January 2025

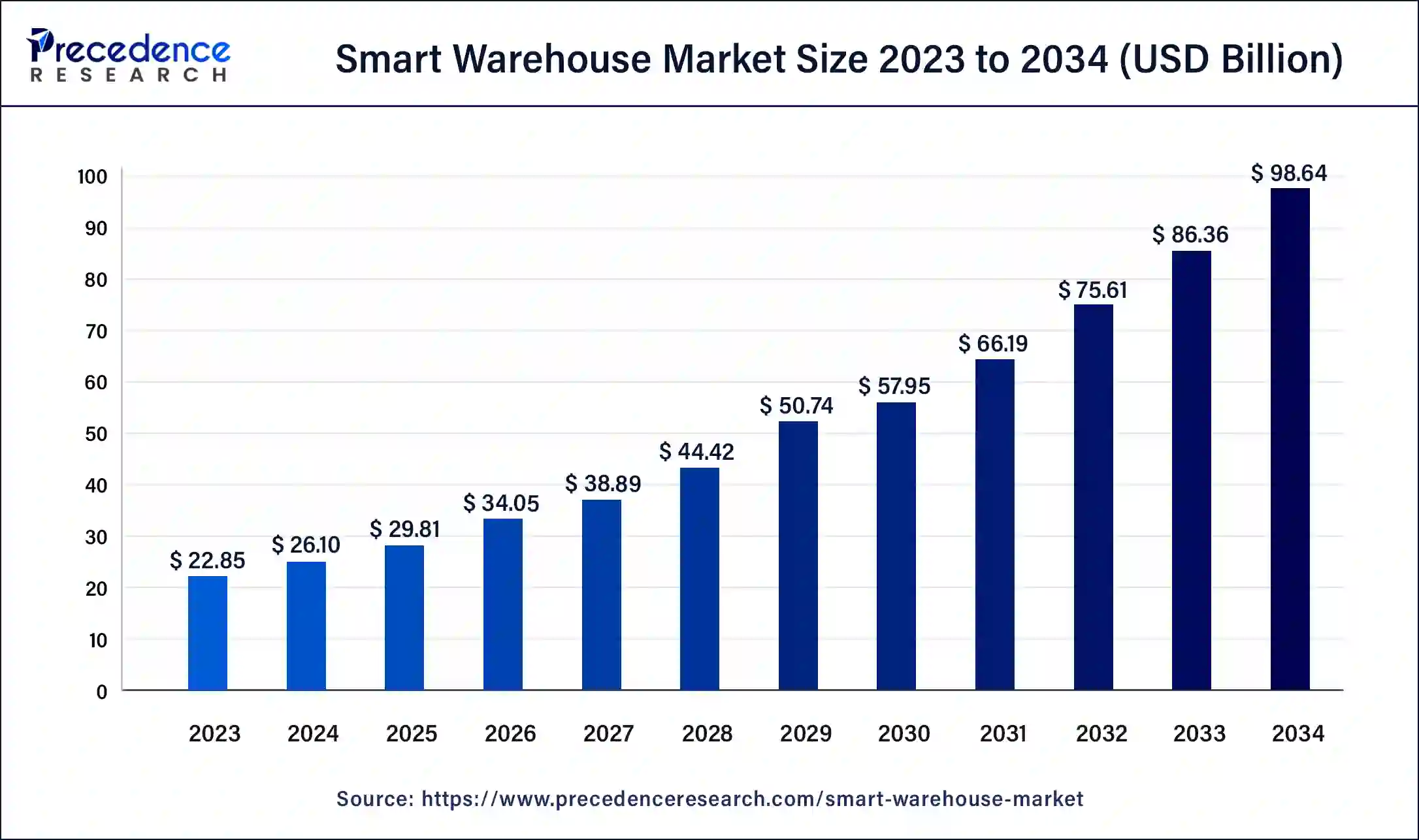

The global smart warehouse market is worth around USD 26.10 billion in 2024 and is expected to reach around USD 98.64 billion by 2034, representing a healthy CAGR of 14.22% during the forecast period from 2024 to 2034.

