September 2024

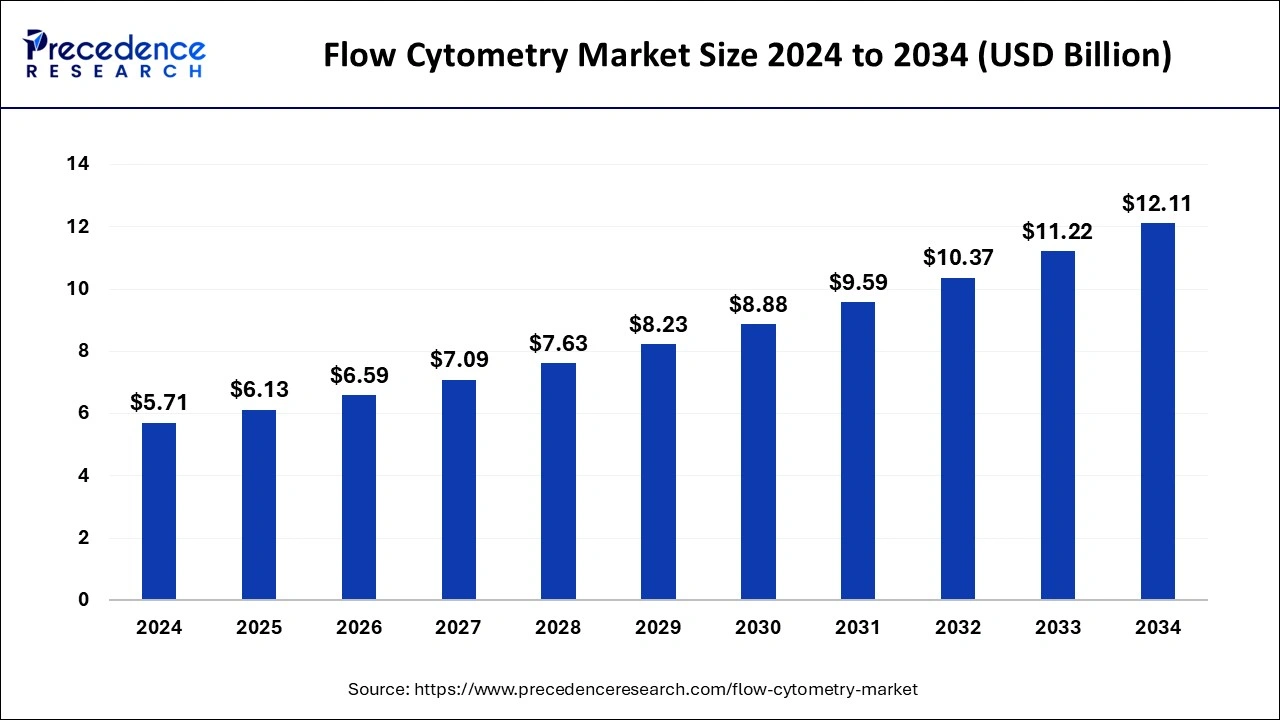

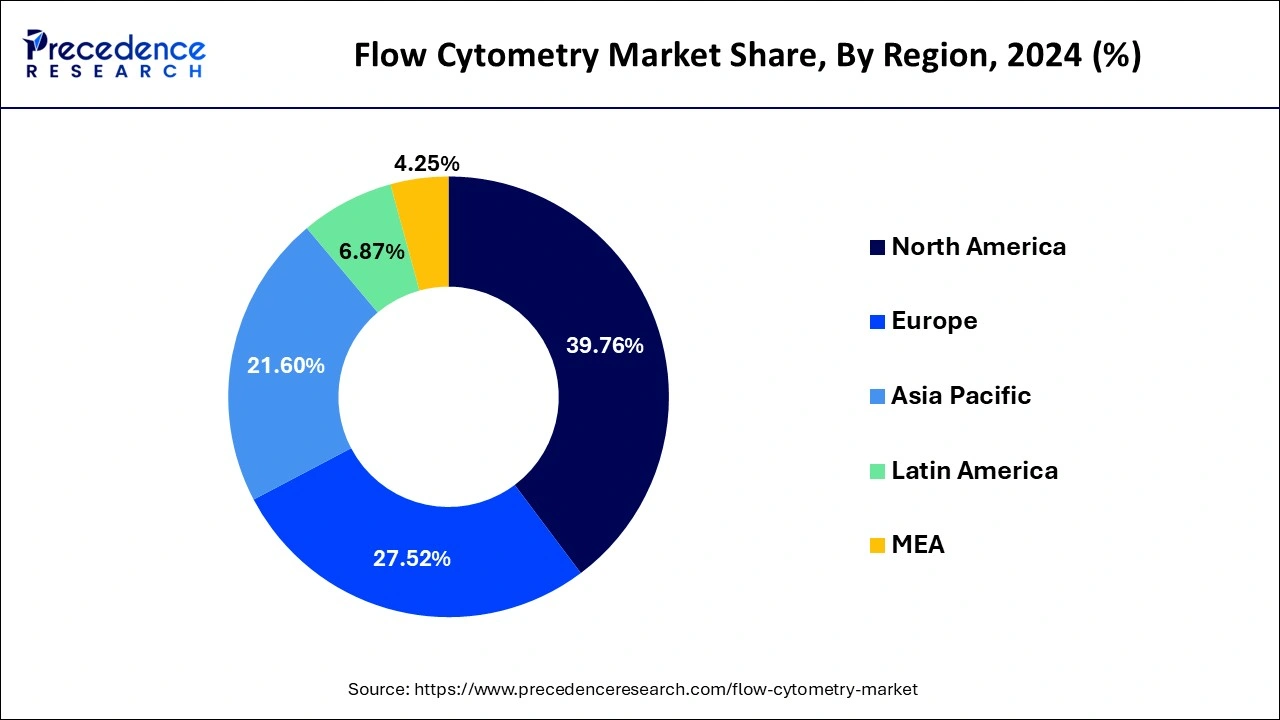

The global flow cytometry market size is calculated at USD 6.13 billion in 2025 and is forecasted to reach around USD 12.11 billion by 2034, accelerating at a CAGR of 7.8% from 2025 to 2034. The North America market size surpassed USD 2.27 billion in 2024 and is expanding at a CAGR of 7.81% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global flow cytometry market size was USD 5.71 billion in 2024, accounted for USD 6.13 billion in 2025, and is expected to reach around USD 12.11 billion by 2034, expanding at a CAGR of 7.80% from 2025 to 2034. The flow cytometry market is growing due to its usage in healthcare for disease diagnosis and analysis of various specimens

The flow cytometry market share would increase as more people contract diseases like cancer and HIV. However, issues including expensive instrument and reagent costs, a lack of awareness among prospective end users, and a shortage of technical know-how are anticipated to restrain market expansion. The preference for ow cytometry in drug research, development, and diagnostics is anticipated to provide the market potential for ow cytometry.

Artificial intelligence (AI) has come a long way in the past ten years. The complexity of cell populations and the exponential rise of data make manual gating more challenging and impracticable. An answer to this problem is provided by AI and ML-powered automated gating algorithms. AI and ML are essential for data analysis and visualization in addition to automated gating. By enabling dimensionality reduction, cluster analysis, and cell identity interpretation, sophisticated algorithms enable researchers to glean valuable insights from intricate datasets. The foundation of this change will be advanced flow cytometry, which will use extremely complex, automated gating algorithms in place of manual gating.

