List of Contents

What is the Smart Meters Market Size?

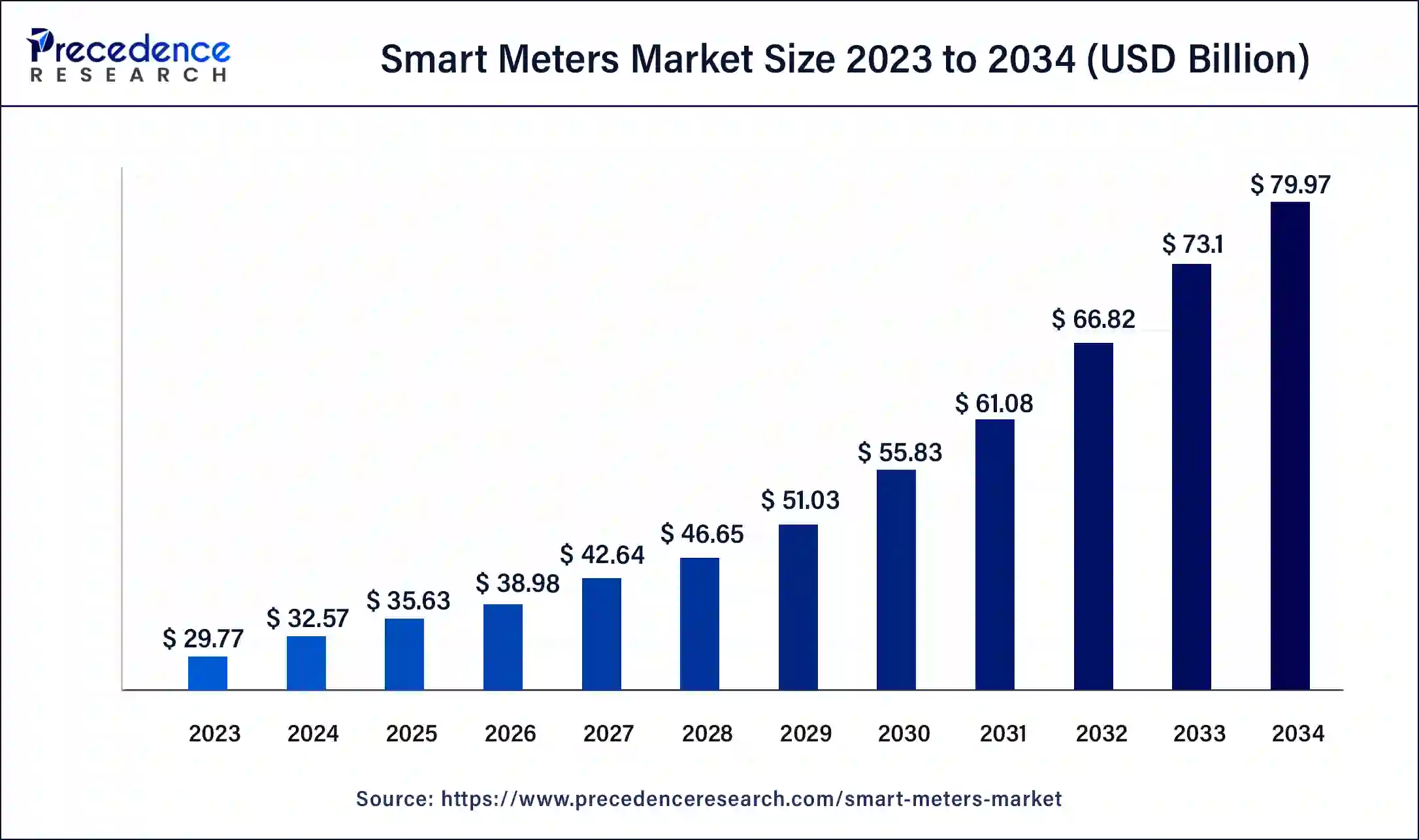

The smart meters market size is accounted at USD 32.57 billion in 2025 and is predicted to increase from USD 38.98 billion in 2026 to approximately USD 79.97 billion by 2034, expanding at a CAGR of 9.4% from 2025 to 2034.

