November 2024

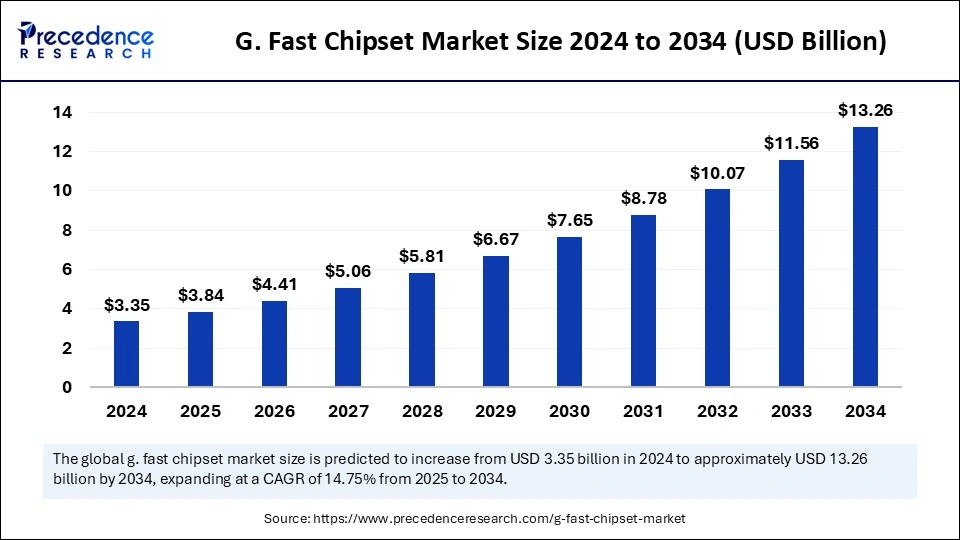

The global G. fast chipset market size is evaluated at USD 3.84 billion in 2025 and is forecasted to hit around USD 13.26 billion by 2034, growing at a CAGR of 14.75% from 2025 to 2034. The North America market size was accounted at USD 1.34 billion in 2024 and is expanding at a CAGR of 14.86% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global G. fast chipset market size was estimated at USD 3.35 billion in 2024 and is predicted to increase from USD 3.84 billion in 2025 to approximately USD 13.26 billion by 2034, expanding at a CAGR of 14.75% from 2025 to 2034. The rising proliferation of the Internet across the world is expected to boost the growth of the market during the forecast period.

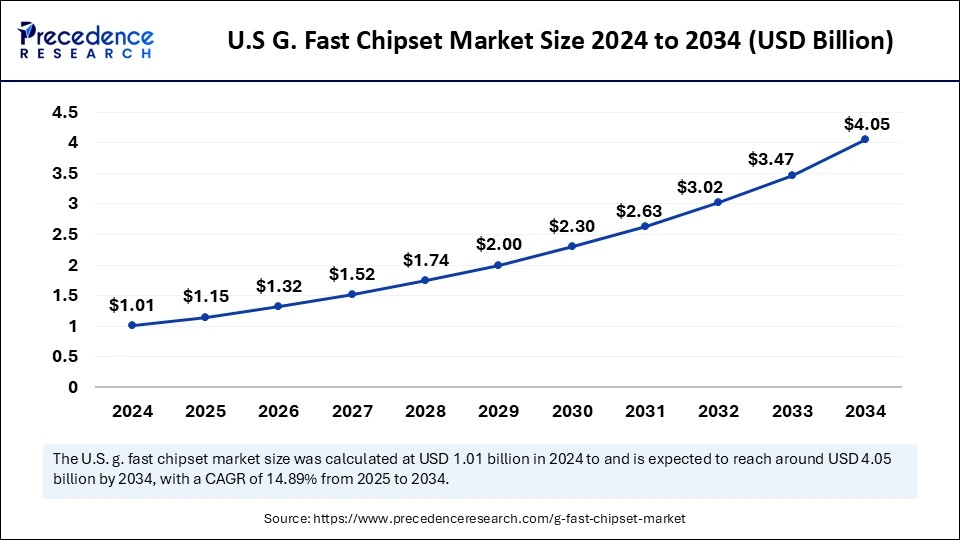

The U.S. G. fast chipset market size was exhibited at USD 1.01 billion in 2024 and is projected to be worth around USD 4.05 billion by 2034, growing at a CAGR of 14.89% from 2025 to 2034.

