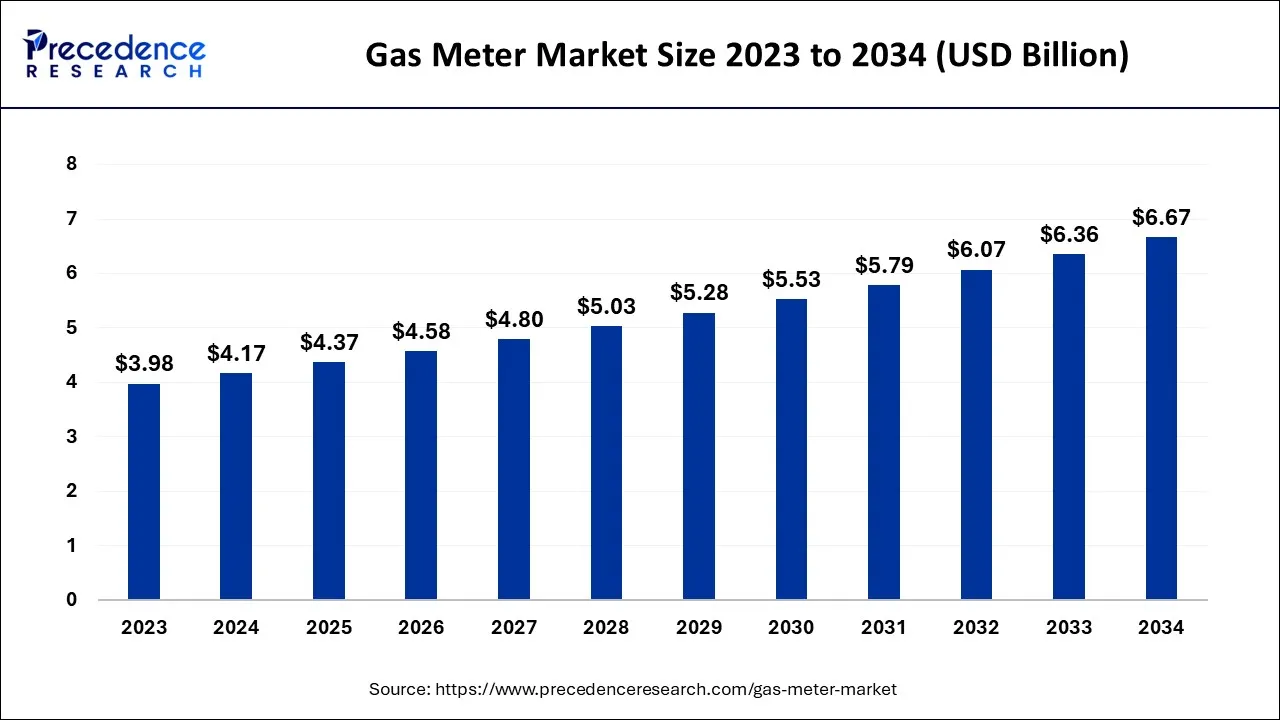

The global gas meter market size accounted for USD 4.17 billion in 2024, grew to USD 4.37 billion in 2025 and is expected to be worth around USD 6.67 billion by 2034, registering a CAGR of 4.81% between 2024 and 2034. The North America gas meter market size is calculated at USD 1.50 billion in 2024 and is estimated to grow at a CAGR of 4.95% during the forecast period.

The global gas meter market size is calculated at USD 4.17 billion in 2024 and is projected to surpass around USD 6.67 billion by 2034, growing at a CAGR of 4.81% from 2024 to 2034.

