What is the Antioxidants Market Size?

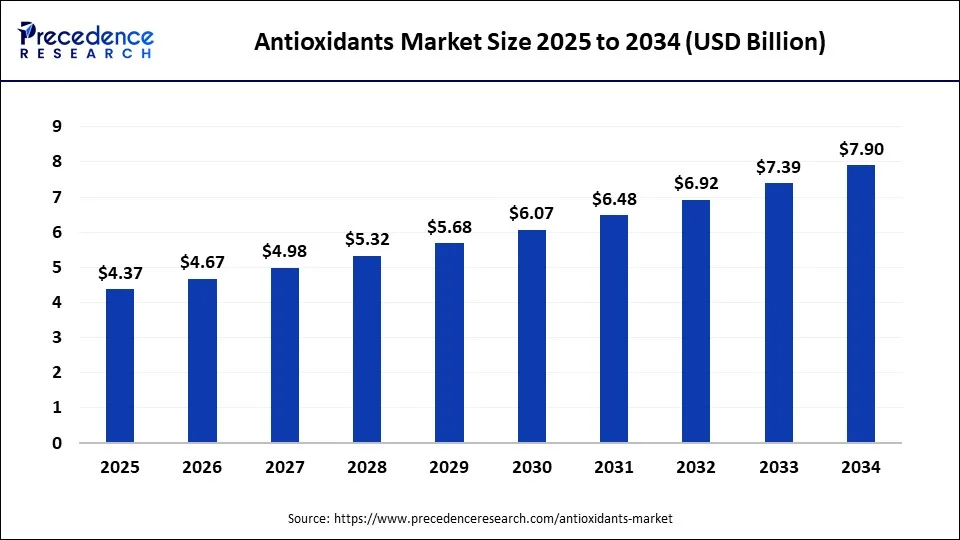

The global antioxidants market size accounted for USD 4.37 billion in 2025 and is anticipated to reach around USD 7.90 billion by 2034, expanding at a notable CAGR of 6.80% between 2025 and 2034.