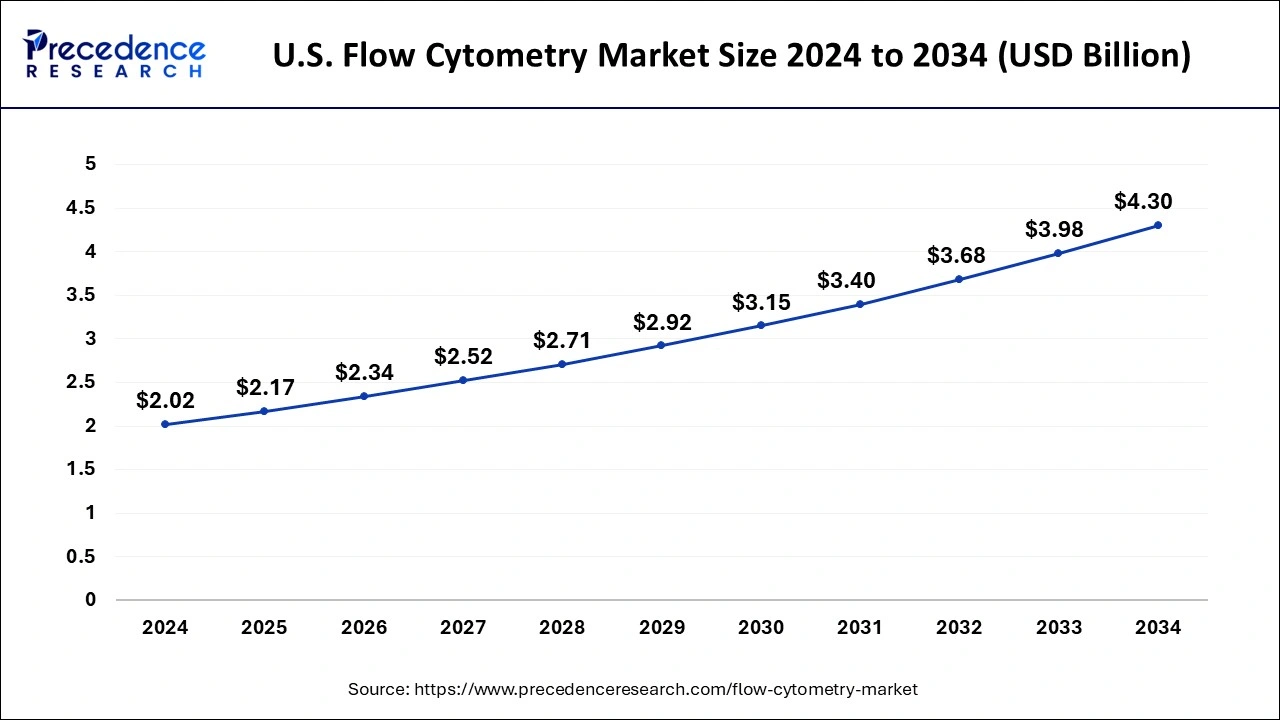

The U.S. flow cytometry market size was estimated at USD 2.02 billion in 2024 and is predicted to be worth around USD 4.30 billion by 2034, at a CAGR of 7.87% from 2025 to 2034.

North America dominated the flow cytometry market in 2024. The growth of the market is attributed to the rising advancements in the healthcare and pharmaceutical industry, the higher prevalence of advanced flow cytometry solutions, and well-established healthcare structures in countries like the United States and Canada are driving the growth of the flow cytometry market. Rising investments in the research and development program for the development of flow cytometry devices the rising investment in research activities by the research universities and the presence of the major pharmaceutical firms contribute to the growth of the flow cytometry Market.

Asia Pacific is expected to witness significant growth in the flow cytometry market during the forecast period. The region is expected the grow in the market owing to the rising healthcare infrastructure and the rising investments by the leading healthcare companies for the development of healthcare facilities are driving the growth of the flow cytometry Market. Additionally rising availability of biotechnology and pharmaceutical firms in emerging economies like India and China. The rising cases of chronic diseases and the use of cytometry devices in several applications are driving the growth of the flow cytometry market across the region.

The growth of pharmaceutical and biotechnology industries in emerging nations including China, and India reinforces the utilization of flow cytometry devices. The market growth is boosted by the increasing prevalence of chronic diseases and the growing utilization of cytometry devices across various applications.