Smart Meters Market Key Takeaways

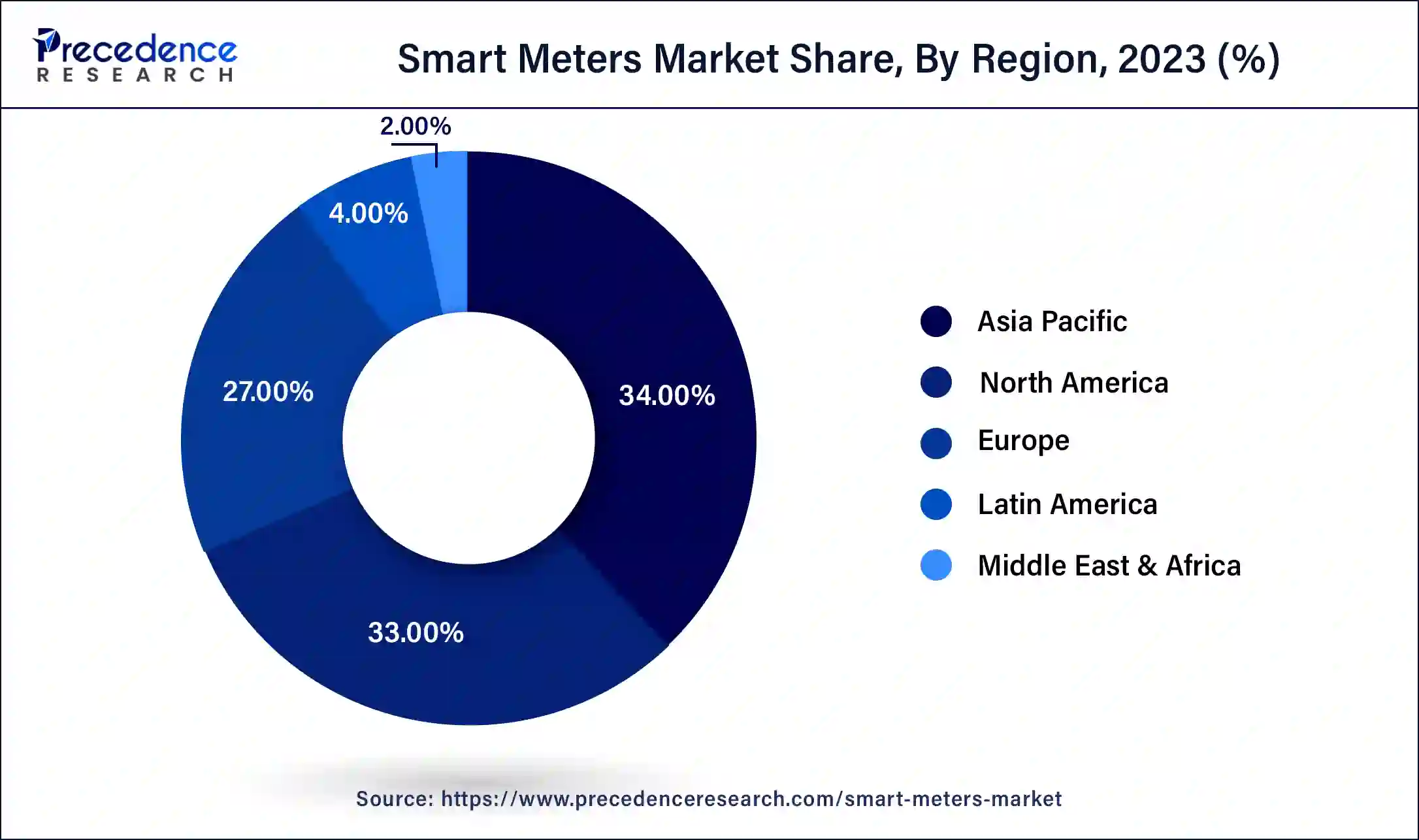

- Asia Pacific led the global market with the highest market share of 34% in 2024.

