November 2024

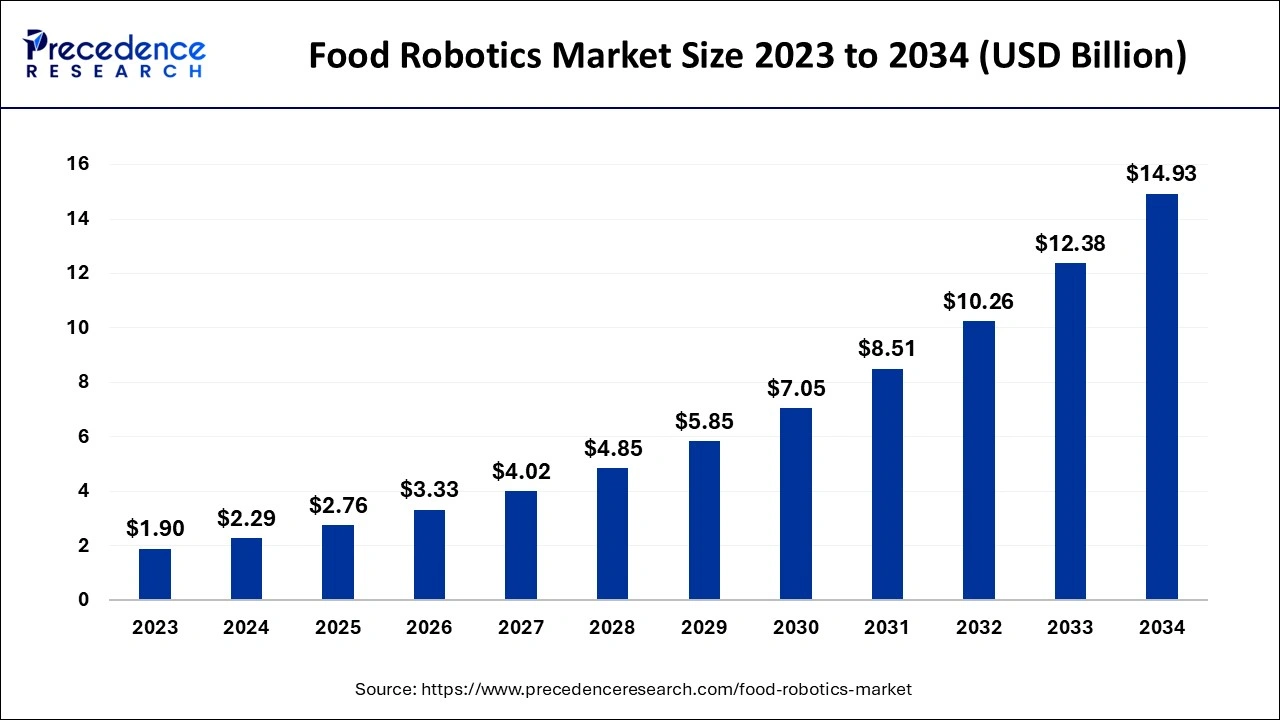

The global food robotics market size accounted for USD 2.29 billion in 2024, grew to USD 2.76 billion in 2025 and is expected to be worth around USD 14.93 billion by 2034, registering a healthy CAGR of 20.61% between 2024 and 2034. The Europe food robotics market size is evaluated at USD 0.78 billion in 2024 and is expected to grow at a fastest CAGR of 20.7% during the forecast year.

The global food robotics market size is calculated at USD 2.29 billion in 2024 and is predicted to hit around USD 14.93 billion by 2034, expanding at a CAGR of 20.61% from 2024 to 2034. The food robotics market is driven by the shortage of workers, particularly for repetitive, low-paying jobs like packaging and food preparation.

