November 2024

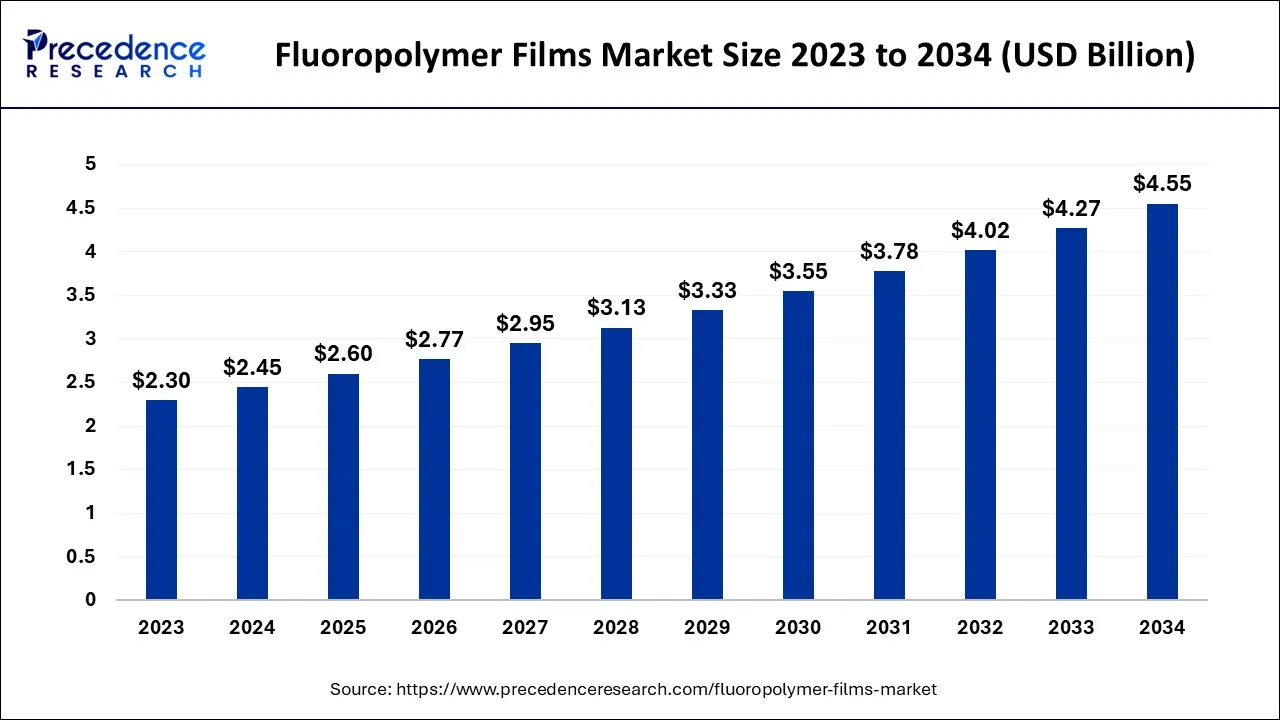

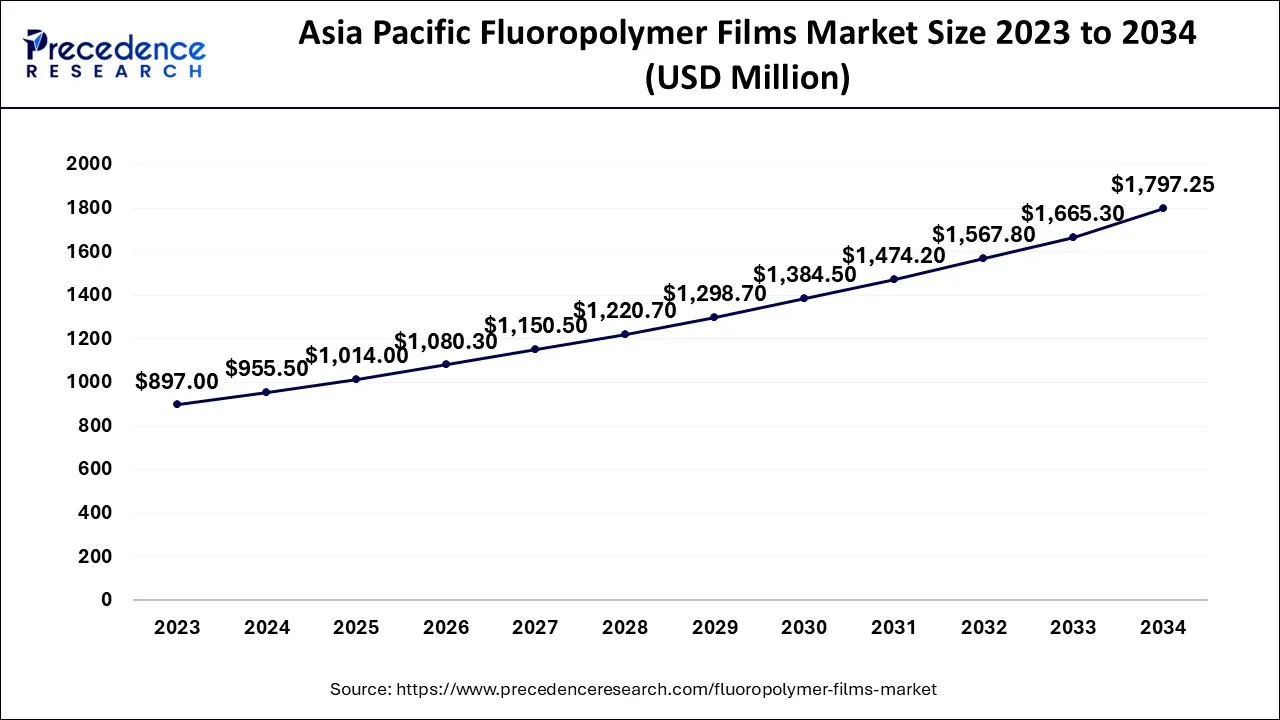

The global fluoropolymer films market size accounted for USD 2.45 billion in 2024, grew to USD 2.60 billion in 2025, and is expected to be worth around USD 4.55 billion by 2034, registering a healthy CAGR of 6.39% between 2024 and 2034. The Asia Pacific fluoropolymer films market size is predicted to increase from USD 955.50 million in 2024 and is estimated to grow at the fastest CAGR of 6.52% during the forecast year.

The global fluoropolymer films market size is expected to be valued at USD 2.45 billion in 2024 and is anticipated to reach around USD 4.55 billion by 2034, expanding at a CAGR of 6.39% over the forecast period from 2024 to 2034.

The Asia Pacific fluoropolymer films market size is exhibited at USD 955.50 million in 2024 and is projected to be worth around USD 1,797.25 million by 2034, growing at a CAGR of 6.52% from 2024 to 2034.