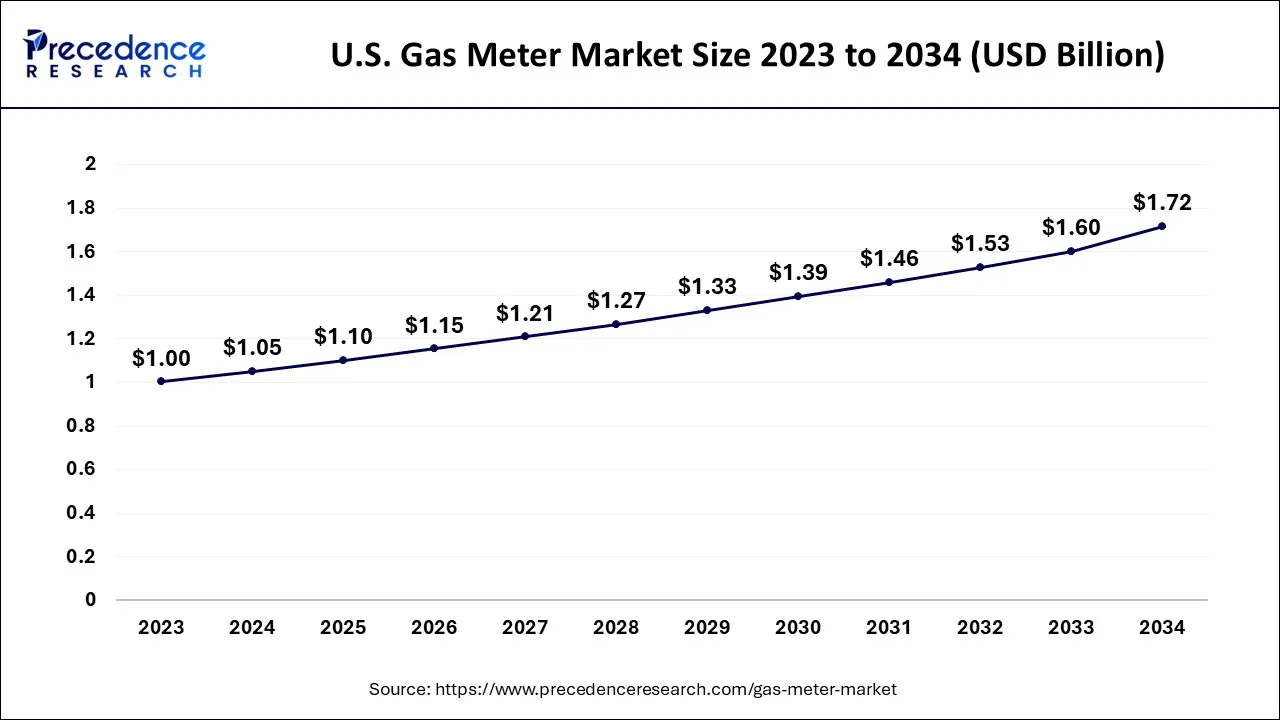

The U.S. gas meter market size is exhibited at USD 1.05 billion in 2024 and is projected to be worth around USD 1.72 billion by 2034, growing at a CAGR of 5.03% from 2024 to 2034.

