October 2024

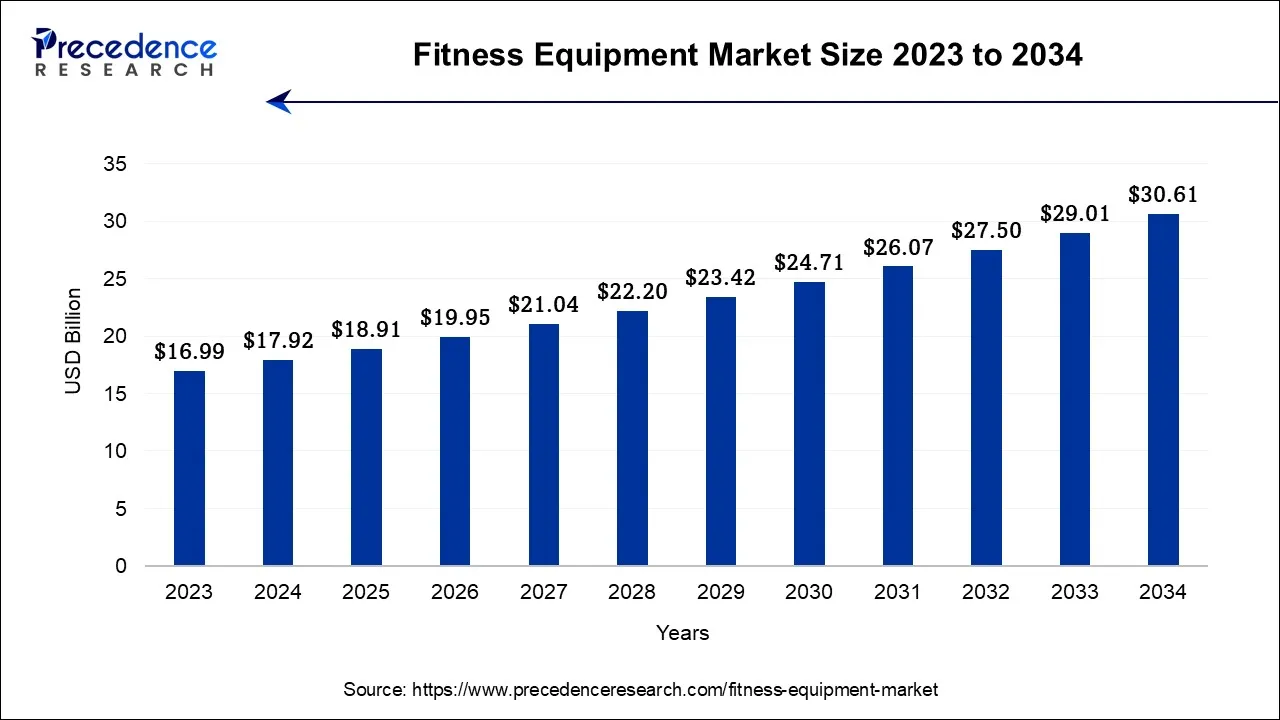

The global fitness equipment market size is calculated at USD 17.92 billion in 2024, grew to USD 18.91 billion in 2025, and is predicted to hit around USD 30.61 billion by 2034, poised to grow at a CAGR of 5.5% between 2024 and 2034. The North America fitness equipment market size accounted for USD 13.88 billion in 2024 and is anticipated to grow at the fastest CAGR of 6.97% during the forecast year.

The global fitness equipment market size is expected to be valued at USD 17.92 billion in 2024 and is anticipated to reach around USD 30.61 billion by 2034, expanding at a CAGR of 5.5% over the forecast period from 2024 to 2034.

The U.S. fitness equipment market size is accounted for USD 4.14 billion in 2024 and is projected to be worth around USD 7.23 billion by 2034, poised to grow at a CAGR of 5.73% from 2024 to 2034.

