April 2025

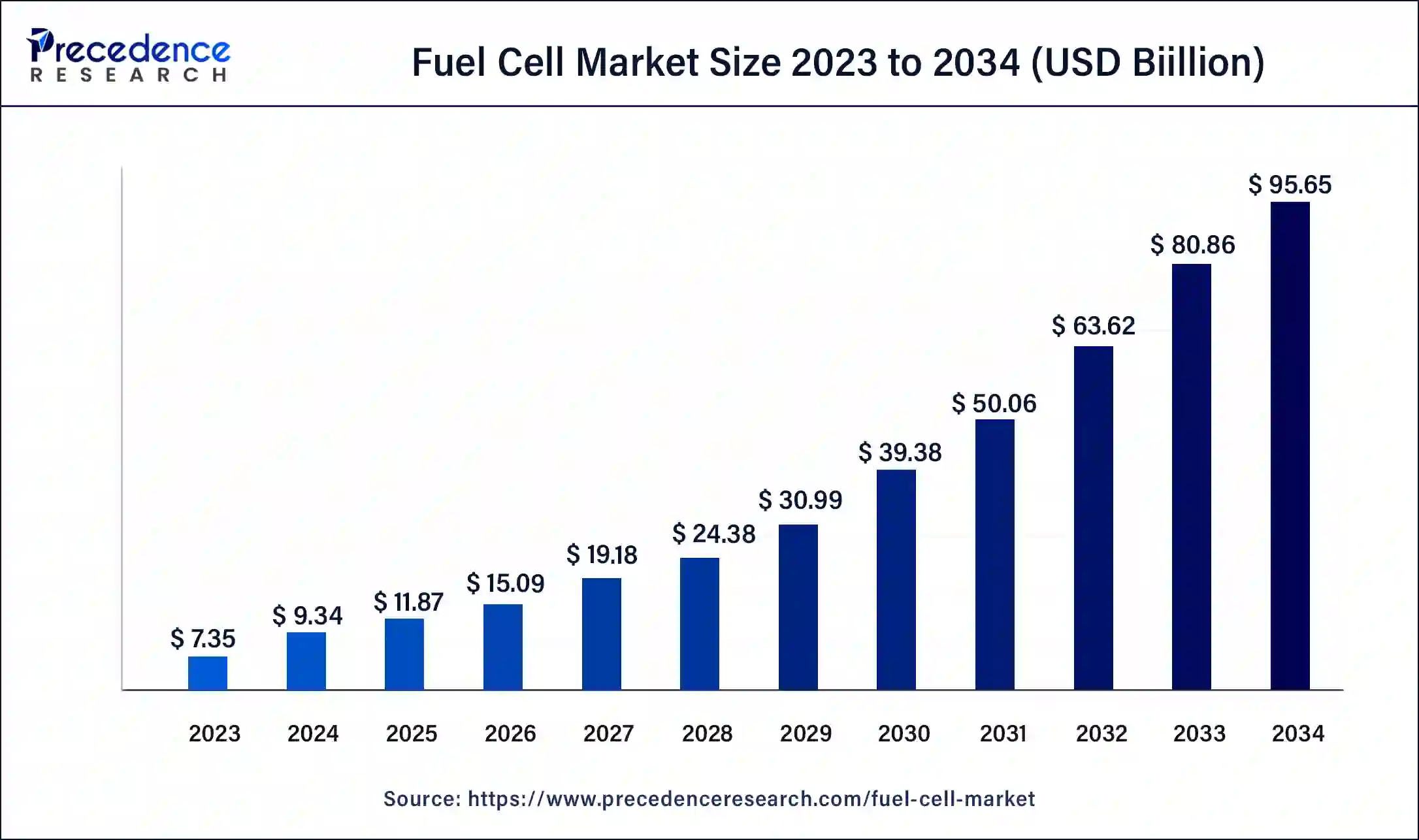

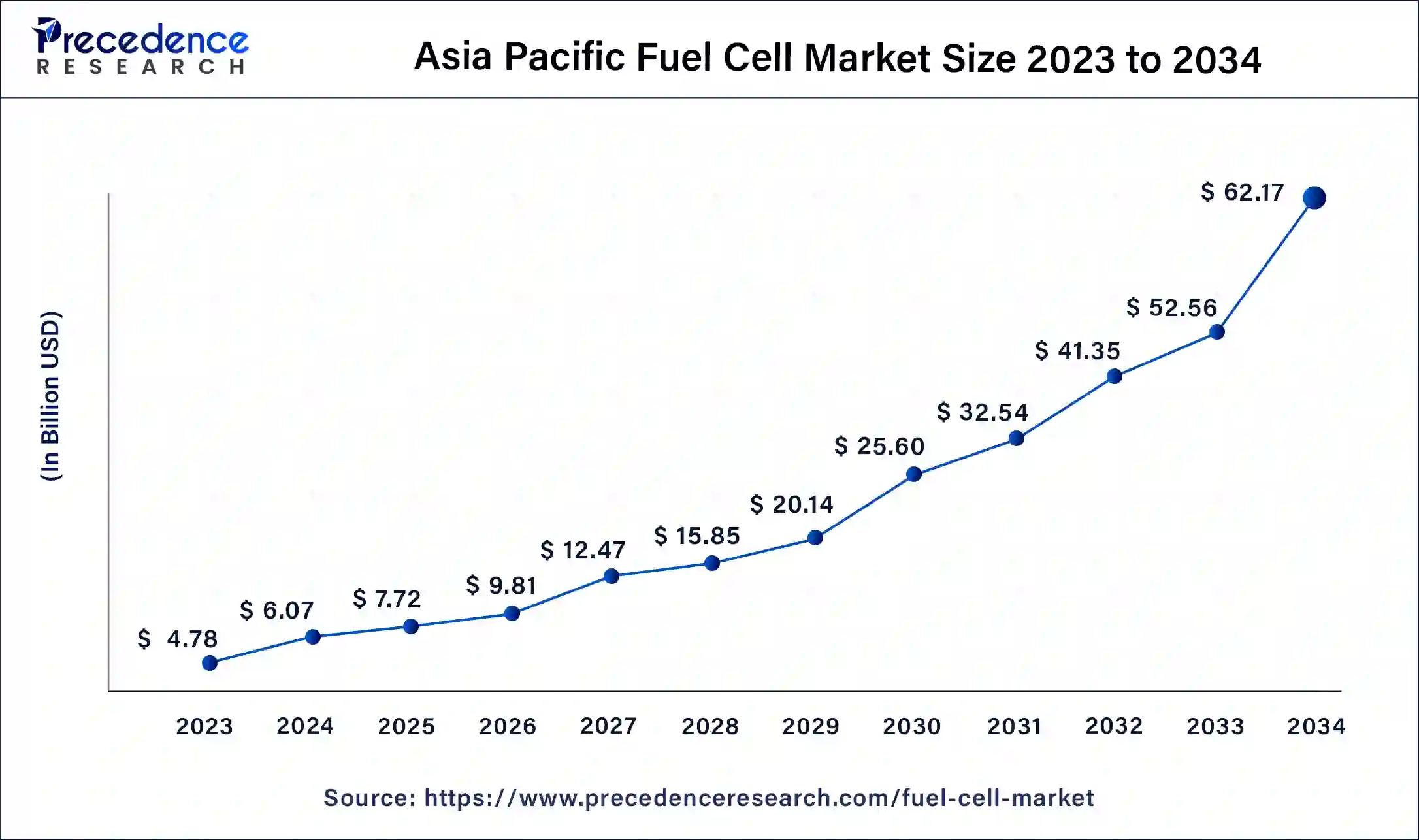

The global fuel cell Market size is estimated at USD 11.87 billion in 2025 and is anticipated to reach around USD 95.65 billion by 2034, expanding at a CAGR of 26.19% from 2025 to 2034. The Asia Pacific fuel cell market size accounted for USD 7.72 billion in 2025 and is expanding at a CAGR of 26.29% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global fuel cell market size accounted at USD 9.34 billion in 2024 and is predicted to reach around USD 95.65 billion by 2034, growing at a noteworthy CAGR of 26.19% from 2025 to 2034.

The global fuel cell market size was valued at USD 6.07 billion in 2024 and is expected to be worth around USD 62.65 billion by 2034, at a noteworthy CAGR of 26.29% from 2025 to 2034.

