January 2025

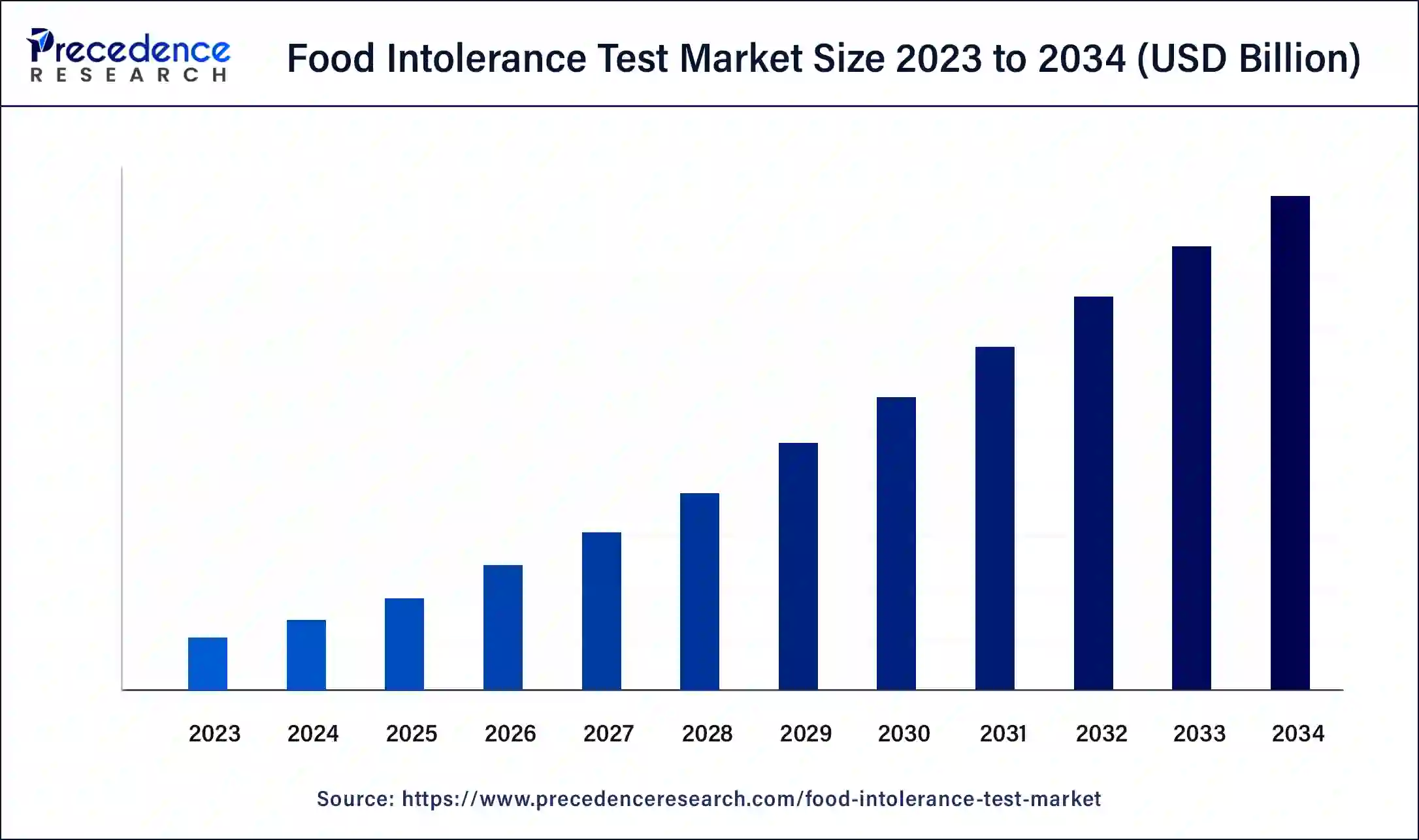

The global food intolerance test market is ready and the increasing demand highlights its potential. It is projected to grow at a solid CAGR during the forecast period from 2024 to 2034.

The global food intolerance test market is ready and the increasing demand highlights its potential. It is projected to grow at a solid CAGR during the forecast period from 2024 to 2034. The key driver of the food intolerance test market is the increasing demand due to higher incidences, rising awareness, and technical developments.

A food intolerance can be defined as the difficulty digesting certain foods or ingredients in food. Food intolerance is a pathology that leads food to be treated as invaders by the immune system, which then targets them like pathogens. Food intolerance is an action taken by immune system organs concerning food products and can lead to serious health consequences. Common culprits like dairy and gluten may result in discomfort and unpleasant sensations, such as bloating, nausea, aches, and fatigue, within a few hours of consumption. Food intolerance testing is used to detect if a child or adult is allergic to a particular food.

How is AI Changing the Food Intolerance Test Market?

AI is significantly affecting the food intolerance test market. The Food Intolerance Tracker (F.I.T.) is a mobile application that helps users with certain food allergies to determine the presence of specific allergens in a consumable product. It is a powerful application with a machine learning system that diagnoses food intolerances in the consumer. The F. I. T. App augments all the areas that intolerance sufferers face. Here, the user inputs its details and gets immediate results.

| Report Coverage | Details |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Largest Market | North America |

| Segments Covered | Test Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing prevalence of food intolerances

Food intolerance has become a common occurrence with the changing lifestyles and environmental conditions. This intolerance may be attributed to reduced secretion in enzymes required for digestion or intolerance to some chemicals. It is a pathological response wherein the body has a chemical reaction to the consumption of a specific food or beverage. The signs of adverse reactions with moderate to severe food allergy or intolerance may be somewhat similar.

