April 2025

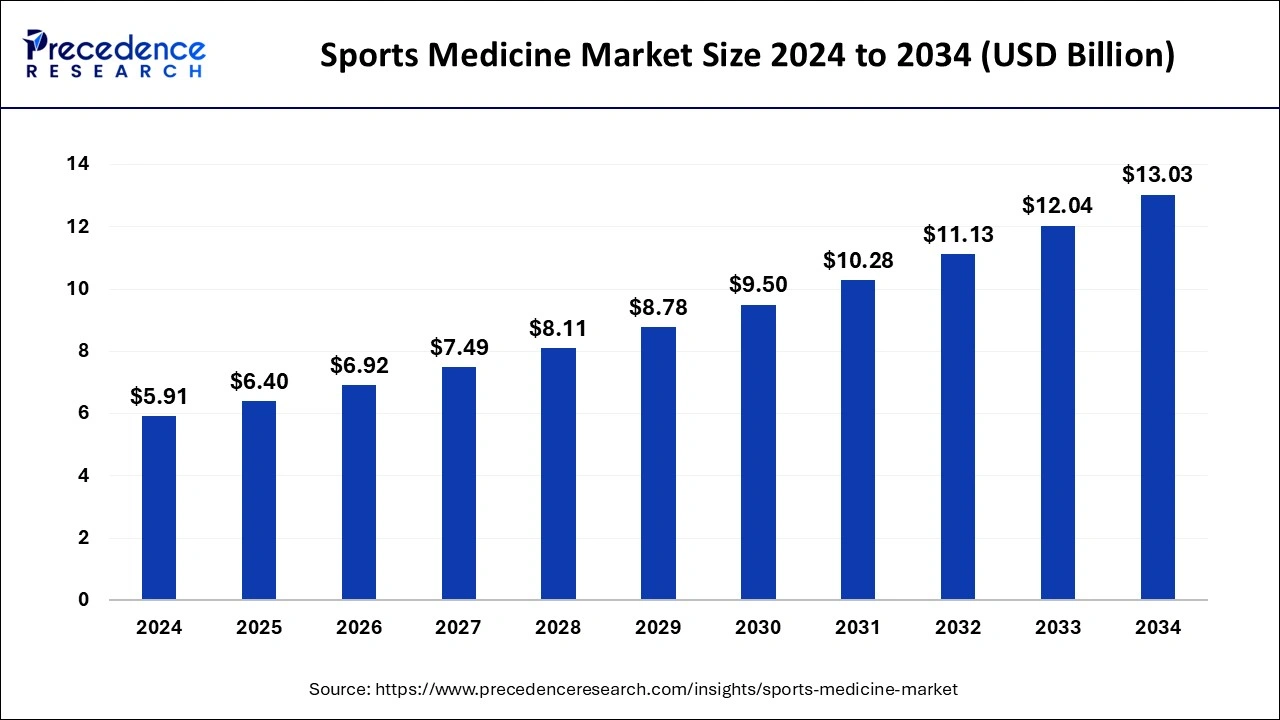

The global sports medicine market size is calculated at USD 6.40 billion in 2025 and is forecasted to reach around USD 13.03 billion by 2034, accelerating at a CAGR of 8.23% from 2025 to 2034. The North America sports medicine market size surpassed USD 2.78 billion in 2024 and is expanding at a CAGR of 8.33% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global sports medicine market size was estimated at USD 5.91 billion in 2024 and is anticipated to reach around USD 13.03 billion by 2034, expanding at a CAGR of 8.23% from 2025 to 2034. With growing participation in sports and growing sports activities across the globe, the demand for sports medicine is also growing, which is boosting the growth of the sports medicine market.

Artificial intelligence (AI) is transforming sports medicine by bringing cutting-edge methods for injury diagnosis, treatment, rehabilitation, and prediction. Advances in wearable technology, sophisticated data analytics, and improved medical imaging methods are driving the use of AI in sports medicine. An athlete's biomechanical data may be analyzed by AI algorithms to predict injury risks, provide individualized feedback, and design customized rehabilitation plans. AI also increases the accuracy of medical imaging, which makes it easier to diagnose injuries.

