January 2025

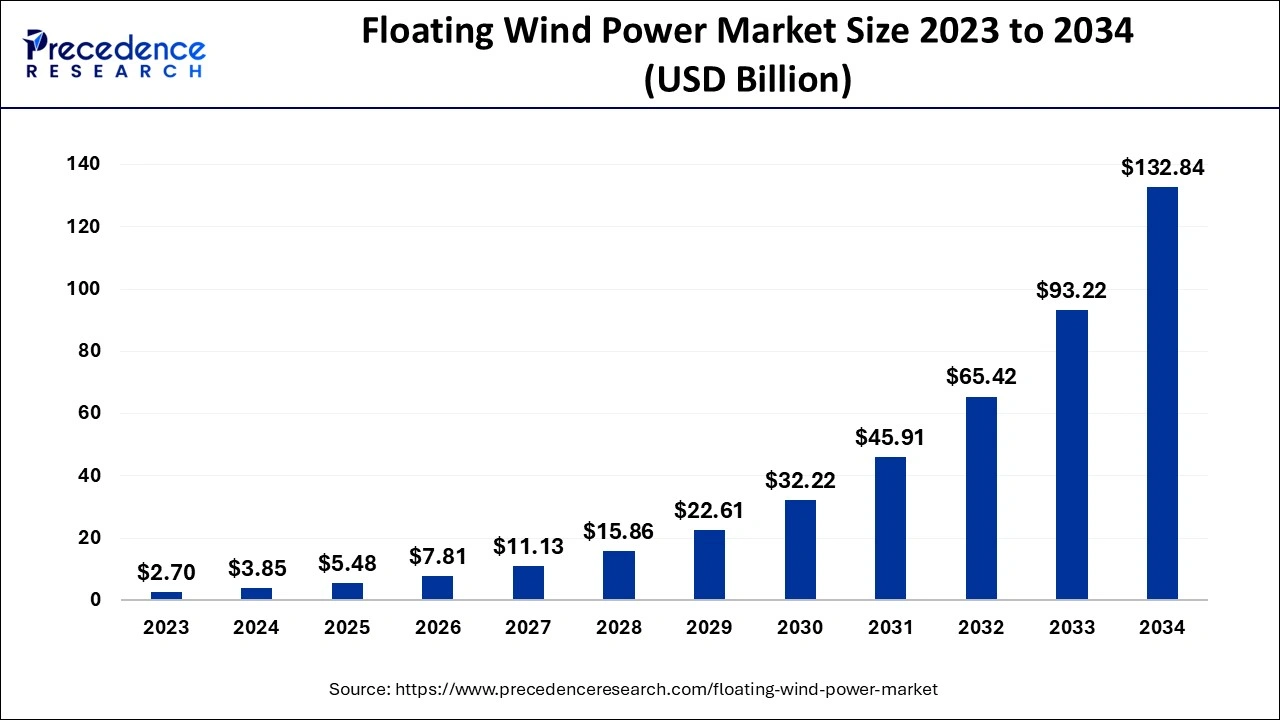

The global floating wind power market size accounted for USD 3.85 billion in 2024, grew to USD 5.48 billion in 2025 and is predicted to surpass around USD 132.84 billion by 2034, representing a healthy CAGR of 42.50% between 2024 and 2034.

The global floating wind power market size is accounted for USD 3.85 billion in 2024 and is anticipated to reach around USD 132.84 billion by 2034, growing at a CAGR of 42.50% from 2024 to 2034.

