February 2025

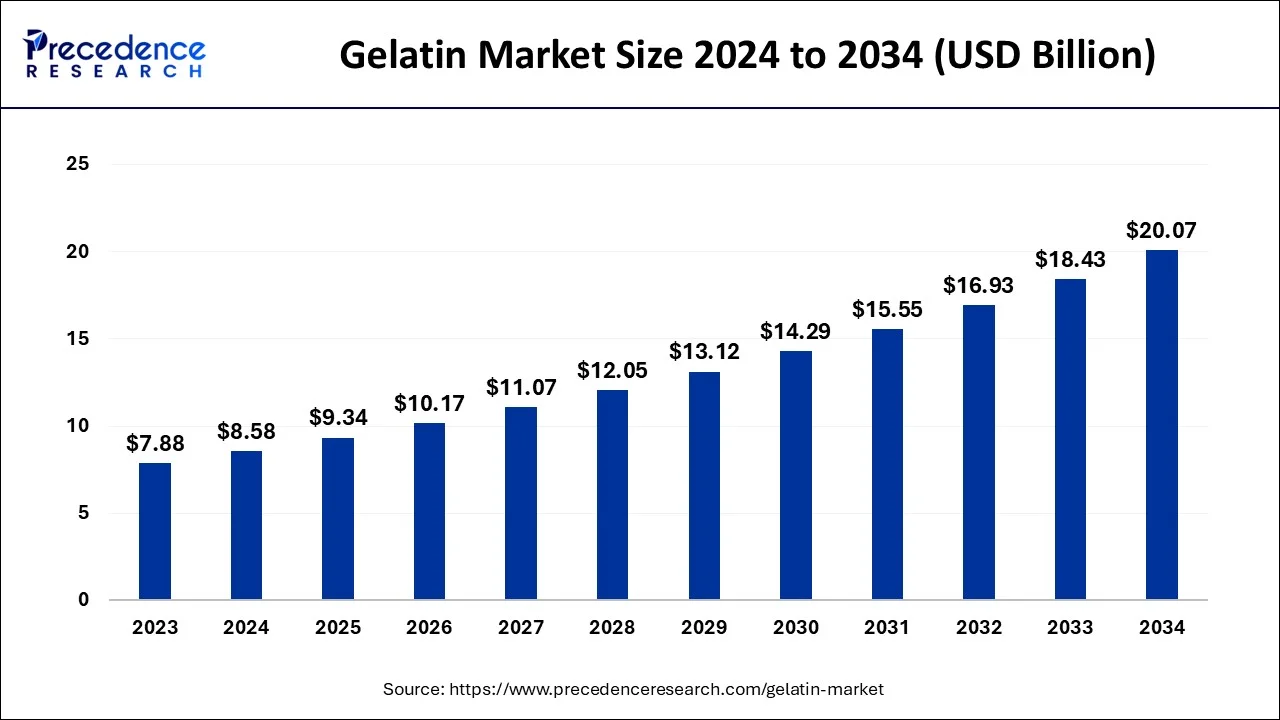

The global gelatin market size accounted for USD 8.58 billion in 2024, grew to USD 9.34 billion in 2025 and is predicted to surpass around USD 20.07 billion by 2034, representing a healthy CAGR of 8.87% between 2024 and 2034.

The global gelatin market size is estimated at USD 8.58 billion in 2024 and is anticipated to reach around USD 20.07 billion by 2034, expanding at a CAGR of 8.87% from 2024 to 2034. Increasing demand for gelatin from the nutrition industry for the production of well-being products will fuel the growth of the global market.