Foods commonly associated with food intolerance include

In September 2023, A total of 1,065 adults with food-related hypersensitivity completed the wave two surveys, which included 64 reporting ‘other’ conditions or ‘don’t know’ when asked to describe their reaction to food.

Personalized nutrition solutions

Personalized nutrition solutions are expected to drive the growth of the global food intolerance test market over the forecast period. Personalized nutrition can be described as proposing foods that meet the health needs of each individual. Certain pathologies require the specific selection or avoidance of certain foods. This is notably the case for lactose or gluten intolerance, allergies, diabetes, or hypercholesterolemia. The aim is to limit health risks or improve digestive comfort for those concerned. This diet used for lesions is based on individual differences and their immune response and lack of enzymes or gastrointestinal issues.

Challenges in diagnosing food intolerance

Allergies and food intolerances, in many cases, manifest similar symptoms, and their differentiation is possible only with the help of additional tests. This means that, especially when a patient has to deal with more than one food intolerance, diagnosis is also not easy. The food intolerance test market is largely impacted by these statistics.

Food intolerances are complex because their causes and symptoms are diverse, and they are more likely to be triggered by the digestion rather than the immune system. Lactose intolerance, for instance, presents with that are similar to those of chronic digestion complications, including irritable bowel syndrome (IBS). Nevertheless, no specific and efficient methods exist to determine food allergy apart from lactose intolerance and celiac disease. This means there is no accurate biomarker to quickly diagnose the condition.

Innovative apps for managing food intolerances and allergies

Food intolerance detection and tracking apps can be of immense help to those clinically diagnosed with certain intolerances. For example, lactose intolerance apps enable the consumer to find items that allow them to plan their diet depending on specific needs. It explains that daily buildups of a substance can be more critical than individual servings, which is expected to create opportunities for the growth of the global food intolerance test market over the forecast period. These apps assist consumers in searching for a restaurant or supermarket that best suits their needs, providing information and advice about allergen self-management, and detecting allergens in recipes and food product labels.

Top Food Intolerance Detection Applications

| Mobile Applications | Uses |

| The Gluten Free Scanner | It is one big store that has all types of foods that are strictly off-limit for those with coeliac disease and gluten allergies. The gluten-free scanner is uncomplicated and requires a barcode that can look at more than 500000 products in the U.S. and 150,000 in the UK on four levels. |

| AllergyEats | Even though it is only available in the United States, AllergyEats is among the few greatest allergy applications. What sets it apart is the fact that it is dedicated to restaurants offering foods that are safe for people with allergies. |

| Yummly | A cooking site with a library of more than two million allergy-friendly recipes, as well as a list of recommended recipes, helpful tools, and videos. There is an option to bookmark recipes so that they can be easily found later on. Shopping lists can also be generated with just one button. |

| Soosee | A food scanner scans through the ingredients quickly and gives an instant readout on the parts of the food that cause hypersensitivity in the subject. There are more than 30 filter options available, including those concerning not only allergic diseases but also vegan diets, pregnancy, additives, etc. |

The conventional tests accounted for the biggest share of the food intolerance test market in 2023. The skin is normally the organ that identifies the onset of an allergy because it is the primary target organ for allergic reactions. Food allergy skin manifestations include rashes, itching, eruption zone, redness, and tingling. Food intolerance can also be checked through blood tests. The blood is tested for the levels of IgE antibodies. These specific antibodies are produced in the body when our body comes across an allergen, which is a substance to which we have an allergy.

The alternative allergy tests segment is expected to witness significant growth in the food intolerance test market during the forecast period. Local sampling, which employs noninvasive or minimally invasive techniques of sample collection, may be low cost and well tolerated, perhaps for the primary or home-based care for sampling. The noninvasive diagnostic methods would allow for earlier patient diagnosis, differentiation of infections from allergies, and the definition of endotype-specific prevention or treatment strategies. Blood test for IgG antibodies to determine slow-reacting antibodies linked with food intolerances. For example, an IgG food intolerance test determines the quantity of Immunoglobulin G present in the blood for the foods consumed. The test can help identify food intolerances by measuring the body's immune system response to foods.

North America led the global food intolerance test market in 2023. The increasing incidence rate, better healthcare infrastructure, and personalized health solutions in countries like the United States and Canada drive the food intolerance test market. Rising health awareness and the need for more definite diet necessities are crucial to development stimulated by growing smartphone usage and quickly available applications. Furthermore, partnerships with regional food shops and dining establishments increase the utility and realism of these applications for controlling intolerance and allergies.

Asia Pacific is anticipated to grow notably in the food intolerance test market during the forecast period. Increased awareness of food sensitivities, urbanization, and food intolerances. People’s awareness regarding health and wellness has been increasing, and there is a growing number of mobile users in the world. Also, the increasing health consciousness and the increasing rate of diseases associated with diets, especially in the urban population.

Segments Covered in the Report

By Test Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

October 2024