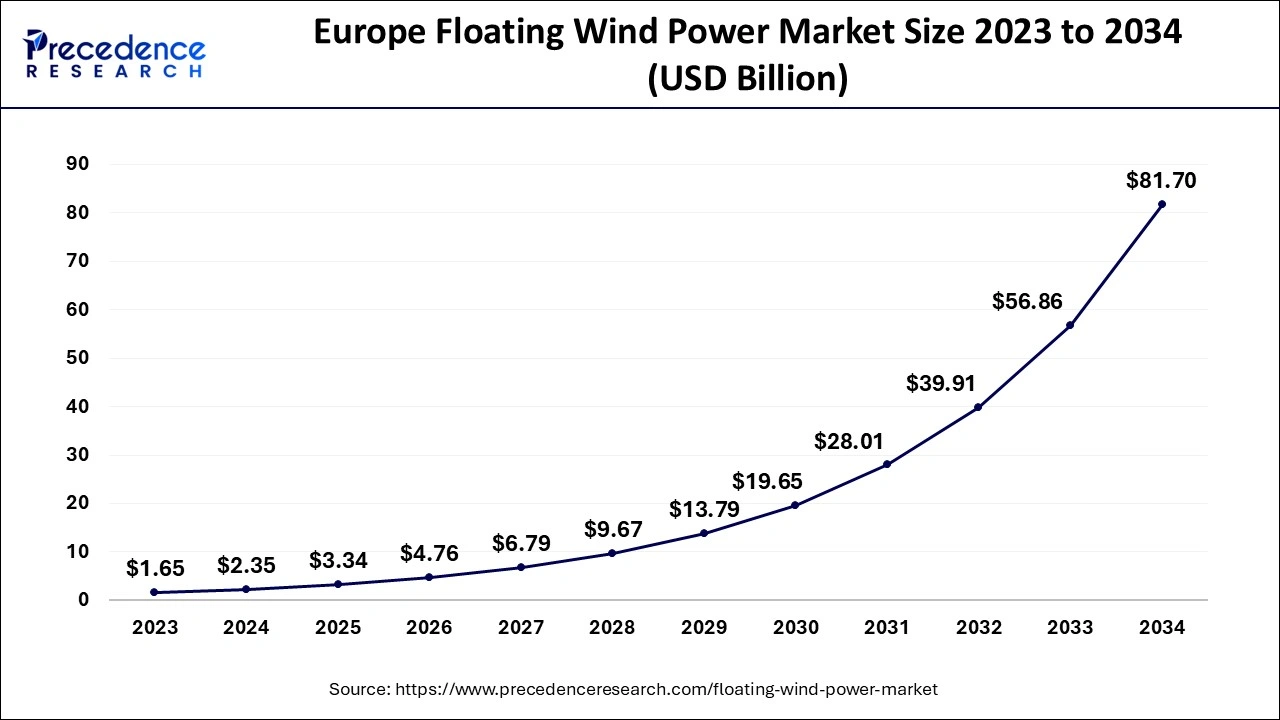

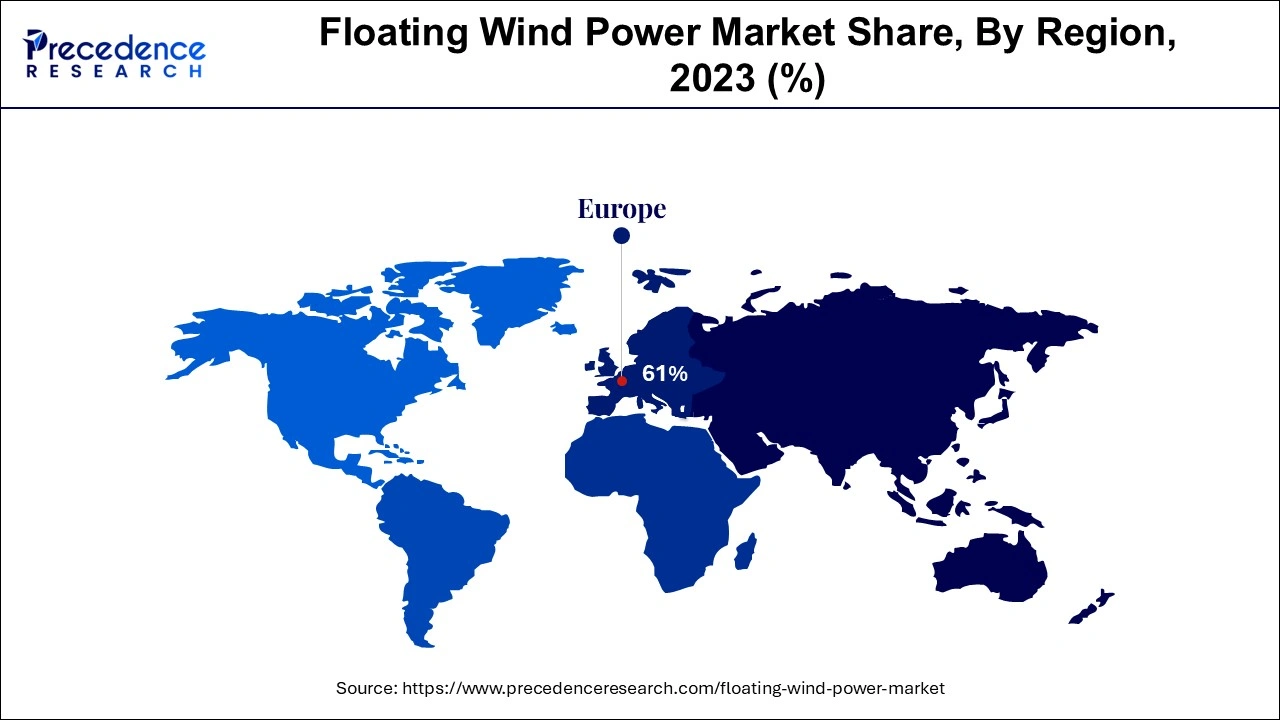

The Europe floating wind power market size is evaluated at USD 2.35 billion in 2024 and is predicted to be worth around USD 81.70 billion by 2034, rising at a CAGR of 42.58% from 2024 to 2034.