Market Highlights

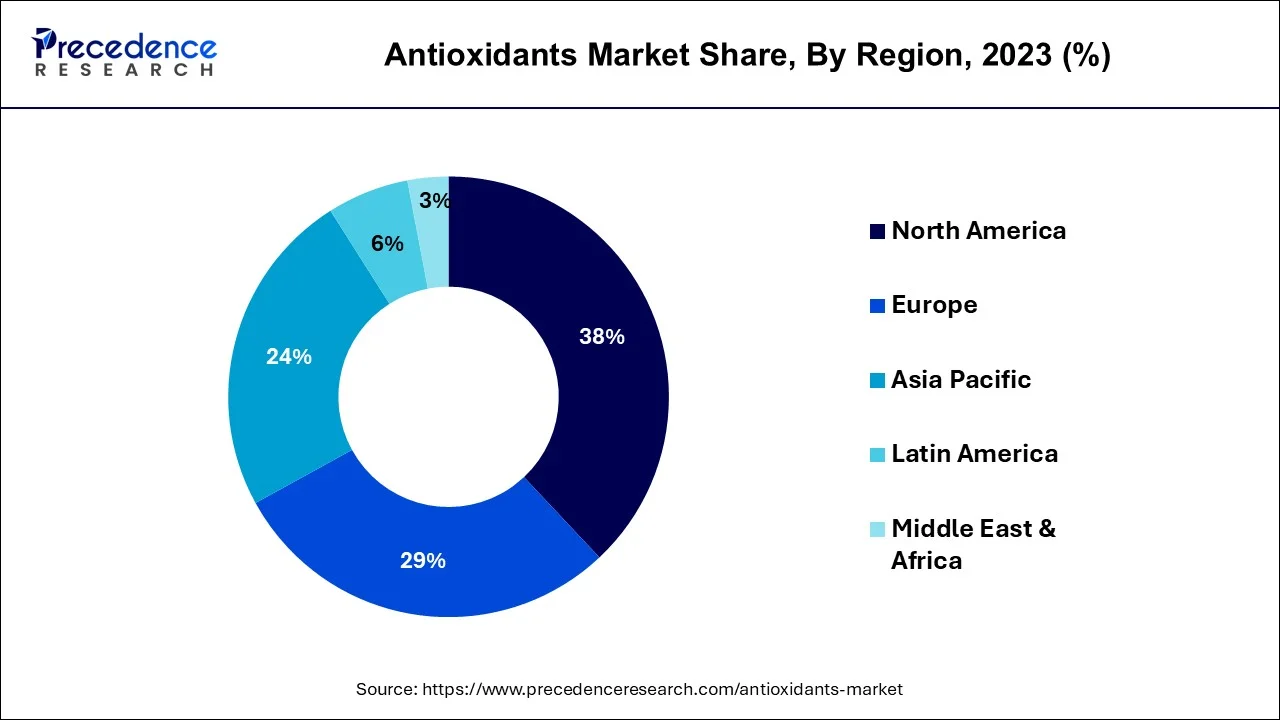

- North America contributed more than 38% of revenue share in 2034.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, the natural antioxidants segment has held the largest market share of 65% in 2025.

- By type, the synthetic antioxidants segment is anticipated to grow at a remarkable CAGR of 10.2% between 2024 and 2034.

- By form, the dry segment generated over 72% of revenue share in 2025.

- By form, the liquid segment is expected to expand at the fastest CAGR over the projected period.

- By application, the food and feed additives segment had the largest market share of 37% in 2025.

- By application, the pharmaceuticals and personal care products segment is expected to expand at the fastest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 4.37 Billion

- Market Size in 2026: USD 4.67 Billion

- Forecasted Market Size by 2034: USD 7.90 Billion

- CAGR (2025-2034):6.80%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The antioxidants market revolves around compounds that inhibit the oxidation of molecules, thereby protecting products from deterioration caused by chemical reactions with oxygen. Antioxidants are widely used in various industries, including food and beverages, cosmetics, pharmaceuticals, and petrochemicals, to prevent oxidation and extend product shelf life.

Antioxidants, prized for their potential health benefits and role in enhancing overall well-being, are witnessing increasing demand due to heightened consumer health awareness. This growing consciousness, coupled with the desire for products boasting extended shelf lives, propels the expansion of the antioxidants market. This dynamic sector offers a range of natural and synthetic solutions, catering to the diverse needs of various industries and applications.

Antioxidants Market Growth Factors

- Rising health consciousness among consumers propels demand for antioxidants in functional foods, dietary supplements, and cosmetics, as these compounds are associated with health benefits.

- Consumer preferences for clean label and natural ingredients boost the market for natural antioxidants derived from botanical sources.

- Increased demand for products with longer shelf lives, particularly in the food industry, drives the use of antioxidants to prevent oxidation and maintain product quality.

- Ongoing advancements in antioxidant formulations enhance their effectiveness and versatility across diverse applications.

- Antioxidants are finding innovative applications in petrochemicals, where they preserve the quality of fuels and lubricants.

- The development of antioxidant-infused functional foods and nutraceuticals offers growth opportunities, catering to health-conscious consumers.

- The cosmetics sector sees prospects in the integration of antioxidants to develop anti-aging and skin-enhancing products.

- The global market's expansion, especially in emerging economies, presents opportunities for manufacturers and suppliers to broaden their reach and customer base.

- In the cosmetics industry, there is a growing trend towards using antioxidants in clean label products, aligning with consumers' preferences for natural and transparent ingredients.

- Utilizing digital technologies and data analytics for quality control and monitoring of antioxidants' performance is an emerging trend in ensuring product effectiveness and regulatory compliance.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.37 Billion |

| Market Size in 2026 | USD 4.67 Billion |

| Market Size by 2034 | USD 7.90 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.80% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Form, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Extended shelf life demands and clean label movement

The relentless pursuit of products with extended shelf lives, particularly in the food and beverage industry, is a driving force in the antioxidants market. Consumers increasingly seek convenience and longevity in their purchases. Antioxidants play a pivotal role by inhibiting the oxidation process that leads to product degradation and spoilage. This not only satisfies consumer expectations for longer-lasting items but also reduces food waste and associated costs.

