November 2024

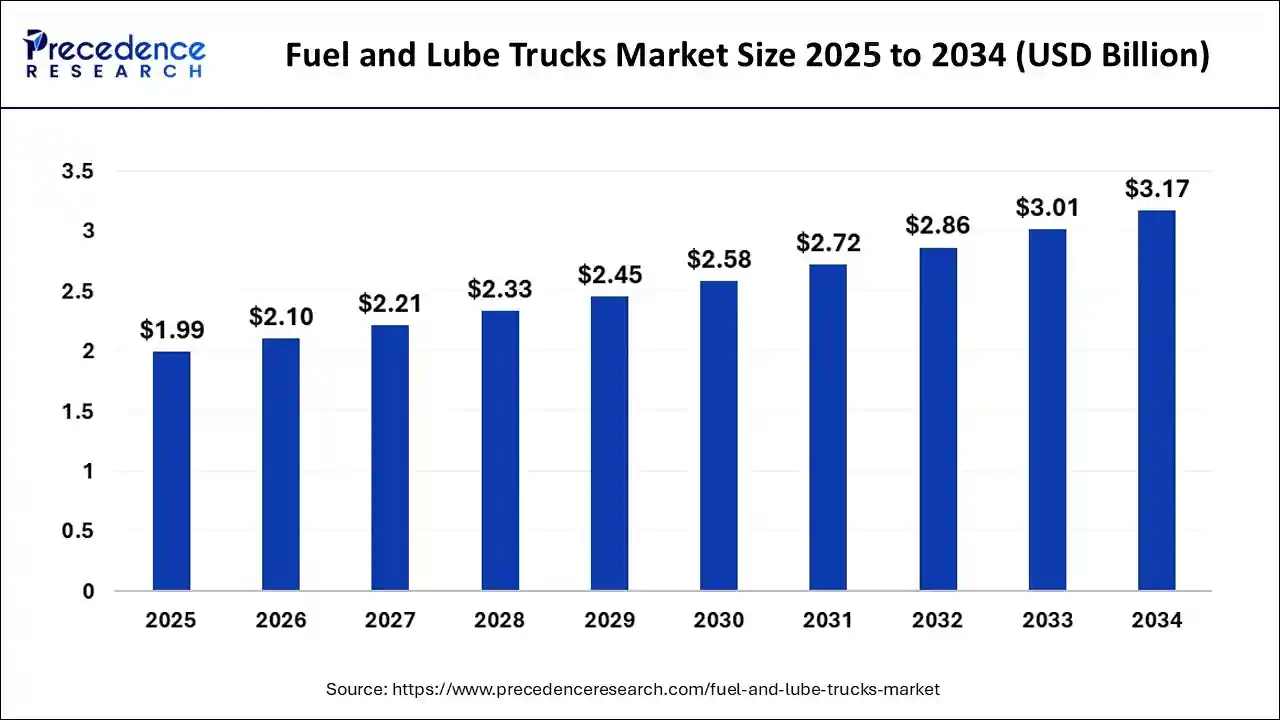

The global fuel and lube trucks market size is accounted at USD 1.99 billion in 2025 and is forecasted to hit around USD 3.17 billion by 2034, representing a CAGR of 5.32% from 2025 to 2034. The North America market size was estimated at USD 790 million in 2024 and is expanding at a CAGR of 5.50% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global fuel and lube trucks market size was estimated at USD 1.89 billion in 2024 and is predicted to increase from USD 1.99 billion in 2025 to approximately USD 3.17 billion by 2034, expanding at a CAGR of 5.32% from 2025 to 2034. The rising demand for fuel and lube trucks from the different end-use industries is the key factor driving market growth. Also, the ongoing expansion of construction and mining industries coupled with the technological advancements in truck design can fuel market growth further.

Artificial Intelligence algorithms can predict when the machine may require maintenance or new lubricants. Hence, AI can decrease downtime, lengthen equipment life, and optimize lubricant usage in the fuel and lube trucks market. Furthermore, AI can streamline the whole supply chain for lubricants, forecasting fluctuations in demand and optimizing delivery routes. This can help to ensure the availability of the right lubricant at the right time.