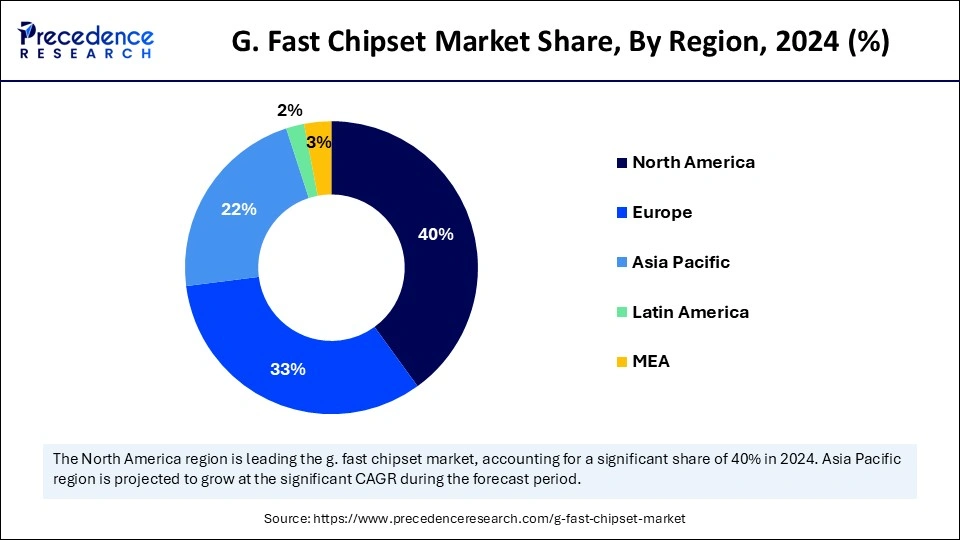

North America held the dominant share of the G. fast chipset market in 2024. The market growth in the region is mainly driven by its developed network infrastructure. The widespread adoption of broadband technologies across North America further bolstered market growth. Increased investment in infrastructure development from the telecommunication and Internet service providers significantly boosted the regional market growth. The region is expected to continue its growth trajectory in the coming years. With the increasing utilization of Internet of Things devices and rising demand for smart home solutions, the demand for high-speed Internet is increasing. The rising integration of advanced technologies into private and public sectors is fueling the growth of this market.

The U.S. plays a crucial role in the North American G. fast chipset market. There is a high demand for fast and reliable Internet connectivity. The easy availability and accessibility of the Internet across the country has boosted the need for G. fast chipsets. With the increasing adoption of streaming services, wearables, and online gaming, the consumer demand for high-performance and reliable Internet connections is increasing in the U.S., supporting market growth.

Asia Pacific is projected to witness the fastest growth during the forecast period. The rapid pace of urbanization, modernization, and digitalization in this region is boosting the growth of the G. fast chipset market. The increasing proliferation of the Internet is likely to support market growth in the region. Consumers are actively seeking reliable and high-speed connectivity. The growing focus on improving availability and accessibility to the Internet, especially in rural areas, is playing an important part in the growth of this market. Governments of various Asian countries are making efforts to improve and enhance digital connectivity, which further drives market growth.

Many smart city projects are ongoing that will utilize smart devices and advanced technologies, which will aid market growth. The rising number of Internet users further contributes to market expansion. In China, there is a high demand for copper telephone lines. The G. fast chipset can easily integrate into the existing copper infrastructure, expanding the market growth.

Europe is expected to grow at a notable growth during the projection period. The European G. fast chipset market growth can be attributed to the increasing number of Internet users and the rising adoption of advanced technologies. The demand for high-speed Internet connectivity is also rising in the region. The UK can have a stronghold on the market. The rising government initiatives, like the Digital Infrastructure Investment Fund (DIIF) that aims to support digitalization and strengthen the existing infrastructure, drive market growth. Moreover, the increasing popularity of smart homes is expected to support market growth.

G. fast technology is a next-generation broadband technology that utilizes the existing coaxial cable or copper infrastructure to deliver high Internet speeds reaching up to 1 Gbps. G. fast chipset market is witnessing significant growth because of the utilization of this technology, especially in areas that are not feasible for fiber-optic cables. The utilization of the g. fast technology with advanced chipsets helps broadband providers offer high-speed connectivity at shorter distances. The increasing demand for high-speed Internet worldwide is a key factor driving the growth of this market.