As manufacturers address this demand by incorporating antioxidants into their products, it propels the market forward, creating opportunities for innovation and the development of more sustainable, long-lasting food options.

The Clean Label Movement, characterized by a consumer preference for natural and transparent ingredients, has a profound impact on the antioxidants market. As synthetic additives fall out of favor, there is a growing demand for natural antioxidants derived from botanical sources. Consumers associate clean label products with health and wellness, and antioxidants align with these expectations.

As the market responds to this trend, it expands the range of available antioxidant sources and solutions, offering cleaner, more natural alternatives that cater to the discerning consumer palate. This clean label movement not only drives market growth but also reflects a broader shift in consumer values towards transparency, health, and sustainability.

Restraint

Health misconceptions and cost of natural antioxidants

Misconceptions and misinformation about antioxidants can act as restraints in the antioxidants market. In some cases, consumers may not fully understand the nuances of antioxidants' health benefits, leading to unrealistic expectations. Unsubstantiated claims about antioxidants' abilities to prevent or cure specific diseases can create skepticism among informed consumers.

Furthermore, the potential spread of misinformation within the marketplace can lead to consumer confusion and erode trust. To counteract this, manufacturers and suppliers may need to commit resources to educate consumers and implement transparent labeling to dispel these misconceptions. This endeavor can be a resource-intensive and time-consuming process, posing a financial restraint on market demand.

The cost of sourcing, processing, and testing natural antioxidants can be a significant restraint on market demand. Natural antioxidants, often derived from botanical sources, may involve complex extraction processes and necessitate quality testing to ensure their efficacy. These steps can be costly and time-intensive, affecting the overall production cost of antioxidant-enriched products.

Small and medium-sized manufacturers, in particular, may find it challenging to incorporate expensive natural antioxidants without significantly increasing their products' price points. This cost consideration can limit the accessibility and affordability of antioxidant-fortified goods, impacting their market competitiveness and consumer appeal.

Opportunity

Clean label cosmetics, functional foods, and nutraceuticals

The surge in demand for clean label cosmetics is significantly driving the antioxidants market. Consumers are increasingly seeking beauty products with natural, transparent ingredient lists. Antioxidants are embraced as ingredients that align with this clean label trend. These compounds offer anti-aging and skin-enhancing benefits, resonating with consumers looking for effective yet naturally derived solutions.

Cosmetic manufacturers are incorporating antioxidants into their formulations, enhancing product appeal and catering to the discerning preferences of health-conscious consumers. This upsurge in clean label cosmetics, featuring antioxidant-rich components, amplifies the demand for antioxidants in the cosmetics sector.

The growing market for functional foods and nutraceuticals represents another substantial driver for the antioxidants market. Consumers are increasingly seeking products that provide health benefits beyond basic nutrition. Antioxidants are incorporated into these products to support overall well-being, addressing specific health concerns.

Whether it's antioxidant-infused energy bars or dietary supplements targeting heart health, functional foods and nutraceuticals leverage antioxidants to meet consumers' wellness goals. This burgeoning demand in the sector propels the requirement for antioxidant-rich ingredients, offering opportunities for manufacturers to meet consumers' appetite for health-promoting foods and supplements.

Segments Insights

Type Insights

According to the type, the synthetic antioxidants segment held 65% revenue share in 2025. Synthetic antioxidants are artificially created compounds, such as BHA and BHT. They offer stable and cost-effective options for various industries. However, there's a trend towards reducing their use due to consumer concerns and the rise of natural alternatives, encouraging the development of innovative synthetic antioxidants with improved safety profiles. The antioxidants market continues to see a shift towards more sustainable and consumer-friendly options.