On the international market, Japan now controls the Asia continent area. The government intends to increase the wind capacity of installed floating offshore up to 4 GW by the end of year 2032 and to 18 W in 2050, according to the Japan Wind Power Association, which would further draw in numerous investors. The UK leads the industry globally with yearly installation of 47.5 megawatts and a target of 1 gigawatts for offshore floating wind by 2032. It is believed that most of the target will be constructed off the coast of the Scotland region and in south-westerly waters close to the UK. Following Japan, other nations with erected floating wind farms include the United Kingdom, France, the United States, and Sweden. Other nations, including Norway Germany, Spain, are anticipated to establish as significant market players throughout the projection period in light of the planned construction of floating wind power.

Additionally, Asia Pacific countries are shifting toward web-based modern activities in every field as a result of expanding industry. According to the GSM Association, research on the potential effects of new services and linked devices is progressing in countries including Japan, Australia, and South Korea. Additionally, the local automobile industry is thriving. The most notable region in the world for producing vehicles is Asia Pacific. Thus, during the speculative term, the APAC market will likely be driven by the expansion of these end-use organisations. Because of increased interest in the oil and gas sector and increased building activity within the regions, which promotes the expansion of the private and business areas, it is projected that Latin America, the Middle East, and Africa would see remarkable improvement.

When compared to pre-pandemic analyses, demand for floating wind power has been lower than expected across all the nations because to the unprecedented and overwhelming COVID-19 pandemic. In comparison to 2019, the worldwide market for floating wind power showed a fall of 56.9 percent in 2020. Floating structure is used to deploy floating wind power in offshore sites that are impractical for permanent foundations because of the harsh weather conditions.

Farms having floating wind farms represent enormous potential for generating a tremendous quantity of electricity and have already shown to be helpful in tough environmental circumstances.

Among the top nations on the international market are China, Japan, the United Kingdom, Norway, and Germany. The UK, China, Spain, and Norway all had significant increase in latest offshore wind energy installations in 2021. According to their most recent investment plans in renewable energy, the trend will continue.

The COVID 19 pandemic's continued breakout has had an effect on market expansion. The key countries for developing new floating power plants are China, the UK, Japan and United States. These countries all have significant economies. But the coronavirus pandemic has left its mark on them. According to the IEA, a coronavirus has led the demand for energy to decline by an unprecedented 4.9 % in 2020. Renewable energy has lagged behind the least expensive source of energy during the crisis caused by COVID 19 as a result of favourable policies favouring less expensive and much cleaner sources. The cost of energy from new wind energy capacity additions has decreased by 9% over the past ten years, according to the worldwide weighted average levelized in 2020.

Due to the availability of cutting-edge technology, operational benefits the global market is expected to expand as demand for floating wind power installations rises. This will inspire more governments, organisations, and offshore operators to explore floating wind energy possibilities. The worldwide market size is expected to increase from 2023 to 2032 as a result of the growing need for renewable energy.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.85 Billion |

| Market Size by 2034 | USD 132.84 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 42.50% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Water Depth, Turbine Capacity, and Geography |

Growing shift towards the generation of clean energy

Growing investments expenditure in the development of sustainable energy

The operative benefit of floating wind as compared with the fixed offshore structure

Due to the numerous benefits of installing floating wind farms in deep water, the deep-water sector is forecast to have a greater market share for floating wind power and to expand even further. Deep oceans provide more wind speeds and zero obstructions in path of wind, which increases the possibility for catching wind energy. These factors are major benefits of this sort of installation.

The Floating foundations are thought to open new prospects for the large-scale development of various wind farms in some nations with a short continental shelf, hence driving the need for floating wind power. Floating wind turbines are a recommended substitute for permanent bottom foundations in the depth range of 25 to 50 metres for shallow and transitional water. These provide a number of benefits, including lower capital requirements, environmental advantages, and easily accessible.

The installation of the wind farms usually depends on anticipated electricity and the availability of funding. Since a wind farm requires significant upfront investment, a bigger capacity of the wind farm is viewed as a viable investment when considering the potential returns. In line with this trend, latest wind farms that have been approved for development have a capacity greater than 5 MW. As a result, this market sector has a bigger market share.

Globally, several testing phase projects have been conducted since 2013, with the majority of them having a capacity between 2 and 5 MW. The excellent examples are the projects in Germany, the UK, and Japan. These initiatives are anticipated in nations with promise but little market penetration. In the upcoming years, this will fuel investment in the 3MW to 5MW and up to 3MW sectors.

By Water Depth

By Turbine Capacity

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

August 2024

March 2025