March 2025

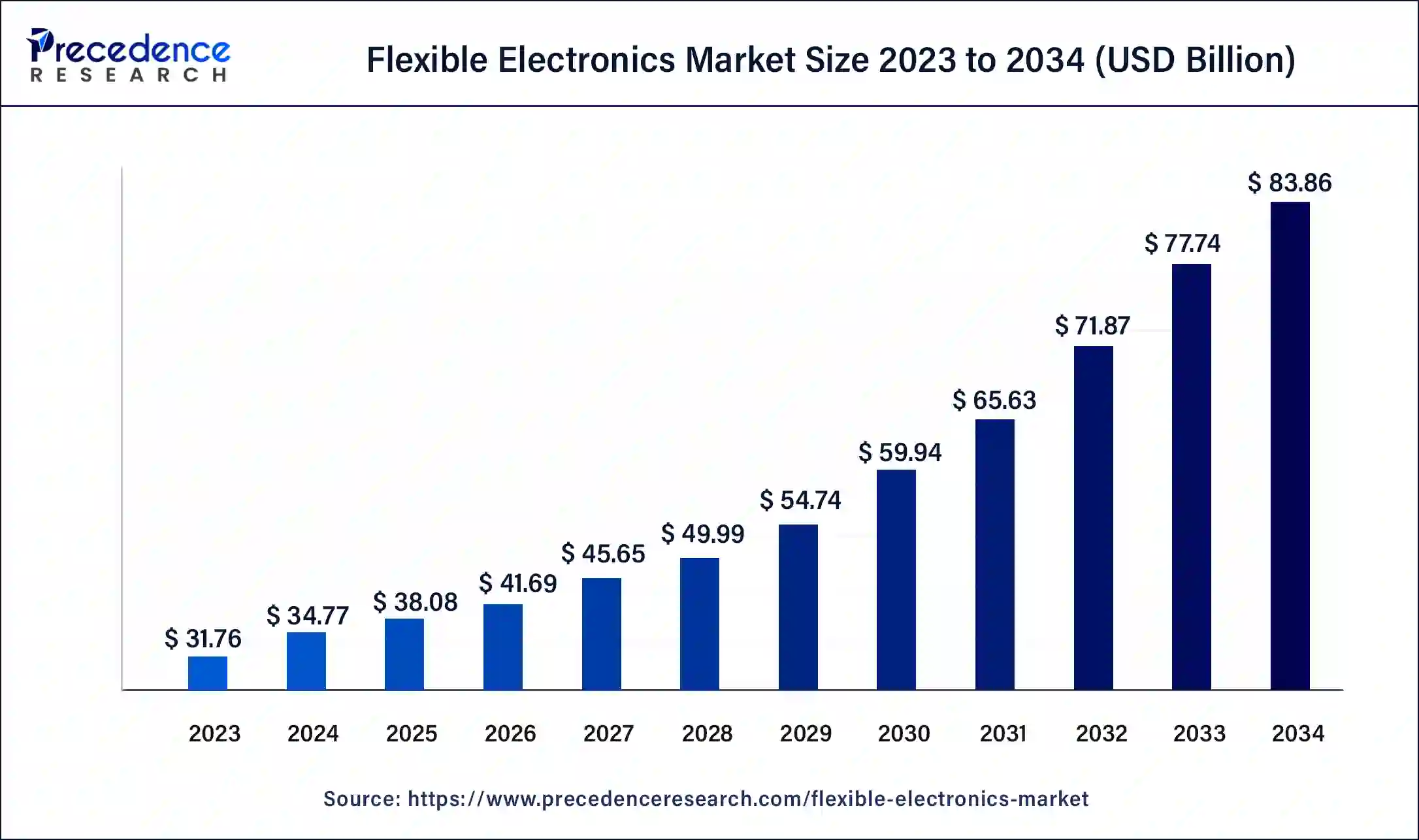

The global flexible electronics market size was USD 31.76 billion in 2023, estimated at USD 34.77 billion in 2024 and is anticipated to reach around USD 83.86 illion by 2034, expanding at a CAGR of 9% from 2024 to 2034.