The natural antioxidants segment is anticipated to expand at a significantly CAGR of 10.2% during the projected period. Natural antioxidants are compounds derived from botanical sources like fruits, vegetables, and herbs. They are valued for their plant-based origins and health benefits, making them increasingly popular in the antioxidants market. As consumers prefer clean label products and natural ingredients, the demand for natural antioxidants has surged. Trends include using extracts like green tea, rosemary, and turmeric in various applications, aligning with the clean label movement.

Form Insights

The dry segment held the largest market share of 72% in 2025. Dry antioxidants are typically in powder or solid form and find extensive use in the food industry, where they prevent oxidation and extend shelf life. A notable trend is the increased adoption of dry antioxidants in the pharmaceutical and petrochemical sectors, where they protect against degradation and deterioration in various applications. Additionally, the convenience of dry antioxidants for storage and handling has contributed to their popularity in diverse industries.

The liquid segment is projected to grow at the fastest rate over the projected period. Liquid antioxidants are soluble in water or oil and are favored for their ease of incorporation into various formulations. The cosmetics industry has witnessed a rising trend in the utilization of liquid antioxidants in skincare products, as they provide texture and application benefits. Furthermore, the liquid form is prominent in the pharmaceutical sector for its compatibility with liquid medications and the ability to address oxidative stability challenges.

Application Insights

In 2025, the food & feed additives segment had the highest market share of 37% based on the application. In the antioxidants market, antioxidants find application in food & feed additives, serving as essential ingredients to prevent oxidation and extend the shelf life of various food products. A prominent trend is the increasing consumer preference for clean labels and natural antioxidants in these products, aligning with a desire for healthier and minimally processed food options. The demand for antioxidants in the food and feed industry is also driven by the need for extended product shelf life to reduce food waste and maintain product quality.

The pharmaceuticals & personal care products segment is anticipated to expand at the fastest rate over the projected period. Antioxidants play a vital role in pharmaceuticals & personal care products, where they are harnessed for their anti-aging and skin-enhancing attributes. A prevailing trend in this sector is the rising consumer demand for clean label cosmetics and skincare items, resulting in the integration of natural antioxidants to align with preferences for transparency and naturally sourced ingredients.

Furthermore, antioxidants are increasingly integrated into pharmaceutical formulations, with a focus on elevating the therapeutic attributes of medications and bolstering their shelf stability. This trend underscores the dual role of antioxidants in enhancing both personal care and pharmaceutical applications.

