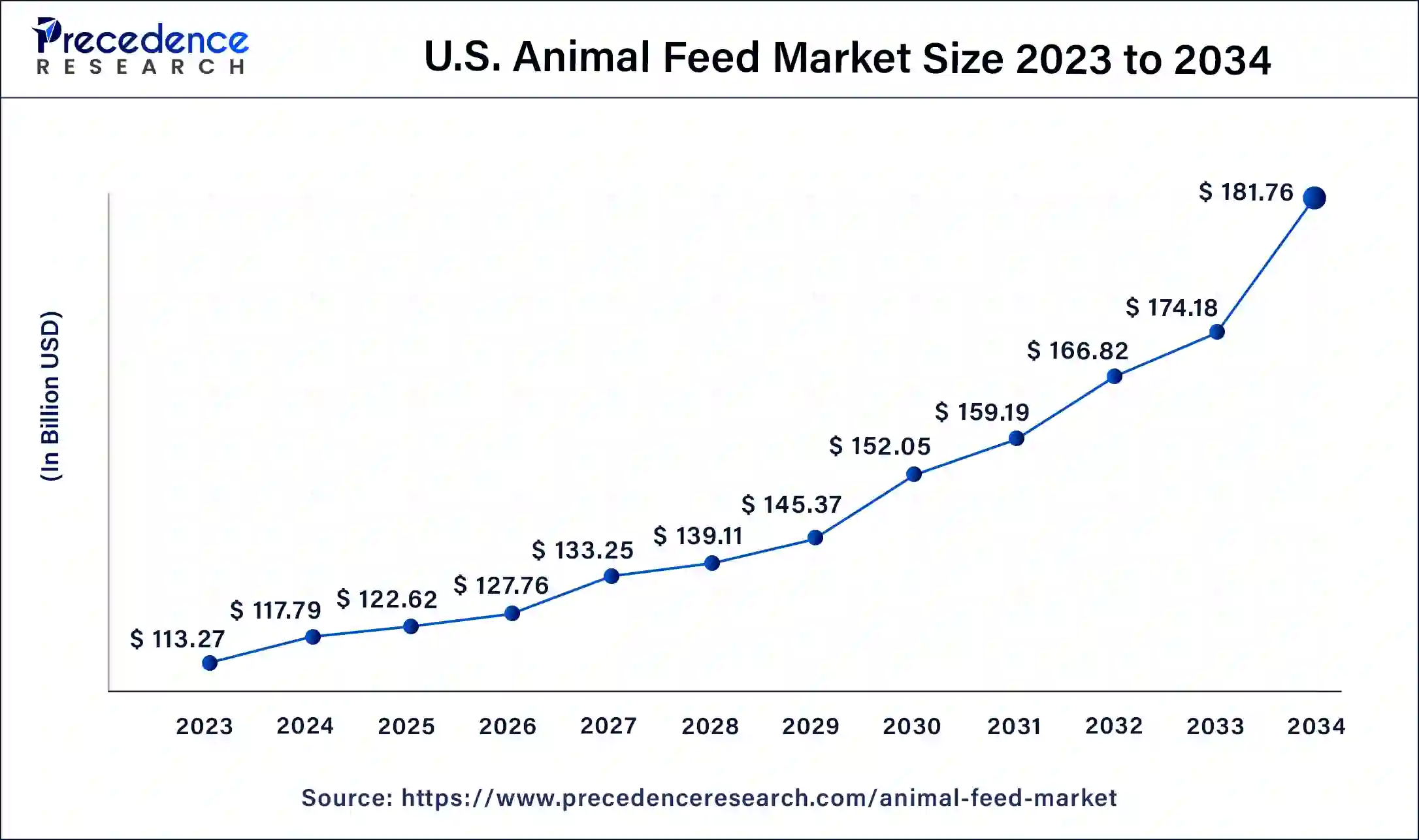

The U.S. animal feed market size reached USD 113.27 billion in 2023 and is predicted to be worth around USD 181.76 billion by 2034, registering a CAGR of 4.40% between 2024 and 2034.

