December 2024

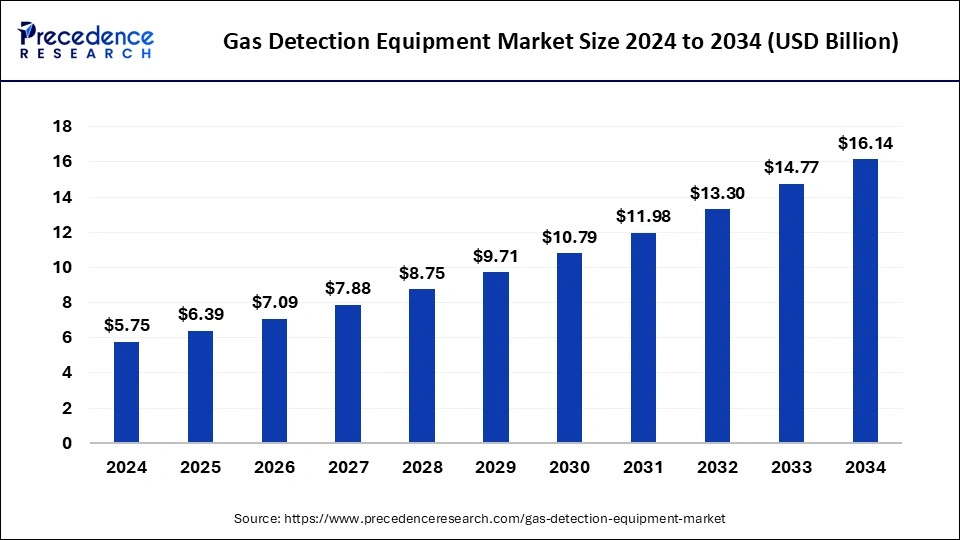

The global gas detection equipment market size is accounted at USD 6.39 billion in 2025 and is forecasted to hit around USD 16.14 billion by 2034, representing a CAGR of 10.87% from 2025 to 2034. The Asia Pacific market size was estimated at USD 1.96 billion in 2024 and is expanding at a CAGR of 11.05% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global gas detection equipment market size was calculated at USD 5.75 billion in 2024 and is predicted to increase from USD 6.39 billion in 2025 to approximately USD 16.14 billion by 2034, expanding at a CAGR of 10.87% from 2025 to 2034. The rising demand for portable gas detection equipment across the world is driving the growth of the gas detection equipment market.

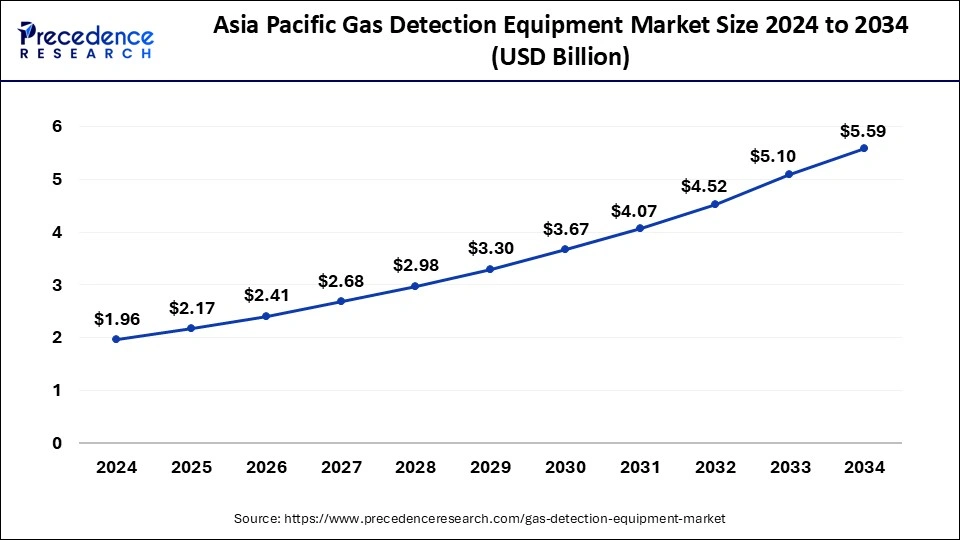

The Asia Pacific gas detection equipment market size was exhibited at USD 1.96 billion in 2024 and is projected to be worth around USD 5.59 billion by 2034, growing at a CAGR of 11.05% from 2025 to 2034.