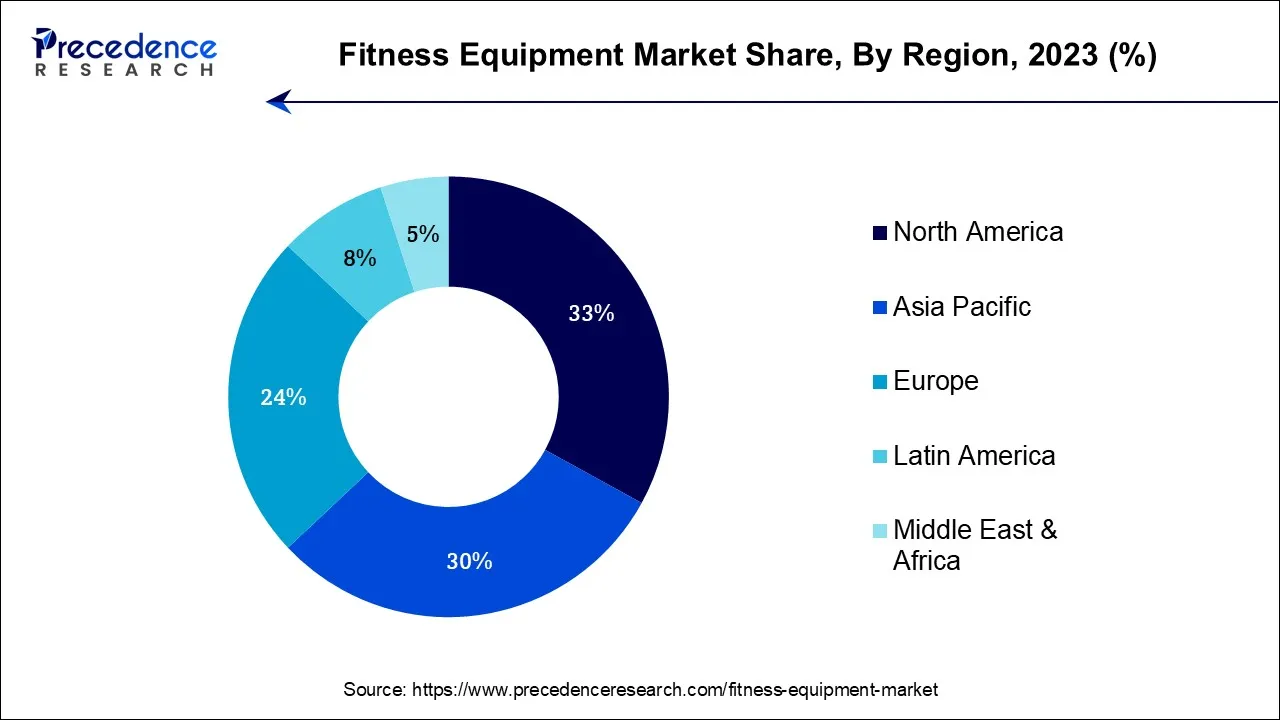

North America has held the largest revenue share of 39% in 2023. In North America, the fitness equipment market is witnessing several notable trends. There's a growing emphasis on connected fitness equipment, with consumers demanding integrated technology for tracking workouts and accessing virtual fitness content. The pandemic has accelerated the popularity of home fitness solutions, driving sales of residential fitness equipment. Additionally, sustainability is gaining importance, with eco-friendly and energy-efficient equipment options becoming more prevalent. These trends reflect evolving consumer preferences and a continued focus on health and wellness in the region.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, the fitness equipment market is experiencing robust growth due to rising health awareness and increasing disposable incomes. There is a growing preference for home fitness solutions, driving demand for innovative and space-efficient equipment. Moreover, urbanization, changing lifestyles, and a focus on preventive healthcare are contributing to the fitness equipment market's expansion in the Asia-Pacific region, making it a dynamic and competitive market landscape.

The fitness equipment market encompasses the production and sale of various exercise machines and accessories for individuals and fitness facilities. It is a dynamic and growing sector driven by increasing health awareness. Key trends include a shift towards smart and connected equipment, integrating fitness technology such as wearables and apps. Additionally, eco-friendly and sustainable equipment is gaining popularity. The market also sees a surge in home fitness equipment purchases, driven by the rise of remote and home-based workouts, a trend accelerated by the COVID-19 pandemic.

| Report Coverage | Details |

| Market Size in 2024 | USD 17.92 Billion |

| Market Size by 2034 | USD 30.61 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.5% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By End Users, and By Price Point |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Health and wellness trends have surged market demand for fitness equipment by fostering a culture of proactive self-care. Consumers prioritize their physical and mental well-being, and they increasingly seek fitness solutions to meet their lifestyle goals. Surge in consumers investing in fitness equipment for home use, enabling them to exercise conveniently and consistently.

Moreover, the desire for a holistic approach to wellness, which includes regular exercise, has amplified the demand for fitness equipment that caters to diverse fitness needs, such as cardio, strength training, and flexibility, thereby driving the sustained growth of the fitness equipment market. Moreover, the aging population fuels fitness equipment demand by promoting active aging. Older adults seek equipment to maintain mobility, strength, and overall health, contributing to sustained growth in the market.