- By product, the electricity meters segment held the largest market share in 2024.

- By end use, the water supply segment captured the biggest revenue share in 2024.

Smart Meters: A Nervous System of Modern Utilities

Smart meters are digital devices that measure energy use and provide detailed, near-real-time data on electricity, and increasingly on gas and water consumption. They enable two-way communication between consumers and utilities. Driven by grid upgrades, demand-side management, time-of-use pricing, and distributed energy resources (DERs), the smart-meter market is at the crossroads of decarbonization, customer engagement, and operational efficiency. Benefits include accurate load balancing, quicker outage detection, lower meter-reading costs, improved billing accuracy, and a platform for advanced services like demand response, dynamic pricing, and energy analytics. As utilities and regulators aim for resilience and net-zero goals, smart meters are becoming essential infrastructure for electrified, distributed energy systems.

Market Outlook

- Industry Growth Overview: The smart meters market is rapidly expanding as utilities worldwide upgrade aging electrical grids and adopt digital metering infrastructures to support better demand management, energy efficiency, and real‑time consumption tracking. Rising regulatory mandates, growing investment in smart‑grid modernization, and increased consumer awareness of energy conservation are key growth factors fueling adoption.

- Sustainability Trend: Smart meters reduce operational carbon by cutting manual meter readings and enabling targeted demand-response that shifts load away from peak, thus lowering peak fossil generation. They support efficient integration of renewables and storage by providing the granular telemetry necessary for balancing.

- Major Investment Theme: Investors prioritize firms offering secure AMI platforms, meter-data analytics, OTA firmware-management tools, and metering cybersecurity services.

Smart Meters MarketGrowth Factors

There are different types of smart meters available in the market. Those are smart electricity meters, water meters, and gas meters. The growing demand for smart electricity meters is driving the growth of global smart meters market. As per the research published by the Institute for Electric Innovation, the U.S. electric providers installed around 98 million smart electricity meters in 2019, reaching more than 70% of the U.S. residential end users as of January 2020. By the end of 2020, the total number of installed smart energy meters will have risen to 107 million.

The major market players operating in smart meters market are adopting unique strategies for the growth and development of global smart meters market. Genesis will provide energy security to its New Zealand customers in 2019 through a partnership with Chirpy Chirpyplus, Australia's newest online community for over 55s. In order to expand its market reach and position in New Zealand, IntelliHUB completed the acquisition of Mercury's smart metering subsidiary Metrix for $270 million in 2019. Metrix will bring the total number of individually controlled and contracted meters on the Intellihub to about 2 million.

Another factor propelling the expansion of global smart meters market is growing government initiatives for the market growth. So, under the government of India's Smart Meter National Program, India's state-owned Energy Efficiency Services Limited proposed the implementation of about 1 million smart meters across the country in February 2020. Over the next few years, Energy Efficiency Services Limited aims to deploy 250 million smart meters. Such initiatives and activities are supporting the expansion of global smart meters market.

The smart meters are highly adopted by developing and developed countries for the purpose of commercial, residential, and industrial. It is expected that 148 million smart meters are going to be installed all around the world in the upcoming years. On the other hand, the factors such as growing costs for maintenance and installation are a major challenge for the growth of global smart meters market. However, the growing demand for energy and power is providing lucrative opportunities for the expansion of global smart meters market. In addition, the growing investments by the government for infrastructural projects are driving the growth of global smart meters market over the forecast period.

Smart Meters Market Trends

- Technological advancements like cloud computing, advancements in communication technologies, and analytics are a growing trend in the market, which fuels the growth.

- Advancement in metering infrastructure, which helps in accuracy, transparency, and energy efficiency, also promotes cost saving, and remote management further drives the growth.

- The rising investment by the government for smart cities, with initiatives like Smart City Mission, boosts the growth and demand for the market.