In biology and medicine, flow cytometry is a potent analytical method that examines the physical and chemical properties of particles—usually cells or microorganisms—as they pass past a laser beam in a fluid stream. It makes it possible to assess several aspects of individual cells at once, including size, granularity, and fluorescence intensity, which offers important information on the makeup, activity, and function of cells. Scientists and medical professionals may analyze and identify cell types, look into disease causes, and create tailored therapeutics thanks to the widespread use of flow cytometry in research, clinical diagnostics, and drug discovery.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.8% |

| Market Size in 2024 | USD 5.71 Billion |

| Market Size in 2025 | USD 6.13 Billion |

| Market Size by 2034 | USD 12.11 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Technology, By Application, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Studies into immunology and immuno-oncology are receiving more attention

The increasing number of HIV cases

The market observed substantial growth in the bioengineering segment

Increased use of flow cytometry methods in academic and research settings

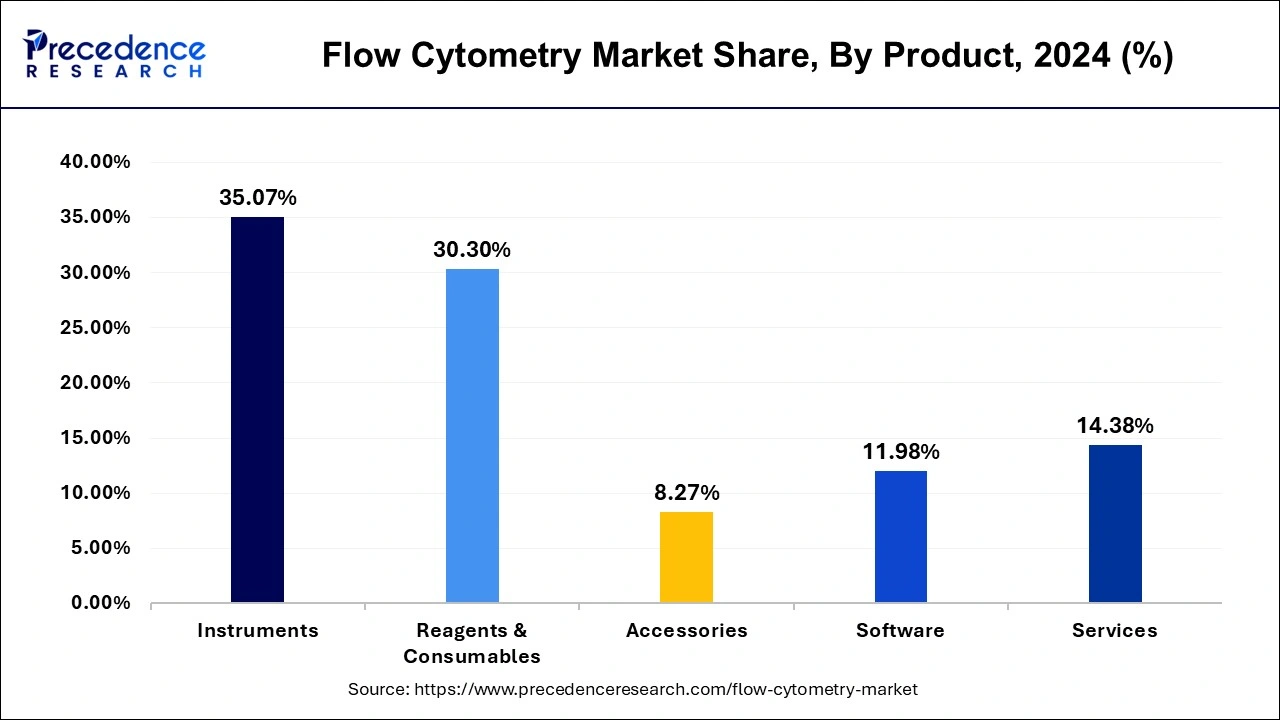

The instruments segment led the flow cytometry market in 2024, accounting for the biggest revenue share of 35.07%. It is anticipated that this segment will continue to dominate the market during the forecast period. This high proportion is credited to recent technological developments and the introduction of innovative cytometers by significant players. The high cost of these devices is another factor in this segment's strong income creation.