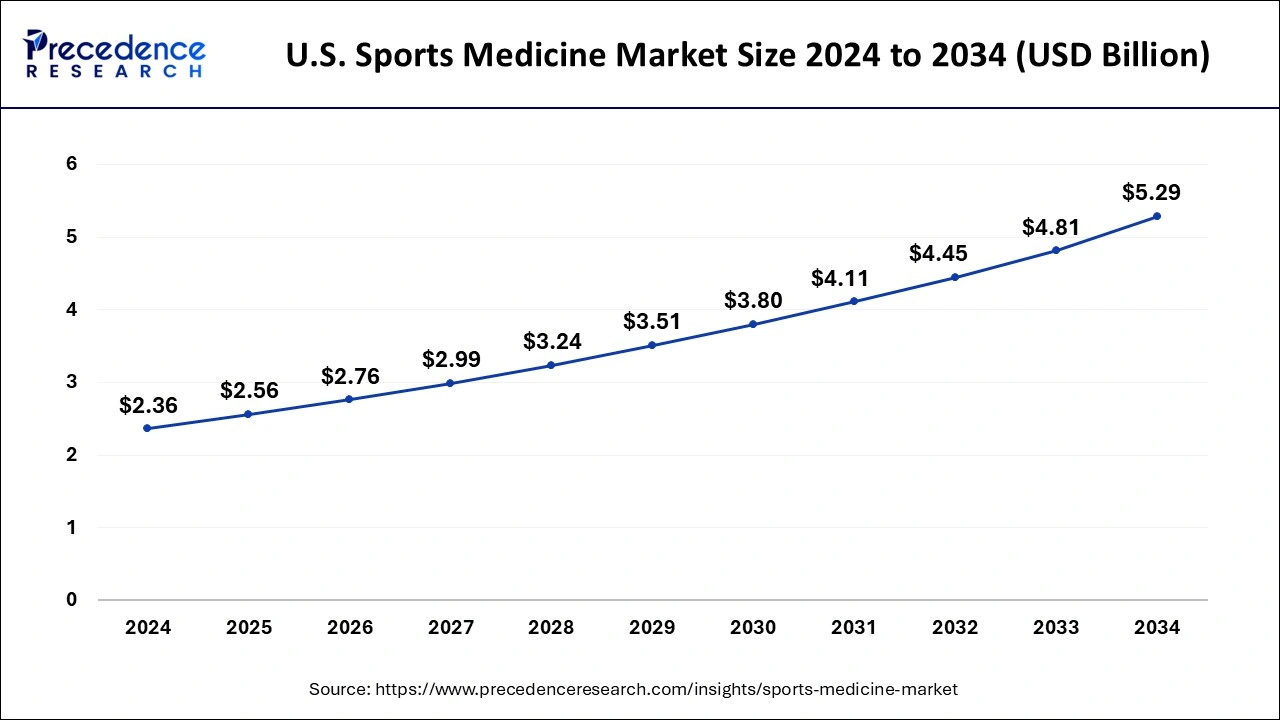

The U.S. sports medicine market size was evaluated at USD 2.36 billion in 2024 and is predicted to be worth around USD 5.29 billion by 2034, rising at a CAGR of 8.40% from 2025 to 2034.

