November 2024

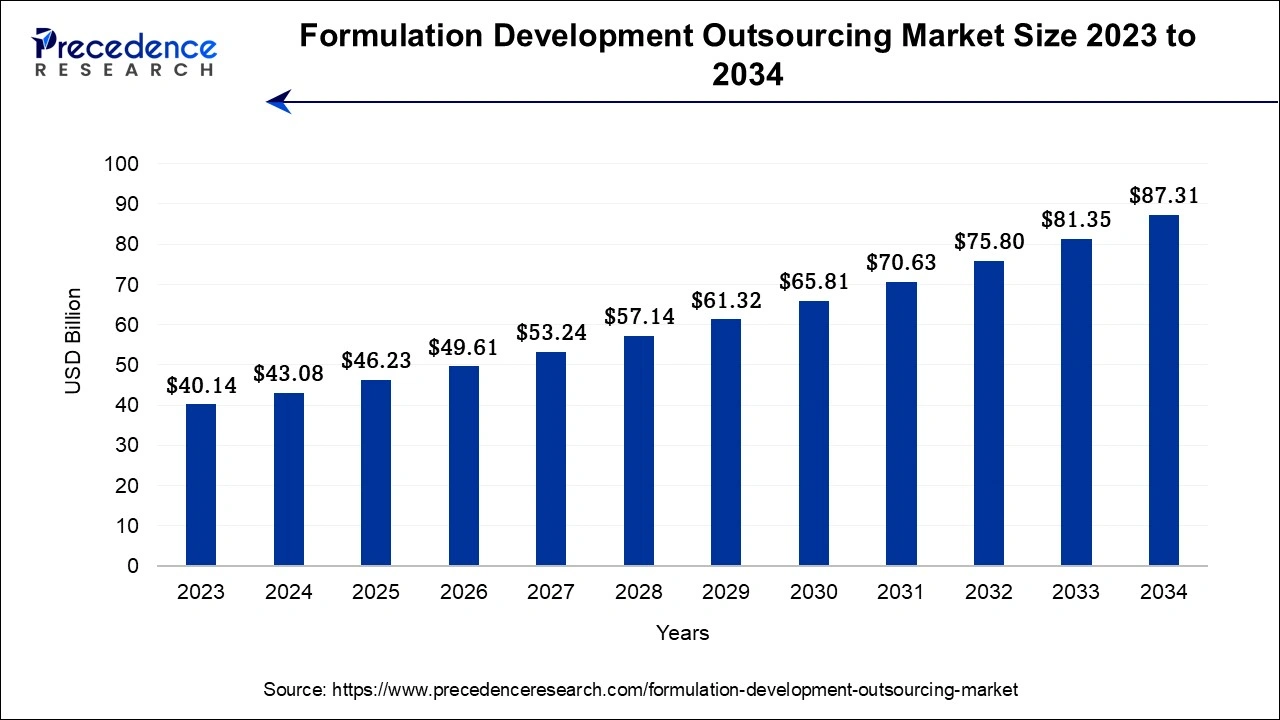

The global formulation development outsourcing market size accounted for USD 43.08 billion in 2024, grew to USD 46.23 billion in 2025 and is projected to surpass around USD 87.31 billion by 2034, representing a healthy CAGR of 7.32% between 2024 and 2034.

The global formulation development outsourcing market size is estimated at USD 43.08 billion in 2024 and is anticipated to reach around USD 87.31 billion by 2034, growing at a CAGR of 7.32% from 2024 and 2034.