The high cost of fitness equipment can significantly restrain market demand by limiting accessibility to a broad consumer base. It acts as a barrier for individuals with lower disposable incomes, reducing their ability to invest in fitness equipment. Many potential customers opt for more budget-friendly fitness alternatives or gym memberships, making it challenging for equipment manufacturers to capture a broader market share. Additionally, the high cost can deter impulse purchases, and consumers may delay or forego buying fitness equipment altogether, negatively impacting market growth and sales volumes.

Moreover, competition from gyms constrains the fitness equipment market as consumers can access a variety of exercise equipment at fitness facilities without the need for ownership. Gym memberships offer cost-effective alternatives, reducing the incentive for individuals to invest in expensive home fitness equipment, thus limiting market demand for home-based fitness equipment.

Health tech integration drives market demand in the fitness equipment sector by enhancing user experiences and providing data-driven workouts. Smart equipment with features like real-time performance tracking, AI-driven coaching, and compatibility with fitness apps offers users interactive and personalized workouts. This integration caters to tech-savvy consumers seeking advanced fitness solutions.

Additionally, health tech enables remote training and virtual classes, making fitness more accessible. As individuals increasingly prioritize data-driven wellness, fitness equipment manufacturers can capitalize on this trend to meet evolving consumer demands, thereby expanding their market share and driving growth in the industry. Moreover, online retail boosts fitness equipment market demand by offering a convenient and extensive shopping experience. Consumers can easily browse, compare, and purchase a wide range of equipment, expanding access to fitness products and driving sales, especially among those who prefer the convenience of shopping from home.

According to the type, the cardiovascular training equipment segment held a 59% revenue share in 2023. Cardiovascular training equipment refers to machines designed to improve cardiovascular health, including treadmills, stationary bikes, and elliptical trainers. In the fitness equipment market, trends include the integration of digital and interactive features, enabling users to access virtual workouts and track performance. Sustainable and eco-friendly designs are also emerging as a priority, aligning with the growing demand for environmentally conscious fitness solutions.

The strength training equipment segment is anticipated to expand at a significant CAGR of 3.5% during the projected period. Strength training equipment refers to machines and devices designed to increase muscle strength, endurance, and overall fitness. Examples include free weights, weight machines, resistance bands, and kettlebells. Trends in the fitness equipment market include a shift toward compact and versatile strength training equipment for home use, integration of smart technology for tracking progress and providing personalized workouts, and a focus on sustainability by using eco-friendly materials and manufacturing processes.

Based on the end user, the home consumer segment is anticipated to hold the largest market share of 53% in 2023. The "home consumer" segment in the fitness equipment market comprises individuals who purchase fitness equipment for personal use in their homes. Recent trends in this segment include a growing demand for compact and space-saving equipment, such as folding treadmills and portable exercise devices. Additionally, integration with fitness apps and virtual fitness classes has become increasingly popular, providing users with interactive and guided workouts from the comfort of their homes.

On the other hand, the health care segment is projected to grow at the fastest rate over the projected period. In the fitness equipment market, the healthcare end user segment comprises hospitals, clinics, and rehabilitation centers. These institutions utilize fitness equipment for physical therapy, patient recovery, and promoting overall wellness. A significant trend within this segment is the integration of advanced technology, such as tele-rehabilitation platforms and AI-powered monitoring systems, to enhance patient outcomes and provide remote healthcare services, making fitness equipment a vital component of modern healthcare practices.

In 2023, the standard segment had the highest market share of 63% on the basis of the price point. Standard fitness equipment typically offers basic functionality at lower price points, appealing to budget-conscious consumers. However, a key trend in the fitness equipment market is the integration of advanced features, such as touchscreen interfaces, smart connectivity, and personalized workouts. While premium equipment remains popular, the demand for affordable, entry-level options with these modern features is growing, bridging the gap between price and innovation.

The Premium/Luxury segment is anticipated to expand at the fastest rate over the projected period. Premium/Luxury fitness equipment refers to high-end, top-quality exercise machines and accessories designed for discerning consumers who prioritize premium features, aesthetics, and performance. Trends in this segment include the integration of cutting-edge technology such as touchscreen displays and AI-powered coaching, sustainable and eco-friendly materials, bespoke customization options, and exclusive partnerships with luxury brands to create unique, high-value fitness solutions. These trends cater to affluent individuals seeking the ultimate fitness experience.

Segments Covered in the Report

By Type

By End Users

By Price Point

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

January 2025

February 2025