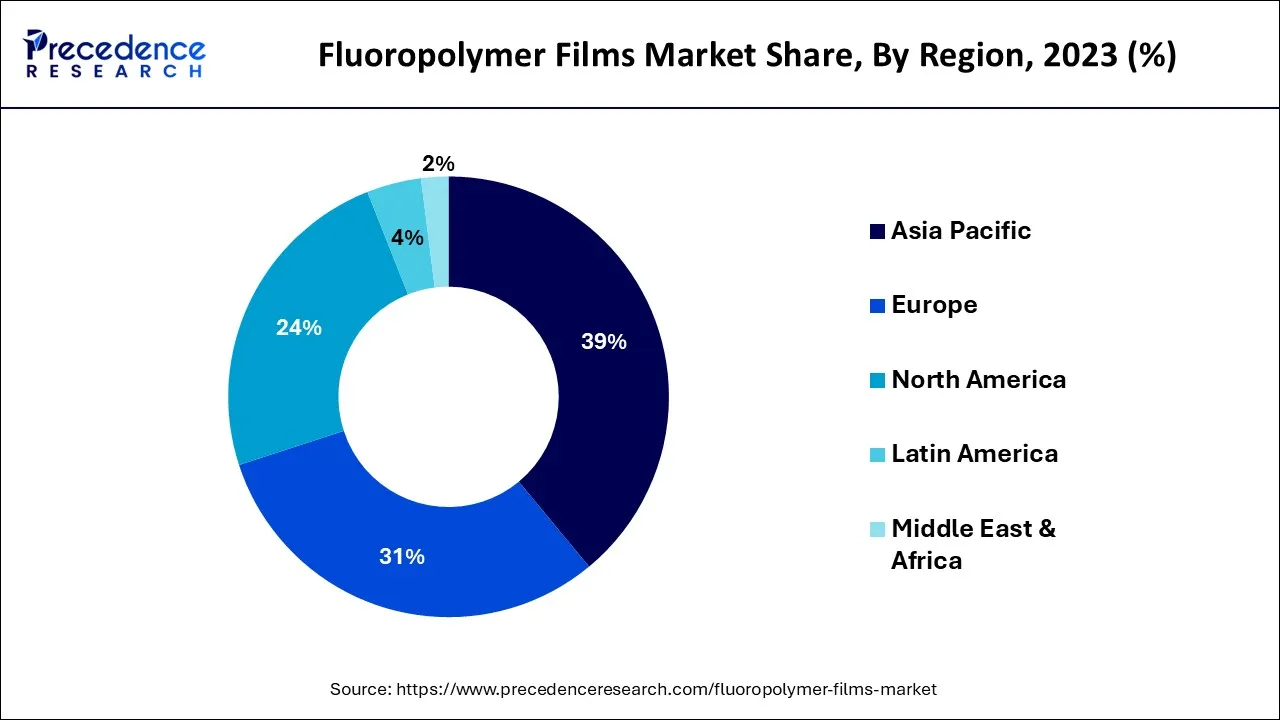

The Asia Pacific accounted for the largest market share in 2023. The growth in the region is attributed to the increasing solar industry coupled with the rising government initiatives, the growing chemical sector and the increasing electrical and electronics sector. In the Asia Pacific region, the growth of the fluoropolymer is mainly driven by the countries such as China, India and Japan.

Thus, the growing pharmaceutical industry and solar sector provide an enormous opportunity for the growth of fluoropolymer film markets over the projected period as these films are used in the packaging of drugs and it is used in the back sheet of the PV module to prevent the environment.

Fluorine and carbon-based polymers are produced as fluoropolymer films by the cast film extrusion process. They are high-performance polymers that are frequently utilized in applications involving high temperatures and harsh chemical environments. They are extensively utilized in cable insulation, anticorrosive linings, solar cell glazing, and pharmaceutical cap liners. Fluoropolymer compounds and resins, which are made up of monomers including propene, chlorotrifluoroethylene, vinyl fluoride, propene hexafluoro, tetrafluoroethylene, and ethylene, are used to create fluoropolymer films. They have high transparency, weather resistance, water absorption, dielectric, and cryogenic qualities in addition to a low friction coefficient. Fluoropolymer films are consequently widely used in the automotive, medical, building, electrical, and electronics industries.

The construction industry is seeing significant expansion on a global scale, which is generating favorable prospects for the market. For safety and security reasons, fluoropolymer films are frequently utilized as a coating material in textile architecture, windows, and doors. Accordingly, the widespread use of the product due to its exceptional non-adhesive and low friction features as well as the rising consumer preference for aesthetically beautiful designs are encouraging market expansion. Additionally, market growth is being fueled by the deployment of numerous government initiatives encouraging infrastructure development. In addition, the launch of green fluoropolymer films as a result of growing environmental awareness and a quick move toward ecologically friendly products is bolstering market expansion.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.45 Billion |

| Market Size by 2034 | USD 4.55 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.39% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing adoption in the electrical and electronics industry

The increasing adoption of fluoropolymer films in the electrical and electronics industry is expected to drive market growth over the forecast period. Fluoropolymer films made of FEP, PFA, ETFE, Matte ETFE and cast PTFE combine outstanding dielectric characteristics with chemical and temperature resistance and weldability. Fluoropolymer films are used in a variety of electrical applications, such as circuit board laminates and high-temperature insulation tapes for wrapping wire and cable. Since ETFE films maintain their superior release capabilities and modest cushioning at high temperatures, they are employed as release films for electronics.