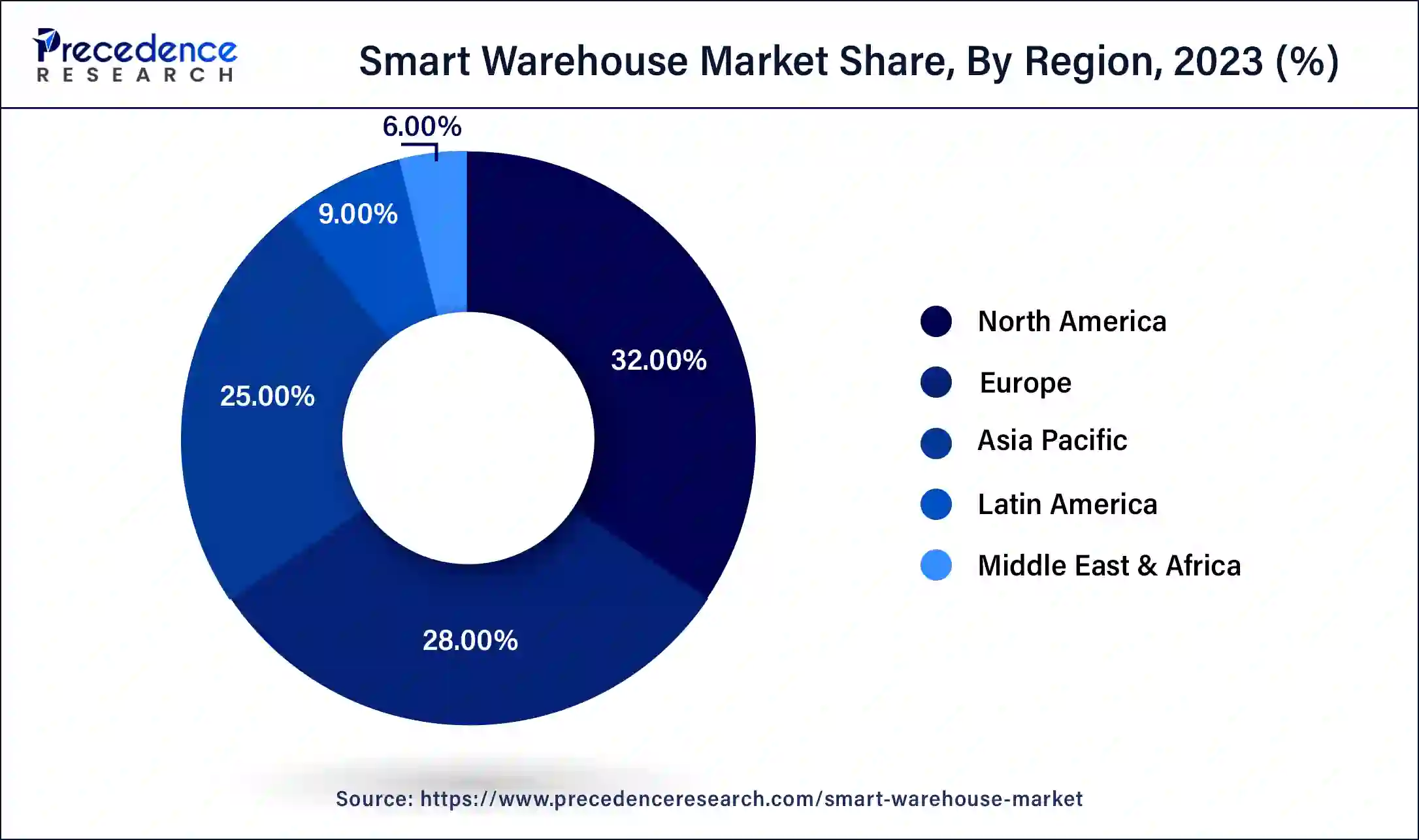

The global smart warehouse market size is worth around USD 26.10 billion in 2024 and is anticipated to reach around USD 98.64 billion by 2034, growing at a solid CAGR of 14.22% over the forecast period 2024 to 2034. The North America smart warehouse market size reached USD 7.31 billion in 2023. The rapid growth of e-commerce and the adoption of technological innovations in the Internet of Things, automation, and mobile robotics is driving growth in the smart warehouse market.