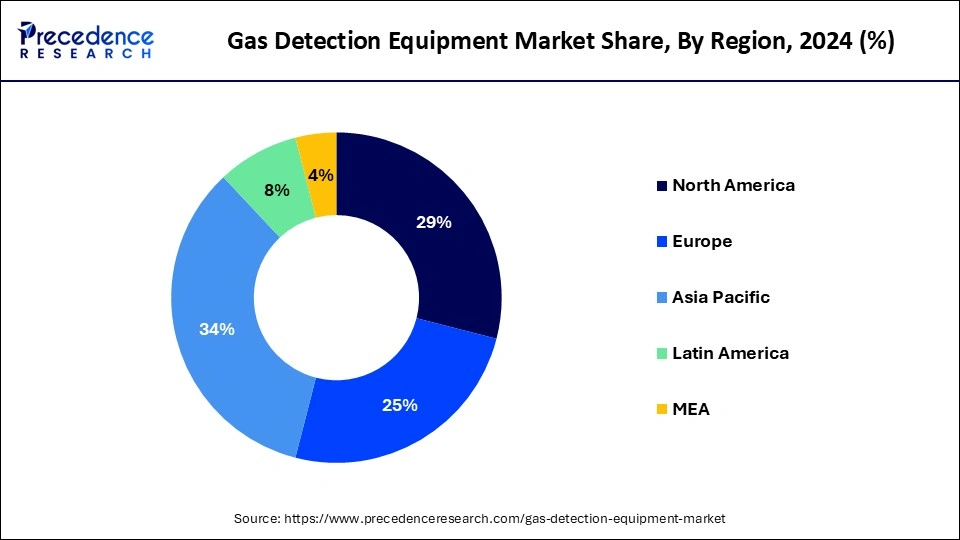

Asia Pacific held the largest market share in 2024. The growth of this region is mainly driven by the rising government initiatives in countries such as the India, China, South Korea, Japan and some others for developing the chemical industry. The rising developments in the semiconductor industry in China, Taiwan, South Korea, Japan and some other along with the presence of numerous hospitals in India and China increases the application of gas detectors that drives the market growth. Also, the rising developments in science and technology related to gas detection processes along with the affordability of raw materials is likely to drive the growth of the gas detection equipment market.

Moreover, the petrochemicals industry in countries such as China, India, and Indonesia is well-established with the presence of numerous market players such as China National Petroleum Corporation, PetroChina, Sinopec, Reliance Industries and some others has increased the demand for gas detection equipment for preventing workers from harmful gases, which in turn propels the market growth. Furthermore, the local market players of gas detection equipment such as Subtronics, Uniphos, Hanwei Electronics Group Corporation, New Cosmos Electric Co Ltd and some others are launching new products, which in turn is driving the growth of the gas detection equipment market in this region.

North America is expected to be the fastest growing region during the forecast period. The rising demand for fixed gas detectors in industrial settings is driving the market growth in this region. The increasing investment in oil and gas refineries along with mining industries has increased the demand for portable gas detectors, which in turn drives the market growth. Also, several strict rules and regulations regarding workplace safety standards along with the presence of well-established industrial sector increases the demand for gas detectors, thereby driving the market growth. Moreover, the automotive industries in the U.S, Canada and Mexico is highly established that in turn increases the demand for gas detectors to prevent workers in these industries. In addition, technological advancements in gas detection technologies along with adoption of IoT and AI in gas detection systems drives the market growth.

Furthermore, there are several local market players of gas detection equipment such as Honeywell, Emerson Electric Company, DOD technologies, MSA Safety Inc and some others that are constantly developing new gas detectors for increasing safety of workers, thereby driving the growth of the gas detection equipment market in this region.

The gas detection equipment market has grown rapidly with the developments in factory automation technologies. This industry mainly deals in developing, manufacturing and supply of gas detection equipment for the end-user industries. There are different types of gas detectors found in the market that mainly includes fixed gas detectors and portable gas detectors. The various technologies involved in this industry includes semiconductor, infrared (IR), laser-based detection, and some others. This gas detectors finds applications in several end-user industries including medical, building automation & domestic appliances, petrochemical, automotive, and some others. The growing demand for gas detection for limiting methane detection is driving the market growth. This industry is expected to grow rapidly with the developments in the petrochemical industries.

| Report Coverage | Details |

| Market Size by 2034 | USD 16.14 Billion |

| Market Size in 2025 | USD 6.39 Billion |

| Market Size in 2024 | USD 5.75 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.87% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for wireless gas detector

The demand for wireless gas detection system has increased due to its cost-effectiveness, increased safety and other factors that drives the market growth. Also, wireless gas detector helps in real-time detection and monitors industry from remote areas, thereby driving the market growth. Moreover, the growing demand for wireless detection systems in oil and gas drilling and exploration activities is likely to boost the growth of the gas detection equipment market. Furthermore, the rising developments of superior grade wireless gas detectors by various brands is driving the market growth.

High installation and maintenance costs

The cost of installing a gas detection system in any industry comes with a very high cost. The prices of sensors, control panels, and other components used in gas detection system has increased rapidly as the prices of raw materials associated with it has grown significantly. Also, the maintenance cost of the components is growing day by day. Thus, the increasing cost of installation of gas detection system along with maintenance costs associated with it acts as a barrier in the industry, thereby restraining the growth of the gas detection equipment market.