The global flexible electronics market size accounted for USD 34.77 billion in 2024 and is predicted to reach around USD 83.86 illion by 2034, growing at a CAGR of 9% from 2024 to 2034.

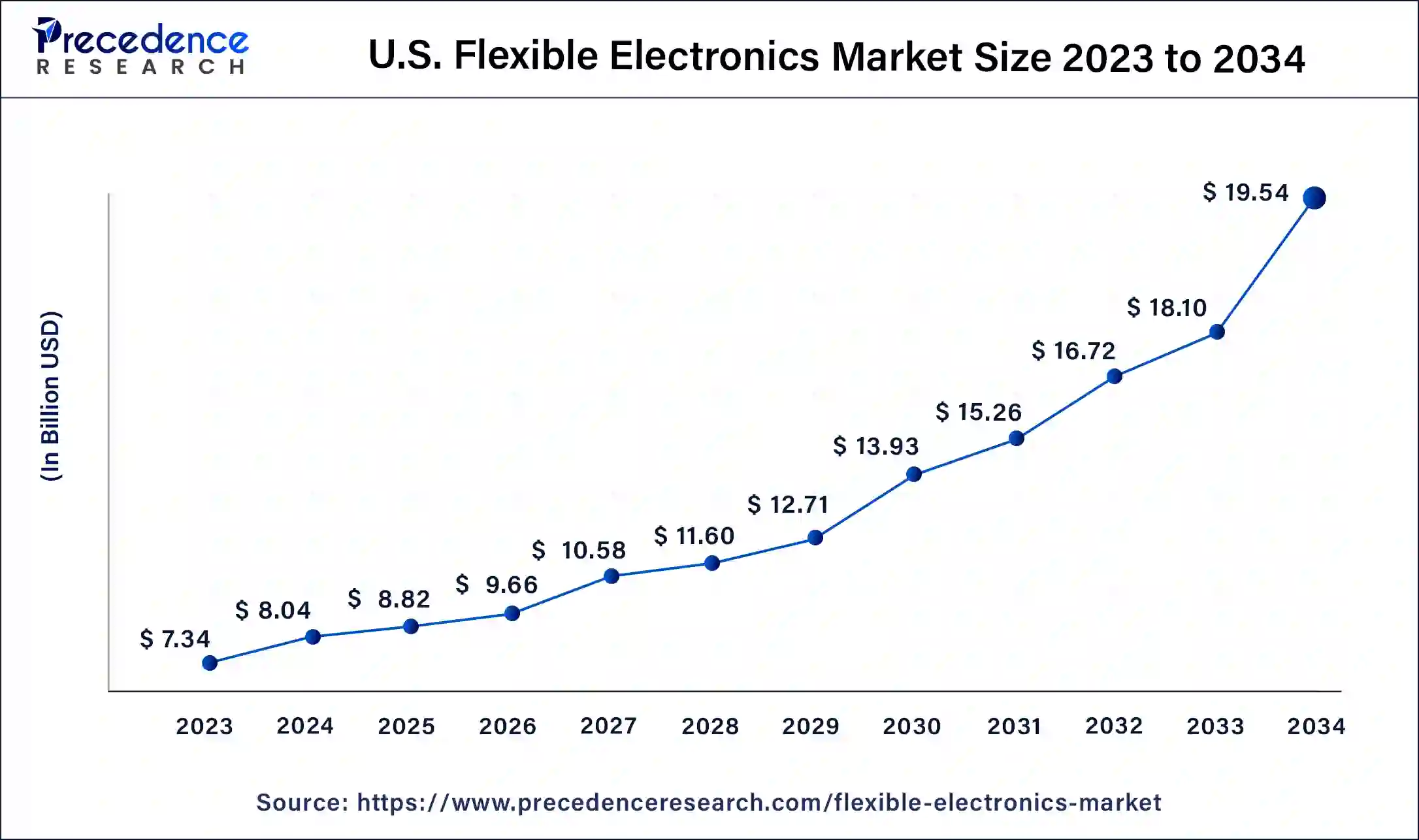

The U.S. flexible electronics market size was valued at USD 7.34 billion in 2023 and is expected to be worth around USD 19.54 billion by 2034, growing at a CAGR of 9.28% between 2024 to 2034.

