January 2025

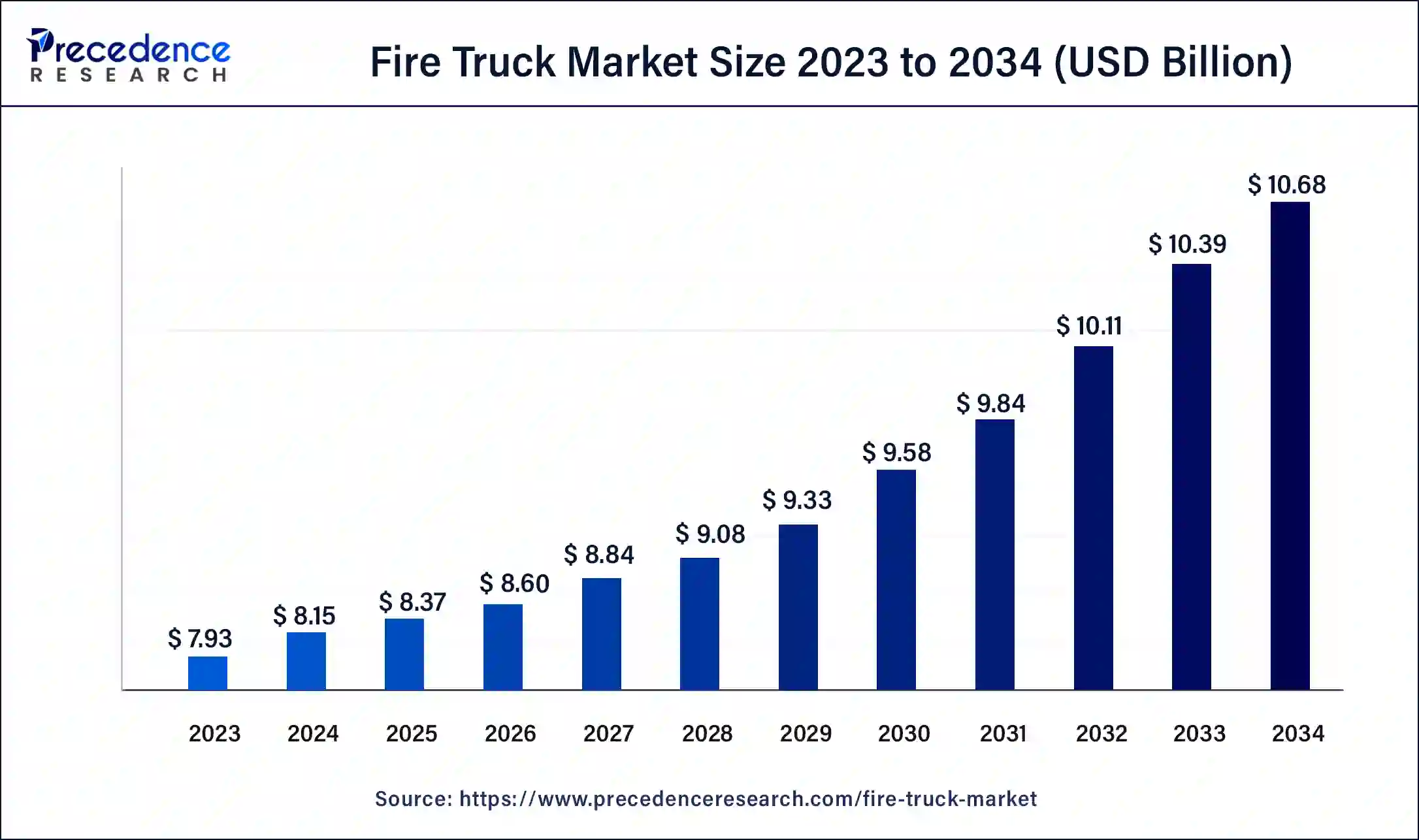

The global fire truck market size surpassed USD 7.93 billion in 2023 and is estimated to increase from USD 8.15 billion in 2024 to approximately USD 10.68 billion by 2034. It is projected to grow at a CAGR of 2.74% from 2024 to 2034.

The global fire truck market size is estimated to be worth around USD 10.68 billion by 2034 from USD 8.15 billion in 2024, at a CAGR of 2.74% from 2024 to 2034. Rapid urbanization and infrastructure development have led to an increased risk of fires, driving demand in the market.