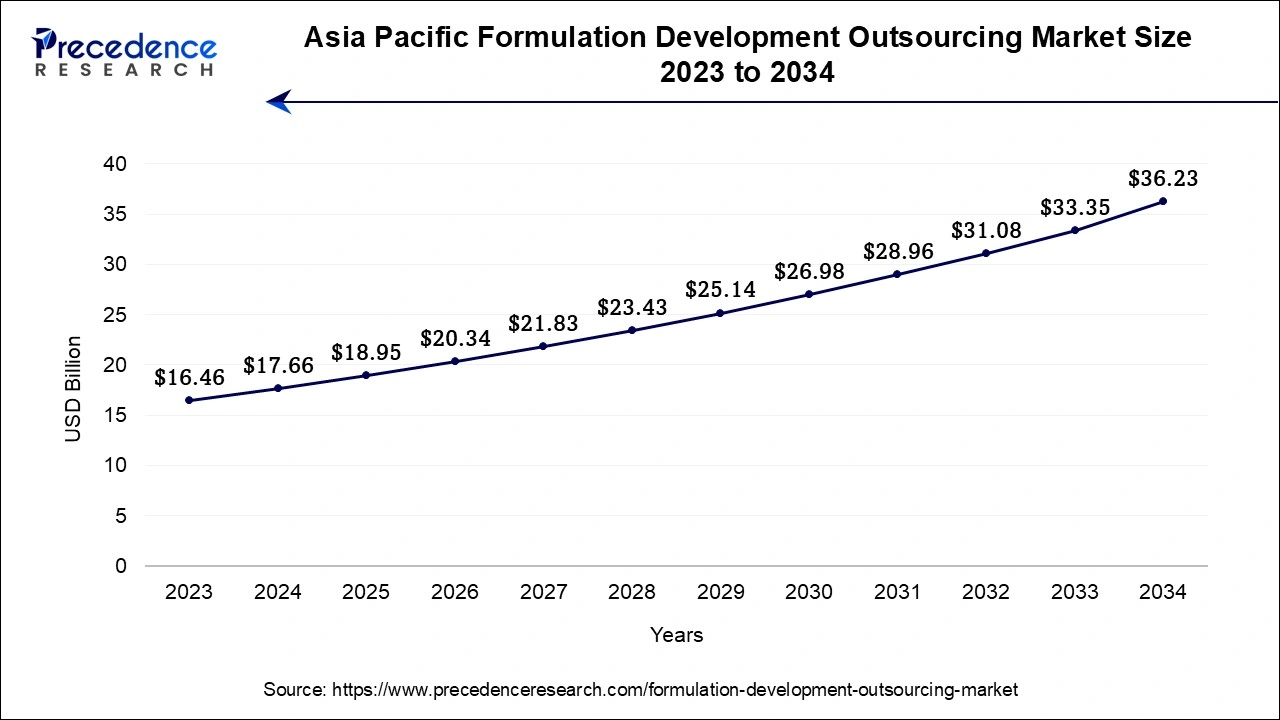

The Asia Pacifc formulation development outsourcing market size accounted for USD 17.66 billion in 2024 and is expected to be worth around USD 36.23 billion by 2034, at a CAGR of 7.45% from 2024 and 2034.