In the Film Assisted Molding (FAM) techniques used to manufacture semiconductors and integrated circuits, it is also utilized as a cushioning or releasing media. Fluoropolymer films boost productivity by eliminating the need to clean the mold in between uses, which reduces the release force required to extract the integrated circuit from the mold. Thus, these attributes drive the market growth over the forecast period.

High cost of fluoropolymer films

The price of fluoropolymer films closely correlates with the expense associated with the development of their technology, the complexity of their production process, and the price of the raw materials required to make the films, such as PTFE, PVDF, FEP, and Others. To accommodate consumer demand, the major manufacturers in the market have created expensive technologies to generate fluoropolymer films. Small businesses find it challenging to develop this patented technology. This drives up the production costs and raises the expense of these films. Thus, the high cost of fluoropolymer films is expected to hamper the market expansion during the forecast period.

Growing investment in the solar industry

PVDF, ECTFE, and ETFE films are highly suited for usage in the back sheet and front sheet glazing of PV panels due to their good dielectric performance, fire resistance, and high solar transmittance. They are widely utilized as an outside component for the back sheet, providing the PV module with prolonged environmental protection. Thereby, the rising investment in solar energy is expected to provide enormous opportunities for market growth over the forecast period.

As per Solar Energy Industries Association, in 2021, more than 255,000 Americans were employed by more than 10,000 solar businesses across all 50 states. Nearly USD 33 billion in private investment was brought into the American economy by the solar industry.

Based on the type, the global fluoropolymer films market is segmented into polyvinyl fluoride, polytetrafluoroethylene, polyvinylidene fluoride, fluorinated ethylene propylene and others. The polytetrafluoroethylene segment is expected to grow at the fastest rate over the forecast period because it has high dielectric and chemical resistance qualities and absorbs UV electromagnetic energy. Additionally, it can be utilized in both extremely cold (down to -530 K) and extremely high temperatures. These qualities are used in a wide variety of products, including semiconductors, electrical appliances, auto parts, and non-stick frying pans.

Additionally, as the price of raw materials, which are used to produce resins, pigments, and fillers, has climbed over time, the cost of PTFE has gone up. Gujarat Fluorochemical Limited, for instance, uses INOFLON PTFE Resins, an engineering plastic designed for exceptional performance under some of the most demanding conditions. They are recognized for having a wide operating temperature range, excellent weather ability, low coefficient of friction, dielectric strength, thermal stability, and flame resistance.

Based on the application, the global fluoropolymer films market is divided into automobile & aerospace, construction, electronics & electrical, packaging, medical & pharmaceutical and others. The automobile & aerospace segment is expected to capture a substantial revenue share over the forecast period. Fluoropolymers are essential for many applications in the aerospace industry because of their distinctive characteristics. These include internal data and power supply systems, wing design and manufacture, engine production, landing gear, fuel systems, helicopters, and fuselage design and assembly/testing.

Fluoropolymers improve aircraft safety and fuel efficiency. They extend the useful life of several components essential for performance, emission control, and safety in the aerospace sector by providing strong and efficient protection against heat, corrosive fluids and fuels, humidity, vibrations, and compressions. Additionally, fluoropolymers products are used in various application in the automotive sector which includes fluid delivery, coatings and sealings, temperature and level detection, and emission testing. Thus, the broad application of fluoropolymer films in the aerospace and automotive industry drives the market growth during the forecast period.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

February 2025

February 2025