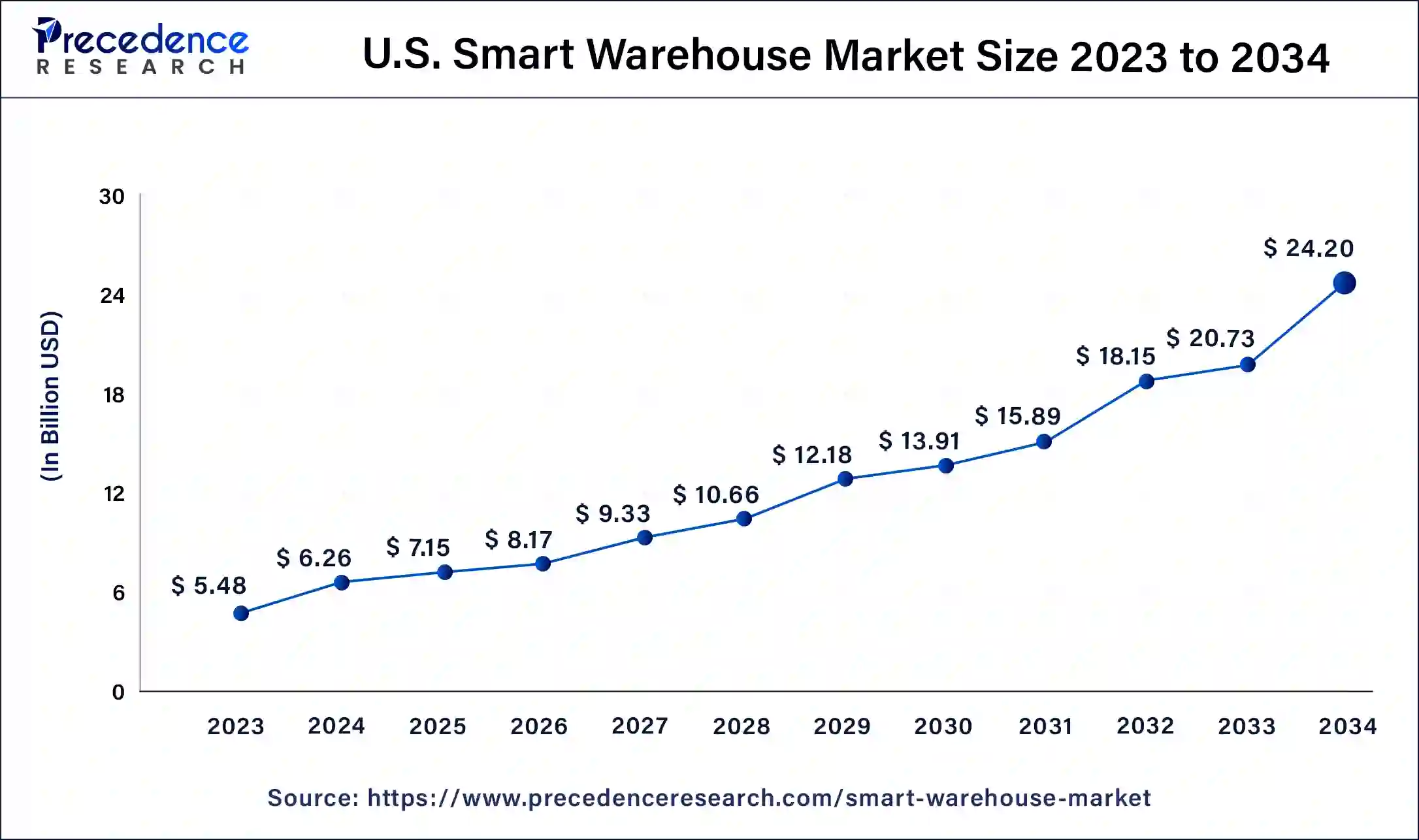

The U.S. smart warehouse market size was exhibited at USD 5.48 billion in 2023 and is projected to be worth around USD 24.20 billion by 2034, poised to grow at a CAGR of 14.45% from 2024 to 2034.

