January 2025

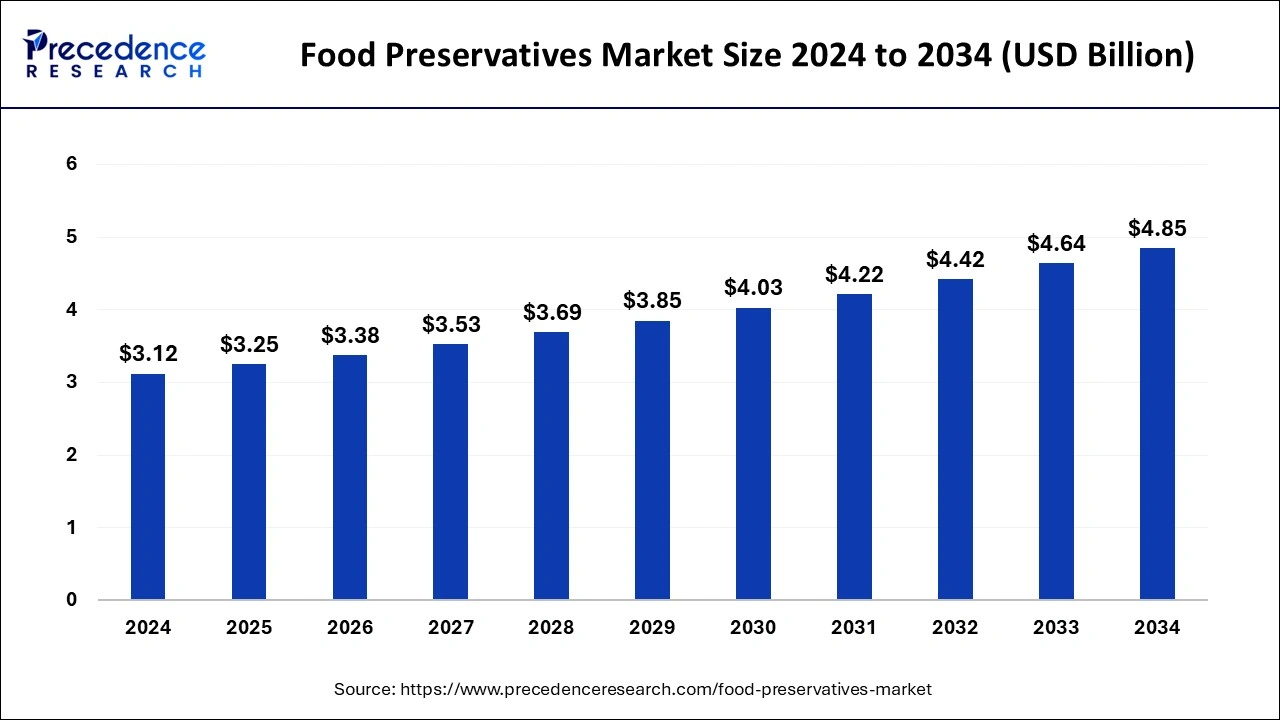

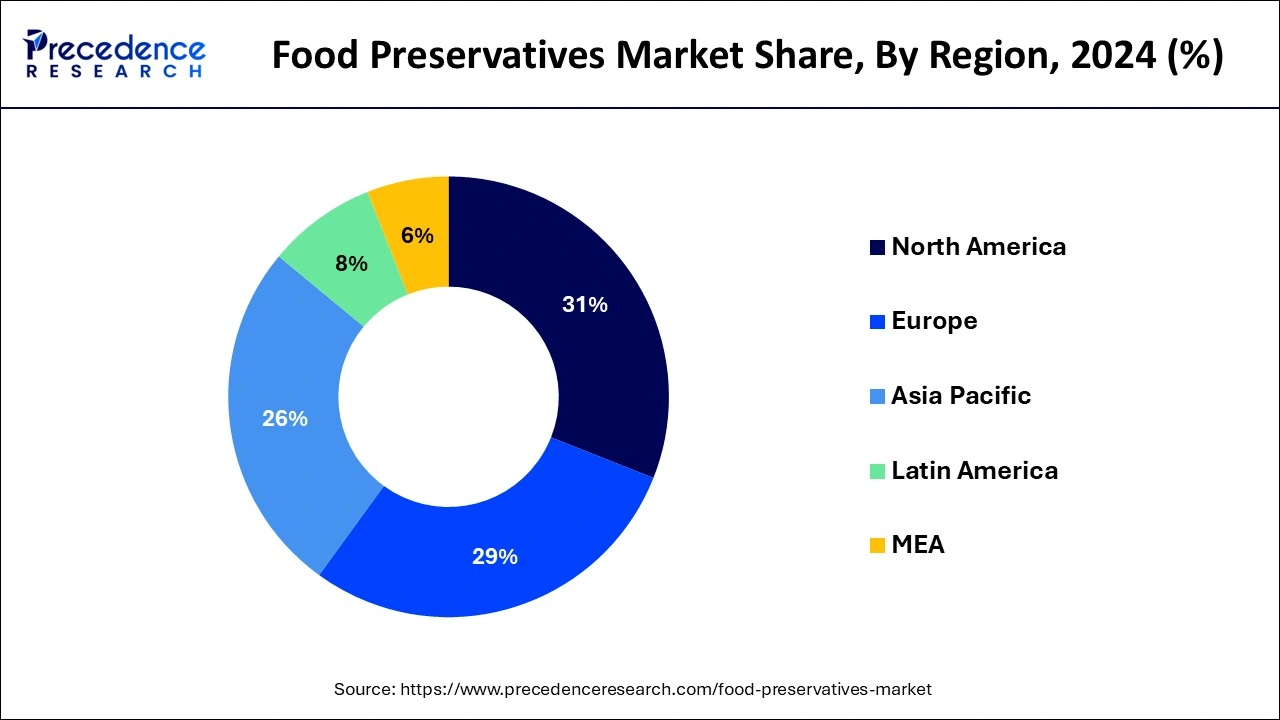

The global food preservatives market size is calculated at USD 3.25 billion in 2025 and is forecasted to reach around USD 4.85 billion by 2034, accelerating at a CAGR of 4.51% from 2025 to 2034. The North America food preservatives market size surpassed USD 970 million in 2024 and is expanding at a CAGR of 4.54% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global food preservatives market sizewas estimated at USD 3.12 billion in 2024 and is predicted to increase from USD 3.25 billion in 2025 to approximately USD 4.85 billion by 2034, expanding at a CAGR of 4.51% from 2025 to 2034. The food preservatives market is driven by the growing market share for clean-label and natural preservatives.

