Foot And Ankle Devices Market Size and Forecast 2025 to 2034

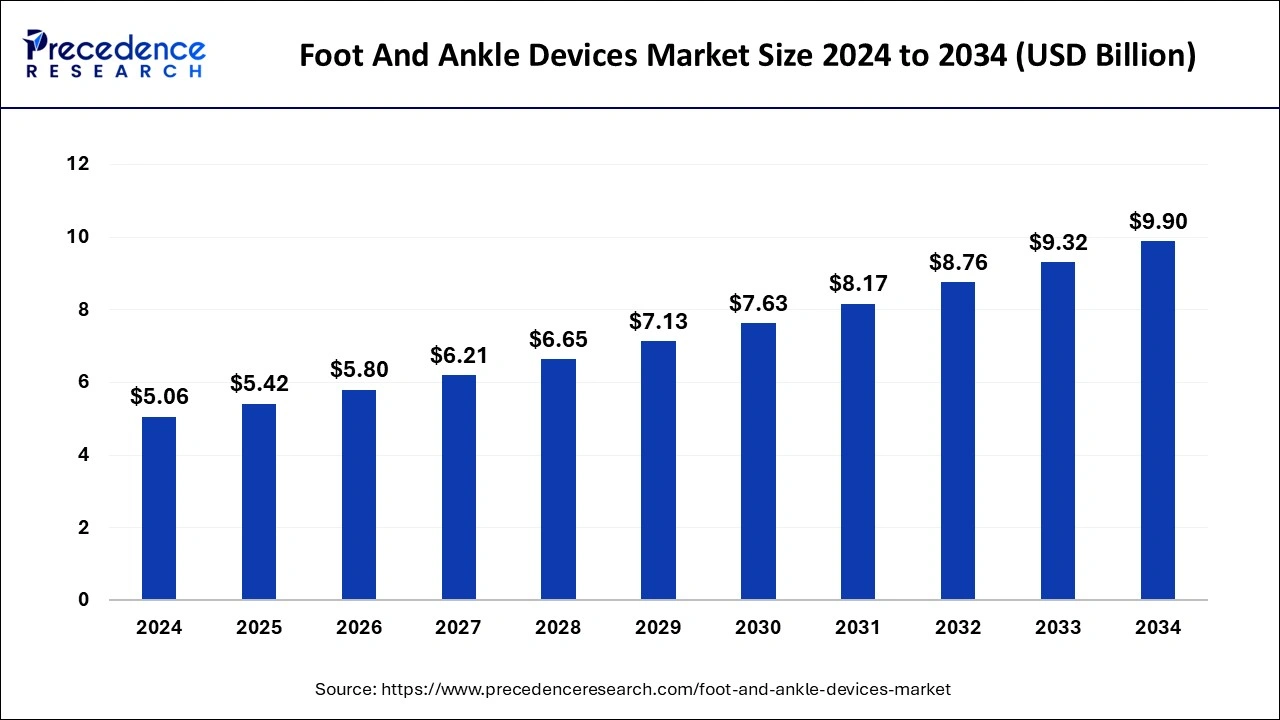

The global foot and ankle devices market size was estimated at USD 5.06 billion in 2024 and is predicted to increase from USD 5.42 billion in 2025 to approximately USD 9.90 billion by 2034, expanding at a CAGR of 6.94% from 2025 to 2034.