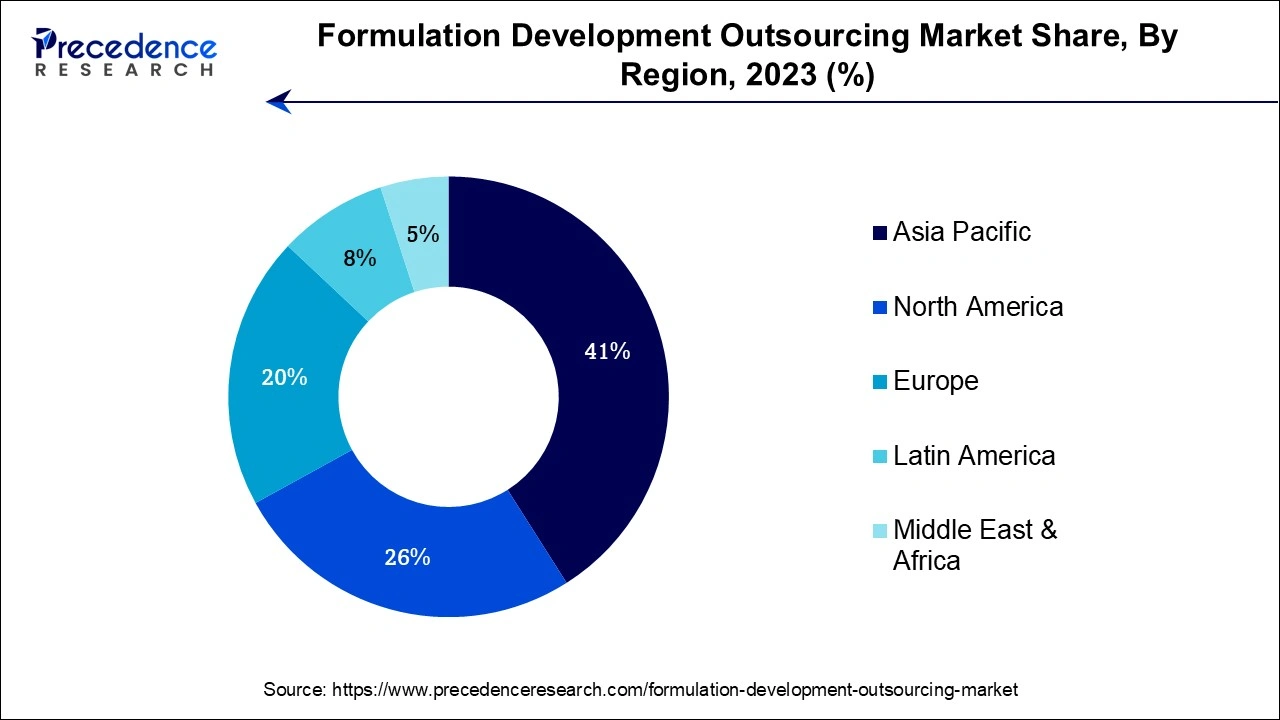

Asia-Pacific has its largest revenue share in 2023 and is expected to sustain its position in the formulation development outsourcing market throughout the predicted timeframe. It is due to the pharmaceutical industry's expansion, cost-effectiveness, skilled labor force, and knowledge of regulatory compliances in the region. The location of the region is appealing for outsourcing pharmaceutical formulation development because of its supportive infrastructure and good regulatory climate. Moreover, the rising population along with the rapidly expanding pharmaceutical sector in Asia Pacific is observed to support the market’s growth.

North America is expected to expand at a robust pace during the forecast period. The market in the region is benefited from North America's well-established research and development structure, production, and clinical trial infrastructure. Moreover, the availability of a highly educated and skilled workforce has promoted the market’s expansion in the region. Additionally, the region offers a favorable regulatory environment that promotes the expansion and development of the pharmaceutical business.

The desire for efficient drugs or vaccines among scientists, researchers, and healthcare professionals to treat viral infections has increased research and development activities. The rising requirement of drug formulation and innovation has boosted the demand for outsourcing agencies that can manage active contract formulation activities. Such outsourcing agencies can manage significant areas taking from patents for the drug development to the overall success of the formulated drug. Discovery, characterization, development and managing clinical area are a few responsibilities handed to the outsourcing agency. The largest share of the formulation development outsourcing market are held by group of companies, including Aizant Drug Research Solutions Private Limited, Charles River Laboratories, Catalent Inc., Syngene International Ltd, and Laboratory Corporation of America Holdings.

According to the International Organization for Standardization, the outsourcing of pharmaceutical activities can reduce up to 15% of cost required for the overall procedure. It also saves up on the area required for the firm along with the cost invested for other utilities in the pharmaceutical company.

The formulation development outsourcing market is expected to be accelerated with the rising requirement of commercial production of drugs and therapeutics along with the rising cases of disorders across the globe. Considering the rising cases of disorders, the America Cancer Society stated that in the United States, there will be 1,958,310 new cases of cancer in 2023. Moreover, the rapidly expiring pharma patients support the expansion of the market. The market is also expanding due to the trend of necessary pharmaceutical patent protection passing. The outsourcing of formulation development can limit the risk of financial loss by reducing the capital investment required from pharmaceutical companies. This element also acts as a major growth factor for the market.

| Report Coverage | Details |

| Market Size in 2024 | USD 43.08 Billion |

| Market Size by 2034 | USD 87.31 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.32% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 To 2034 |

| Segments Covered | Service, Formulation, Therapeutic Area, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for patent protection

The growing relevance of novel drug development due to the expanding number of essential medications whose patents are expiring and the rise in the outsourcing of formulation development services by most pharmaceutical and biotechnological businesses are significant market growth drivers. At the research and development stage, pharmaceutical companies rely heavily on patent protection to lower the risk of failure and to save investments done in the development activity. The most significant factor associated with outsourcing is cost saving. Outsourcing of formulation development allows companies to optimize its operational capabilities by reducing expenses and capital investments, which directly offers patent protection for the pharmaceutical company. Thus, the rising demand for patent protection is observed to act as a driver for the growth of the market.