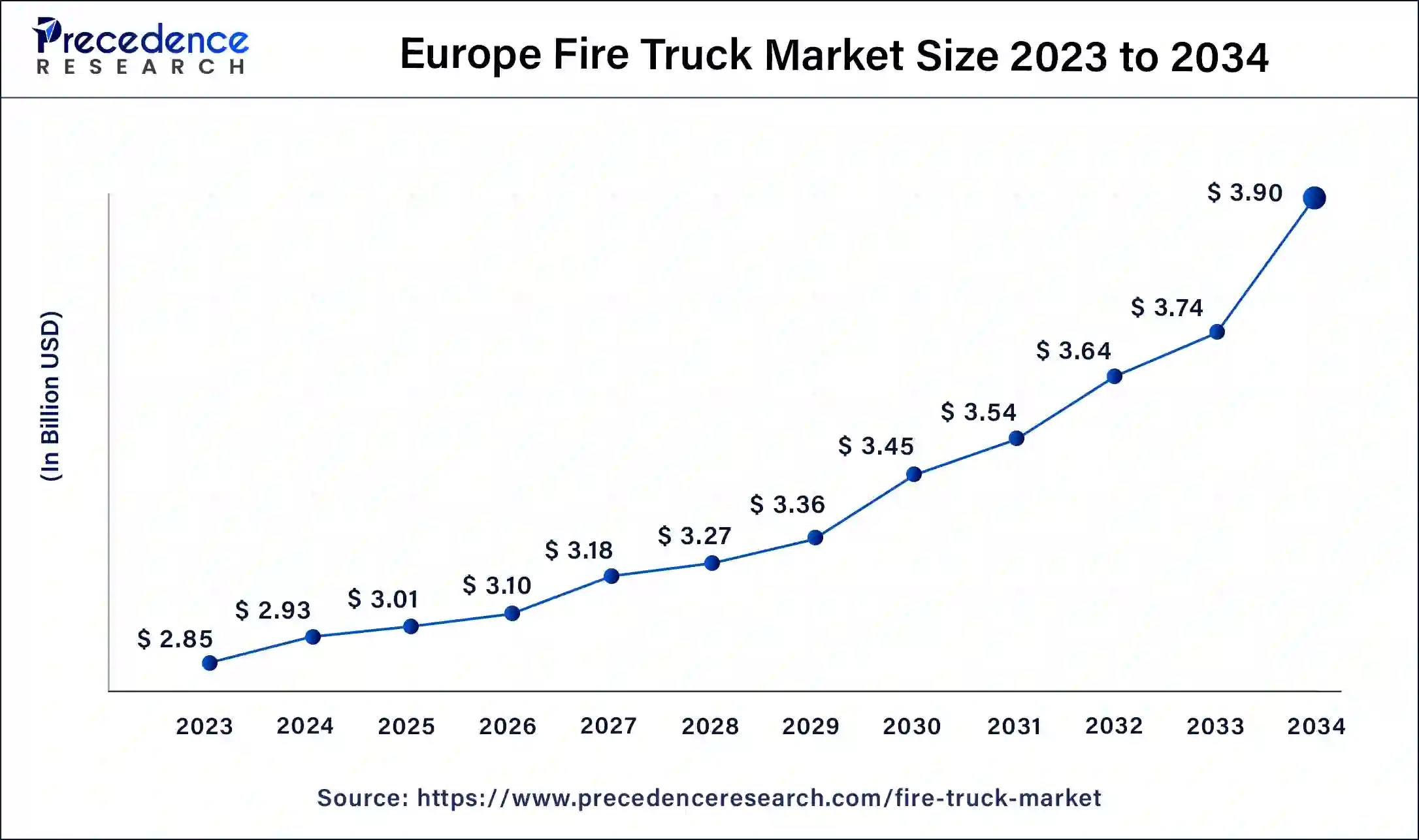

The Europe fire truck market size was exhibited at USD 2.85 billion in 2023 and is projected to be worth around USD 3.90 billion by 2034, poised to grow at a CAGR of 2.89% from 2024 to 2034.