Foot And Ankle Devices MarketKey Takeaways

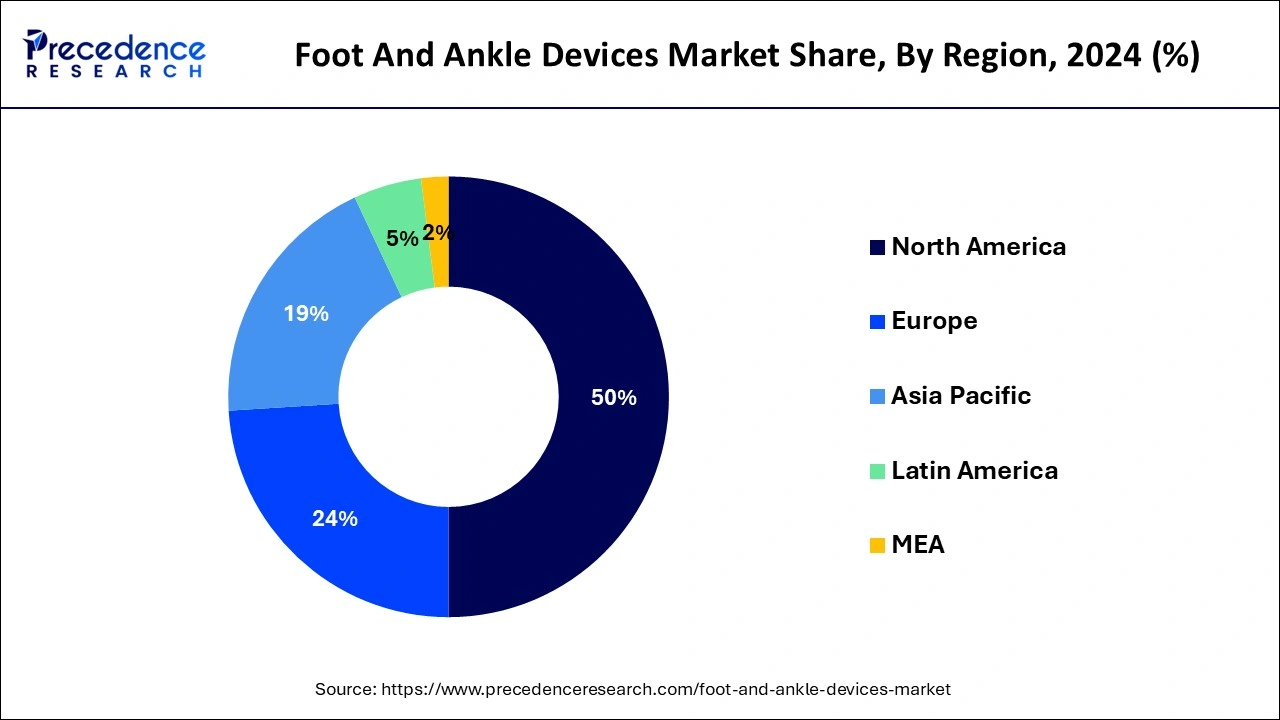

- North America led the global market with the largest market share of 50% in 2024.

- Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By Product, the orthopedic fixation segment has held the biggest revenue share in 2024.

- By Product, the soft tissue orthopedic devices segment is expected to expand at a significant CAGR during the projected period.

- By Application, the trauma segment dominated the global in 2024.

- By Application, the osteoarthritis segment is estimated to grow at the fastest CAGR over the projected period.