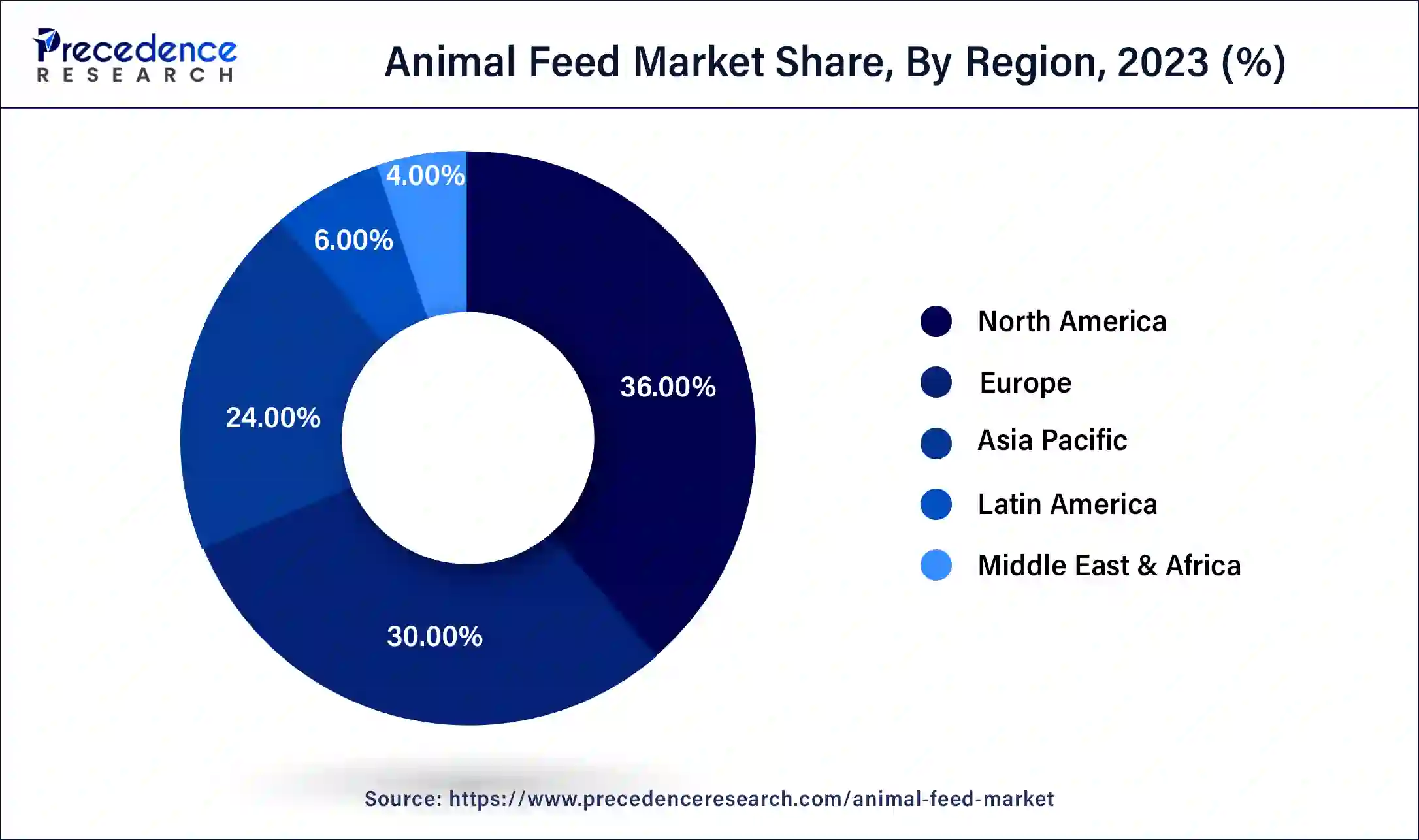

North America has held the largest revenue share of 36% in 2023. In North America, the animal feed market is well-established, driven by the region's large and advanced livestock industry. Key trends include a growing focus on sustainable and eco-friendly feed options, as well as precision feeding technologies to enhance animal nutrition and efficiency. The demand for high-quality animal feed, coupled with stringent food safety regulations, has led to investments in advanced quality control and traceability systems to meet consumer expectations.