North America dominated the smart warehouse market in 2023. The region houses several major players in the market and is a major producer of smart warehousing technologies. Substantial investment in research and development in sensors, mobile networking, artificial intelligence, and machine learning in the region has led to several breakthroughs in artificial intelligence and automation tailored for the warehousing market. The robust technological infrastructure and a rise in e-commerce in the region have led to widespread automation in manufacturing and logistics. Companies are increasingly investing in automation to improve productivity and cut down on labor costs.

Asia Pacific is set to host the fastest-growing smart warehouse market during the forecast period. Emerging economies like China and India are seeing widespread adoption of smart warehousing technologies due to a rapid expansion of the e-commerce, automotive, and food and beverage sectors. Rapid industrialization is spurring demand for AI-powered automation and IoT devices to optimize material handling, transportation, and warehouse logistics.

A smart warehouse is a warehouse that uses technology and automation to optimize operations. Businesses use warehouses to store everything from raw materials to finished products ready for shipping. Smart warehouses are equipped with a variety of technologies, including automation software, robots, artificial intelligence, digital and RFID tags, and automated conveyor belts, which assist with administrative and inventory management issues, especially for large warehouses.

The substantial growth of e-commerce has led to massive demand for the smart warehouse market solutions for optimizing inventory and managing multi-channel distribution networks. Smart warehousing solutions help optimize warehouse management, reduce the required manual labor, and increase productivity through technologies such as integrated conveyor systems, sensors, scanners, and autonomous robots.

The smart warehouse market involves digital technology vulnerable to data breaches and cyber-attacks. The advent of augmented reality and virtual reality technology has the potential to transform warehousing activities like order allotment, material handling, and most processes in supply chain management. Augmented reality technology increases the efficiency of different data collection processes, using barcodes and other scanning systems to help workers find products easily and track deliveries better.

How is AI Revolutionizing the Smart Warehouse Industry?

Artificial intelligence is bringing major changes to several industries and is becoming a key component in the modern smart warehouse market. AI is used in several warehouse management processes, including in planning, where demand for products can be forecasted, allowing companies to meet demand without stockouts or oversupply. Artificial intelligence-powered machines are used in the automation of tasks such as arranging items on shelves. Cognitive automation can also help simplify billing and payment processes.

Integration of artificial intelligence into warehouse operations leads to the optimization of logistics, inventory management, and optimum storage. Autonomous mobile robots trained through machine learning move products across the facility without the need for human intervention. Robots also help take the burden of labor-intensive, repetitive tasks off human workers, allowing other tasks to be allocated to them. These factors contribute to the improvement of worker safety and are driving demand in the smart warehouse market.

| Report Coverage | Details |

| Market Size by 2034 | USD 98.64 Billion |

| Market Size in 2024 | USD 26.10 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.22% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Deployment, Technology, Application, Warehouse, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Integration of technology into warehouses allows for better decision-making

The smart warehouse market integrates tracking platforms, staff navigation, and scheduling into warehouse management. Warehouse asset tracking systems and IoT technology, including various tags and labels, help staff easily locate products and show them the shortest routes, reducing the time spent searching for items. Tracking systems also help businesses track the real performance of workers, assisting managers in optimizing staff workflow and conducting fleet management. Tracking systems use sensors and digital signatures to collect data, which can be used to solve operational challenges, perform predictive maintenance, and minimize unnecessary costs.