- Integration of AI and machine learning and enhancement in smart machine technology with functionality efficiency drives the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 79.97 Billion |

| Market Size in 2026 | USD 38.98 Billion |

| Market Size in 2025 | USD 35.63 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.4% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End Use, Component, Technology, Communication and Region |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Market Dynamics

Opportunity

The increasing adoption of smart meters in developing economies is expected to create lucrative opportunities for manufacturers in the upcoming years, as manufacturers can set up their plant or business in these types of countries that can provide a huge profit advantage, while these countries can receive the cost-effective smart meters. Also, the manufacturers can benefit from the establishment of strategic collaboration with regional governments, which is likely to provide a long-term profit margin with a sophisticated consumer base during the forecast period.

Restraint

The higher deployment cost of the smart meters is anticipated to hinder the industry growth in the coming years. Moreover, smart meters need digital networks, software systems, and skilled staff, which are more expensive than traditional meters. Also, in the developing countries, the adoption of smart meters is comparatively lower in the urban areas, which can create growth barriers for the new entrepreneurs and mid-sized businesses in the coming years, as per future industry observation.

Segmental Insights

Product Insights

The electricity meters segment dominated the smart meters market in 2024. The rapid urbanization is paving way for the growth of smart electricity meters segment. The growing initiatives for smart cities are also driving the growth of the segment. As per the British Petroleum, global power production reached 27004.7 terawatt hours in 2019. Energy consumption is predicted to rise in the near future, as per the U.S. Energy Information Administration, worldwide energy consumption is expected to rise by about 50% between 2018 and 2050, with Asia continuing to be the largest consumer. Thus, the smart electricity meters segment is growing at a rapid pace.

The smart gas meters segment is expected to witness strong growth during the forecast period. The installation and implementation of smart gas meters is fueled by an increase in demand for data. In 2019, residential sector in the UK paid an average of 655 pounds for gas, as per the Department of Business, Energy, and Industrial Strategy. Gas is used in the homes of approximately 23.5 million people for heat and electricity. The natural gas consumption in the UK reached 78.8 billion cubic meters in 2019, as per the British Petroleum. All these figures shows that the smart gas meters segment is growing at fastest rate.

End Use Insights

The residential segment dominated the smart meters market in 2024. The demand for smart meters is growing in residential sector due to the growing energy consumption. The residential areas use consumer electronics on a large scale. As a result, the demand for smart meters is growing at a rapid pace for residential end users.

The industrial segment is projected to witness strong growth during the forecast period. The rapid industrialization is driving the growth of global smart meters market. The expansion of manufacturing and construction sectors is boosting the demand for smart meters for industrial end users.

Technology Advancement

Improvements in technology are transforming the smart meters market by providing better, more dependable, and smarter ways to monitor and control energy use. The rise of improvements in communication, data analysis, and sensors has led to the improved use of smart meters that track electricity, gas, or water use for both businesses and homes in real-time.

This smart communication, modern meters allow the utility provider to quickly exchange data with the meter without interruption. Therefore, users can watch readings in real time, discover outages faster, and manage things from a distance, requiring less manual work.

According to the industry report by Avener Capital, India is on track to roll out 250 million smart meters, opening up a $20 billion opportunity for the energy sector. As of that date, about 117.7 million meters have been awarded and 14.5 million have been installed, as part of the Advanced Metering Infrastructure Service Provider (AMISP) initiative, which has an annual growth rate of 25% expected from 2024 to 2027.