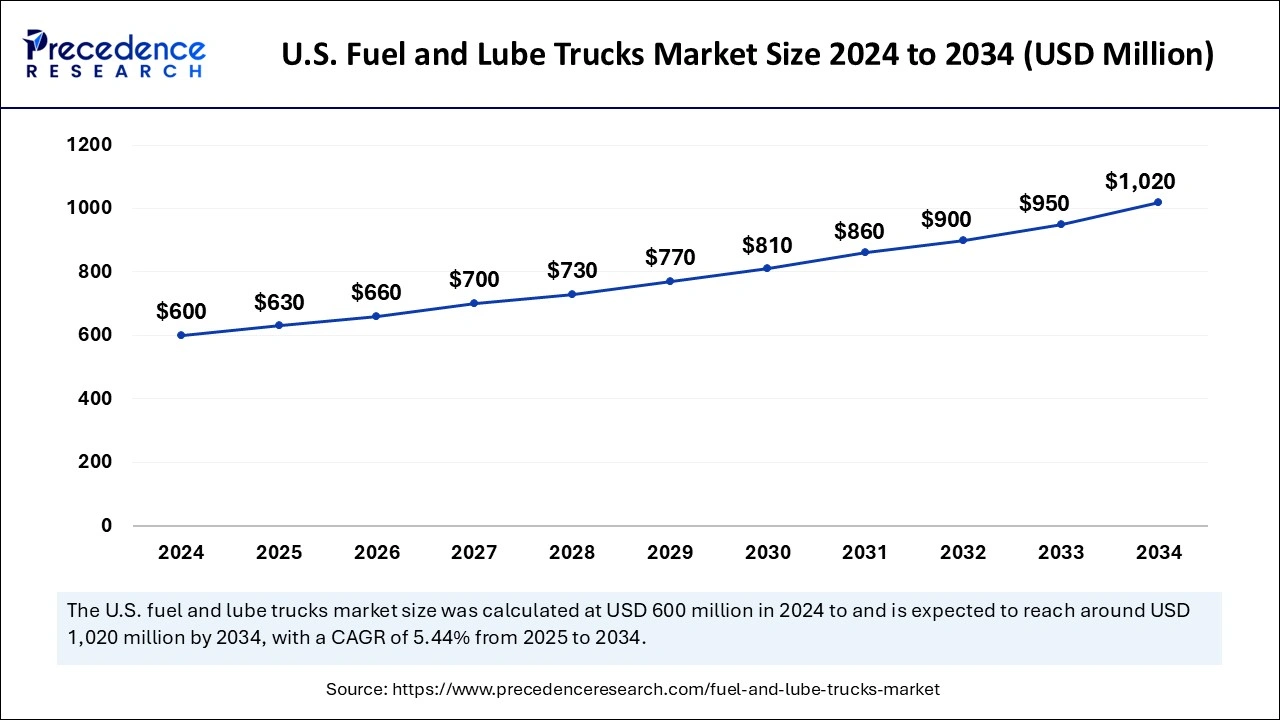

The U.S. fuel and lube trucks market size was exhibited at USD 600 million in 2024 and is projected to be worth around USD 1.02 billion by 2034, growing at a CAGR of 5.44% from 2025 to 2034.

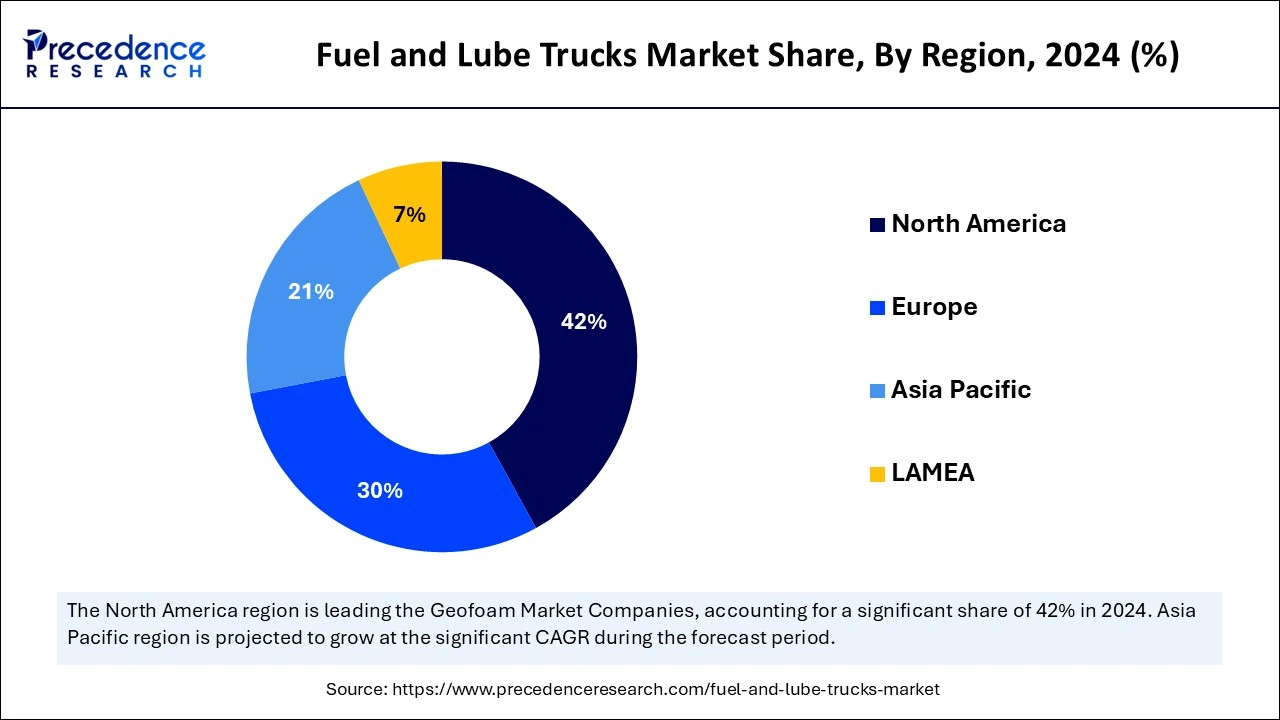

North America dominated the global fuel and lube trucks market in 2024. The dominance of the region can be attributed to the ongoing infrastructure development and increase in demand from logistics companies and industries like mining, transportation, construction, and energy, which need constant fuel and lubrication support. In North America, the U.S. led the market owing to the growing adoption of innovative technologies such as real-time monitoring, automated dispensing systems, etc.