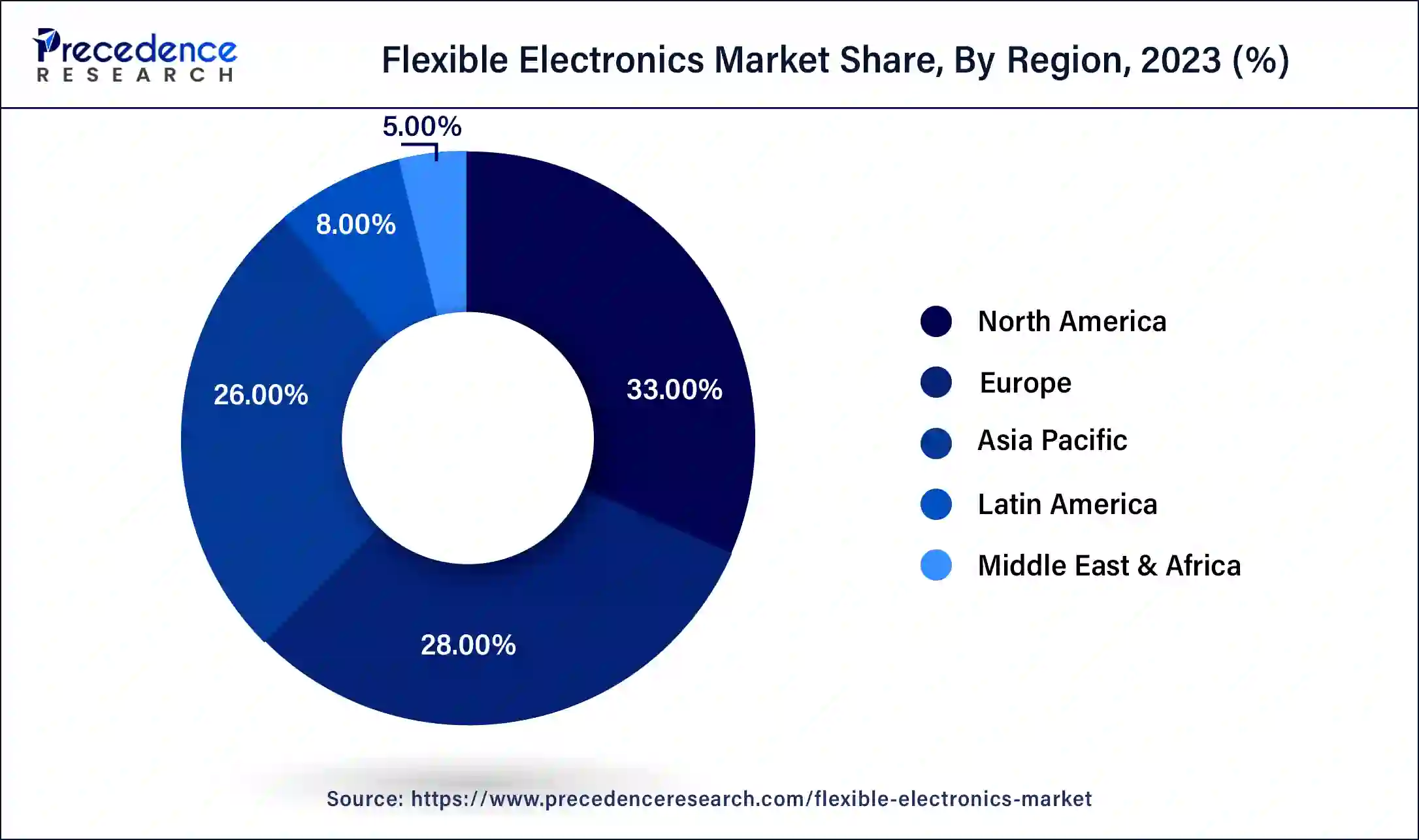

North America accounted for more than 32% of the market share in 2023. The increasing adoption of the flexible electronics across healthcare, automotive, military, and consumer electronics in this region has significantly contributed towards the growth of the market. The higher demand for the innovate technologies in this region has spur the demand for the flexible electronics.