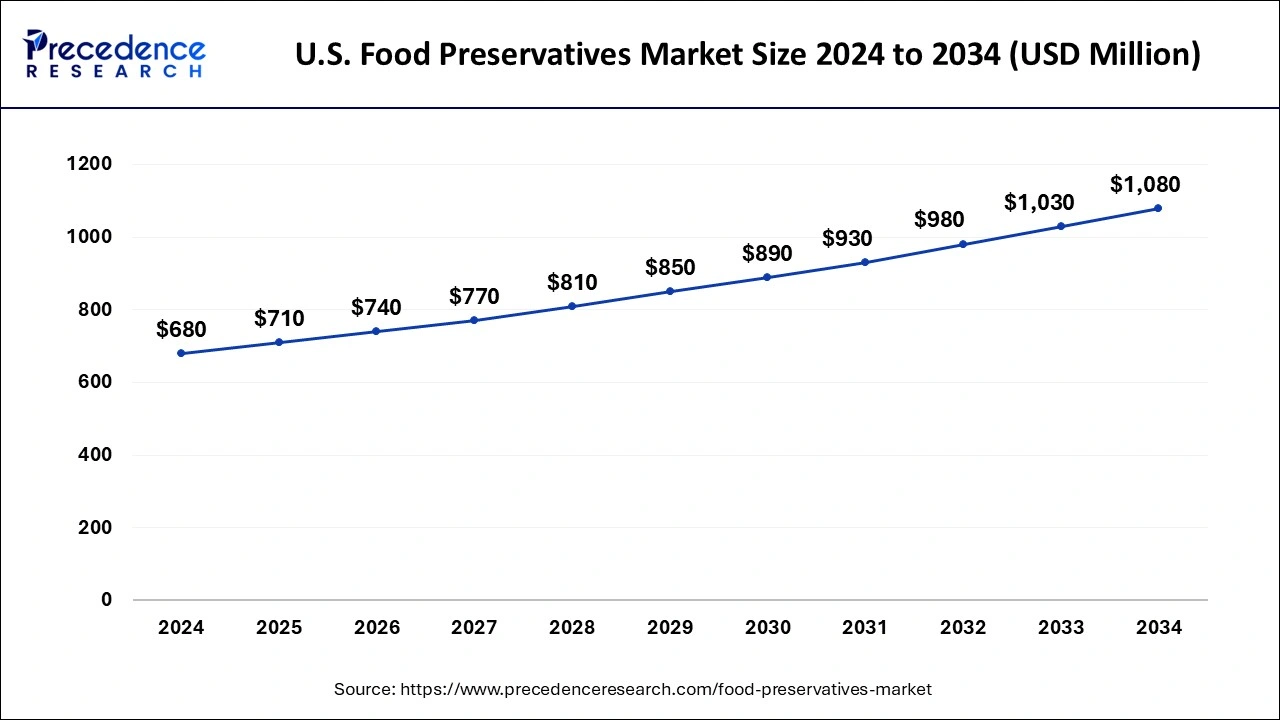

The U.S. food preservatives market size was valued at USD 680 million in 2024 and is anticipated to reach around USD 1080 million by 2034, poised to grow at a CAGR of 4.73% from 2025 to 2034.

North America dominated the food preservatives market while contributing 31% of the market share in 2024. The factors driving the market's expansion include rising consumer demand for processed and convenience foods, strict laws encouraging food safety, and significant investments in R&D by leading industry companies. North America is likely to maintain its dominant position in the food preservatives market for the foreseeable future due to its robust infrastructure and technical developments, as well as the rise in consumer awareness of food quality and safety and preservative innovations.

Asia-Pacific is the fastest-growing in the food preservatives market during the forecast period. Technological developments in food processing and packing are driving up the use of preservatives to preserve food quality and safety through the supply chain. Furthermore, the region's regulatory agencies strongly emphasize food safety laws, forcing producers to utilize preservatives to meet these requirements. Additionally, rising consumer awareness of foodborne illnesses and the value of food preservation drive up preservative demand in the Asia-Pacific region.

The food preservatives market offers compounds that are mostly added to industrially manufactured processed foods or other foods for technical reasons, such as enhancing food safety, extending the shelf life of food, or altering the food's sensory qualities. These preservatives are meant to destroy microorganisms that could decompose and ruin food in any other way. For decades, common preservatives such as sugar, salt, vinegar, and alcohol have been employed; nevertheless, contemporary food labels now list more unusual compounds, including potassium sorbate, sodium benzoate, and calcium propionate.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.25 Billion |

| Market Size by 2034 | USD 4.85 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.51% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Label, By Type, By Function, and By Function |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for convenience and processed foods

For processed foods to stay safe and high-quality, their shelf lives must frequently be extended. Food preservatives prevent oxidation, microbiological development, and other types of deterioration, extending the shelf life of these goods. Due to urbanization and hectic lifestyles, there is an increasing need for ready-to-eat and portable food items. By creating portable, easy-to-transport items with extended shelf lives, food preservatives help manufacturers satisfy the demands of urban consumers. Thereby, the rising demand for convenient and processed foods is observed to drive the growth of the food preservatives market.