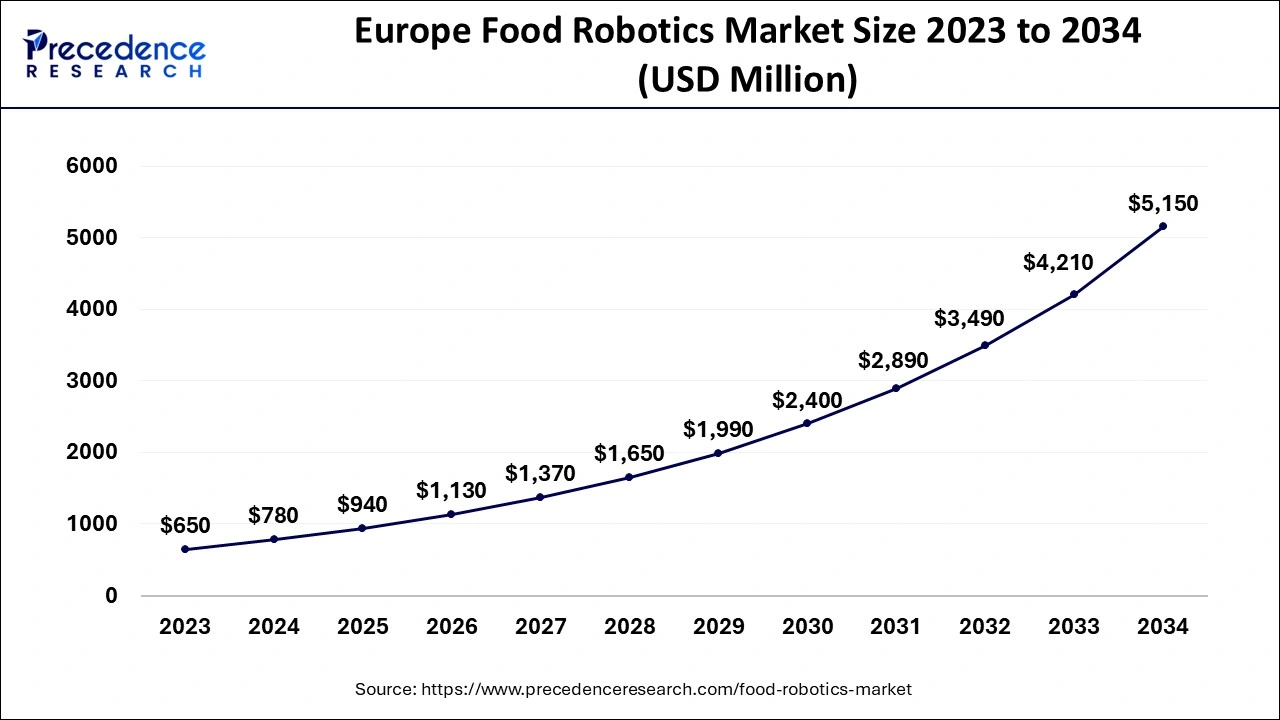

The Europe food robotics market size is exhibited at USD 0.78 billion in 2024 and is anticipated to reach around USD 5.15 billion by 2034, growing at a CAGR of 20.7% from 2024 to 2034.