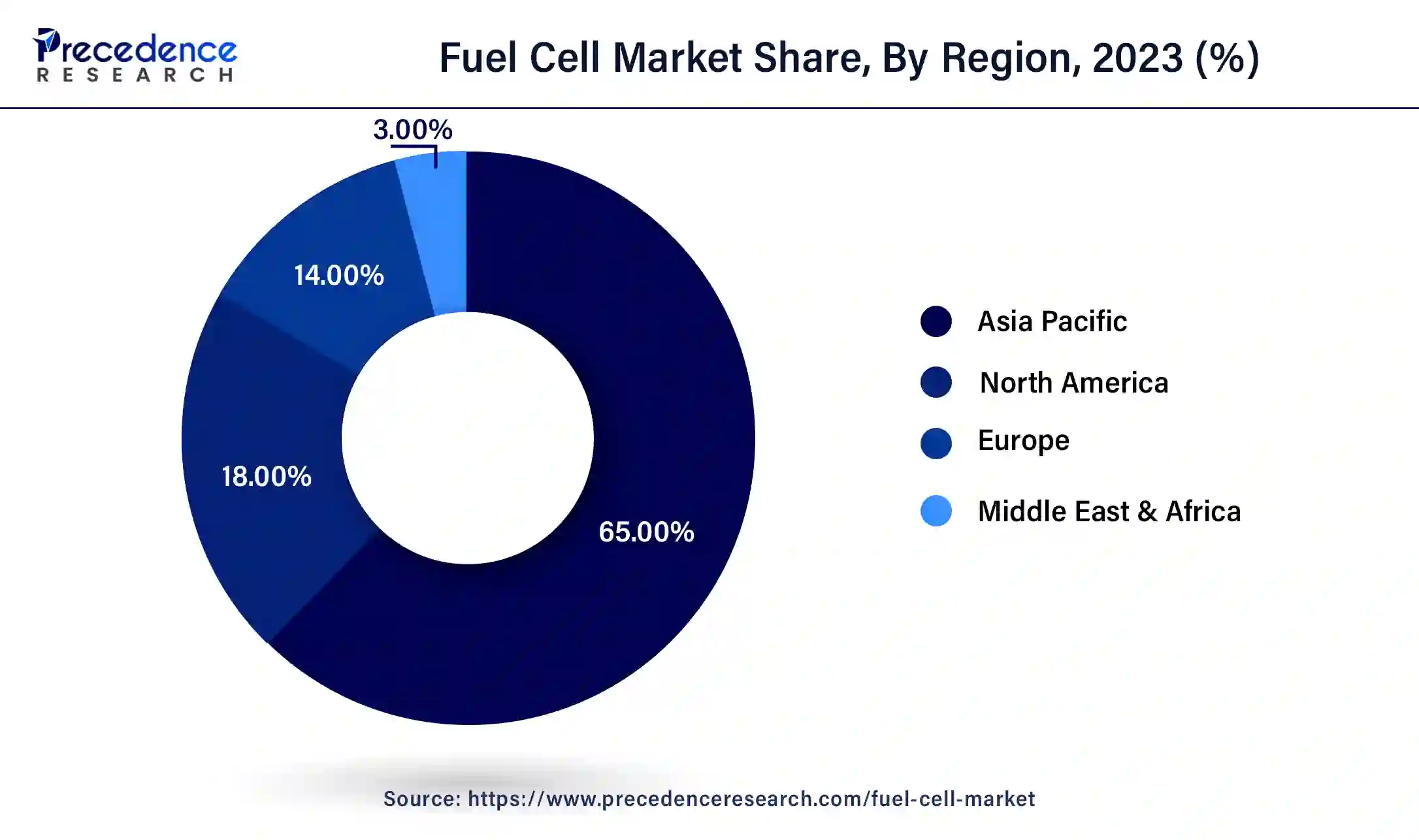

Asia Pacific dominated the fuel cell market in 2024. The expansion of the fuel cell market in the Asia-Pacific region has been propelled by policies and strategies that encourage fuel cell systems for transportation applications in India, China, Japan, and South Korea. This is due to the presence of supportive legislation in the North America region aimed at reducing carbon emissions, as well as the availability of financing for fuel cell research and development initiatives.