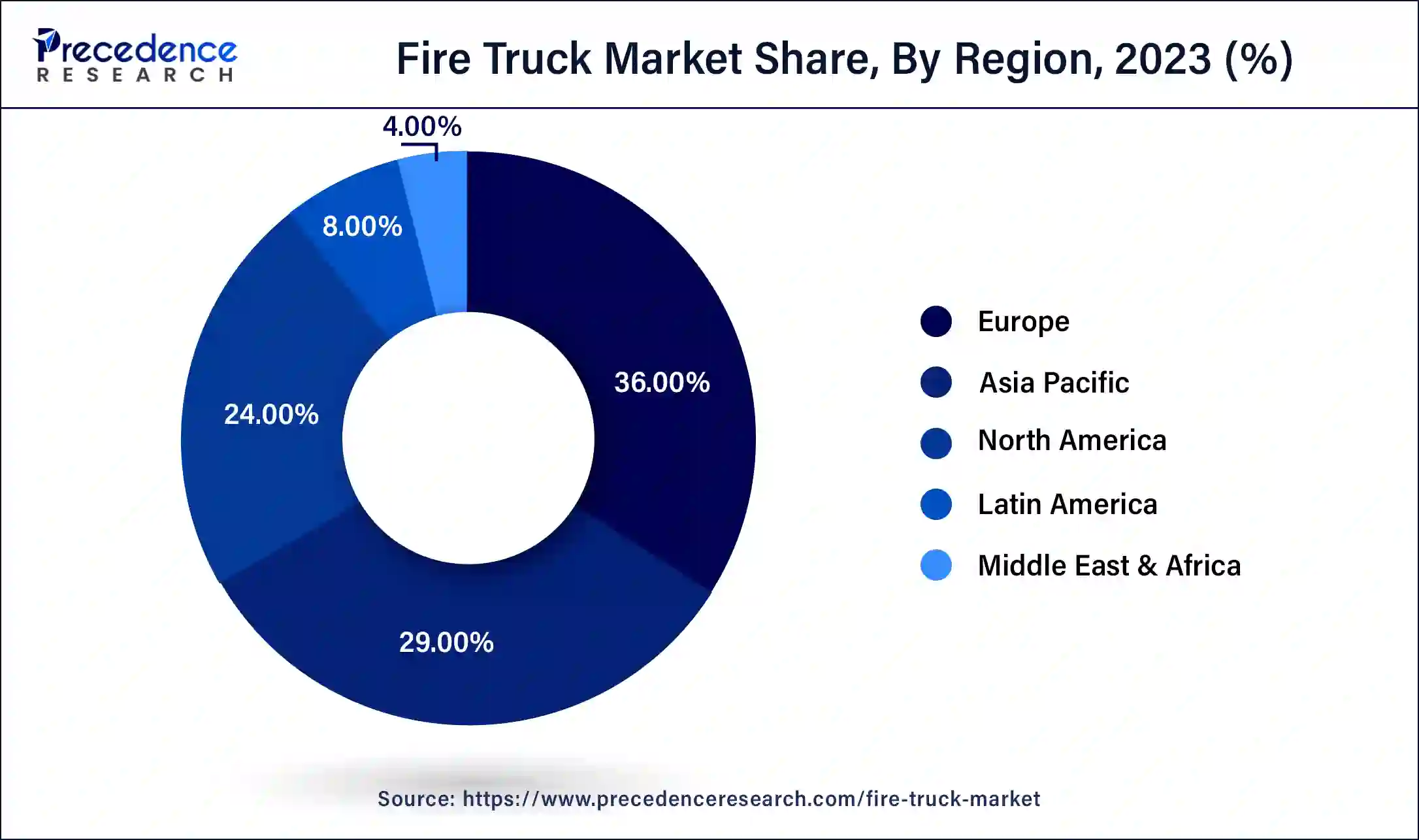

Europe dominated the global fire truck market in 2023. A combination of strict regulations along with significant investment in fire safety infrastructure in the region has boosted demand for fire trucks. Several large players in the market, such as Rosenbauer International AG, Magirus GmbH, and Simon Carmichael International Group Ltd., are also located in Europe.

Asia Pacific is anticipated to grow with the highest CAGR in the fire truck market during the forecast period. There is a growing need for firefighting infrastructure with increasing government investment to improve fire safety in the region. According to data from the World Health Organization, over 95% of fatal fire-related burns occur in low and middle-income countries. The highest mortality rates occur among children under five years and elders aged 70 years and above. Burn injury risks are higher in urban areas, especially in slum settlements.