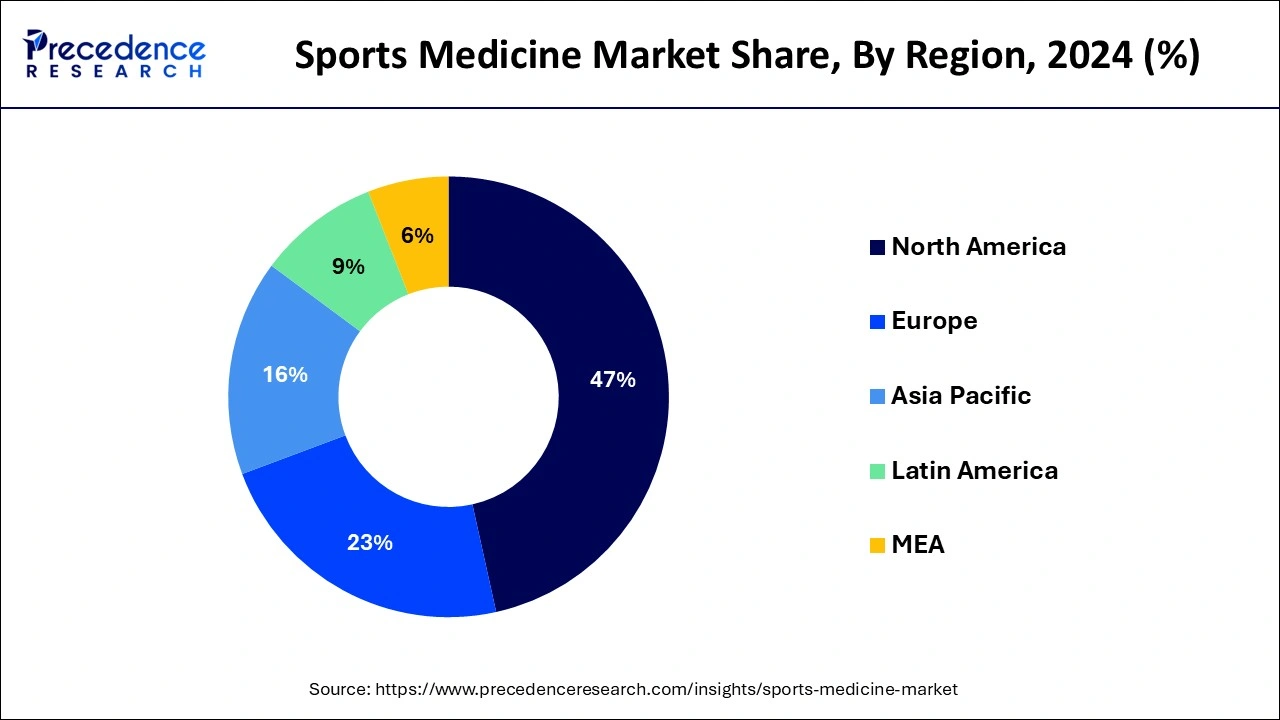

North America led the sports medicine market with the largest market share of 47% in 2024.

Due to millennials' growing infatuation with exercise and fitness, there is an increasing need for sports medicine in the nation. Additionally, doctors are teaching people about the need to engage in regular physical activity for disease prevention and health maintenance.

Asia Pacific is estimated to host the fastest-growing sports medicine market in 2024. It is projected that growing demand for these medications from developing nations like China, India, and Japan would accelerate the region's market expansion. In addition, the Asia Pacific Knee, Arthroscopy, and Sports Medicine Society (APKASS) hold yearly conferences to train medical professionals. The purpose of these conferences is to raise awareness of the latest advancements in this field of medicine, update information, and support education. It is projected that these variables will raise the need for sports medical equipment and the adoption of athletic vocations, which will enhance market revenue.

In China, where the government has made significant investments in recent decades to become a global force in the Olympics and other sports and to promote physical activity rates that would enhance public health, sports are becoming more and more popular. The establishment and growth of academic sports medicine organizations in China is being spearheaded and led by the China Sport Science Society. The government makes an effort to provide top athletes with comprehensive support and aid. The government gave the Hong Kong Sports Institute (HKSI) around $941.6 million in 2024–2025 from the Elite Athletes Development Fund, which is more than 40% higher than it was five years prior (2019–20).

A wide variety of medical and paramedical specialities are included in the relatively new medical speciality of sports medicine. Although it's a popular misconception that sports medicine is solely relevant for athletes and sports professionals, it has applications for everyone, including those who are healthy and active.

Amateur athletes are becoming more interested in sports medicine, which improves overall public health by promoting physical activity and quality of life. The discipline thus covers all years, from childhood to old age, intending to maintain and promote physical health throughout all age groups. Sports medicine, commonly referred to as sports and exercise medicine (SEM), is a field of medicine that focuses on preventing, diagnosing, and treating injuries that are sustained during sports or physical activity. Its main goal is to support athletes in exercising safely and effectively to meet their training objectives. Sports medicine specialists typically have specialized training to help patients maximize function and reduce handicaps. They deal with various physical ailments, such as acute traumas like strains, sprains, fractures, and dislocations, chronic overuse injuries like tendonitis, degenerative illnesses, and overtraining syndrome.

The increasing use of wearable technology, such as fitness bands, to track athletes' stress levels and prevent athlete fatigue and injury issues has contributed to the market's growth.

Due to an increase in sports injuries and the number of people engaging in athletic and fitness activities, there is a rising demand for sports medicine. The market is expected to grow over the forecast period due to the switch from a strategic approach to preventative care for sports-related injuries.