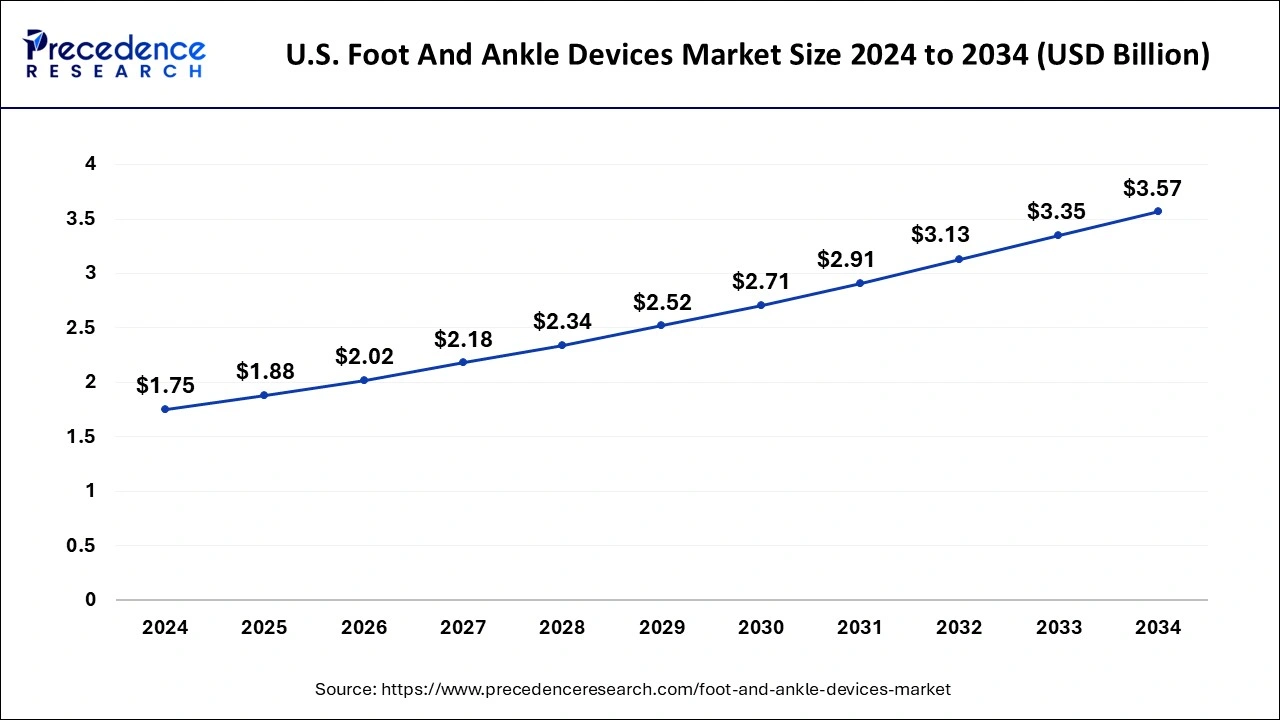

U.S.Foot and Ankle Devices Market Size and Growth 2025 to 2034

The U.S. foot and ankle devices market size was valued at USD 1.75 billion in 2024 and is estimated to reach around USD 3.57 billion by 2034, growing at a CAGR of 7.39% from 2025 to 2034.

North America held the largest revenue share in foot and ankle devices in 2024. This is due to the minimally invasive surgical procedures that are gradually becoming popular for the handling of foot and ankle disorders in North America. These measures offer various advantages over traditional open surgery, such as a smaller amount of pain, smaller recovery times, and decreased risk of complications. This may further drive demand for the market across the region.

Asia-Pacific is estimated to observe the fastest expansion in the foot and ankle devices market in 2024. This is because the incidence of foot and ankle conditions is growing rapidly in the Asia-Pacific region due to various factors such as the growing incidence of diabetes, the aging population, and the growing participation in recreational and sports activities. Moreover, the geriatric population is rising rapidly in Asia-Pacific, and this is anticipated to drive the demand for foot and ankle devices, as older adults are primarily more prone to experience foot and ankle problems.

The European foot and ankle devices market is anticipated to grow at a high rate during the forecast period. This is due to the technological advancements that are leading to the development of innovative and new foot and ankle devices in Europe. For instance, 3D printing is being used to create custom-made implants and orthotics that offer a more comfortable and precise fit. In addition, robotic surgery is being used to execute complex foot and ankle surgeries with greater accuracy and precision.

Market Overview

The foot and ankle devices market comprises a wide range of devices used to treat, diagnose, and manage foot and ankle disorders. The devices helps in protecting, supporting, or replacing damaged or diseased tissues and structures in the foot and ankle. Moreover, it is mainly used by healthcare professionals such as podiatrists, orthopedic surgeons, and physical therapists to cure a wide range of musculoskeletal issues and disorders affecting the lower extremities.

The market is driven by various factor such as medical necessity and to improve patients' quality of life by alleviating improving mobility, pain, and avoiding further difficulties in the lower extremities. Several companies in this industry constantly transform to improve new and enhanced devices and technologies to meet the rising demand for effective solutions and treatments for foot and ankle-related issues.

