January 2025

Food Service Packaging Market (By Product: Corrugated Boxes and Cartons, Plastic Bottles, Cups and Lids, Clamshells, Trays, Plates, Food Containers, and Bowls, Other Product Types; By End-User Industries: QSR, Institutional, Full-service Restaurants, Hospitality (Dine-ins, Coffee, Snack, etc.), Other End-user Industries) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

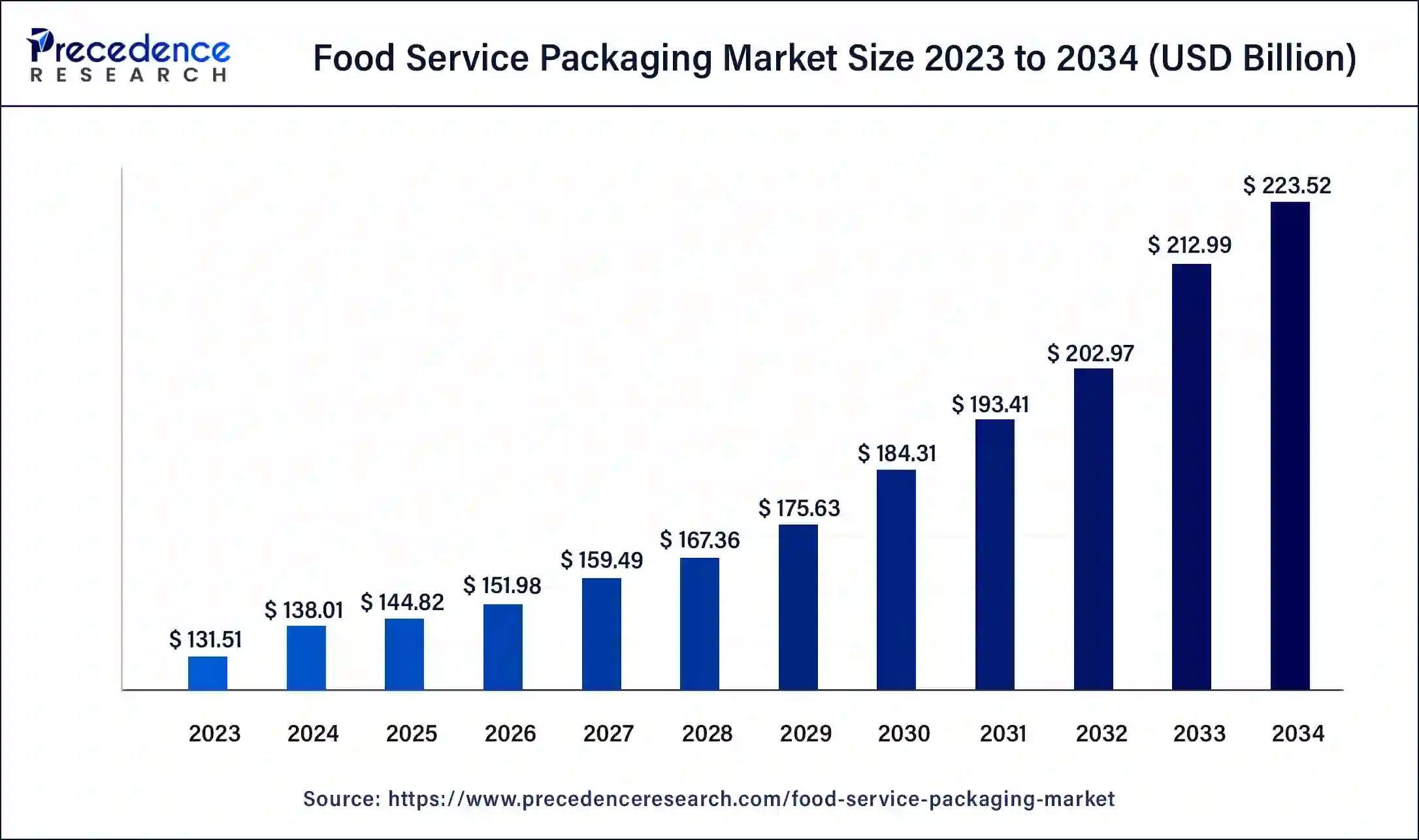

The global food service packaging market size was USD 131.51 billion in 2023, calculated at USD 138.01 billion in 2024 and is expected to reach around USD 223.52 billion by 2034, expanding at a CAGR of 4.94% from 2024 to 2034. The rising demand for sustainable food products across the world is driving the growth of the food service packaging market.

The global food packaging market size accounted for USD 377.05 Billion in 2023 and is projected to surpass around USD 679.71 Billion by 2033.