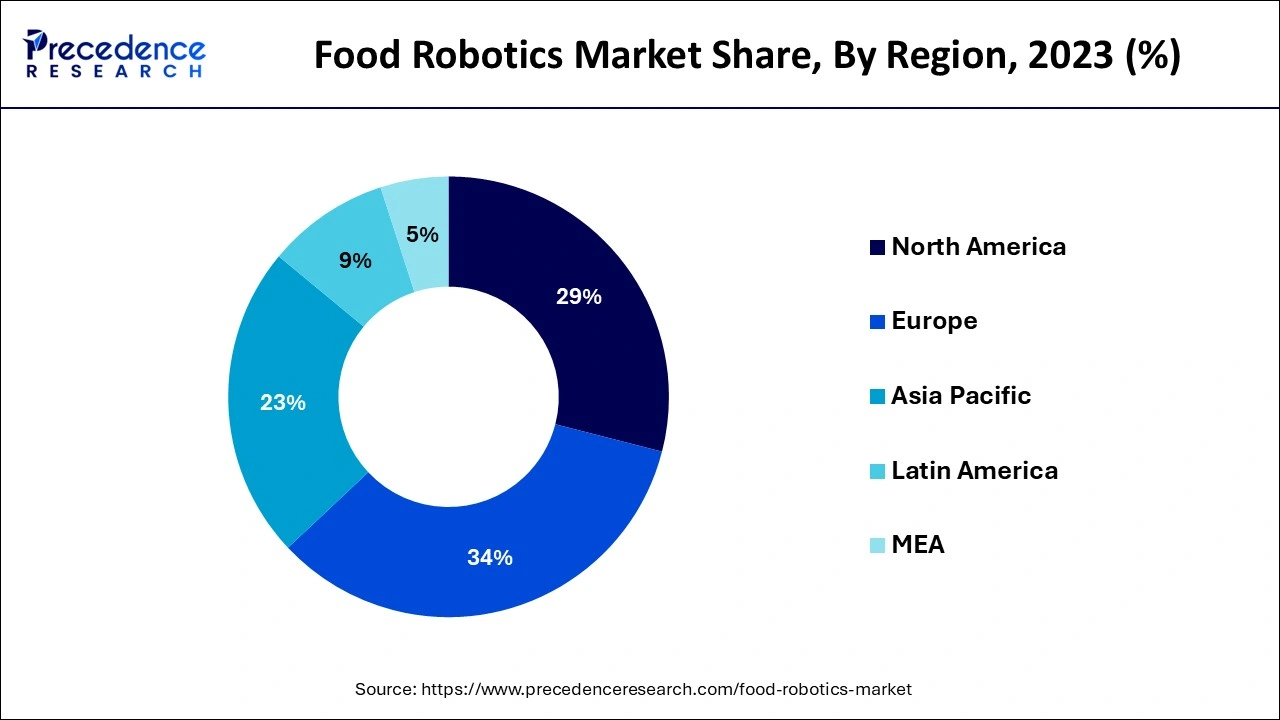

Europe dominated food robotics market in 2023. Food producers have been strongly encouraged to engage in robotics because of the high cost of manpower and labor shortages in Europe. Robots provide a cost-effective alternative for businesses that maintain production efficiency since they free up personnel for labor-intensive, repetitive jobs. A scarcity of trained laborers in various industries, such as food processing, has resulted from Europe's aging population. Food robots fill the void left by activities that are frequently physically taxing and less desirable to employees, particularly when cutting, slicing, and handling large materials.

North America shows a lucrative growth in the food robotics market in 2023. The need for automation is rising due to a chronic labor shortage, particularly in the food processing and packaging industries. These labor shortages can be filled with robotics, lowering operating costs. In food processing facilities, IoT-enabled robots are becoming more prevalent. A centralized system that tracks these robots' real-time performance optimizes output and reduces the chance of equipment failure.

Asia- Pacific is observed to be the fastest growing in the food robotics market during the forecast period. The quick development of robotics technology, particularly artificial intelligence (AI) and machine learning, makes more complex food robots possible. These robots can complete complex jobs like quality control, packaging, and cooking. Government and commercial sector partnerships are being formed to advance robotics technology research and make it easier for the food industry to embrace.

Food robotics boosts operational efficiency by automating repetitive food packaging, preparation, and transportation processes. Due to this automation, businesses may extend operations and meet growing demand without raising labor expenses proportionately, which can greatly enhance productivity. Modern robots can make it easier to customize food items, allowing companies to provide customers with individualized choices. This improves client happiness and loyalty and satisfies the growing demand from consumers for customized experiences and goods.

Robot installations in various countries of the world in 2021

| Country Name | Units installed in 2021 |

| China | 268,195 |

| Japan | 47,182 |

| Republic of Korea | 31,083 |

| Germany | 23,777 |

| Italy | 14,083 |

| France | 5,945 |

| United Kingdom | 2,054 |

How is AI helping the food robotics market growth?

| Report Coverage | Details |

| Market Size by 2034 | USD 14.93 Billion |

| Market Size in 2024 | USD 2.29 Billion |

| Market Size in 2025 | USD 2.76 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 20.61% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Robot, Payload, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing demand for packaged foods

Food producers must expand their production capacity in response to rising demand without sacrificing quality. These demands are partly met by robotics, which speeds up and improves packing processes. Robotics systems can operate nonstop, cutting down on downtime and increasing the efficiency of food production. Moreover, automated systems can easily adjust to modifications in product packaging, such as a change in packing format or size.

