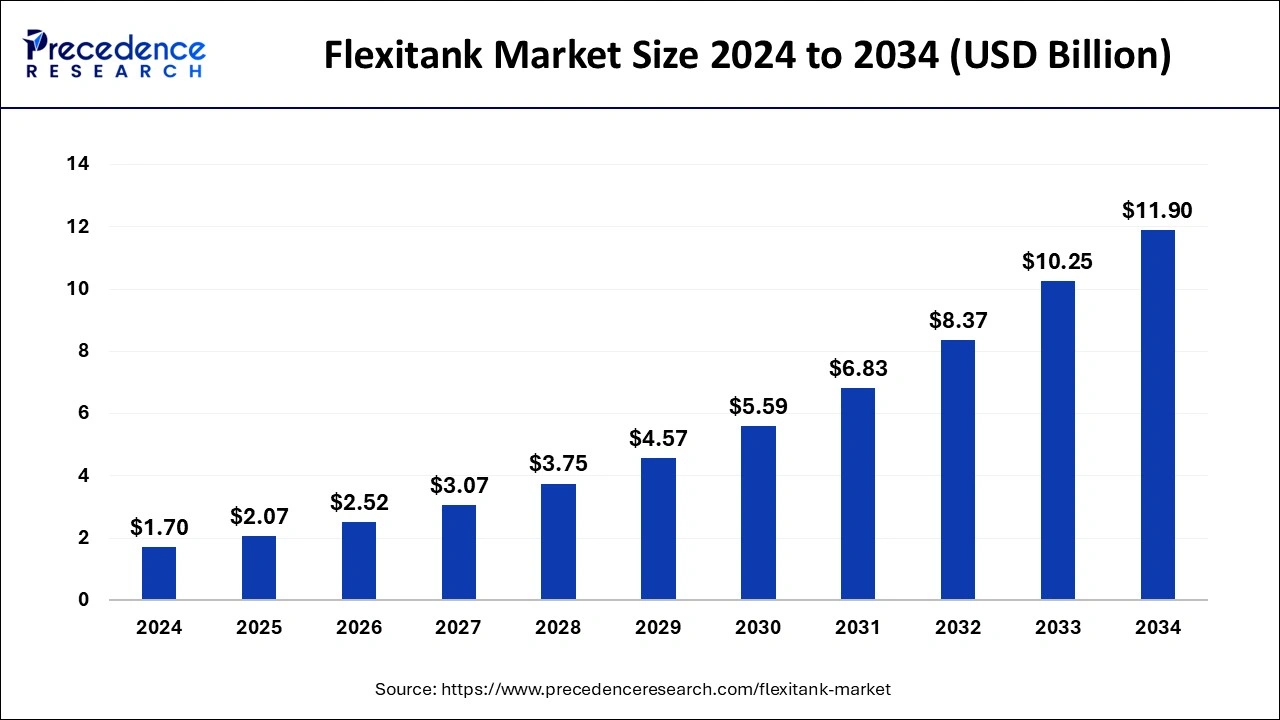

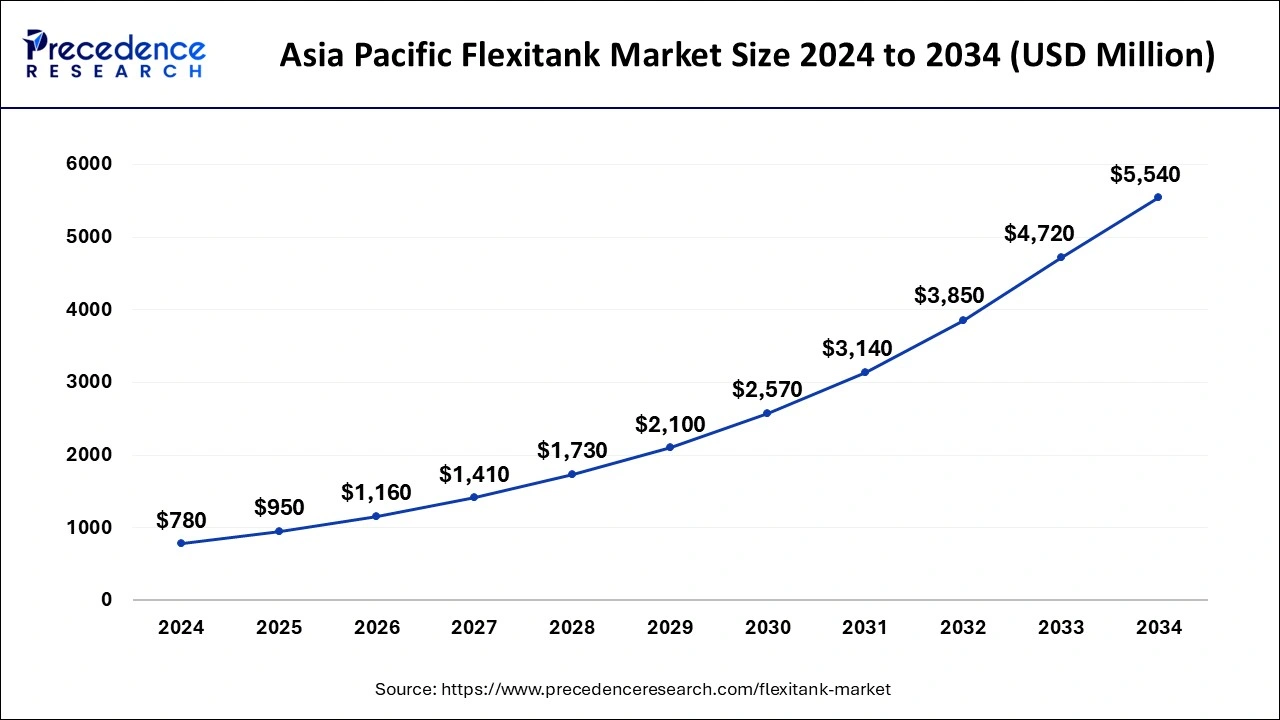

The global flexitank market size is accounted at USD 2.07 billion in 2025 and is forecasted to hit around USD 11.90 billion by 2034, representing a CAGR of 21.48% from 2025 to 2034. The Asia Pacific market size was estimated at USD 780 million in 2024 and is expanding at a CAGR of 21.66% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global flexitank market size was calculated at USD 1.70 billion in 2024 and is predicted to increase from USD 2.07 billion in 2025 to approximately USD 11.90 billion by 2034, expanding at a CAGR of 21.48% from 2025 to 2034.

The Asia Pacific flexitank market size was exhibited at USD 780 million in 2024 and is projected to be worth around USD 5,540 million by 2034, growing at a CAGR of 21.66% from 2025 to 2034.