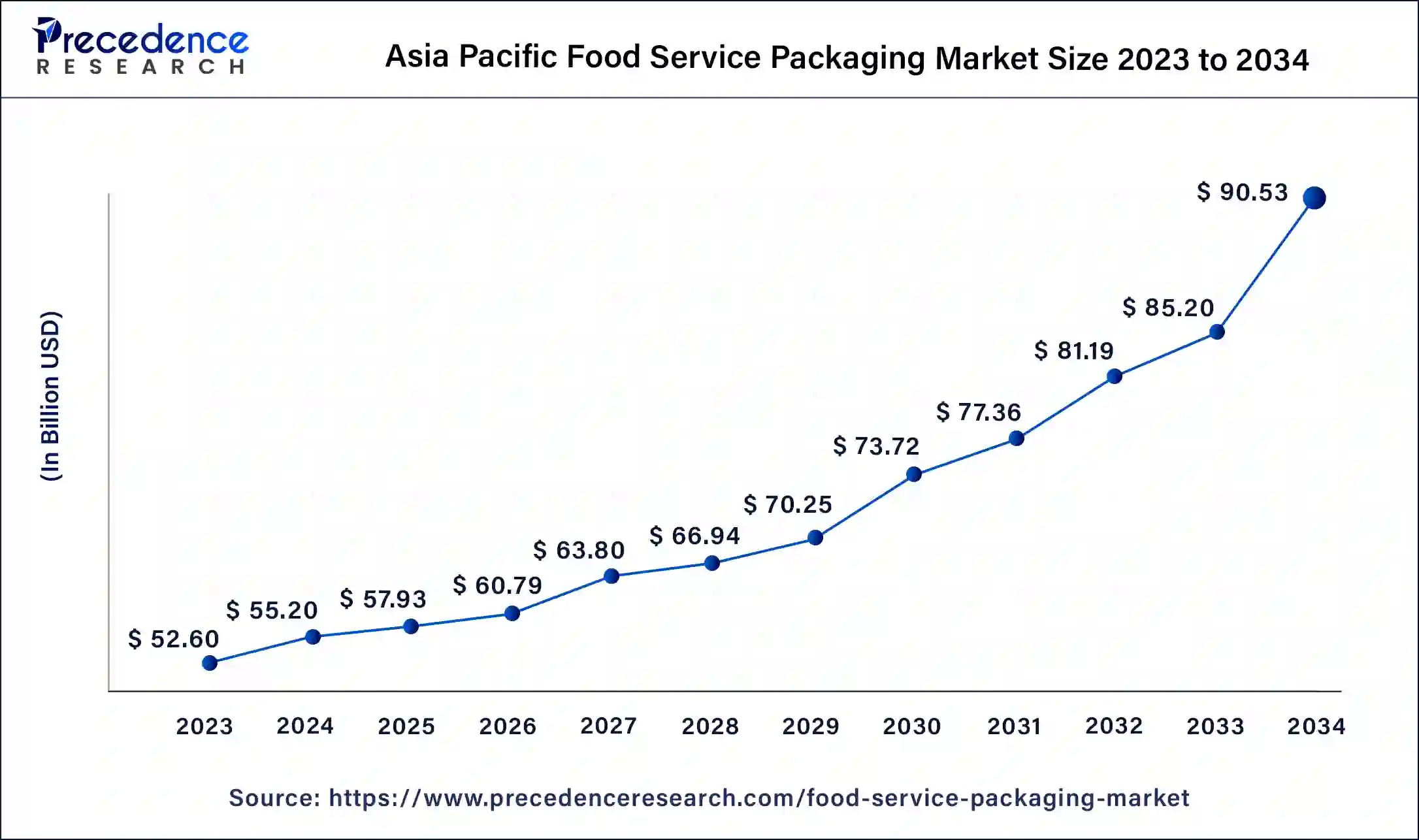

The Asia Pacific food service packaging market size was exhibited at USD 52.60 billion in 2023 and is projected to be worth around USD 90.53 billion by 2034, poised to grow at a CAGR of 5.05% from 2024 to 2034.