Shifting consumer preferences

Consumers avoid artificial additives and preservatives to favor fresher, healthier, and more natural food options. Food producers are being forced by this shift in customer preferences to look for alternate preservation strategies, including natural preservatives or creative packaging, to satisfy demand while preserving product safety and shelf life. As a result, natural and clean-label preservatives made from plant extracts, essential oils, and fermentation processes are becoming increasingly popular in the food preservatives market. As consumer preferences for healthier products change, manufacturers are emphasizing transparency in their labeling and marketing to convey that their products do not contain artificial preservatives.

Growing preference for "clean label" and natural ingredients

Customers are becoming picky about artificial additives, especially synthetic preservatives, and gravitate toward products with shorter ingredient lists. Food producers have reformulated their goods to eliminate or reduce the use of artificial preservatives in favor of natural substitutes due to the shift in consumer tastes. Consequently, as customers move toward goods, they believe to be healthier and more natural, the market for conventional synthetic preservatives is decreasing.

Investing in research and development of new natural preservatives

Customers are becoming increasingly interested in natural and clean-label products because they are worried about the possible health implications of synthetic ingredients. Creating natural preservatives gives businesses a competitive edge in satisfying consumer wants and is in line with this trend. When it comes to their effects on the environment, natural preservatives frequently outperform their synthetic equivalents. Businesses can lower their carbon footprint and attract eco-aware customers by investing in sustainable R&D.

Developing cost-effective and efficient preservatives

Putting money into research and development to create new preservatives or enhance current ones. Improve efficacy and cost-effectiveness; this can entail investigating natural sources, bio-based materials, and creative formulations. It can also entail integrating sustainability into preservative development by emphasizing eco-friendly ingredients, cutting energy use, and minimizing environmental impact throughout the product lifecycle.