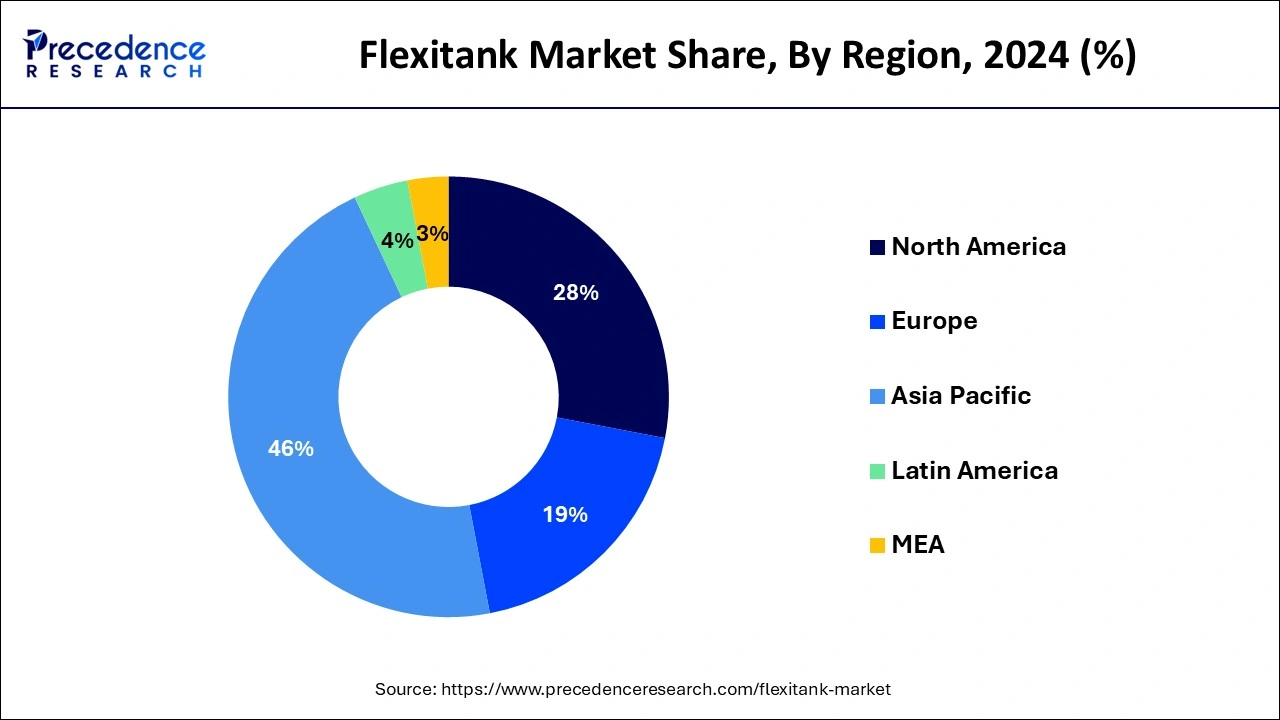

Asia-Pacific held a share of 46% in the flexitank market due to its robust economic growth, expanding industrial activities, and a thriving international trade landscape. The region's manufacturing powerhouses, such as China, contribute significantly to the demand for cost-effective and efficient liquid transportation solutions like flexitanks. Additionally, the rise of various industries, including chemicals, food and beverages, and pharmaceuticals, further propels the use of flexitanks. The region's strategic position in global trade routes and the continuous expansion of its logistics and transportation infrastructure solidify Asia-Pacific's major share in the flourishing flexitank market.

North America is poised for swift growth in the flexitank market due to increased adoption by industries seeking cost-effective and efficient liquid transportation solutions. The region's robust economic activities, coupled with a rising focus on sustainable logistics, are driving the demand for flexitanks. As businesses recognize the benefits of higher payload capacity and reduced transportation costs, the flexibility and versatility of flexitanks position them as a preferred choice. The growth is further fueled by advancements in technology and an expanding awareness of the environmental advantages offered by flexitank solutions.

Meanwhile, Europe is experiencing notable growth in the flexitank market due to several factors.

With Europe holding the largest share in this global trade, the demand for efficient and cost-effective liquid transportation solutions, such as flexitanks, is likely to surge. The region's prominence in alcoholic beverage exports underscores a significant market potential for flexitank applications, offering a strategic advantage for companies in the liquid logistics industry looking to capitalize on the robust export activities within Europe.

A flexitank is a versatile and cost-effective bulk liquid transportation solution designed for shipping non-hazardous liquids in standard 20-foot containers. Typically made of multiple layers of polyethylene and reinforced with a specialized outer layer, flexitanks effectively convert dry cargo containers into efficient liquid transport vessels. These containers can hold up to 24 tons of payload, offering a significant increase in capacity compared to traditional alternatives such as intermediate bulk containers (IBCs) and drums.

The flexibility and efficiency of flexitanks make them particularly popular for transporting liquids like wine, edible oils, and industrial chemicals. The Container Owners Association (COA) has established stringent guidelines to regulate the production, installation, and use of flexitanks, ensuring safety and reliability in their widespread global use for liquid logistics.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 21.48% |

| Market Size in 2025 | USD 2.07 Billion |

| Market Size by 2034 | USD 11.90 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased payload capacity

The surge in demand for flexitanks in the market can be attributed significantly to their increased payload capacity. As global trade intensifies, businesses seek cost-effective and efficient solutions for transporting larger quantities of liquids. Flexitanks, with their ability to accommodate up to 24 tons of payload in a standard 20-foot container, provide a substantial increase in shipping volume compared to traditional methods. This heightened efficiency not only reduces transportation costs but also enables companies to meet the escalating demands of a globalized market.