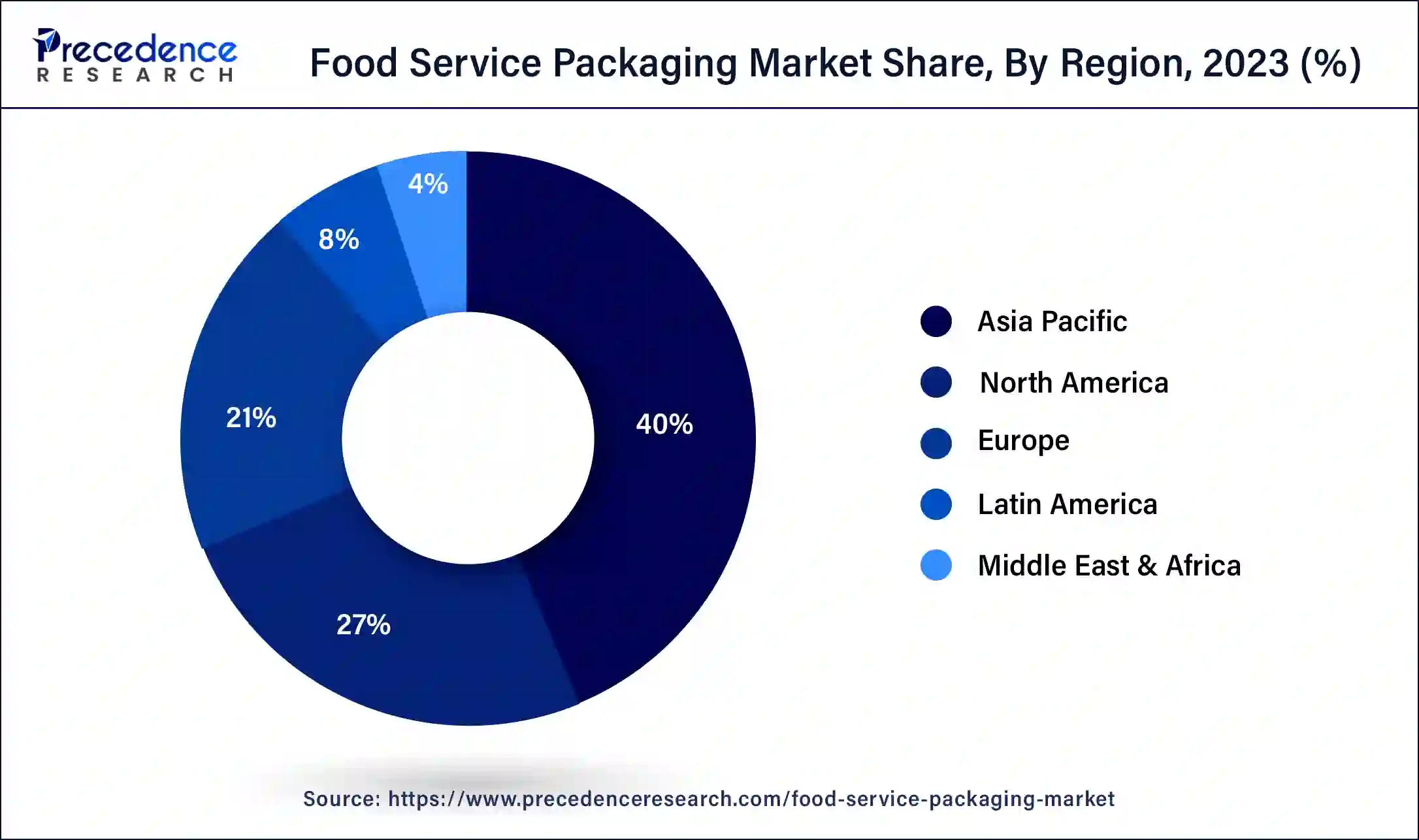

Asia-Pacific held the largest food service packaging market share in 2023. The market's growth in the Asia-Pacific region is mainly driven by the rising development of food industries in countries such as Japan, India, China, and others. The rising developments in the beverage sector, along with the rising demand for alcoholic and non-alcoholic drinks, have increased the demand for packaging solutions across the region, which, in turn, boosts the market growth. For instance, in December 2023, Coca-Cola launched Lemon Duo in India. Lemon Duo is an alcoholic drink that is manufactured using crushed lemons, infused in alcohol, and mixed with bubbles that deliver a unique taste to consumers.

Moreover, several local market players in food service packaging, such as Amcor PLC, Detpak, Takigawa Corporation, and others, are constantly engaged in developing food service packaging solutions and adopting strategies such as product launches and business expansions, which in turn drives the growth of the food service packaging market in this region.

Europe is expected to be the fastest-growing region during the forecast period. The growing number of restaurants and food chains has increased the demand for sustainable food containers, which, in turn, boosts market growth. Also, the rising number of corporate offices, colleges, hospitals, and others has increased the demand for food products, which in turn increases the demand for packaging services associated with it, which is likely to drive market growth. Also, the governments of several countries, such as the UK, France, Germany, and some others, have increased their emphasis on developing the food and beverage industries as they are major contributors to the GDP, which in turn drives market growth. For instance, in February 2024, the government of the UK announced that the food and drink manufacturing sector is prominent for the nation’s growth. It also stated that this sector contributed around 38 billion euros to the overall GDP of the United Kingdom.

Moreover, there are several local companies of food service packaging such as Hinojosa, Faerch, and some others, are constantly engaged in developing parenteral packaging solutions and adopting several strategies such as product launches and others, which in turn drive the growth of the food service packaging market in this region.

The food service packaging market is important in the packaging domain. This industry mainly deals in developing several packaging solutions for food products around the globe. This industry consists of several products, such as corrugated boxes and cartons, plastic bottles, trays, clamshells, and others. There are several materials that are used in the manufacturing of food packaging, such as aluminum, paperboard, molded fibers, and others. The food service packaging industry consists of several end-users, including QSR, institutional, full-service restaurants, hospitality (dine-ins, coffee and snacks, etc.), and others. This industry is expected to grow exponentially with the growth in the food and beverage industry.

Silgan Holdings announced that it had become the leading supplier and manufacturer of metal containers in North America and Europe, with net sales of US$3.1 billion for the metal containers segment in 2023, which represents a CAGR of around 7.2 % since 1987.

| Report Coverage | Details |

| Market Size by 2034 | USD 223.52 Billion |

| Market Size in 2023 | USD 131.51 Billion |

| Market Size in 2024 | USD 138.01 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.94% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End-User Industries, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for sustainable packaging solutions

The food and beverage industry has grown rapidly in recent times with the changing food habits and lifestyle transitions among people around the world. With the increased demand for ready-to-eat food, the demand for sustainable packaging solutions has increased due to the growing awareness among people regarding environmental protection along with government initiatives to mitigate pollution around the world. Thus, the growing demand for sustainable packaging solutions is likely to boost the growth of the food service packaging market during the forecast period. Moreover, several food service packaging companies are developing superior quality sustainable packaging solutions for various end-user industries that, in turn, drive market growth.

High cost and stringent rules

The applications of food service packaging are very important for storing and transporting food products across the world. Although the application of food service packaging in the food & beverage industry is worth mentioning, the problems associated with the prices of raw materials and the rising labor charges working in this industry have increased rapidly, which in turn increases the overall manufacturing cost of packaging. In addition, there are several rules and regulations in various countries that forbid the use of plastic packaging due to the growing burden of plastic waste across the world. Thus, the high cost associated with the manufacturing of food service packaging, along with strict rules regarding plastic waste, is expected to restrain the growth of the food service packaging market.

Integration of AI in food service packaging

The applications of AI have increased rapidly in the fields of labeling and packaging of food products due to its ability to provide accurate labeling and a superior level of packaging associated with food products. Currently, AI is being integrated into food service packaging industries to achieve superior outcomes and increase the brand awareness of the product among consumers. Thus, the growing integration of AI technology in food service packaging activities is expected to create ample growth opportunities for the food service packaging market players in the future.

The cups and lids segment held the largest market share in 2023. The growing applications of cups and lids from the food and beverage industries for maintaining the hygiene of various beverages are likely to boost the market growth. Also, the rise in the number of restaurants and cafes across the world has increased the demand for cups and lids, thereby driving market growth. Moreover, the demand for eco-friendly cups among consumers, along with the growing application of cups and lids in the quick service restaurant (QSR) sector and the fast-food sector, has driven the growth of the food service packaging market during the forecast period.

The plastic bottles segment is expected to grow with the highest compound annual growth rate during the forecast period. The rising demand for sustainable plastic bottles that are bio-degradable and recyclable has driven the market growth. Also, the growing application of plastic bottles for storing food products such as sauce, vinegar, mayonnaise, oil, ghee, and some others is likely to boost the market growth. Moreover, the demand for plastic bottles from the beverage sector for storing water, coffee, alcoholic drinks, cold drinks, and some others has propelled the growth of the food service packaging market. Furthermore, the rising developments in polyethylene terephthalate (PET) and high-density polyethylene (HDPE) polymers for manufacturing plastic bottles are boosting the market growth.

The QSR segment held the dominant share of the food service packaging market in 2023. The growing demand for bakery products, meat-based cuisines, burgers, pizzas, and some others has increased the demand for quick-service restaurants, which drives the market growth. Moreover, the rising popularity of global fast-food chains such as McDonald's, KFC, and Domino's around the world has boosted market growth. For instance, in December 2023, McDonald’s announced that it is the leading global food service retailer around the world with nearly 40,000 locations across 100 countries. Also, quick-service restaurants provide food items for a shorter duration of time than conventional restaurants, thereby boosting market growth.

Food service packaging companies have also started developing sustainable packaging items for QSR companies such as Domino, Mcdonald's, KFC, and others, which, in turn, drive market growth. For instance, in February 2023, Chuk launched a compostable delivery container. This container was launched with the aim of stopping the use of single-use plastic products for food delivery, and this container comes in four different sizes such as 350 ml, 500 ml, 750 ml, and 1000 ml.

The institutional segment is estimated to be the fastest-growing segment during the forecast period. The growing number of higher education institutes, corporate offices, hotels, and others across the world has increased the demand for food service packaging solutions, which is driving market growth. The rising application of coffee cups in corporate offices, along with the growing demand for food containers in schools and colleges, has boosted the market growth. Moreover, rising partnerships among coffee providers and delivery service providers worldwide are driving the growth of the food service packaging market. For instance, in June 2024, Starbucks announced a partnership with GrubHub. This partnership aimed to strengthen the coffee delivery chain in the cities of Colorado, Pennsylvania, and Illinois in the U.S. region.

Segments Covered in the Report

By Product

By End-User Industries

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

October 2024

January 2025