Asia-Pacific is estimated to observe the fastest expansion. The animal feed market in the Asia-Pacific region is undergoing remarkable growth, primarily due to a surging demand for meat and dairy products resulting from a growing population and urbanization. A noteworthy trend involves the incorporation of innovative feed ingredients like insect meal and plant-based feeds to align with sustainability objectives. Furthermore, the region places a strong emphasis on disease prevention and management in animal agriculture, driving advancements in feed formulations and quality assurance measures.

The Europe market is characterized by advanced regulations and a strong commitment to sustainability. With a well-established livestock industry, the region focuses on producing high-quality and environmentally responsible feed solutions. Emerging trends include the adoption of alternative protein sources and the use of precision feeding technologies. Europe places a significant emphasis on quality control, traceability, and disease prevention to ensure safe and nutritious animal feeds.

| Report Coverage | Details |

| Market Size by 2034 | USD 705.15 Billion |

| Market Size in 2023 | USD 448.61 Billion |

| Market Size in 2024 | USD 465.65 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Additives, Animal Type, Mode of Delivery, By End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Changing diets and population growth

Changing dietary patterns and rapid population growth are two primary drivers of surging market demand in the animal feed industry. As global populations expand, so does the need for food, particularly protein sources. People in emerging markets are increasingly adopting diets rich in animal-based proteins, contributing to a significant uptick in the demand for meat, dairy, and fish products. This surge, driven by increased income and urbanization, has profound implications for the animal feed market.

Changing diets plays a critical role in this transformation. As more consumers opt for protein-rich diets, the need for efficient and sustainable animal feed solutions becomes paramount. These dietary shifts necessitate innovative feed formulations that optimize animal nutrition and growth, aligning with the broader sustainability goals of the industry. To meet this demand, the animal feed market is evolving, introducing alternative protein sources and exploring eco-friendly feed additives while ensuring the production of high-quality and safe feed for livestock and aquaculture.

Rising ingredient costs and competition for resources

Rising Ingredient Costs is one of the significant restraints on the animal feed market is the volatility in ingredient costs, particularly key components like grains and soy. These ingredients serve as the foundational elements in many feed formulations. These cost fluctuations are influenced by various factors, including weather patterns, global supply and demand, and commodity market conditions. The animal feed industry must navigate these uncertainties, often requiring strategic planning and risk management to maintain profitability.

Moreover, another challenging restraint on the animal feed market is the intensifying competition for vital resources. As the global population grows and dietary preferences evolve, there is increased pressure on resources like arable land and freshwater, which are essential for cultivating feed crops. The competing demands for these resources from other sectors, such as food and biofuel production, can constrain the availability of feed ingredients. This, in turn, can limit the production capacity of animal feed and lead to supply shortages, further elevating ingredient costs. Balancing the resource requirements for both food production and animal agriculture is a complex challenge that the animal feed industry must address to sustainably meet the growing demand for animal-based protein products.

Technology adoption and quality assurance solutions

The integration of advanced technologies such as precision feeding, data analytics, and automation has revolutionized feed production and animal nutrition. Precision feeding ensures that animals receive the right nutrients, improving their health and overall growth while minimizing feed wastage. Data analytics allow for real-time monitoring and adjustment of feeding programs, optimizing efficiency. Automation streamlines production processes, reducing labor costs, and enhancing consistency in feed formulation. These technologies not only boost efficiency but also promote sustainability by reducing resource use.

Moreover, with increasing concerns about food safety and transparency, quality assurance solutions have gained prominence. Consumers and regulatory bodies are demanding stringent quality control and traceability throughout the animal feed supply chain. This has led to the development of advanced testing methods and quality management systems, ensuring the safety and nutritional value of animal feed. Businesses that invest in these solutions gain a competitive edge by meeting and exceeding these expectations, boosting consumer confidence and demand for their products. Quality assurance also contributes to the prevention and mitigation of disease outbreaks, further driving market demand by ensuring animal health and productivity.