Regional Insights

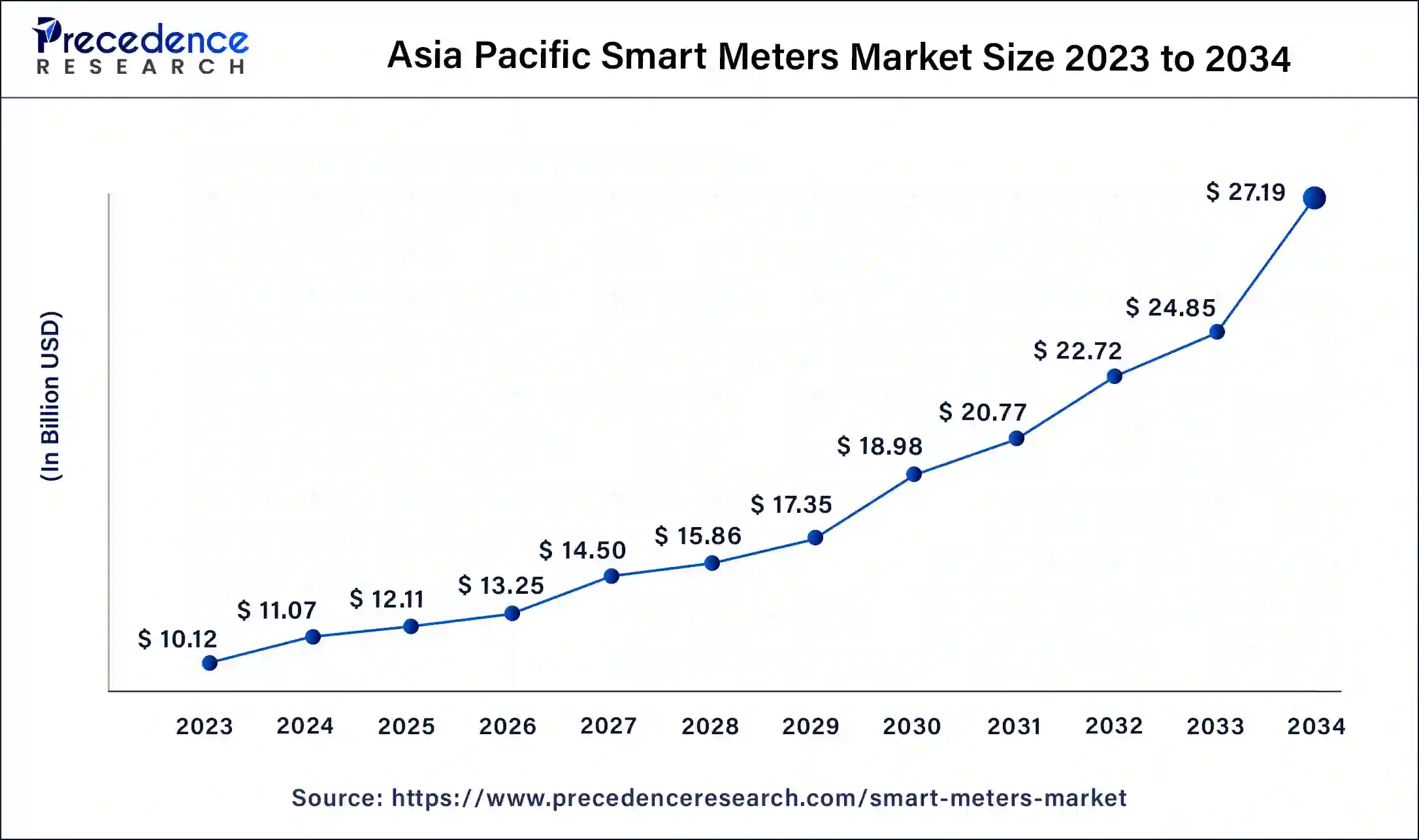

Asia Pacific Smart Meters Market Size and Growth 2025 to 2034

The Asia Pacific smart meters market size is estimated at USD 12.11 billion in 2025 and is predicted to be worth around USD 27.19 billion by 2034, at a CAGR of 9.6% from 2025 to 2034.

Asia-Pacific dominated the smart meters market in 2024. China dominated the smart meters market in Asia-Pacific region. The growing infrastructural investments are driving the growth of smart meters market in the region.

Asia Pacific features mature markets like Japan, South Korea, and Australia, which are advancing smart-grid technologies, and emerging markets such as India and Southeast Asia, where large-scale AMI rollouts are accelerating to reduce losses and improve energy access. Urbanization, rapid electrification, micro-grids, and rooftop PV proliferation serve as major drivers for smart meter adoption. Cost sensitivity in developing markets increases interest in scalable, low-cost metering solutions and pay-as-you-go models that support various utility business models. Telecom partnerships with NB-IoT and LTE-M are commonly used to provide reliable, low-power connectivity for meter fleets.