Fire trucks or fire engines are vehicles designed or modified to assist in firefighting. These vehicles carry firefighters and equipment such as water, hoses, fire retardant foam, extinguishers, breathing apparatus, ladders, and hydraulic rescue tools (also called the Jaws of Life). Fire trucks are also equipped with sirens, emergency lights, and communications equipment to aid firefighting. There are different types of fire trucks designed to work in specific environments and different equipment configurations; for example, wildland fire engines are used to tend to wildfires, while airport crash tenders are used to deal with aerodrome fires.

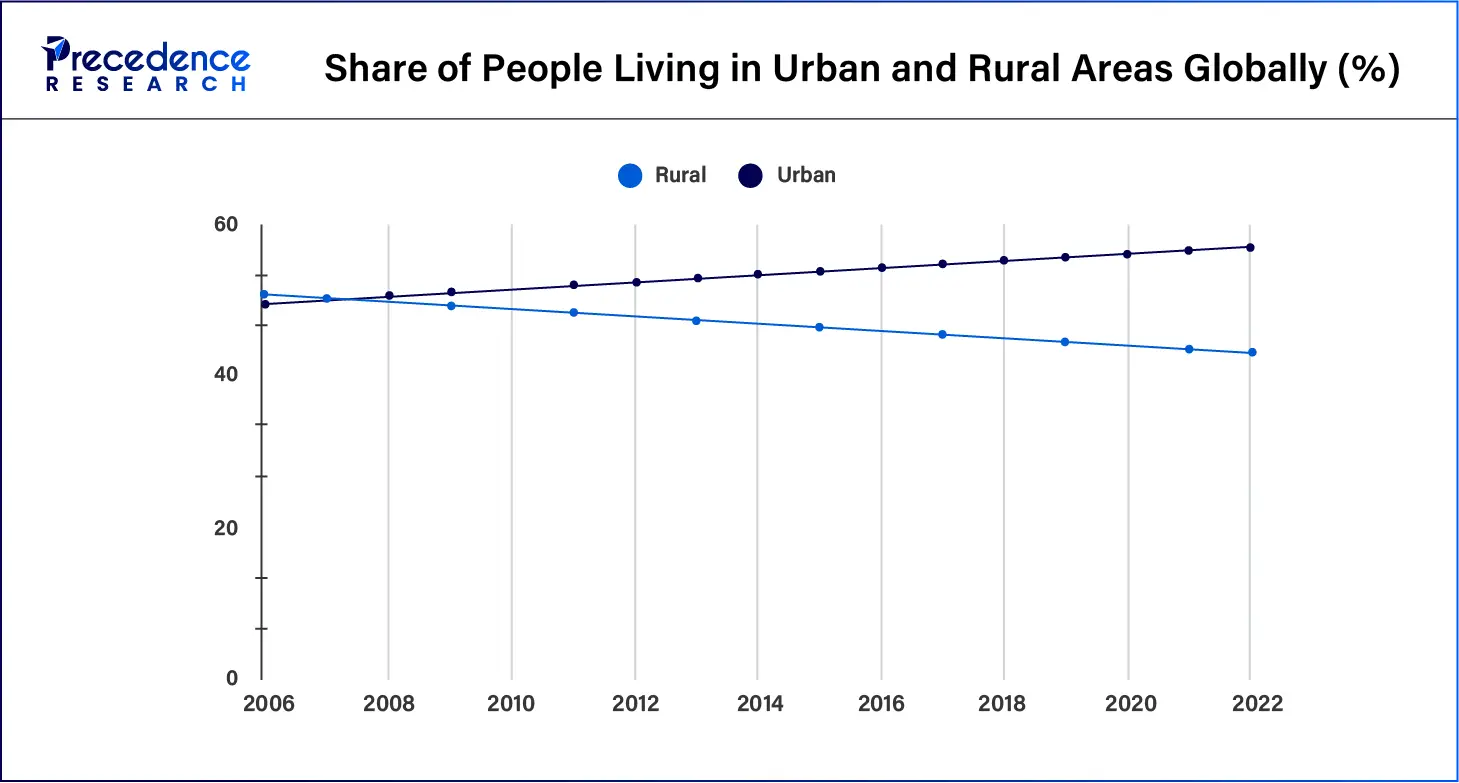

Increasing investment in infrastructure and urbanization in emerging economies is driving demand for fire trucks to deal with the growing instances of urban fires. Established economies currently have several fire trucks in operation to cater to their existing urban environments, which need maintenance and replacement, leading to a steady demand in the fire truck market in these countries. However, the high cost of investment involved in acquiring these specialized vehicles is a significant barrier to growth in the market. A rising focus on sustainability and technological advancements in vehicle design are opportunities for growth in the sector.