The growing emphasis on lowering carbon emissions and advocating for clean energy alternatives is a key factor driving market expansion. In addition to this, the increasing utilization of fuel cells, because of their high efficiency and minimal to zero emissions, is supporting market expansion. Furthermore, the establishment of government incentives and regulations that promote the use of clean technologies is fostering an optimistic perspective for market expansion. In addition to this, the expansion of hydrogen refueling stations and advancements in hydrogen production techniques, particularly green hydrogen production via renewable energy sources, are driving market growth.

North America, on the other hand, is expected to develop at the fastest rate during the forecast period. This is due to the presence of supportive legislation in the North America region aimed at reducing carbon emissions, as well as the availability of financing for fuel cell research and development initiatives.

A fuel cell generates electricity using the chemical energy of hydrogen or other fuels in a clean and efficient manner. Water, electricity, and heat are the only results when hydrogen is used as a fuel. Fuel cells have a wide range of applications, including industrial, residential, transportation, commercial structures.

Fuel cells have a number of advantages over traditional combustion-based technologies, which are being employed in a number of power plants and automobiles. When compared to combustion engines, fuel cells emit fewer or no emissions. As hydrogen fuel cells emit only water and no carbon dioxide, they can help to address crucial climate issues.

The major market players are taking enormous steps to increase their market position throughout developing countries, including increasing research and development investments and constant mergers and acquisitions. The product deployment is being aided by ongoing technology advancements and a decrease in the overall cost of fuel cell installations. The rising government investments in the construction of hydrogen-based infrastructure, together with the rising demand for fuel cells electric vehicles, are expected to propel the growth of the fuel cell market.

Furthermore, rising demand for portable devices, strict government restrictions aimed at reducing rising pollution levels, and improved fuel cell efficiency are some of the fuel cell market’s major driving factors. The influence of these factors is projected to grow dramatically as the benefits of fuel cell become more widely known. The high cost of the catalyst, which boosts the cost of the fuel cell, and the absence of fuel cell infrastructure are factors hindering the growth of the global fuel cell market during the forecast period.

The implementation of favorable regulations and incentives to encourage the use of renewable energy, as well as increased financing for electrification of distant and off-grid areas, is expected to boost the system installation. The adoption of various investment projects aimed at putting a greater emphasis on distributed power generating techniques and expanding fuel cell setup would boost the growth of the fuel cell market. However, product implementation has several key limitations, including insufficient infrastructure, hydration, and excessive fuel cell costs, and storage.

The growing consumer awareness of clean energy solutions, as well as an increase in the use of favorable governmental subsidies to promote fuel cell electric vehicles, will boost the product demand in the transportation sector. The recent technological advancements, such as the incorporation of high efficiency portable technology, are more likely to create lucrative opportunities for the growth of the fuel cell market during the forecast period.

| Report Coverage | Details |

| Market Size by 2034 | USD 95.65 Billion |

| Market Size in 2025 | USD 11.87 Billion |

| Market Size in 2024 | USD 9.34 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 26.19% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The proton exchange membrane fuel cell segment dominated the fuel cell market in 2024. The substantial market share of proton exchange membrane fuel cell is attributed to its widespread use is fixed, transit, and portable applications.

The solid oxide fuel cell segment is fastest growing segment of the fuel cell market in 2024. The ability of solid oxide fuel cell to work at high temperatures eliminates the need for expensive catalysts like ruthenium. Solid oxide fuel cells are most commonly used in stationary applications.

In 2024, the stationary segment dominated the fuel cell market. During the forecast period, the stationary segment is expected to become the most popular application. The stationary application segment is predicted to develop because of the factors such as high efficiency and the ability to use a variety of fuels.

The transportation segment, on the other hand, is predicted to develop at the quickest rate in the future years. Due to the growing demand for fuel cell automobiles and fuel cell powered forklifts, the transportation application segment is predicted to increase at the quickest rate over the forecast period. Moreover, the industry is expected to grow due to increased research and development activities in the developed and developing countries to produce hydrogen powered hybrid vehicles.

The major market players are highly investing in research and development to improve the technical features of fuel cells and modules, which offer cheaper battery costs, longer life, and greater performance. Several strategic initiatives have been attempted by industry players, including supplying varied product ranges, joint ventures, mergers, acquisitions, and collaborations. These tactics help firms and market players to gain a stronger presence in the global fuel cell market.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

January 2025

January 2025