The high cost of implant materials significantly constrains the market's expansion. In nations like India, where only a tiny percentage of the population has access to health insurance, an expensive implant poses a severe threat to the market's expansion. Since orthopaedic surgeons undertake most operations for sports injuries, a significant barrier for the business is the need for educated orthopaedic doctors.

Additionally, it is anticipated that during the forecast period, a rise in public-private funding for focused research, an increase in children's participation in sports, and an increase in innovation and development due to technological advancements globally will present lucrative opportunities for market participants.

| Report Coverage | Details |

| Market Size in 2025 | USD 6.40 Billion |

| Market Size by 2034 | USD 13.03 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.23% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type and By Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Sports injuries are becoming more common everywhere, which is directly affecting the market's expansion. This predicts that rising rates of knee injuries, sore muscles, Achilles tendon injuries, pain along the shin bone, rotator cuff injuries, fractures (broken bones), and dislocations are directly influencing the market's growth. According to the Board of Certification for Athletic Trainers, an estimated 2 million acute ankle injuries happen each year in the United States. Rising investment in research & development, particularly in developed and developing nations, will further open up attractive market expansion potential for medical instruments and technologies.

The market growth rate is also being boosted by research and development efforts being made to comprehend the human body. Another significant element promoting market growth is the increased focus on improving the state of healthcare facilities and the infrastructure for healthcare as a whole. Increased public-private partnerships and strategic collaborations to fund and implement new and improved technology are also opening up attractive market prospects.

However, the increase in product recalls, and the need for healthcare infrastructure in underdeveloped nations are impeding market expansion. For instance, Zimmer Biomet recalled several medical products in 2016, including bones, surgical screws, implants, and instruments for trauma and sports medicine. Additionally, the total number of medical devices recalls rose by 126% in the first quarter of 2018. Customers' perceptions of a product and a firm become more negative as a result of a product recall, which is currently impeding the market for sports medicine.

Due to slow economic growth, underdeveloped and developing nations need more sophisticated healthcare infrastructure. These nations also have relatively low levels of government spending on healthcare, which inhibits the use of these items. Furthermore, one reason for the delayed growth of sports medicine in these nations is a need for athletic culture.

Sports medicine is anticipated to expand as manufacturers place more emphasis on regenerative medicine research and clinical clearances.

Regenerative medicine provides cutting-edge treatments for the non-surgical management of frequent incidences associated with damage. Treatments typically use the patient's own totipotent cells to encourage the repair of the wounded part of the body. Regenerative medicine is receiving a lot of attention due to the potential of these stem cells to increase knowledge in developmental biology, medicine, and big pharma. A doctor might suggest a regenerative medicine treatment plan when a sports injury is difficult to repair with typical non-surgical remedies like rest and physical therapy. This covers therapies, including stem cell therapy, platelet-rich plasma therapy, and specific cartilage repair techniques. This is a crucial element anticipated to fuel the market for sports medicine expansion.

The market's major companies likewise concentrate on growing their operations in developing nations. For example, Smith & Nephew opened its first Medical Education Centre for the Asia Pacific in Singapore in November 2021.

The sthe body reconstruction and repair segment has held a major market share of 41% in 2024. Devices, including surgical tools, soft tissue repair tools, and bone reconstruction tools, are included in the body reconstruction and repair sector. The significant market share was attributable to the rising use of arthroscopy devices in minimally invasive procedures, the use of fracture and ligament repair devices, and both.

On the other hand, over the projected period, the accessories section is anticipated to develop the fastest. Bandages, tapes, wraps, disinfectants, and other items needed for treating minor sports injuries are primarily included in this segment. The primary driver propelling the growth of this market is the increasing use of PRICE (Protection, Rest, Ice, Compression, and Elevation) therapy as the urgent treatment for any sports injury.

The knees segment dominated the global market in 2024 because of the ongoing rise in knee injuries. A lot of sports-related and other physical activity-related ailments involve the knee, and this is due to the knee joint's deterioration caused by excessive running and jumping. Knee injuries are quite frequent and makeup about 41% of all sports injuries, according to the British Journal of Sports Medicine.

Additionally, there are a number of cutting-edge therapies available, such as arthroscopic knee replacement, dry needling, soft tissue massage, osteopathic manipulation, and platelet-rich plasma therapy. Some key reasons influencing the segment's growth are the large range of readily available therapies and the rising prevalence of knee injuries.

By Product Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2024

February 2025

January 2025