Foot And Ankle Devices MarketGrowth Factors

The foot and ankle devices market is expected to grow, driven by various factors such as the intensified awareness of foot and ankle health, sports injuries, rising aging population, the surge in prevalence of chronic diseases, and technological innovations. Moreover, the increasing awareness of ankle and foot health, the surging demand for cosmetic foot surgery, and the escalating healthcare infrastructure in developing countries are also anticipated to further fuels market growth. The surging demand for foot and ankle devices is generating a several opportunities for key market players. Companies that provide effective and innovative foot and ankle devices are well-positioned to profit on the growth of the market.

In addition, increasing prevalence of ankle and foot disorders is on the surge due to a several factors such as the rising incidence of diabetes, aging population, and the growing participation in recreational and sports activities. According to the World Health Organization, in 2019, about 520 million people globally suffering from osteoarthritis, a growth of 113% since 1990. Moreover, diabetes is another key risk factor for ankle and foot disorders, as it may harm nerves and blood vessels in the feet, which may led to complications such as foot ulcers and infections.

Furthermore, minimally invasive surgical procedures are becoming gradually popular for the cure of foot and ankle disorders. These procedures offer various advantages over traditional open surgery, such as less pain, shorter recovery times, and reduced risk of complications. For instance, in September 2023, Stryker launched an innovative internal fixation system using a minimally invasive surgical reduction of hallux valgus deformity and subsequent fusion for the treatment of bunions called as PROstep MIS Lapidus. The growing demand for minimally invasive surgical procedures is expected to drive the demand for foot and ankle devices, such as joint implants and fixation devices.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.94% |

| Market Size in 2025 | USD 5.42 Billion |

| Market Size by 2034 | USD 9.90 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing number of sports injuries and road accidents

Road accidents and sports injuries are disastrous events may cause traumatic injuries to the lower extremities such as ankle and foot, needing medical intervention and the use of specialized devices. Sports injuries, ranging from fractures and sprains to ligament tears, are becoming gradually common as physical movement and competitive sports continue to gain popularity globally. Amateur and professional athletes, need prompt and effective treatment to recover and resume their activities. Foot and ankle devices such as supports, braces, and orthopedic implants play an important role in endorsing healing, stabilizing injuries, and restoring mobility, making them vital in the field of sports medicine.

In addition, road accidents such as motorcycle accidents and car crashes may led to a range of lower extremity injuries, containing dislocations, fractures, and soft tissue damage. Ankle and foot devices are crucial for post-accident rehabilitation and may support accident victims recover their ability to walk and maintain an active lifestyle.

The demand for ankle and foot devices driven by advancements in technology, which led to the development of more effective and innovative solutions for treating sports-related and accident-related injuries. Forma Medical launched OptimalHT, the minimally invasive surgery (MIS) solution for the treatment of hammer toe. Thus, the foot and ankle devices market is poised for sustained growth, offering hope and improved outcomes for individuals who have suffered injuries due to sports or road accidents.

Restraints

Cost and affordability

Foot and ankle devices, ranging from orthopedic implants to custom orthotics, are essential for improving the quality of life and mobility of individuals with foot and ankle issues. However, several factors contribute to concerns about cost and affordability such as the initial expense associated with foot and ankle devices may be substantial. It may discourage both healthcare providers and patients from following these devices or treatments, mainly in regions where healthcare costs are high, or insurance coverage is limited. Moreover, insurance coverage may not always fully refund the expenses of these devices. Patients may find themselves burdened with out-of-pocket costs, led them to consider more economical, and possibly less effective, alternatives.

Furthermore, low-income individuals may face tasks in affording these devices, which may lead to hindered treatment or even denial of care, worsening their conditions. In addition, the competitive nature of the market may occasionally end in high prices as various companies invest in research, development, and marketing, which may further hinder affordability of the market. Efforts to lessen these concerns include promoting for improved insurance coverage, discovering cost-effective manufacturing processes, and promoting governmental policies that prioritize convenience to essential foot and ankle devices. Thus, assuring affordability is critical to guarantee that all individuals, irrespective of their financial circumstances, have access to the vital treatments and devices to retain their foot and ankle health and whole well-being.