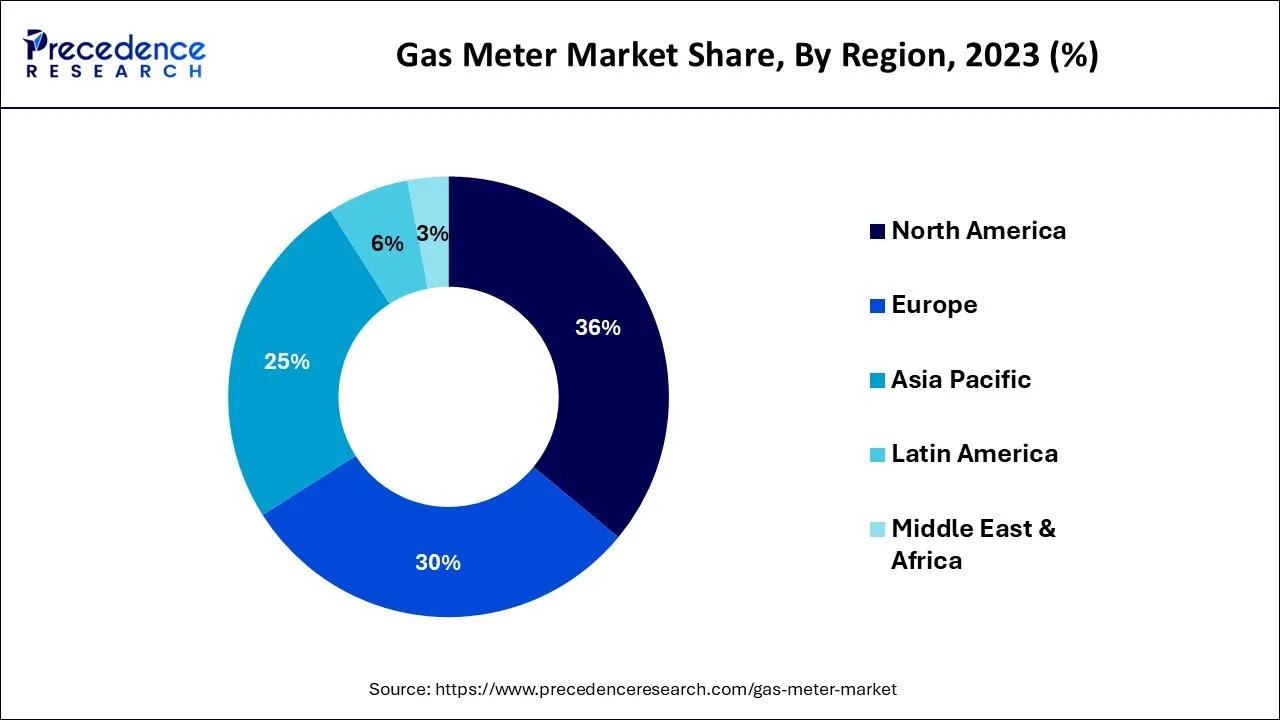

North America dominated the gas meter market with the largest market share in 2023. The growth of the market is attributed to the increasing industrialization in the region which will contribute to the growth of the market. Emerging technological advancements in the countries like United States, Canada, etc. are likely to adapt the smart gas meter and basic gas meters. Emerging technologies and the increasing adoption of gas power as compared to fossil fuels result in a higher demand for the market. In North America, the United States is leading in the adoption of gas meters. Canada emerges as the second-largest country in the consumption of gas meters.

Asia Pacific is the second-largest region, the region is experiencing the fastest growth in the market. The growth of the market in the region is due to the rising population and the rising domestic use of gas in the residential sector. Increasing industrialization and commercialization in the countries like India, China, and Japan will likely contribute a higher demand for gas meters. The willingness to adopt advanced services in order to conserve energy highlights the development of the gas meter market in the Asia Pacific. Multiple restaurants and hotels are deploying smart meters with gas pipelines, this factor will fuel the growth of the market in the region in the upcoming years.

Asia Pacific is expected to contribute almost half of the global demand for gas by 2025. In which only industries are occupying 60% of the global demand.

Gas has a variety of practical uses, including cooking, heating, and powering some equipment. It is also a very affordable option to power your home. A gas meter is an instrument used to gauge the amount or rate of gas flow, it keeps track of how much natural gas is used in homes and businesses. Further, it transmits that information to energy suppliers for billing reasons. Megajoules (MJ) are used to measure and record gas consumption for properties. Megajoule-hours (MJ/h) are the most common unit of measurement for energy consumption in gas appliances, it aids utility companies in observing gas meter behavior and forecasting demand using data from gas meters. Additionally, the market expansion of different gas meters is further fueled by significant backing from governments across the world.