Asia Pacific is expected to show the fastest growth in the fuel and lube trucks market over the studied period. The growth of the region can be linked to the rapid urbanization and industrialization in developing economies such as China and India. Moreover, the region's strong manufacturing base and heavy investments in building projects can influence market growth positively. In Asia Pacific, Japan is anticipated to grow at a moderate rate due to technological innovations in automation and equipment management.

Fuel and lube trucks are mobile units created to offer fuelling services and on-site lubrication for heavy equipment and machinery. The applications of the fuel and lube trucks market are important in industries like mining, construction, and agriculture. Where equipment requires proper maintenance and fuelling to perform effectively, this truck helps to reduce downtime, lessen transportation costs, and improve operational efficiency by providing key services to the job site directly.

| Report Coverage | Details |

| Market Size by 2024 | USD 1.89 Billion |

| Market Size in 2025 | USD 1.99 Billion |

| Market Size in 2034 | USD 3.17 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Truck Type Insights, Capacity Insights, Application Insights, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Increasing demand for sophisticated delivery systems

The fuel and lube trucks market is witnessing an increase in demand for sophisticated delivery systems due to the increasing need for lubricants in different sectors like industrial machinery, automotive, and construction. Because vehicles and equipment require proper lubrication to ensure their longevity and optimal operation. In addition, this need is further fuelled by increasing emphasis on preventive maintenance strategies, where timely lubrication is needed.

Complexity with regulatory compliance

The complexity between market and regulatory complaints is the major factor hampering the fuel and lube truck market. Laws governing vehicle safety, like those associated with braking systems, driver training, and stability control, require manufacturers to invest heavily in innovative safety features. Moreover, all this can lead to increased overall manufacturing costs, which can carry on to the consumers in the form of elevated prices.

Surge in the automotive and industrial sector

The rapid growth in the automotive and industrial sectors is a significant factor creating opportunities for the fuel and lube trucks market. There is a constant rise in the demand for lubricants from the automotive industry to ensure their proper maintenance and functioning. Furthermore, the ongoing expansion of the vehicle industry is escalating due to urbanization, increasing consumer demand, and launches of innovative vehicles to create scenarios for lube truck application as a practical option.

The fuel tank trucks segment led the global fuel and lube trucks market in 2024. The dominance of the segment can be attributed to the increasing use of fuel tanks in a diverse range of industries such as mining, construction, agriculture, transportation, and oil and gas. Additionally, these end-use industries need on-site refueling solutions for vehicles, heavy machinery, and equipment that work in remote locations where conventional fuel stations are unavailable.

The combination trucks segment is expected to show the fastest growth over the forecast period. The growth of the segment can be credited to the operational flexibility and cost-efficiency provided by these trucks to businesses that require both maintenance and fuelling services. Also, the dual functionality of these trucks enables operators to decrease operational costs and fleet size and enhance service delivery.

The 15,000 to 25,000 kg segment led the global fuel and lube trucks market in 2024. The dominance of the segment can be linked to the provision of sufficient weight capacity by this segment to carry enough fuel and lubricants for big operations. Trucks between this weight range give a balance between maneuverability and capacity to make them convenient for an extensive range of industries. These capacity trucks are widely used in logistics, agriculture, and construction.

The above 25,000 kg segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be driven by increasing utilization of this capacity truck for mining and oil extraction purposes, which are mostly situated in outer areas. Moreover, these trucks provide the capacity to deliver huge volumes of fuel and lubricants without needing frequent refueling.

In 2024, the construction and infrastructure development segment held the largest fuel and lube trucks market share. The dominance of the segment is due to the ongoing surge of megaprojects like airports, highways, and industrial facilities. This sector requires an extensive range of heavy machinery, including bulldozers, excavators, cranes, and earth movers. Furthermore, fuel and lube trucks are important for on-site maintenance and fuelling to ensure the infrastructure and construction projects are functioning properly.

The mining and natural resources extraction segment is estimated to witness the fastest growth during the projected period. The growth of the segment is because of the increasing global need for natural resources such as minerals, metals, and fossil fuels. Moreover, technological developments in mining operations, which require more fuel-sufficient equipment with larger capacity, can impact segment growth positively.

By Truck Type

By Capacity

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

September 2024

August 2024

August 2024