Opportunities

Technological advancement in foot and ankle devices

Technological advancements leading to the increase of innovative and new foot and ankle devices that are further affordable, effective, and accessible to patients. Advanced technologies such as 3D printing and digital imaging is one such example which helps in further creating various opportunities in the foot and ankle device market. For instance, in May 2022, UNYQ Inc., launched an innovative prosthetic feet for persons with amputations, UNYQ FOOT.

It will use technology to capture user design preferences and biometrics, a process that includes 3D printing, 3D imaging, and design finishing. 3D printing is used to create custom-made implants and orthotics that provide a more precise and comfortable fit than traditional devices. 3D-printed implants and orthotics are also more durable and less likely to break or crack.

In addition, robotic surgery is another example of a technological advancement that is creating opportunities in the foot and ankle device market. It is used to perform complex ankle and foot surgeries with higher accuracy and precision than traditional open surgery. It may also help in reducing the risk of complications and shorten the recovery time. Furthermore, innovations in surgical instruments and imaging systems have paved the way for minimally invasive procedures.

These techniques reduce recovery times, ease patient trauma, and increase the scope of treatable conditions, opening up new market segments. Thus, these technological advancements are producing various opportunities for manufacturers that function in the foot and ankle device market. Companies that can develop innovative and effective foot and ankle devices are well-positioned to capitalize on the growth of this market.

Product Insights

According to the product, the orthopedic fixation product segment has held the highest revenue share in 2024. Orthopedic fixation devices include screws, plates, wires, and pins used to stabilize fractured bones and facilitate the healing process. In the context of the foot and ankle, these devices are essential for surgical fracture repair and joint fusion procedures.

Soft tissue orthopedic devices is anticipated to expand at a significant CAGR during the projected period. These devices may provide targeted cushioning, compression, and support. The devices are used to address conditions and injuries concerning tendons, muscles, and ligaments in the foot and ankle. It also include devices for plantar fasciitis, Achilles tendonitis, and other soft tissue injuries.

Application Insights

Based on the application, the trauma segment is anticipated to hold the largest market share in 2024. Traumatic injuries to the foot and ankle may include dislocations, fractures, and soft tissue injuries caused by falls, accidents, or sports-related incidents. The devices in this segment comprise a wide range of solutions, such as fixation devices, orthopedic implants, and braces, used to stabilize and repair the affected area.

On the other hand, Osteoarthritis is projected to grow at the fastest rate over the projected period. It involves the degeneration of joint cartilage, leading to pain, inflammation, and reduced mobility. Foot and ankle devices for osteoarthritis management include orthotics, specialized footwear, joint implants, and bracing support to alleviate pain and improve joint function.

Foot and Ankle Devices Market Companies

- Stryker Corp.

- Johnson & Johnson (De PuySynthes)

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew plc

- Ossur

- Enovis

- Acumed, LLC

- Arthrex, Inc.

- Paragon 28

- Orthofix

Recent Developments

- February 2021: US FDA (Food and Drug Administration) approved implant for the treatment of avascular necrosis (AVN) of the ankle joint additive orthopedics' 3D-printed patient specific talus spacer for the humanitarian use device. Avascular necrosis is an exceptional but severe progressive condition that may result in death of bone tissue.

- December 2022: Stryker launched a suture anchor system for foot and ankle surgical procedures, Citrefix. It features bioresorbable material that is aimed to mimic the chemistry and structure of native bone.

- April 2023: Paragon 28, Inc. launched intramedullary device for fixation of in-line shortening osteotomies of the lesser metatarsals, Phantom Metatarsal Shortening System.

Segments Covered in the Report

By Product

- Bracing and Support

- Joint Implants

- Soft Tissue Orthopedic Devices

- Orthopedic Fixation

- Prosthetics

By Application

- Hammertoe

- Trauma

- Osteoarthritis

- Rheumatoid Arthritis

- Neurological Disorders

- Bunions

- Osteoporosis

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa