February 2025

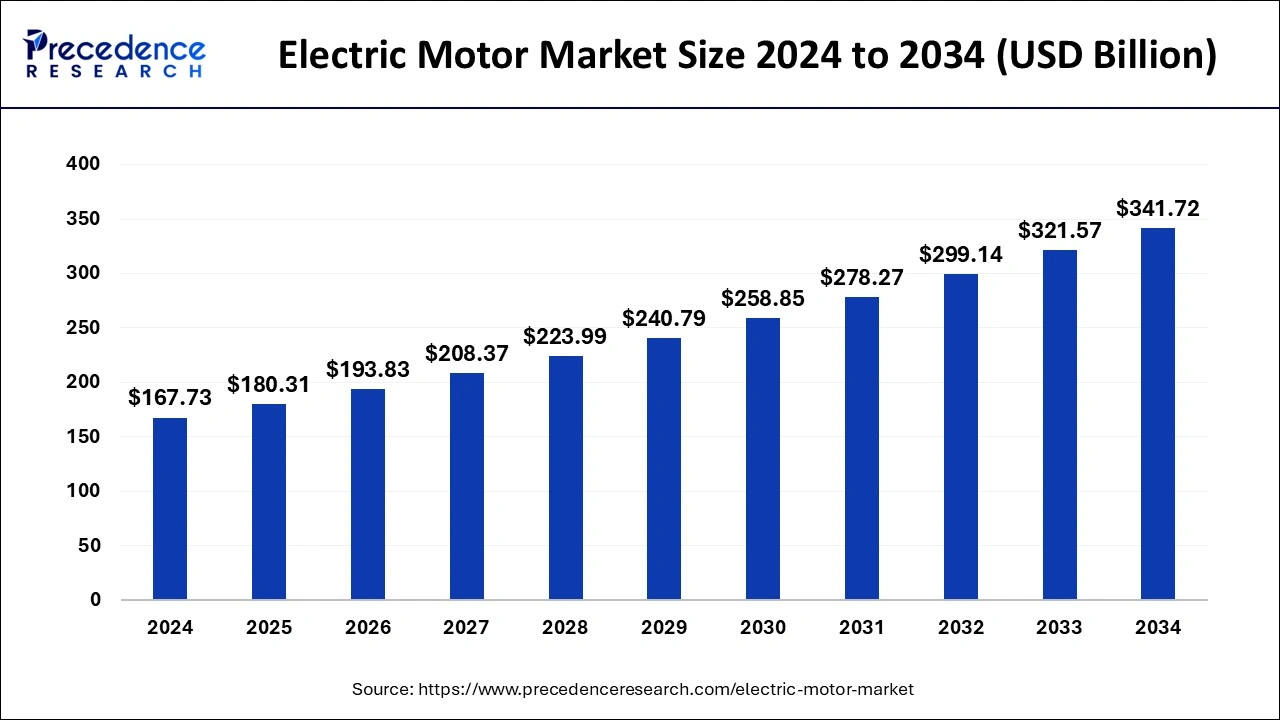

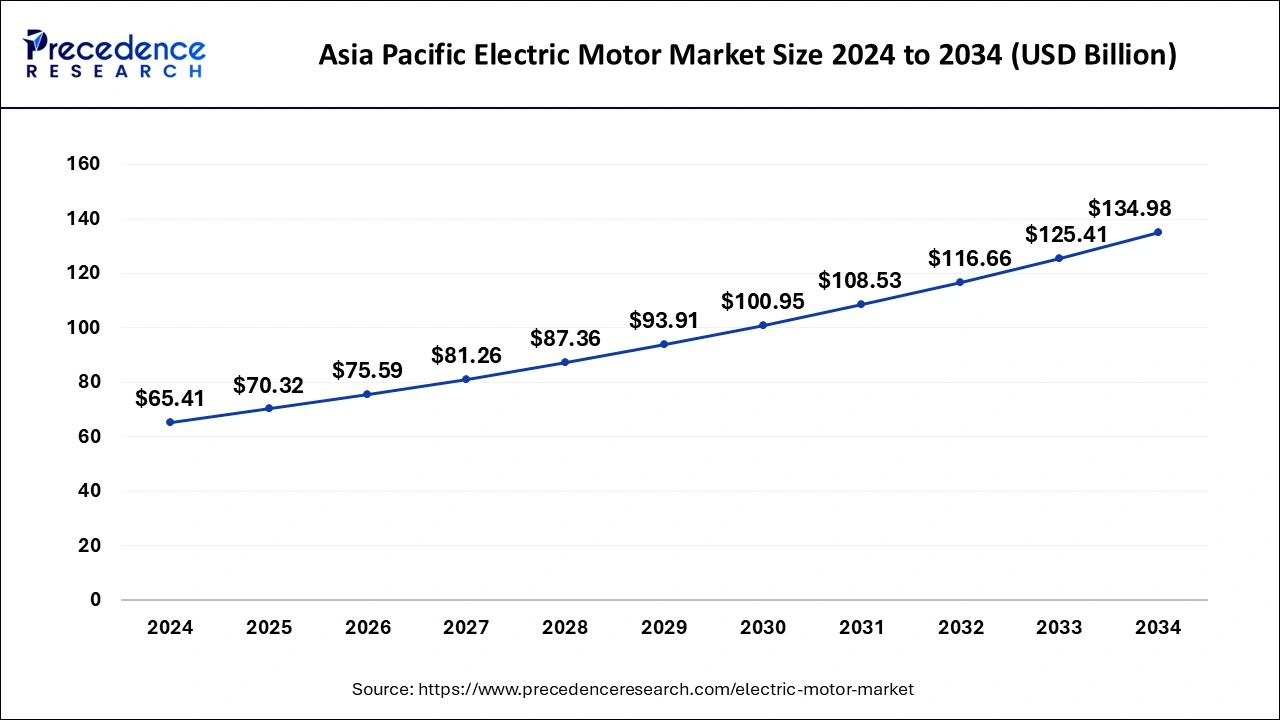

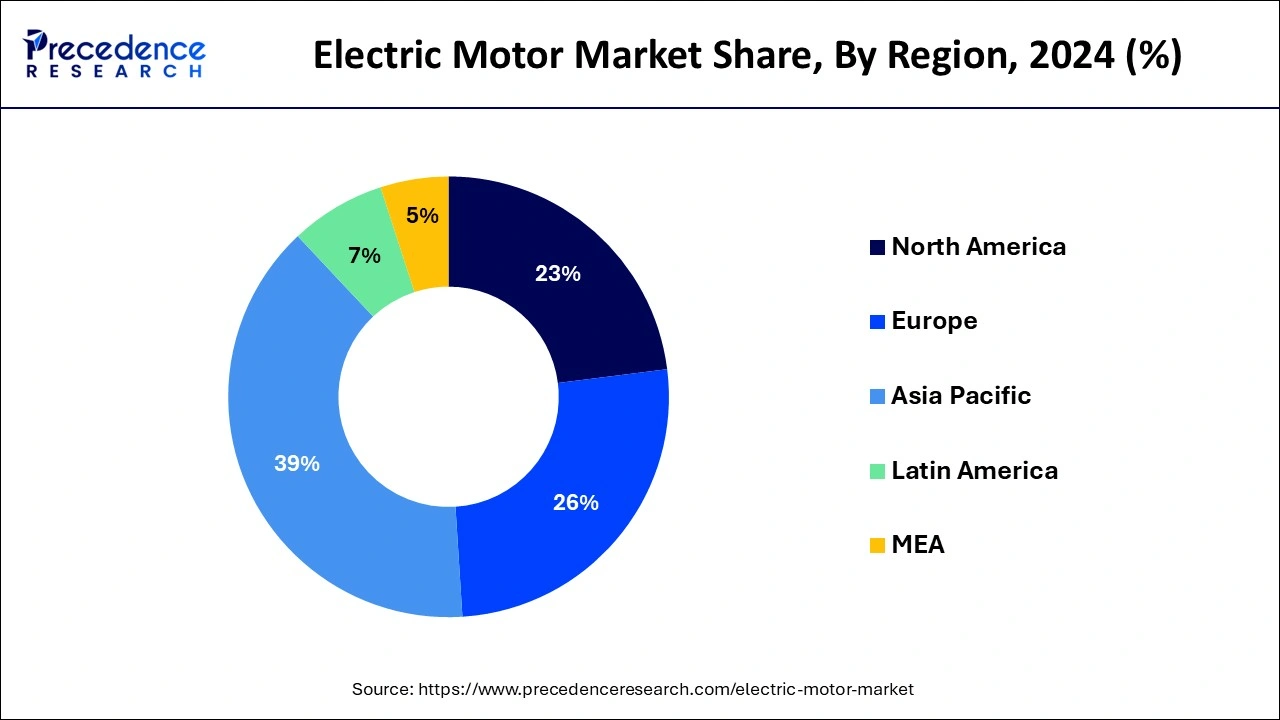

The global electric motor market size is calculated at USD 180.31 billion in 2025 and is forecasted to reach around USD 341.72 billion by 2034, accelerating at a CAGR of 7.38% from 2025 to 2034. The Asia Pacific market size surpassed USD 65.41 billion in 2024 and is expanding at a CAGR of 7.51% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global electric motor market size is recorded at USD 167.73 billion in 2024 and is expected to exceed around USD 341.72 billion by 2034, growing at a CAGR of 7.38% from 2025 to 2034.