How Artificial Intelligence is Transforming the Fire Truck Market

Artificial intelligence is making waves in many sectors related to firefighting, including wildfire management and fire safety. Several AI-based innovations, such as the remote-controlled aerial firefighting robot and AI-powered advanced thermal and visual imaging devices, are already being adopted for firefighting. In 2018, the United States Department of Homeland Security funded a project developed by NASA’s Jet Propulsion Laboratory to design software to make firefighting even more efficient.

The Assistant for Understanding Data through Reasoning, Extraction, and sYnthesis, called AUDREY for short, is an AI-based software application designed to learn from video and sensor data and provide situational awareness to firefighters. A series of test burns were conducted to provide AUDREY with data on flashover, fire growth, and flow patterns to teach the program about fire behavior and precautions firefighters take in each situation. Researchers working on the project expect to see AUDREY on fire trucks soon and even integrate it with the internet of things equipment for first responders' use.

| Report Coverage | Details |

| Market Size by 2034 | USD 10.68 Billion |

| Market Size in 2023 | USD 7.93 Billion |

| Market Size in 2024 | USD 8.15 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 2.74% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Engine Type, Capacity, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Congested infrastructure in urban areas of emerging economies

The rapid population growth and economic development of regions such as Asia Pacific have led to widespread urbanization and the undertaking of numerous planned and unplanned infrastructure developments. Unregulated construction in high-density developments increases the safety hazards and severity of natural and man-made disasters. High population density and urbanization lead to the creation of slums and other congested housing areas, which are correlated with increased frequencies of fire. According to a 2014 research paper in Landscape and Urban Planning, fire frequency is positively correlated with the amount of urban land. The highest rates of fire activity are in relatively urbanized areas with little un-vegetated land. Such high-density urban areas give rise to fire hotspots with higher frequencies of fire.

According to a 2020 article in the International Journal of Geo-Information, in urban areas, the most intensifying and persistent fire hot spots are found in the central districts, which have limited urban expansion but high population densities. Suburban districts with rapid population growth and urban expansion in recent years tend to develop new hot spots for fires. These rising frequencies of fires in urban settings necessitate the growing presence of firefighting personnel and fire stations and are driving demand in the fire truck market.

The high cost of fire trucks

There is a high initial investment necessary to set up fire stations and purchase the required trucks. The price of trucks depends on their size, condition, age, and equipment included. Fire trucks usually include specialized equipment such as ladders and other aerial devices. These large vehicles also have a spacious chassis for storing medical and firefighting equipment, safety glass windshields, and powerful, superior-quality pumps to provide enough water pressure to reach high places. These attributes make fire trucks expensive.

According to Fenton Fire, the cost of fire trucks varies between USD 15,000 to over USD 1 million. In 2024, a new fire truck can cost as much as USD 2 million. These high prices are prohibitive for developing economies, putting a strain on fire safety budgets. These trucks can also need regular repair and maintenance as they are routinely involved in dangerous situations. The necessary significant investment is challenging growth in the fire truck market.

Environmentally friendly alternate fuel options for fire trucks

Fire trucks in established economies such as the United States are increasingly being powered by compressed natural gas rather than diesel fuel or gasoline for longer range and reduced emissions. In recent decades, some fire engines have switched to hybrid or electric power options. According to some manufacturers, these are better suited for certain environments, such as resorts and manufacturing facilities. Alternative fuel options include diesel hybrids, CNG hybrids, and fuel cell hybrids. Electric motor options tend to be cleaner and greener alternatives to gasoline and diesel fuel fire trucks. The growing use of hybrid electric-fuel options and the shift towards sustainability is a major opportunity for players in the fire truck market.

| Fuel | Upper Explosive Limit (%) | Auto ignition | Special Hazards | Specific Gravity |

| Ethanol | 19.0 | 700°F | Light flame/little smoke breaks down the foam | >15% gas blends mix with water |

| Gasoline | 8.0 | 500°F | Wants to change from liquid to explosive gas | <15% blends float on water |

| Diesel | 8.0 | 400°F | - | Floats on water |

| Biodiesel | 6.5 | 800°F | Slightly less hazardous than diesel fuel | Floats on water |

| CNG | 15.0 | 1200°F | High pressure, light flame/little smoke, breaks down foam | Lighter than air |

| LPG | 10.0 | 1000°F | Light flame/little smoke, break down foam | Heavier than air |

| LNG | 15.0 | 1200°F | Cryogenic, light flame/little smoke | Initially heavier, it turns to vapor lighter than air |

| Hydrogen | 75.0 | 1000°F | Cryogenic or high-pressure, invisible flame | Lighter than air |

The engine pumper truck segment held a dominant presence in the fire truck market in 2023. Engine pumper trucks are commonly used in residential, commercial, and military applications. These trucks use water, the most common firefighting extinguisher. The United States National Fire Protection Association defines a pumper truck as a fire apparatus with a permanently mounted fire pump of at least 750 gpm (3000 L/min) capacity, water tank, and hose body whose primary purpose is to combat structural and associated fires. These pumper trucks come in several sizes and configurations depending on their intended environment of use, such as mini pumper fire apparatus, rescue pumper, heavy-duty rescue pumper, high-flow industrial pumper, ultra high-rise pumper, etc.

The aerial truck segment is projected to expand rapidly in the fire truck market in the coming years. An aerial fire apparatus is equipped with an aerial ladder, elevating platform, or water tower. An aerial fire apparatus may also include a fire or foam proportioning system, as well as a smaller water tank and hose setup. According to the United States National Fire Protection Association, a truck must include a minimum of 40 ft.(3) enclosed weather-resistant compartmentation and a minimum of 115’ of ground ladders. These aerial trucks are commonly used in urban settings with numerous skyscrapers to access higher locations.

The ICE segment dominated the fire truck market globally in 2023. ICE or internal combustion engines are the most popular engine types used globally. Internal combustion engines, as the name suggests, ignite and combust fuel such as petrol or diesel to generate power to move the vehicle. The range and efficiency of these engines have been long established, leading to their continued domination in the automobile technology sector for several decades. This extends to emergency vehicles such as fire trucks as well.

The electric segment is predicted to witness significant growth in the fire truck market over the forecast period. As federal agencies become more environmentally conscious, the adoption of storage battery-operated electric or hybrid fire engines continues to grow. Government agencies continue to incentivize the use of hybrid through monetary grants.

The <500 Gallon segment accounted for a considerable share of the fire truck market in 2023. This tanker fire truck is one of the smallest available sizes in commercial fire engines, making it cost-effective for smaller fire departments. These tankers are compact and lightweight, giving them superior maneuverability in congested urban settings with narrow streets and tight turns. <500 Gallon tanker fire trucks also fill up quickly, helping firefighters mobilize quickly.

The >2000 Gallon segment is projected to expand rapidly in the fire truck market in the coming years. Fire departments in the United States are increasingly using tankers with a capacity of 3,000 gallons or higher to dispatch fewer vehicles and firefighters and optimize resource management. Higher-capacity tankers do not require frequent refilling, allowing for sustained firefighting in larger fire disasters.

The residential & commercial segment led the global fire truck market in 2023. As the global urban population rises, the demand for firefighting in residential and commercial settings grows significantly. High-density residential and commercial areas where city infrastructure systems are under strain are at a high risk of fire-related disasters. As a result, the high frequency of fires in residential and commercial settlements necessitates robust firefighting infrastructure and equipment such as fire trucks.

The industrial segment is predicted to witness significant growth in the fire truck market over the forecast period. Industrial development has ushered economic growth in countries like China, South Korea, Taiwan, and Indonesia in the last half-century. Along with this comes industrial infrastructure, including factories, chemical plants, manufacturing plants, refineries, power plants, and the corresponding fire hazards.

Many industries deal in the handling and manufacturing of flammable and hazardous materials, leading to industrial fires that have the potential to quickly get out of control. While many industries impose strict fire safety regulations, some manufacturing units, especially in low-income economies, lack proper equipment and protocols to deal with fire disasters. Fire extinguishers or other firefighting equipment are usually absent in such factories.

Segments Covered in the Report

By Type

By Engine Type

By Capacity

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

February 2025