Cost of implementation for smart technologies

The cost of adopting new technologies to transition to smart warehousing is high. The initial investment necessary to purchase and install smart technologies such as RFID tags, warehouse tracking and management systems, and robotics is steep. Businesses also need to hire professionals to maintain and operate new systems as well as train existing staff.

Although these investments provide significant returns in terms of productivity and cost-cutting, small and medium businesses working with tight budgets may be discouraged from employing these measures. Even larger players may need to find workarounds for AI technology that is still not sophisticated enough to do complex tasks. These factors contribute to challenges in the growth of the smart warehouse market.

Implementation of low-latency networks and augmented reality

IoT devices require a strong internet connection and the use of advanced 5G networks. Focusing on the deployment of low-latency networks will improve connectivity and the speed at which these IoT devices operate. Integrating augmented reality with IoT devices has the potential to provide accurate real-time information and guide employees, improving inventory accuracy and minimizing errors. Adopting low-latency networks and augmented reality technology are huge opportunities for further growth in the smart warehouse market.

The hardware segment dominated the smart warehouse market in 2023. Increasing adoption of sensors, tags, and smart devices equipped with Bluetooth, wireless mesh, ultra-wideband communication, and similar technologies is the cornerstone for transitioning to smart warehouses. These devices help acquire real-time information and reduce errors and downtime, helping optimize supply chains from the ground up.

The software segment is expected to be the fastest-growing in the forecast period between 2024 and 2033. Warehousing management software such as Digital Twins helps recreate logistical processes and emulate various scenarios to optimize the throughput of a warehouse by improving decision-making processes, planning resources, and distributing workload efficiently without overworking the staff.