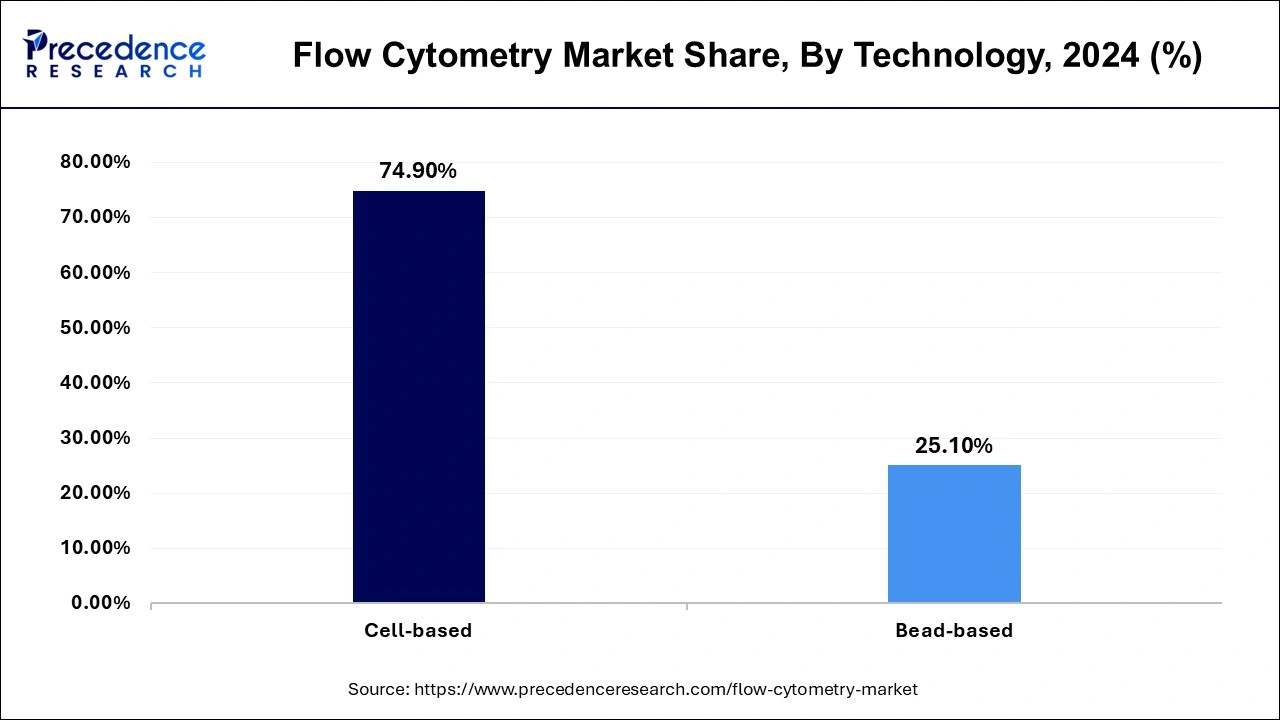

The market for flow cytometry was led by the cell-based category, which in 2024 had the highest revenue share (74.90%). Its biggest proportion is driven by rising interest in early diagnosis and expanding knowledge of the advantages of cell-based tests. Additionally, it is projected that improvements in cell-based assay technology, including innovation in tools, labels, affinity reagents, software, and algorithms, will spur usage in the upcoming years.

Infectious illness research uses tests using beads. Due to developments in molecular engineering and monoclonal antibody manufacturing and the benefits they bring, such as cost-effectiveness, a low sample need, and quick turnaround times, the market for these assays is anticipated to expand profitably throughout the projection period. These tests, also known as indirect or sandwich immunoassay formats are used to gauge the number of antibodies present in biological fluids. In these assays, conjugated antigen molecules are coated on beads to assess the presence of antibodies in the fluid.

Global Flow Cytometry Market Revenue, By Technology, 2022-2024 (USD Million)

| Technology | 2022 | 2023 | 2024 |

| Cell-based | 3,713.1 | 3,981.4 | 4,273.1 |

| Bead-based | 1,246.9 | 1,335.7 | 1,432.2 |

With a market share of 45.06% in 2024, the research sector led the industry. It is predicted that this dominance will continue during the forecast period. The rise in R&D efforts for infectious illnesses like COVID-19 and cancer can be blamed for this high percentage. Additionally, it is anticipated that rising R&D expenditures in the pharmaceutical and biotechnology sectors would foster market expansion.