Need for more efficient production lines

Businesses in the food sector are constantly under pressure to satisfy consumer-driven trends like individualized products, speedy turnaround times, and the growing demand for mass production. Human work cannot meet these expectations alone because of inefficiencies, mistakes, and exhaustion. Because robotic systems can operate more quickly, precisely, and for longer periods of time, companies may scale up operations without sacrificing product quality. Additionally, because robots can adjust to various production configurations, businesses can more easily satisfy customer requests without incurring substantial downtime or expensive reconfiguration.

Rising food safety standards

Reducing the danger of contamination, which frequently results from human handling during food preparation, is one of the main objectives of food safety regulations. During processing and packaging, human interaction with food creates the possibility of contamination from foreign materials like hair or dirt and pathogens such as germs or viruses. Robots provide a solution and lower the risk of contamination by doing jobs like sorting, cutting, and packaging with little human assistance. Automation helps businesses comply with more stringent safety rules by guaranteeing that food goods are handled sterile.

Scarcity of skilled workforce in emerging economies

Personnel with specific expertise in automation, mechatronics, and artificial intelligence (AI) are needed for robotics, particularly in food processing, packaging, and handling. Workers with the technical know-how needed to install, maintain, and run complex robotic systems are frequently in short supply in emerging nations. Governments in many developing countries have not completely created programs or policies to encourage workforce development in automation and robots. The lack of government-sponsored training initiatives, financial aid, or public-private partnerships hampers developing a strong talent pipeline in the food robot's industry.

Technological advancements in robotic systems

Robotic systems can guarantee that food handling complies with safety standards, lowering the possibility of contamination. They can maintain accuracy and cleanliness that human workers would not be able to. Robotic systems may require a substantial initial investment, but over time, the operational savings from lower labor costs and greater productivity may exceed these expenditures.

Adoption of automation in food processing

Due to automation, food processing facilities can run at significantly faster speeds than they could with manual labor. Consistent and effective production rates are made possible by robots' ability to work continually without becoming tired. Increased production without a matching increase in labor is possible with automated systems, which are relatively easy to scale up as firms expand.

The articulated segment dominated the food robotics market in 2023. Robotic arms, also known as articulated robots, comprise several joints that provide a great range of motion. These robots can carry out intricate, exact jobs since they usually have three to six degrees of freedom. They can imitate human movements due to their adaptable design, making them appropriate for various food-handling procedures.

The SCARA segment is observed to be the fastest growing in the food robotics market during the forecast period. The SCARA robots are made to perform fast-paced jobs, such as packaging, pick-and-place, and assembly. They are perfect for food processing and packaging lines where efficiency is crucial because of their speed and accuracy. With their sophisticated sensors and vision systems, modern SCARA robots can conduct quality checks and make real-time modifications.

The medium segment held the largest share in the food robotics market in 2023. Medium-sized robots are believed to offer the best trade-off between price and performance. They provide the strength and accuracy required for most food processing jobs, including handling, cutting, and packaging, without the hefty price tag of larger, more industrial robots. Because of this, they are appealing to major food manufacturers and smaller businesses seeking efficiency at a fair price.

The heavy segment shows a notable growth in the food robotics market during the forecast period. Large food items or ingredients must be transported and stacked using heavy food robots, which are becoming more and more capable of carrying heavier loads. Heavy robots may now operate securely alongside humans in food processing settings because of advancements in safety features, including enhanced software integration and sophisticated sensors. This is essential to guarantee that personnel are not harmed by the robots' operations, particularly in high-speed production settings.

The palletizing segment dominated the food robotics market in 2023. Palletizing robots are intended to improve operational efficiency by automating labor-intensive and repetitive processes. Because these robots can work nonstop, food processing facilities can be more productive overall. Furthermore, robots can work in hostile conditions that may be difficult for human employees, including cold storage or regions exposed to pollutants. The adoption of robotic palletizing solutions is further propelled by this capacity, which complies with the stringent regulatory standards of the industry.

The picking segment is observed to be the fastest growing in the food robotics market during the forecast period. Robotic arms' increased sensitivity and accuracy allow them to handle a greater range of food items, including prepared meals and fresh vegetables, which raise their applicability in picking tasks. They are perfect for small and medium-sized businesses (SMEs) in the food industry because of their versatility. Even while they might lack the funds for extensive, wholly automated systems, they nonetheless wish to reap the benefits of automation.

Segments Covered in the Report

By Robot

By Payload

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

September 2024

July 2024

October 2024