The increased payload capacity of flexitanks is particularly advantageous in industries where bulk liquid transportation is prevalent, such as the food and beverage, chemical, and agricultural sectors. The ability to transport larger quantities in a single shipment enhances supply chain efficiency and responsiveness. Consequently, as businesses recognize the economic and logistical benefits of transporting higher payload volumes, the demand for flexitanks continues to surge, solidifying their position as a preferred solution in the liquid transport market.

Handling and loading restrictions

Handling and loading restrictions pose notable challenges to the market demand for flexitanks. The successful utilization of flexitanks requires specialized training and careful handling during the loading and unloading processes. Inadequate training of personnel or improper handling procedures can lead to damage, leakages, or spills, raising operational and safety concerns. Companies may be hesitant to adopt flexitanks if they perceive a heightened risk of mishandling that could compromise the integrity of the transported liquids.

Furthermore, the complexity involved in loading and unloading flexitanks may deter potential users. The need for specialized equipment and trained personnel adds to operational costs and may make the adoption of flexitanks less attractive for businesses seeking streamlined logistics solutions. Overcoming these challenges necessitates industry-wide efforts to standardize handling procedures, invest in training programs, and enhance the user-friendliness of flexitanks to ensure their safe and efficient utilization, ultimately bolstering market demand.

Expansion into new industries

Expanding into new industries represents a significant avenue of opportunity for the flexitank market. While flexitanks have traditionally found success in transporting food and chemicals, the exploration of untapped sectors such as pharmaceuticals, cosmetics, and agricultural products can drive substantial market growth. In pharmaceuticals, for instance, the need for secure and efficient transportation of liquid ingredients makes flexitanks an attractive solution, providing an opportunity for manufacturers to cater to the unique requirements of this industry.

Moreover, as flexitanks prove their adaptability and reliability across diverse liquid cargoes, businesses in sectors like cosmetics, where precise formulation and intact product integrity are paramount, can benefit from the flexibility and cost-effectiveness of flexitank solutions. This expansion into new industries not only broadens the market base but also positions flexitanks as versatile and indispensable tools for liquid logistics across a spectrum of applications, further fueling their adoption and market success.

The single-trip product segment had the highest market share of 94% in 2024. The single-trip product segment in the flexitank market refers to flexitanks designed for one-time use during the transport of liquids. These flexitanks are typically cost-effective and offer a convenient solution for businesses with infrequent or one-off liquid shipments. The trend in this segment involves a growing preference for single-trip flexitanks due to their disposability, eliminating the need for return logistics and reducing the environmental impact. Businesses appreciate the simplicity and efficiency of single-trip flexitanks for their practicality in meeting short-term liquid transport needs.

The multi-trip product segment is anticipated to expand at a significant CAGR of 23.4% during the projected period. In the flexitank market, the multi-trip product segment refers to flexitanks designed for repeated use across multiple shipments. Unlike single-use flexitanks, these products are constructed with durable materials, reinforced seams, and enhanced features to withstand multiple loading and unloading cycles. A growing trend in the flexitank market is the increasing demand for multi-trip solutions, driven by the desire for cost-efficient and sustainable liquid transport. Businesses are recognizing the long-term economic benefits and reduced environmental impact of investing in flexitanks designed for extended usability, contributing to the segment's rising popularity.

According to the application, the foodstuffs segment has held a 29% revenue share in 2024. The foodstuffs segment in the flexitank market pertains to the transportation of liquid food products. This includes edible oils, juices, syrups, and other non-hazardous liquid consumables. A notable trend in this segment is the increasing preference for flexitanks over traditional packaging methods. The flexibility and cost-effectiveness of flexitanks make them an ideal solution for efficiently transporting large volumes of liquid foodstuffs. As food supply chains become more globalized, the demand for secure and economical liquid transport solutions continues to drive the growth of flexitanks in the food industry.

The oils segment is anticipated to expand fastest over the projected period. In the flexitank market, the oils segment refers to the transportation of various liquid oils, such as edible oils and industrial oils, using flexitanks. The demand for flexitanks in the oils segment is on the rise due to their cost efficiency and capacity to transport large volumes, making them ideal for the liquid oil industry. As businesses increasingly seek economical and efficient solutions for bulk liquid transport, the oils segment within the flexitank market continues to witness growth, driven by the versatility and advantages offered by flexitank technology.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client