Governments worldwide are making efforts and putting forth initiatives to improve access to Internet services, which is propelling market growth. The requirement for reliable and fast Internet connectivity in residential and commercial spaces further supports market growth. With rising demand for online gaming and streaming services, the demand for high bandwidth and high-speed Internet is increasing. Consumers are seeking faster connections to adopt the more bandwidth-consuming services easily. The G. fast chipset technology is cost-effective because it can be integrated into the existing infrastructure without high initial investments. Advancements in technology and the rising adoption of smart devices, 5G, and IoT contribute to the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 13.26 Billion |

| Market Size by 2025 | USD 3.84 Billion |

| Market Size by 2024 | USD 3.35 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.75% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Configuration, Application, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

High Demand for IoT and Smart Devices

The increasing demand for the Internet of Things (IoT) and smart home appliances is one of the key factors driving the growth of the G. fast chipset market. With rapid urbanization, smart home solutions are gaining popularity. IoT and smart home appliances often require faster internet speed for their smooth functioning and reliability. This, in turn, boosts the demand for G. fast chipsets. According to a survey report, approximately 69.91 million households in the U.S. actively used smart home devices in 2024, an increase of 10.2% from than previous year. The G. fast technology offers seamless support for integrating devices like security systems, smart appliances, speakers, or TVs by enabling real-time data transmission and control. The smart city projects being undertaken, especially in emerging countries, are boosting the utilization of smart home appliances and IoT connectivity. As more and more consumers choose smart home appliances and applications along with IoT-enabled devices, the demand for G. fast chipsets increases.

High Deployment Costs

The high deployment costs of installing G. fast infrastructure limit the growth of the G. fast chipset market. While this technology is cost-effective in the long run compared to fiber, the deployment and upgradation cost of G. fast infrastructure is significant. This can affect the small or medium-sized service providers that find it difficult to invest the amount in the initial deployment. Key players operating in the market must invest in research and development activities to find solutions to address this issue, which further widens the consumer base.

Emphasis on Sustainable Connectivity

There is an increased awareness among consumers and service providers, and government regulations to reduce environmental impact are ongoing worldwide. The emphasis on sustainable connectivity is expected to create lucrative growth opportunities in this market. The growing concerns related to energy consumption can be addressed by focusing on sustainable options that improve energy efficiency and power consumption without compromising performance. Developing practices that can help reduce the environmental impact, like integrating advanced technology, sustainable materials utilization, and minimizing waste, can help improve sustainability. Minimizing the infrastructure’s carbon footprint further opens new growth avenues for this market.

The wireless solutions segment held a major share of the G. fast chipset market in 2024. The segment growth is driven by the increased demand for wireless connections. The flexibility and scalability of this technology helps in broadening the scope of applications in different environments. With the growing adoption of smart devices, the demand for wireless connectivity is increasing, further solidifying the segment’s position in the market.

The fiber to the node segment is expected to grow at a notable rate during the projection period. The growth of the segment can be attributed to the growing need for robust connectivity, especially online connectivity. This technology provides support in modernization of communication infrastructure, which makes it a popular choice. The rising focus on modernizing or upgrading existing network infrastructure is expected to support this segment’s growth.

The integrated chipset segment dominated the G. fast chipset market in 2024. The compact design and efficiency of these integrated chipsets make them an attractive choice for consumers. These chipsets are suitable for commercial as well as residential applications due to their unique features that enable high-speed broadband access. The rising demand for high-speed Internet bolstered the growth of the segment.

Meanwhile, the stand-alone chipsets segment is likely to witness significant growth. This is mainly due to the rising demand for high-speed broadband. These chipsets are known for their excellent scalability, flexibility, and high power, which makes them popular in the commercial sector. They enable high-speed broadband over existing copper lines.

The broadband access segment led the G. fast chipset market in 2024. The rise in the demand for high-speed Internet connectivity has bolstered the segment's growth. The need for high bandwidth and low latency has increased with the increased adoption of advanced technologies like IoT and 5G. Moreover, rapid digitalization is likely to continue the segment’s growth trajectory.

Meanwhile, the smart home devices segment is projected to grow at a notable rate in the coming years. This is mainly due to the rising production and adoption of smart home devices due to the growing concerns about home security. The rise of smart city projects, along with the growing demand for smart devices to expand interconnectivity in home environments, will boost this segment’s growth.

The residential segment led the G. fast chipset market in 2024. This is mainly due to the rise in consumer demand for faster broadband services and connectivity. There is an increased popularity of digital lifestyle, bolstering the growth of this segment. Moreover, with the increased trend of smart homes, the adoption of advanced technologies has increased to support home automation, boosting the demand for high bandwidth. Integration of smart devices in home automation further bolstered the segment.

On the other hand, the commercial segment is anticipated to observe significant growth over the studied period. The rising need for high-speed and reliable Internet connections for various processes in the commercial sector is likely to support segmental growth. Businesses are constantly improving their network infrastructure to support business operations, boosting the demand for G. fast chipsets and contributing to the growth of the segment.

By Technology

By Configuration

By Application

By End-Use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2025