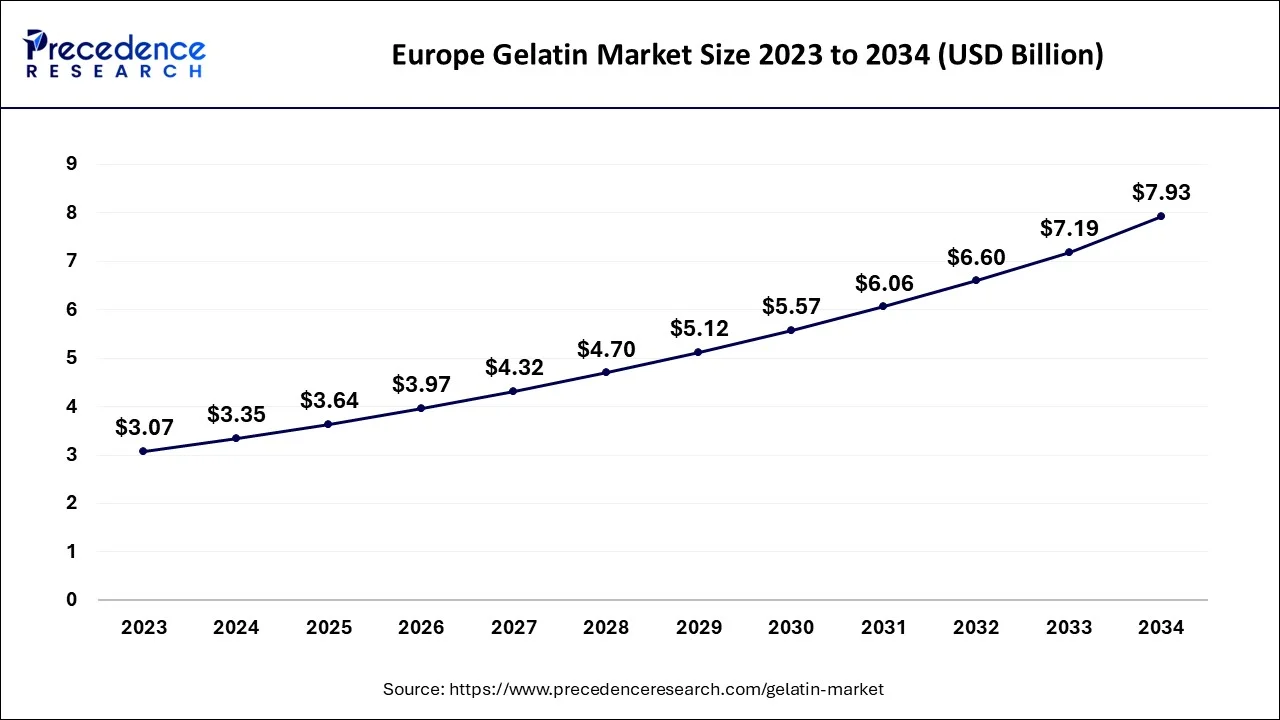

The Europe gelatin market size is estimated at USD 3.35 billion in 2024 and is expected to be worth around USD 7.93 billion by 2034, rising at a CAGR of 9.01% from 2024 to 2034.