The Asia Pacific region is expected to grow at a CAGR of 9.6% during the forecast period. This is attributable to the presence of numerous top consumer electronics manufacturers in the region. The higher demand for the various affordable consumer electronic products is boosting the consumption of the flexible electronics. Moreover, the rising efforts of the government is attracting FDIs and facilitating various vertical participants to set up their production units in the nations like India, China, and Indonesia owing the availability of cheap factors of production in the region. Therefore, Asia Pacific flexible electronics market is expected to grow at a rapid rate in the forthcoming years.

The flexible electronics are gaining traction in the market owing to its flexible and stretchable properties. The flexibility feature facilitates its usage in various substrates such as flex glass, plastics, and paper. The rising demand for the various consumer and industrial products that are uniquely designed and the rising usage of various innovative materials in the consumer goods manufacturing is boosting the demand for the flexible electronics across the globe. The growing demand for the various wearable devices is augmenting the growth of the flexible electronics market. The ability of the flexible electronics to adapt to the various shapes has fostered its adoption in the manufacturing of the various wearable devices across the globe. The rising sales of the internet of things (IoT) devices across the globe is positively contributing towards the market development. The growing demand for the compact and innovative smart consumer electronics among the global consumers is expected to drive the demand for the flexible electronics. Moreover, the rapidly growing printed electronics is influencing the market growth positively.

The growing complexities in designs of various electronic products such as smartphones, tablets, laptops, and smartwatches is propelling the adoption of the flexible electronics in manufacturing of the electronic products. There are wider varieties of devices produced across different verticals such as healthcare, military, aerospace, and various others, which promotes the use of the flexible electronics for the production of different types of flexible and compact electronic devices. The ongoing projects regarding the development of several smart cities in various countries is estimated to boost the demand for the flexible electronics in the forthcoming years. Moreover, the rising penetration of LEDs and OLEDs is significantly driving the growth of the market, as LEDs and OLEDs uses flexible electronics and hence the market is expected to grow at a rapid rate.

| Report Coverage | Details |

| Market Size by 2034 | USD 83.86 Billion |

| Market Size in 2023 | USD 31.76 Billion |

| Market Size in 2024 | USD 34.77 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, Verticle, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the application, the displays segment accounted for around 51% of the market share. The extensive usage of the display in the various consumer electronic products such as laptops, smartphones, and tablets is augmenting the market demand. Furthermore, the foldable smartphones are gaining traction in the market, which is further estimated to foster the growth of the global flexible electronics market.

On the other hand, the battery is estimated to be the fastest-growing segment during the forecast period. The proliferation of the technologies like IoT and AI and its adoption in various wearable devices requires compactness and energy efficiency in the products, which fuels the growth of this segment. With the decreasing size of the electronic devices, the demand for the efficient and long lasting compact batteries in also increasing rapidly, and hence this segment is expected to offer lucrative growth opportunities during the forecast period.

Based on the verticals, the consumer electronics segment accounted for more than 56% of the market share in 2023. This is simply attributed to the rapid advancements in the consumer electronics and development of designer products that attracts the consumers and hence boosts the sales of the latest electronic products. The rising demand for the consumer electronics across the globe is the primary driver of the consumer electronics segment.

On the other hand, the healthcare is estimated to be the most opportunistic segment during the forecast period. This is attributed to the rising investments in the research and development of various medical equipment such as patient monitoring devices, self-monitoring devices, and various wearable medical devices. The rising healthcare expenditure coupled with the rising burden of diseases is fostering the adoption of the innovative and technologically advanced healthcare devices across the healthcare units around the globe.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In June 2019, E Ink Holdings made a strategic investment in Plastic Logic HK, for manufacturing a flexible electrophoretic display (EPD) device for the wearable devices.

The various developmental strategies like collaborations, acquisitions, and partnerships fosters market growth and offers lucrative growth opportunities to the market players.

Market Segmentation

By Application

By Circuit Structure

By Verticals

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

August 2024

December 2024

December 2024