The Asia Pacific electric motor market size was valued at USD 65.41 billion in 2024 and is projected to be worth around USD 134.98 billion by 2034, growing at a CAGR of 7.51% from 2025 to 2034.

The Asia Pacific is predicted to be the biggest electric motor market during the forecast period. The Asia Pacific encompasses China, India, Japan, South Korea, and the Rest of Asia Pacific. With the rapid industrialization, the countries in the Asia Pacific are progressing toward internet-based industrial operations in each sector. According to the GSM Association, the developed countries in the Asia Pacific, such as South Korea, and Japan are rapidly discovering the potential of innovative services and connected devices. The automotive sector in the region is also flourishing. The Asia Pacific is the largest manufacturer of automobiles in the world. These factors are expected to contribute to the market's expansion in the Asia Pacific region.

On the other hand, Europe is anticipated to grow exponentially in the coming years due to an enlarged focus on renewable energy and green energy targets. Furthermore, the region's principal focus has shifted to the deployment of electric motors for agricultural and industrial operations, which would aid the market's demand growth in the region.

Heating, ventilation, and air conditioning systems give thermal comfort and assure air quality in indoor spaces. They are one of the main building blocks of modern infrastructures, particularly for massive office buildings or shopping malls. The demand for HVAC systems is constantly growing in the Asia Pacific region, primarily in China and India, due to continuous expansion in their industrial and commercial sectors. In addition, HVAC systems are connected with construction industry owing to fuel the global market in the coming decade.

The expanding number of partnerships or collaborations among the numerous entities participating in this industry reflects the growing interest in vector manufacturing. The goals of these collaborations varied depending on the purpose. Collaborations have been formed for a variety of reasons, including the manufacture of vector promoters, the establishment or acquisition of manufacturing facilities, and the out / in licensing of vector manufacturing technology.

| Report Coverage | Details |

| Market Size in 2025 | USD 180.31 Billion |

| Market Size By 2034 | USD 341.72 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 7.38% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segment Covered | Type, Output Power, Rotor Type, and End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The AC electric motors segment is estimated to carry for the most prominent share due to its advantages over DC motors because it requires less maintenance and has longer life cycle than DC motors.

Also, AC motors are typically thought to be more powerful than DC motors because they will create more torque with a better current which is increasing its demand for various applications.

The above 1 hp motors segment is predicted to dominate the electric motor market from 2024 to 2033. Electric motors are utilized in various user applications due to their compactness, lightweight, and low maintenance requirements. Electrical motor installation in industrial and transportation user applications is expected to rise rapidly.

From 2025 to 2034, the inner rotor segment is expected to grow at a higher pace. Inner rotor motors have rotors in the middle that are encircled by stator winding. These motors are used in robotics, CNC machines, automatic door openers, and metal cutting and forming machine applications in the manufacturing, automotive, and consumer electronics industries. These applications require motors that will perform fast acceleration and deceleration of speed, offer high starting torque, have reversible action capability, and are compact. Consistent with the IEA, EV Outlook 2020, the worldwide sales of electrical cars reached 2 million in 2019, 40% above in 2018. This means the increased demand for electric vehicles and their accelerated manufacturing in coming years, which successively, is predicted to fuel the demand for inner rotor electric motors.

The industrial segment is predicted to steer the electrical motor market from 2025 to 2034. This sector provides good scope for motor manufacturers, as most industries depend upon motorized automation. Electric motors are used in pumps, boilers, compressors, and other applications in the utilities, oil & gas, cement & manufacturing, metal and mining, oil & gas, renewables, petrochemicals & chemicals, water & wastewater, and paper & pulp industries, among others.

Key Companies & Market Share Insights

ABB Group and General Electric have had strong presence in the market with their wide range of products available for different end-user segments. These companies are well geared up with required products for various applications, having an advanced stator rotor, and copper rotor technology, which enhances motor performance, efficiency, and reliability. In addition, they are presiding in various sectors such as battery manufacturing and renewable energy among others, those benefits in grabbing investment opportunities from several customers.

The other companies in the market contain Nidec Motor Corporation, WEG, Toshiba Corporation and Hitachi among others. These companies target on developing their product portfolio and customer reach by getting contracts and investments in research and development (R&D).

By Type

By Output Power

By Rotor Type

By End-User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

May 2025

March 2024

May 2025