AI-based gas detection system to reshape the future

The applications of gas detection system had increased rapidly with the rise in number of mines, industries, tunnels and some others. The gas detection equipment companies had started integrating AI with gas detectors to identify specific gases in the air with high selectivity and other purposes. Hence, integration of AI in gas detection system is expected to create ample growth opportunities for the market players in the upcoming days.

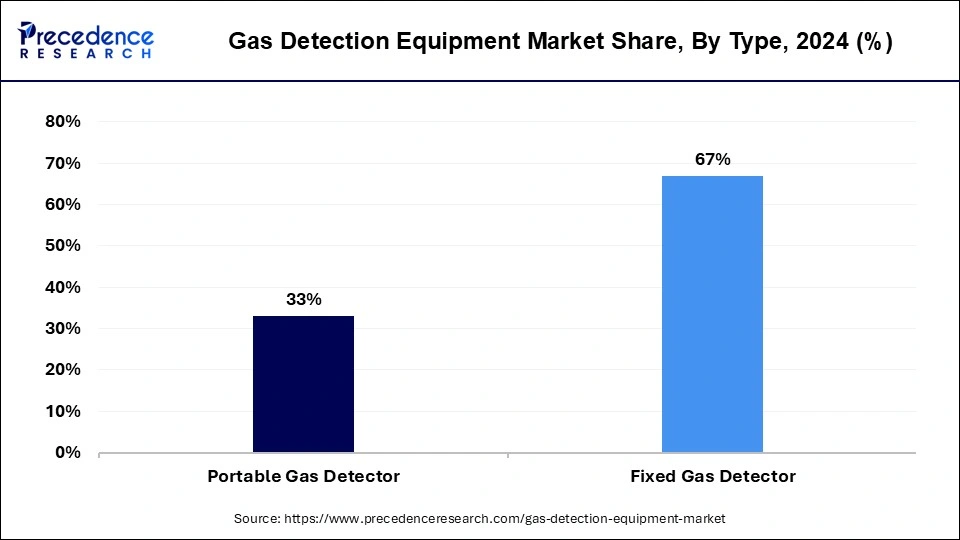

The fixed gas detectors segment held the largest market share in 2024. The demand for fixed gas detectors has increased with the growing demand for detecting presence of dangerous gas in specific areas along with warning the users regarding the potential hazards, which is driving the market growth. Also, the rising application of fixed gas detectors for providing 24/7 protection against gas leak risks and monitoring the gas concentration in warehouses and workplace is driving the growth of the gas detection equipment market.

The portable gas segment is expected to be the fastest growing segment during the forecast period. The demand for portable gas detectors has increased due to their flexibility in various environments for testing gas leaks is driving the market growth. Also, the growing demand for portable gas detectors for providing localized detection in the immediate surrounding of the user along with their light weights and compact design is likely to boost the market growth. Moreover, the growing demand for portable or handheld gas detection equipment for workers employed in hazardous areas has fostered the growth of the gas detection equipment market.

The infrared gas segment dominated the market in 2024. The demand for infrared gas technology has increased for detecting combustible hydrocarbon gases along with sensing CO and CO2 has driven the market growth. Moreover, the rising use of infrared gas sensors in the mining industry is boosting the growth of the gas detection equipment market. In June 2024, Lynred launched EOLE and PICO640S. EOLE is a superior-grade VGA resolution and low power consumption IR detector for detecting methane. PICO640S is a 24/7 area-wide monitoring system that uses infrared technology for detecting gas leaks in several industries.

The semiconductor segment is expected to be the fastest growing segment during the forecast period. The demand for semiconductor-based gas detection equipment has increased due to its cost-efficiency and ability to detect combustible gases, which in turn drives the market growth. Also, the rising use of these gas detectors in several end-user industries such as automotive, petrochemical, medical and some others due to high resistance to corrosion and longer shelf life is likely to boost the market growth.

The industrial segment held the largest market share in the gas detection equipment market in 2024. The demand for gas detector in industrial settings has increased due to monitoring and detection of hazardous gases and vapours is driving the market growth. Moreover, the rising demand for industrial gas detectors for measuring oxygen levels along with the developments in detector, sensor, transmitter or controller for gas detector systems is boosting the growth of the gas detection equipment market. Moreover, the rising demand for early detection of gas leaks and prevention of health hazards along with reducing fire explosion risks and enhancing workplace safety has further driven the market growth.

The petrochemical segment is expected to be the fastest growing segment during the forecast period. The rising demand for personal gas detection equipment in the petrochemical industry drives the market growth. Moreover, the rising risks faced by petrochemical workers from exposure to toxic gases such as carbon monoxide, sulphur dioxide, hydrogen sulphide, VOCs and some others is expected to boost the market growth. Also, the growing demand for gas detectors during drilling activities for prevention from harmful gases is likely to boost the growth of the gas detection equipment market.

By Product

By Technology

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

August 2024

September 2024

February 2025