Adverse effect of drugs

Unpleasant side effects of the medicine are known as adverse reactions. The degree of side effects can vary widely from little annoyances such as a short term allergies to potentially deadly circumstances, including a heart attack or liver damage. Adverse medication reactions impact the industry that outsources formulation development by increasing regulatory scrutiny, raising safety concerns, and perhaps delaying product deadlines, making outsourcing choices more cautious. Thus, adverse effects of drugs are considered to hamper the growth of the market by acting as a major restraint for the market.

Increasing demand for medications for chronic diseases

The market for formulation development outsourcing has a sizable chance to grow with its offerings for pharmaceutical businesses that are looking for expertise in creating efficient therapies for chronic diseases. Companies can gain access to specialized knowledge, cut expenses, and speed up the drug development process by outsourcing formulation development, ultimately satisfying the expanding demands of patients with chronic illnesses. The prevalence of chronic diseases in increasing across the globe with a large number of patients of diabetes, cardiovascular disorders and cancer. Thus, the increasing demand for potential drug for chronic disease is expected to open a set of opportunities for the market.

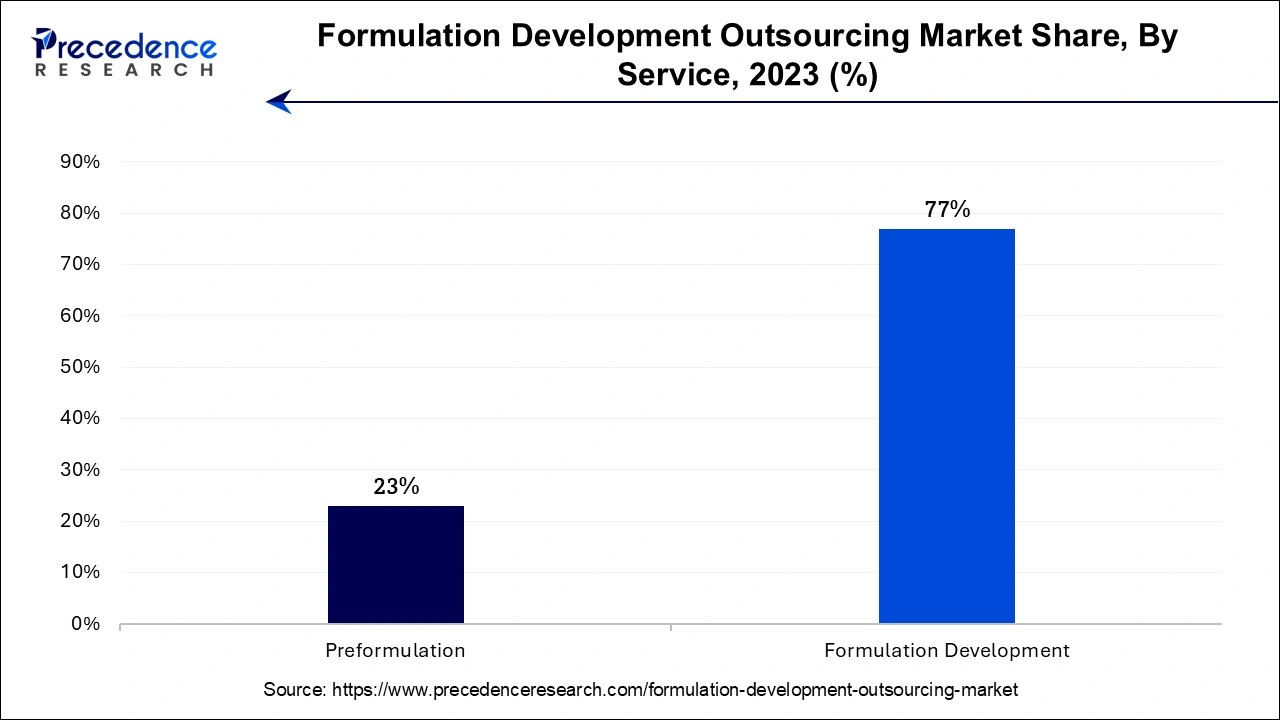

The formulation development segment is expected to hold the largest share of the market during the forecast period. To create, optimize, and test pharmaceutical or chemical formulations, one needs specialized knowledge and experience. Many businesses contract outsource this part of their operations to specialized companies with devoted teams with the requisite training and expertise. Companies can lower the risk of regulatory issues or development failures by outsourcing formulation development.