Due to the rising need for affordable illness diagnosis and the benefits of flow cytometry in disease detection, such as quicker and more precise findings, the clinical diagnostic market is predicted to develop at the quickest rate. The launch of innovative flow cytometry technologies for clinical applications and ongoing organic expansion strategies by leading companies are also projected to considerably help segment growth. For instance, in April 2019, the Chinese FDA approved the use of Cytek Biosciences' new flow cytometer, DxP Athena, which is intended for clinical diagnostic applications in labs, hospitals, and clinics.

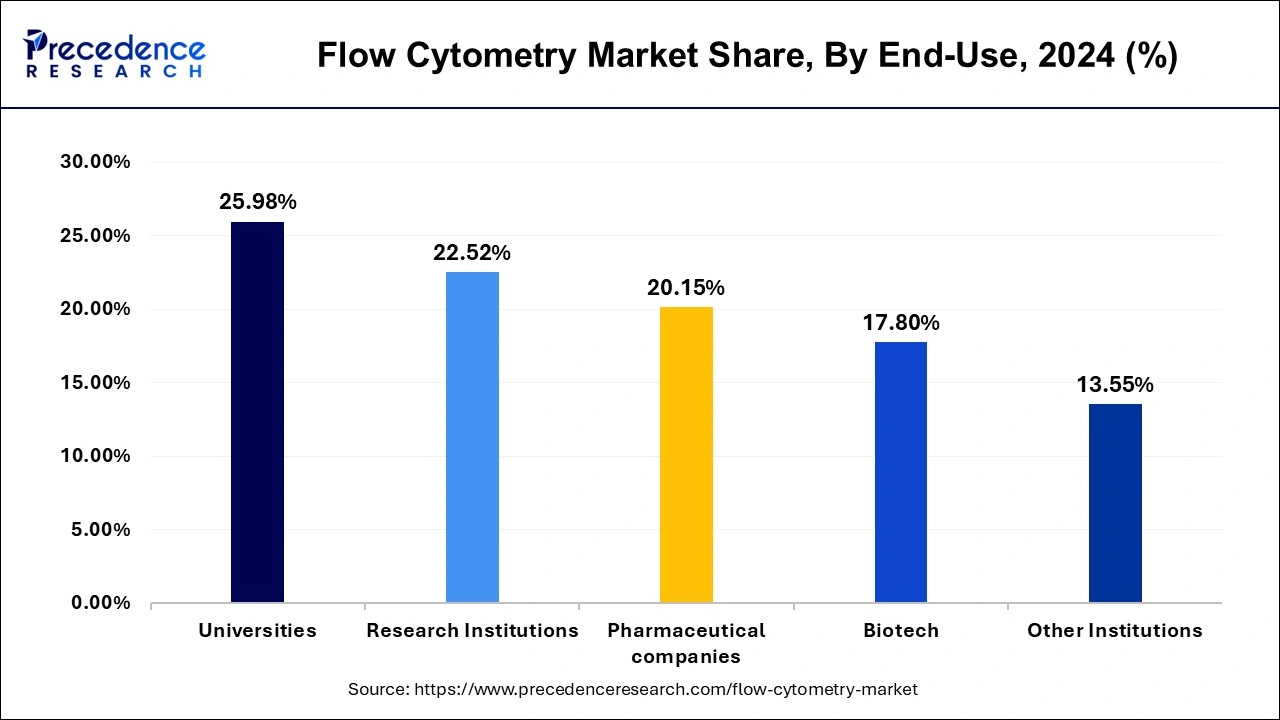

The universities segment dominated the flow cytometry market with the largest share in 2024. This is mainly due to the increased participation of universities in research studies. Universities often focus on the research and study of various fields like biology and medicine. As the participation of universities and academic institutions rises in research programs, the need for flow cytometry also increases. Flow cytometry allows scientists to study cellular functions and disease mechanisms

The research institutions segment is anticipated to expand at a significant growth rate in the coming years. These institutions often engaged in scientific discovery. The increasing focus on cancer research to develop targeted therapies boosts the adoption of flow cytometry. Adopting flow cytometry allows researchers to analyze cell populations and cellular functions and study disease mechanisms. The increasing government investments in R&D activities further contribute to segmental growth.

By Product

By Technology

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

August 2024

September 2024

March 2025