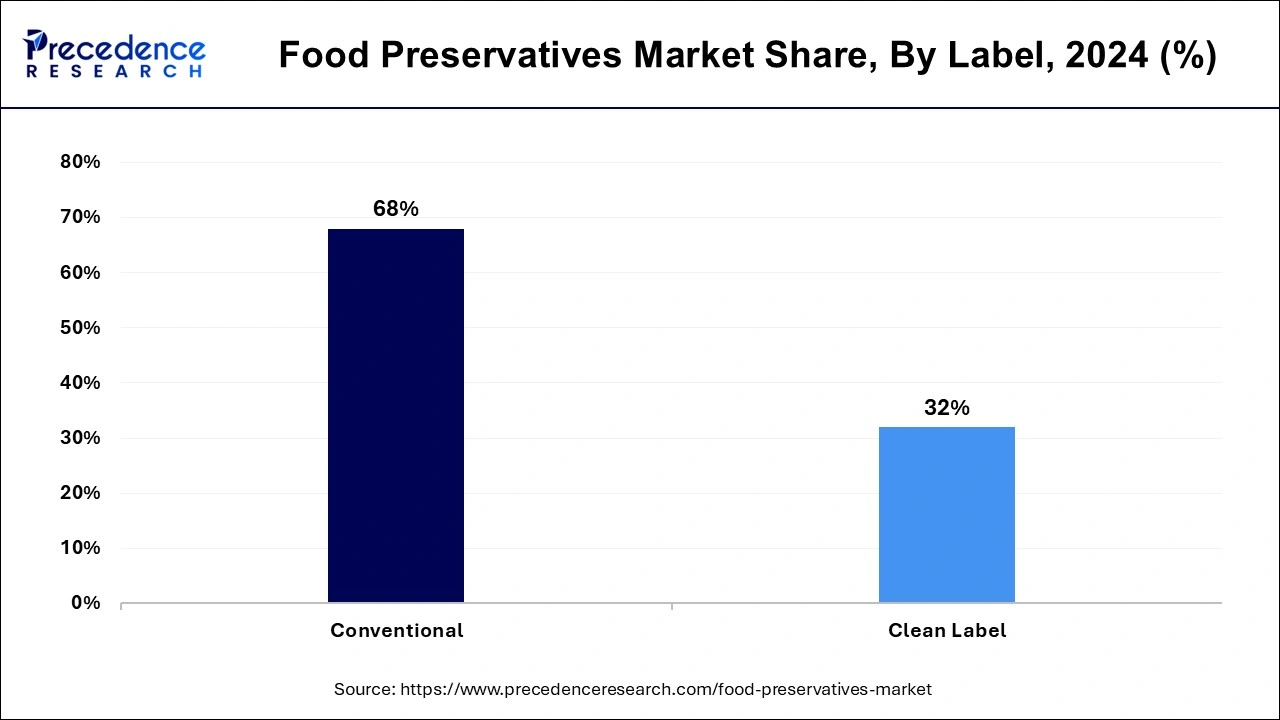

The conventional segment led the food preservatives market with a 68% market share in 2024. Since they effectively inhibit microbial growth, prevent oxidation, and extend shelf life, conventional preservatives like sodium benzoate, sorbic acid, synthetic antioxidants (like butylated hydroxyanisole and butylated hydroxytoluene), and chelating agents (like EDTA) are preferred. Furthermore, as compared to natural alternatives, they are frequently more affordable. Despite the growing consumer desire for natural and clean-label products, the conventional sector maintains a substantial market share. This is attributed to regulatory approvals, stability under different processing conditions, and effectiveness in preserving food quality and safety.

The clean label segment shows notable growth in the food preservatives market during the forecast period. Clean-label ingredient demand results from growing consumer awareness and concerns about the safety and health of food items. Customers prefer natural preservatives over synthetic ones and look for items with identifiable, essential ingredients.

Food manufacturers are spending money on R&D to create novel clean-label preservatives that satisfy customer demands for natural ingredients and efficiently increase shelf life. The clean label market now offers more possibilities thanks to this innovation.

The synthetic segment had the largest share of 70% in 2024 in the food preservatives market. For food makers, synthetic preservatives are more financially feasible because they are frequently less expensive than natural ones. Compared to natural alternatives, it often has more robust antibacterial qualities, giving food products a longer shelf life and better preservation.

The anti-microbial segment had the largest share of 76% in 2024 in the food preservatives market. Preservatives that successfully stop the growth of dangerous bacteria are in higher demand as consumer awareness of foodborne illnesses and the value of food safety grows. Antimicrobial preservatives minimize food spoilage and waste by inhibiting the growth of bacteria, yeast, and molds, extending the shelf life of food goods.

Food manufacturers have adopted antimicrobial preservatives more widely due to regulatory agencies approving their use in food items and ensuring their safety and effectiveness.

The antioxidant segment shows a notable growth in the food preservatives market during the forecast period. Since oxidation can cause spoiling and a decline in quality, antioxidants are essential in prolonging the shelf life of food goods. Products with few additives and preservatives are in greater demand as people seek healthier and more natural food options. Demand for antioxidants has increased since they are considered safer and more natural than synthetic preservatives.

Furthermore, people are actively looking for food products fortified with antioxidants due to growing awareness of these compounds' advantages for health, including the ability to lower the risk of chronic diseases and promote general wellness.

The meat & poultry products segment had the largest share of 32% in 2024 in the food preservatives market. Due to the substantial demand for these goods worldwide, preservatives are inevitably needed to preserve the freshness and lengthen the shelf life of meat and poultry products. Compared to other food products, meat and poultry are highly perishable. Throughout distribution, storage, and transit, preservatives guard against deterioration and preserve quality. Extended shelf life is required to enable the long-distance transportation of meat and poultry products due to the globalization of supply chains.

The beverages segment is the fastest growing in the food preservatives market during the forecast period. Preservatives are in high demand because busy-conscious consumers prefer convenient, ready-to-drink beverages. The desire for natural and clean-label preservatives over synthetic ones is rising as consumers become more health-conscious. In response, producers modify beverage formulas to include natural preservatives derived from spices, herbs, and plant extracts. Beverage makers constantly innovate with new flavors, formulas, and packaging to satisfy changing consumer demands. Preservatives must be used to preserve the freshness and quality of the product.

By Label

By Type

By Function

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

January 2025