Established outsourcing partners can assist in ensuring compliance because they have experience handling regulatory requirements. Companies can speed up their product development process by outsourcing formulation development. Specialized outsourcing companies have streamlined processes and quick access to cutting-edge technology, which has sped up product development.

On the other hand, the pre-formulation segment is expected to witness a notable growth rate during the forecast period. Outsourcing provides the scientific underpinning for formulation development and aids in defining the general features of the drug as well as the best dose form for the therapeutic molecule. The rapidly rising emphasis on research activities for novel drug development plays a significant role in the segment’s development.

The oral segment hold the largest share of the market, the segment is expected to witness the fastest rate of growth during the forecast period. The most prescribed and taken dosage forms of medication are tablets and capsules, necessitating the development of their formulations. It is simpler to traverse because the regulatory approval procedure for oral drugs is well-established and typically more uncomplicated than that for other dosage types. Oral dosage forms are the subject of substantial experience and knowledge among pharmaceutical firms and contract research organizations (CROs).

The injectable segment is expected to grow at a robust pace during the forecast period. The high bioavailability of injectable formulations causes the immediate beginning of the effect. Because of their direct delivery into the bloodstream, injectables have become essential in the pharmaceutical business by providing quick and accurate medication delivery. Injectables are crucial for outsourcing formulation development in the market since they need specialist knowledge in formulation, manufacturing, and regulatory compliance. Pharmaceutical businesses can utilize the expertise and infrastructure of seasoned partners when outsourcing the development of injectable formulations, which speeds up time to market and ensures high-quality products.

The oncology segment held the largest share of the market, the segment is expected to sustain its dominance throughout the forecast period. Cancer is a significant area for research and development, this focus has contributed to the rise of the oncology sector. As it assures the successful translation of these ground-breaking discoveries into patient-accessible medication solutions that are safe, effective, and quick to market, formulation development's role becomes even more crucial. Despite encouraging results in in vitro conditions, present formulations lack focused behavior in both in vivo and human studies, contributing to ineffective treatment. Thus, the sector is expected to adopt outsourcing services more often in the upcoming years to lower the risk of failure.

The infectious disease segment is expected to grow at a significant rate during the forecast period. Due to the rising demand for research, testing, and the development of new therapies and vaccines to battle these diseases, infectious diseases are a significant growth driver in the formulation development outsourcing market. Drug development is sped up via outsourcing, which enables pharmaceutical corporations to access specialized resources and experience.

For instance, In June 2022, to speed up research and development (R&D) for infectious diseases that disproportionately affect lower-income nations, GSK plc announced a commitment of £1 billion over ten years. This study will concentrate on cutting-edge vaccines and medications to prevent and treat neglected tropical diseases (NTDs), HIV (via ViiV Healthcare), tuberculosis, malaria, and anti-microbial resistance (AMR), which carry on having devastating effects on the most vulnerable and account for more than 60% of the burden of illness in many low-income countries.

The pharmaceutical industries segment is expected to hold the largest share of the market during the forecast period. Most pharmaceutical corporations outsource formulation services to cut down on the amount of time and money spent on trials. The pharmaceutical industry adopts and incorporates new scientific developments, technology, and information. Outsourcing of formulation development speeds up the development of sustainable solutions, encourages teamwork, and makes it easier to communicate research findings. The pharmaceutical business may enhance its innovation capacity by successfully transferring technologies and promoting long-term sustainability. The industry should conduct carefully planned clinical trials with a focus on patient safety, ethical standards, and scientific integrity to ensure the success of safe and effective treatments.

The research and academic institutions segment is the fastest-growing segment in the formulation development outsourcing market. High research productivity promotes innovation by quickening the development of new drugs and medical treatments. It allows the industry to address emerging healthcare challenges and improve patient outcomes. Continuously productive research is essential to the pharmaceutical industry's ability to innovate and meet shifting social demands.

Segments Covered in the Report:

By Service

By Formulation

By Therapeutic Area

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

August 2024

October 2024

February 2025