India Smart Meters Market Analysis

India has experienced steady growth in the smart meters market, driven by the increasing adoption of smart grids and the rising demand for energy-efficient management solutions. The country's growth is fueled by growing urbanization and government initiatives in infrastructure development that support market expansion.

Rapid urbanization and population growth increase demand for energy efficiency as energy consumption rises. The country's growth is also driven by reduced non-revenue water and electricity. Advances in technology, such as the integration of AI and cloud computing into processing, aid the market's growth and expansion within the country.

India's ambitious national targets for loss reduction and universal metering have made smart meters a strategic priority, with large tenders for AMI and prepaid meters in distribution utilities. Pilots focus on discom digitization, remote load control, and improved demand forecasting to stabilize stressed networks. Affordability has promoted interoperable, low-cost meter designs and pay-as-you-go business models tailored to economically marginalized consumers. The policy push and local manufacturing mandates are creating a distinctly scalable APAC model for large-scale meter deployments.

What Makes Europe the Fastest-Growing Region in the Market?

Europe is expected to develop at the fastest rate during the forecast period. The UK, Spain, France, and Italy dominate the smart meters market in Europe region. The growing installations of smart electric meters are driving the demand for smart meters in the region. The growth of smart meters market in Europe is being propelled by the existence of major market players, growing adoption of innovative technologies, and increasing acceptance of renewable energy sources.

Europe's smart meter market is driven by decarbonization goals, regulatory frameworks that enable time-of-use pricing and empower consumers, and high DER penetration that requires accurate, two-way data exchange. Several EU countries have implemented advanced rollout programs linked to national smart-metering mandates and energy-efficiency directives, focusing on consumer data access and interoperability. Smart meters in Europe are essential for enabling flexible consumption, local energy markets, and coordinated EV charging strategies that reduce grid stress. The integration of meter data into national energy systems supports comprehensive carbon accounting and demand-response management.

UK Smart Meters Market Analysis

The UK market has seen significant growth in the smart meters market, the growth is driven by the government's set targets in the country for smart meter installations, which drives the growth of the market in the country. The growth is also driven by the net-zero emission by 2050 initiatives, which increase the installation and use of smart meters in the country, which fuels the growth of the market. Growing consumer awareness of smart technologies to enhance energy efficiency supports the growth and expansion of the market in the country.

Germany Smart Meters Market Analysis

Germany emphasizes meter-data integration for energy-efficiency programs and to support household-level PV and battery systems through smart-meter gateways. Investment in secure communication gateways and certified metering infrastructure aligns with national decarbonization targets. The market favors interoperable systems that comply with strict metering and data-protection standards. Germany's strong regulatory oversight ensures that deployments deliver measurable grid and consumer benefits.

Why is North America Considered a Notably Growing Region?

The North America region is notably growing in the smart meters market, akin to the presence of advanced utility infrastructure and the increased shift towards energy efficiency in recent years. As the regional countries, such as Canada and the United States, have actively seen under the development of smart grids and modern energy management systems in the past few years. Also, factors such as growing concerns related to power outage and energy theft are immensely contributing to the growth of the market in the country nowadays. Furthermore, the traditional utilities companies are replacing the conventional meters with the smart ones in the current period.

U.S. Smart Meters Market Analysis

In the U.S., investor-owned utilities, cooperatives, and municipal utilities follow different deployment timelines, with states and regulators guiding cost recovery and benefit realization. Utilities are using AMI Advanced Metering Infrastructure not just for billing but also for outage management, voltage optimization, and distributed-asset orchestration. Cybersecurity, firmware update governance, and OTA management are high priorities due to the critical-infrastructure status. The U.S. market is also a leading testbed for IoT-connected home energy ecosystems that rely on smart-meter-enabled data feeds.

What Potentiates the Smart Meters Market in the Middle East & Africa?