Regional Insights

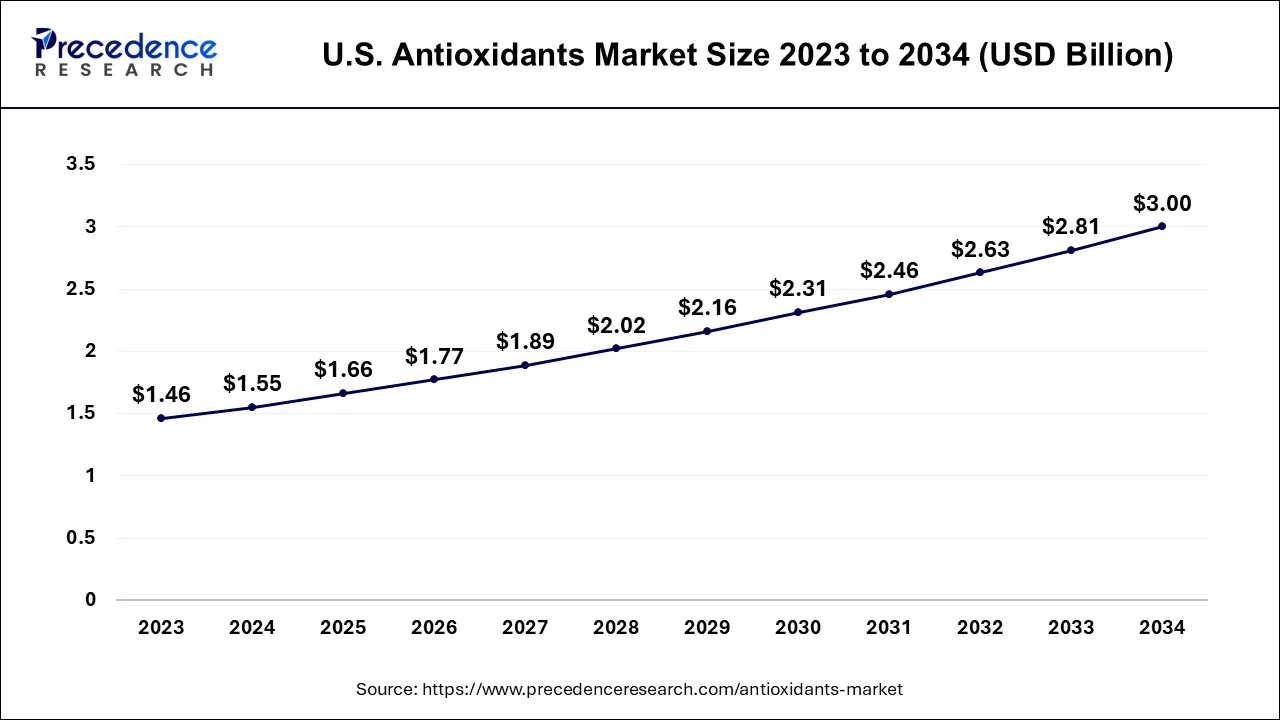

U.S. Antioxidants Market Size and Growth 2025 to 2034

The U.S. antioxidants market size is estimated at USD 1.66 billion in 2025 and is expected to be worth around USD 2.15billion by 2034, poised to grow at a CAGR of 6.87% from 2025 to 2034.

North America has held the largest revenue share 38% in 2025. In North America, the antioxidants market is driven by consumers' increasing health consciousness and the demand for clean-label products. Antioxidants are prominently featured in dietary supplements, functional foods, and cosmetics, aligning with health and wellness trends. Additionally, stringent regulatory standards influence the adoption of antioxidants across various industries, ensuring product safety and effectiveness.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific is witnessing dynamic growth in the antioxidants market. As disposable incomes rise and health awareness increases, there's a surge in demand for antioxidant-rich functional foods and dietary supplements. The cosmetics industry is also embracing antioxidants for their skin-enhancing properties. Furthermore, the region's culinary traditions offer opportunities for incorporating antioxidants into a wide array of dishes and snacks, aligning with consumer preferences for natural ingredients.

In the antioxidants market in Europe, the emphasis is on clean labels and natural ingredients. Consumers prioritize cosmetics and foods with transparent, natural, and minimally processed components. This trend boosts the demand for natural antioxidants sourced from botanical origins. Europe's stringent regulatory landscape fosters innovation and compliance, shaping the market to cater to consumer preferences for cleaner and healthier product options.

Antioxidants Market Companies

- Archer Daniels Midland Company

- DuPont de Nemours, Inc.

- Kemin Industries, Inc.

- BASF SE

- Koninklijke DSM N.V.

- Barentz

- Naturex

- Camlin Fine Sciences Ltd.

- Eastman Chemical Company

- Chr. Hansen Holding A/S

- E. I. du Pont de Nemours and Company

- Frutarom Industries Ltd.

- Kalsec Inc.

- Vitablend Nederland B.V.

- Archer Daniels Midland Company (ADM)

Recent Developments

- In 2022,ADM's acquisition of Yerbalatina Phytoactives expands its offerings in the food, beverage, and health sectors, adding over 100 botanical products. This strategic move bolsters ADM's position in functional nutrition, organic food colorings, and nutritional extracts.

Segments Covered in the Report

By Type

- Natural Antioxidants

- Synthetic Antioxidants

By Form

- Dry

- Liquid

By Application

- Food and feed Additives

- Pharmaceuticals and Personal Care Products

- Fuel and lubricant Additives

- Plastic, Rubber & latex Additives

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content