The gas meter market is expected to grow significantly during the forecast period with the rising adoption of gas pipelines in the urban areas. Administrations in developing countries are offering gas pipeline services with adequate subsidies and tax exemptions, such pipelines require gas meters to manage, detect and analyze the consumption of gas by the users. This element is expected to act as a growth factor for the market.

One of the main variables currently having a favorable impact on the industry is the rising demand for natural gas as a result of expanding urbanization. In addition, there are strict rules that governments in different nations have put in place to make sure that every home and small business installs a smart gas meter so they can track their regular gas expenses and consumption level.

The expansion of contemporary dwellings and cities, together with improvements in gas metering, were the main drivers of the market in recent years. During this time, ultrasonic and smart meters entered the market, substantially enhancing the accuracy and efficiency of gas measurement. Thus, the market is observed to maintain its growth in the upcoming period.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.17 Billion |

| Market Size by 2034 | USD 6.67 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.81% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising utilization of coriolis flowmeter

Over the past five years, one of the flowmeter kinds with the quickest growth has been Coriolis flowmeters. Users are replacing differential-pressure (DP) meters with them in numerous process facilities. When the cost of ownership is taken into account, many customers feel them to be a decent investment despite their higher original purchase price. The fact that Coriolis flowmeters measure mass flow directly, as opposed to computing it via a formula, is one of its most significant aspects. With the exception of thermal meters, most other flowmeters measure volumetric flow. By placing the fluid in small compartments and noting how frequently each compartment is filled, the volumetric flow may be measured. The operation of positive displacement meters is analogous to the act of pouring milk from a huge container. Thus, the Coriolis flowmeter can be majorly used as a measuring device for gas and driving the growth of the market.

Technical disruption in gas meters

Gas meters are often battery-powered and require a strong connection to work in a flow. The weak signal in rural locations makes it difficult for individuals to establish a solid connection for meters, which is a typical issue with smart meters. The connection of gas meters must be powerful enough to transmit the readings to the energy provider. The smart meter industry may experience technical disruption that limits market expansion. Technical disruptions with the meters can stop the operation or may offer false results. Thus, technical disruptions are observed to act as a restraining factor for the market’s growth.

Deployment of smart meters in the market

Smart meters are comparatively easy to operate and considerably simpler to read. Even a simple phone app that analyzes the use and consumption of energy. Additionally, the majority of smart meters already include an in-home display that may be used to view additional anticipated gas and electricity bill amounts. A smart in-home display is capable of assisting users in understanding total energy usage over time. Such meters with advanced functions are observed to bring technological advancements in the market of gas meters. Smart meters also lower the chances of inaccuracy in the bills. As people become more dependent on technologically advanced meters to analyze and calculate energy consumption, the deployment of smart meters will increase.

The basic meter type segment dominated the market with the largest market share in 2023. They expected to continue its dominance due to its simple use. The basic gas meter is analog in nature. A basic gas meter is easy in the installation process. The increasing residential sector in urban areas and the increasing use of gas for domestic and industrial use are propelling the growth of the market.

The smart meter type segment is expected to dominate the market with the largest market share in the forecast period. The rapid adoption of smart meters in the domestic and industrial sectors is likely to boost the segment’s growth. Increasing government subsidiaries in the usage of smart gas meters contributed to the higher demand for such meters. The application of smart meters is maintaining better transparency in gas companies and consumers.

The residential segment dominated the market with the highest market revenue in 2023. Rapid growth in the real estate industry across regions like the Asia Pacific and North America boosts the demand for the segment. A shift in the preference from fossil fuel to gas power will also regulate the demand for the product. Increasing residential sectors in the urban areas of the country and easy availability of gas power by the government and some of the private industries will likely propel the demand for gas meters in the residential segment.

The industrial and commercial segment is expected to increase its market share in the analyzed timeframe. Increasing industrialization across the world will result in the demand for gas power. Many industries need gas power as they are a major source of energy so this will tend to increase the demand for the gas meter in these segments.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client