In the Middle East & Africa, the market is expanding due to increased adoption of smart metering and investments in energy infrastructure, desalination, and utility commercialization initiatives. Utilities use smart meters to reduce non-technical losses, improve billing accuracy for high-energy users, and enable better outage and load forecasting during extreme weather conditions. The commercial and industrial sectors, especially in Gulf countries, are early adopters seeking energy optimization for large facilities and district cooling systems. African markets focus on modular, rugged, and low-power meters that can operate in remote, off-grid, or mini-grid environments.

UAE Smart Meters Market Analysis

The UAE uses smart meters as part of its smart-city and energy-efficiency plans, with major utilities deploying AMI to support dynamic pricing and demand-side programs. Integration with building management systems and district energy networks allows enterprise-level energy optimization. Strong government mandates and public funding lower commercial barriers for quick deployment. The UAE also focuses on cybersecurity and smart-grid resilience because of its role as a regional energy and logistics hub.

Value Chain Analysis

Component Manufacturing

Production of essential smart meter components, such as sensors, communication modules, microcontrollers, and metrology devices, forms the backbone of meter functionality.

- Key Players: Honeywell, ABB, Landis+Gyr, Siemens, Schneider Electric.

Smart Meter Design & Development

Integrating hardware and software, manufacturers design smart meters with capabilities for automated meter reading, two-way communication, and energy monitoring.

- Key Players: Itron, Kamstrup, Elster (Honeywell), Sensus (Xylem).

Assembly & System Integration

Components are assembled into fully functional smart meters, with embedded software for communication with utilities' IT and grid management systems.

- Key Players: Landis+Gyr, Schneider Electric, Siemens, Itron.

Smart Meters Market Companies

- Holley Metering Limited

- Neptune Technology Group Inc.

- Honeywell International Inc.

- Siemens AG

- Kaifa Technology

- Suntront Technology

- Wasion Group

- Aichi Tokei Denkei

- Badger Meter

- Sensus

Recent Developments

- In September 2024, Metron, an international leader in cellular-driven water intelligence and smart metering, presented two products: WaterScope Utility, an analytics application for enhancing frontline operations, and the Metron Spectrum Wave, an advanced ultrasonics smart meter that integrates durability and versatility with industry-leading data capture capabilities.

- In July 2024, Genus Power Infrastructures Limited, a leader in smart meter technology with a large base of smart electricity meter installations, reached a significant milestone in its strategy to become a water management solution provider by successfully shipping its Smart Ultrasonic Water Meters DN20 to Australia.

- In May 2024, Oakter unveiled its Smart Energy Meter, named OAKMETER. The advanced meter creates an extensive communication channel with utility servers through internet connectivity and utilizes various technologies such as Advanced Metering Infrastructure, real-time data analytics, and Internet of Things (IoT) technologies.

- Itron Inc. a provider of latest energy and water management solutions for cities and utilities, declared the launch of Itron Smart Pay for cities and utilities in North America in November 2021.

- Honeywell declared in January 2020 that it would incorporate Verizon's LTE Managed Connectivity service into smart meters and other devices in order to achieve the smart grid's next iteration. Honeywell can now offer a wireless network platform to its clients as part of its smart energy services, hardware, and software as a result of this collaboration with internet of things devices in a secure and dependable manner.

- Landis+Gyr released Revelo electric meters with sophisticated grid sensing technology in January 2020.

- The Japanese Ministry of Economy, Trade, and Industry reach a contract with Sojitz Corporation in November 2020. The contract provides for the expansion of energy infrastructure across Asian regions as well as the implementation of a distributed smart infrastructure.

- In January 2021, Landis+Gyr paid $2 million for a 3% equity stake in Sense Labs Inc. Sense creates and sells electronic devices for evaluating electricity usage in homes in the U.S. as well as the software that goes with them.

Segments Covered in the Report

By Product

- Electricity Meter

- Gas Meter

- Water Meter

By End Use

- Residential

- Commercial

- Industrial

By Component

- Hardware

- Software

By Technology

- AMI

- AMR

By Communication

- RF

- PLC

- Cellular

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client