According to the Additives, Amino acids held 38% revenue share in 2023. Amino acids, the building blocks of proteins, are vital additives in animal feed. They provide essential nutrients to support animal growth, reproduction, and overall health. In the animal feed market, the trend is shifting towards precision nutrition, where amino acids are used in formulations to meet specific dietary requirements. This not only enhances animal performance but also reduces excess protein in feeds, minimizing environmental impact.

The antibiotics segment is anticipated to expand at a significant CAGR of 7.1% during the projected period. Traditionally, antibiotics have been a common inclusion in animal feed to stimulate growth and prevent diseases. However, a recent industry trend is to reduce antibiotic use due to concerns about antibiotic resistance and consumer preferences for antibiotic-free meat products. This shift has prompted the development of alternative solutions, including probiotics and phytogenics, to support animal health and enhance feed efficiency while minimizing reliance on antibiotics.

Based on the Animal Type, poultry feed is anticipated to hold the largest market share of 42% in 2023. Poultry feed is designed to meet the nutritional needs of chickens, turkeys, ducks, and other poultry species. The poultry feed market is increasing demand for high-protein, antibiotic-free, and genetically modified organism (GMO)-free feeds. Sustainability practices are also gaining importance, leading to innovations in eco-friendly feed production. Additionally, precision feeding techniques and probiotics are being used to optimize poultry health and productivity, aligning with consumers' preferences for healthier and more sustainably produced poultry products.

The pet segment is projected to grow at the fastest rate over the projected period. The pet feed market caters to dogs, cats, and other companion animals. The trend in this market is the premiumization of pet diets, with consumers showing a strong preference for high-quality, specialized, and natural ingredient-based pet feeds. There's a rising demand for grain-free, organic, and functional pet foods, along with a shift toward alternative protein sources such as insect-based or plant-based pet food. This trend underscores the emphasis on health and wellness, as pet owners increasingly consider their pets as integral members of their families and seek nutrition that aligns with human food standards.

The premixes segment had the highest market share of 53.2% in 2023 on the basis of the mode of delivery. In the animal feed market, premixes are blend formulations of vitamins, minerals, amino acids, and other essential nutrients. They are typically incorporated into compound feeds or complete diets. A trend in premixes is the growing demand for customized formulations to meet specific animal health and production goals. This includes precision premixes designed to optimize animal performance while minimizing nutrient waste.

Oral powders are anticipated to expand at the fastest rate over the projected period. Oral powders are a mode of delivery for supplements and medications in animal nutrition. A trend in this sector is the development of oral powder products designed for ease of administration and enhanced bioavailability, ensuring animals receive the necessary nutrients or medications efficiently while maintaining their health and productivity.

Based on the End User, Feed manufacturers is anticipated to hold the largest market share of 35.8% in 2023. Feed manufacturers are entities that produce animal feed products for various livestock and poultry. These manufacturers play a pivotal role in the animal feed market by formulating and producing feeds that meet the nutritional requirements of different animals. In recent trends, feed manufacturers are increasingly focused on the development of sustainable and eco-friendly feeds, including alternative protein sources and precision nutrition, to cater to changing consumer demands and environmental concerns.

On the other hand, the Contract manufacturers segment is projected to grow at the fastest rate over the projected period. Contract manufacturers, in the context of the animal feed market, are companies that produce feed products on behalf of other businesses, such as feed producers or livestock farms. These manufacturers provide a cost-effective solution for companies looking to outsource feed production. An emerging trend in contract manufacturing is the use of advanced technology to enhance production efficiency and meet the demand for custom and specialty feeds, addressing the diverse needs of various end users in the industry.

Segments Covered in the Report

By Additives

By Animal Type

By Mode of Delivery

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

October 2024

August 2024

January 2025