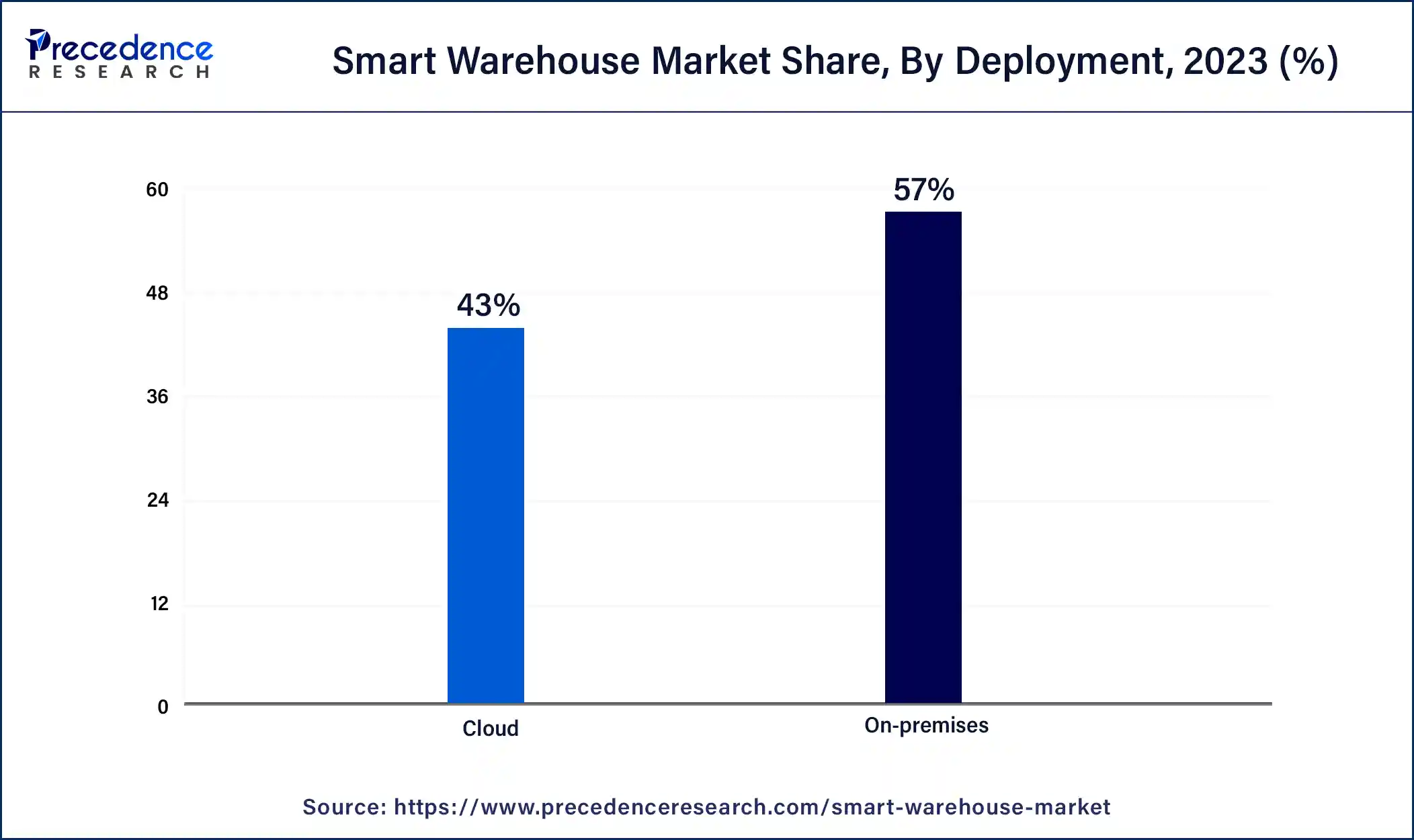

The on-premises segment dominated the smart warehouse market in 2023. On-premise deployment of smart warehousing technologies helps businesses have better control over their operations. The on-premise deployment also helps the customization of the technology to meet the business’s unique operational requirements. Businesses prefer on-premise deployment for better data security and management. Confidential corporate information is housed in a more secure environment. This is important for industries dealing with sensitive data, especially in the healthcare industry.

The cloud storage segment is expected to grow at the fastest rate in the smart warehouse market in the forecast period. As the cost of doing business grows, companies look to outsource the handling and management of data to third-party entities.

The robotics & automation segment accounted for the largest share of the smart warehouse market in 2023. Robots assist with the transportation of materials and goods in warehouses and distribution centers, reducing labor costs and speeding up product placement, inventory, and loading. Mobile robots are especially useful in handling hazardous materials like corrosive chemicals, helping maintain worker safety. Technological innovations in IoT equipment help collect crucial data about warehouse operations, which can be analyzed to improve forecasting and inventory management.

The order fulfillment segment made up the largest share of the smart warehouse market in 2023. Implementation of smart warehousing technologies in order to fulfill this goal has led to better inventory management and overall operational efficiency, which ultimately leads to enhanced customer satisfaction. These AI-driven systems include real-time tracking and advanced analytics, leading to enhanced inventory visibility and ensuring a sufficient market supply of products.

The inventory management segment is set to grow at the fastest rate in the smart warehouse market over the forecast period. Artificial intelligence is emerging as a powerful tool for optimizing inventory management through demand forecasting and streamlining logistics. Machine learning algorithms are now being trained to analyze historical data and identify patterns in demand fluctuation.

The large warehouses segment dominated the global smart warehouse market in 2023. Businesses operating large warehouses have a greater need and sufficient budgets to implement smart warehousing technologies. IoT devices and related AI are expensive, making small-scale businesses hesitant to adopt the technology.

The medium warehouse segment is expected grow at a rapid pace in the smart warehouse market over the forecast period between 2024 and 2033. Medium-size warehouses usually serve as supplementary support for large facilities, making them well-suited for integration into the smart technologies used in bigger warehouses.

The transportation & logistics segment dominated the smart warehouse market in 2023. The logistics sector has rapidly adopted smart warehousing technologies to improve operational efficiencies and cater to the robust e-commerce market.

Segments Covered in the Report

By Component

By Deployment

By Technology

By Application

By Warehouse

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

October 2024

April 2024