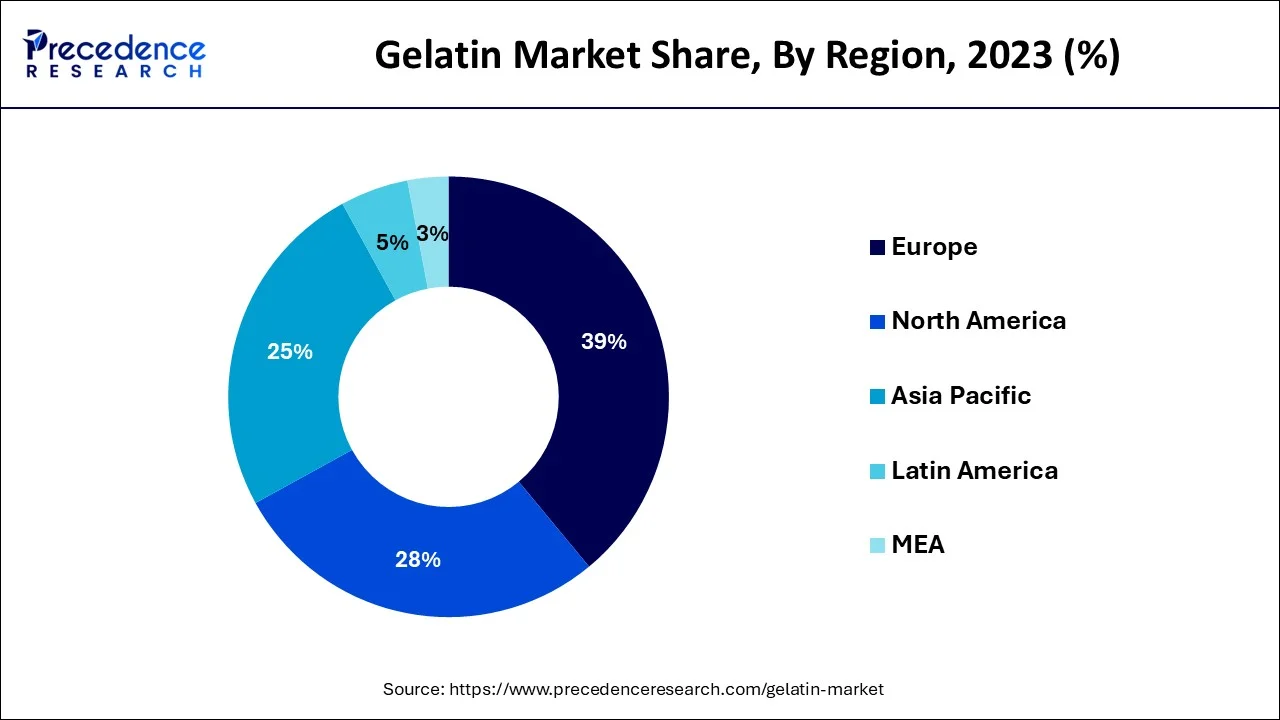

Europe holds the largest revenue share of around 39% in 2023. The growing pharmaceutical industry and demand for nutritional food products have surged the growth of the industry in Europe. The expanding food and beverage and nutraceutical industries have boosted the demand for raw materials used in the production of gelatin, especially from the U.K., Italy, and Germany. North America shows a mature market for gelatin due to the presence of major key players, such as Triple-T Foods Arkansas, Darling Ingredients, and Nitta Gelatin. The expansion of the food & beverage industry is likely to boost the growth of the gelatin market in Asia Pacific during the forecast period of 2023-2032. The growing demand for gelatin-based cosmetic products is another driving factor for the market in the Asia Pacific. Furthermore, China is considered the largest market for packaged food products and beverages, which will boost the demand for gelatin.

Considering the growth in Latin America, countries such as Chile, Brazil & Argentina are considered major players. The growing pharmaceutical industry in Latin America will likely increase the demand for gelatin-based capsules. However, the growing veganism in Latin America is a restraining factor for the growth of the industry. Moreover, rising demand for well-being and gelatin-based cosmetic products is likely to grow the market in the gulf countries (Oman, UAE, Saudi Arabia).

Gelatin is a nearly odorless and colorless ingredient in producing edibles, medicines, and cosmetics. Mostly gelatin is acquired from animal tissues (fish, pigs, or chicken) that contain high amounts of collagen. Gelatin is not available in nature; it is derived by hydrolyzing collagen. Pharmaceutical companies widely use gelatin for coating capsules and as a gelling agent in the food & beverage and cosmetic industries. Gelatin is a mixture of proteins and peptides made from collagen. Gelatin has multiple qualities, such as binding, cleaning, and viscosity. Moreover, it also works as a stabilizer which has fueled the demand for gelatin to be employed in production. In gelatin, multiple acids include glutamic acid, aspartic acid, amino acids, and glycine.

Gelatin is considered an excellent source of calcium and is thus consumed by people to prevent or treat osteoporosis or other bone-related issues. Orthopedic surgeons recommend the consumption of marine/fish gelatin to overcome the deficiency of calcium. Gelatin contains several antioxidants that protect healthy cells in the body and keeps the digestive tract healthy with the presence of glutamic acid in it. The cosmetic industry uses gelatin in various products, such as face creams, lipsticks, sunscreen lotion, bath scrubs, and body creams. Gelatin acts as an excellent gelling agent in cosmetic products, which has resulted in increased demand for gelatin. Gelatin is free of any preservatives or chemicals; thus, it is the most preferred clean-label product.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.58 Billion |

| Market Size by 2034 | USD 20.07 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8.87% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Largest Market | Europe |

| Segments Covered | By Source, By Application, By Type, and By Function |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The global gelatin market is projected to grow during the forecast period of 2023-2032 due to the rising demand for gelatin in the cosmetics, drug, and food industries. Growing awareness for clean-label products among the population has surged the growth of the industry. The demand for well-being products and nutritional supplements for better health care has increased after the uncertain spread of the Coronavirus. This demand has resulted in the invention of new products in the market, which has shown significant growth for the gelatin market. The advancement and automation in gelatin production have strengthened the supply chain by making distribution faster to meet consumer demand.

The widespread market of gelatin across the globe results from a huge demand for gelatin in various products. Increasing demand for packed or ready-to-eat food is a major driving factor for the market. Along with this, the increasing utilization of gelatin in skin care, beauty, and other cosmetic products has fuelled the growth of the market. Using gelatin in personal care products such as hair and skin care products will drive consumer inclination. Gelatin, due to the presence of protein sources, is used in nutrition products. Growing consumption of health drinks such as meal replacements, protein shakes, and diet supplementary drinks is seen as a major driver for the growth of the global gelatin market. Moreover, the rising demand for gelatin photography will fuel the growth of the industry.

Regulations associated with the use of gelatin meant for human consumption, hamper the growth of the global gelatin market. Increasing veganism among the population is another major restraining factor for the market, as gelatin is derived from animal tissues, and the concept of veganism doesn't allow the consumption of products made of gelatin. Furthermore, the increased availability of alternative products for gelatin, such as agar, has negatively affected the market's growth.

Covid-19 impact

The uncertain spread of Coronavirus has negatively affected the market at the beginning of the Covid-19 pandemic. The covid-19 pandemic negatively impacted almost every industry, including food & beverages, agribusiness, and cosmetics. The imposed restrictions to contain the spread of Coronavirus resulted in the supply chain disruption for gelatin, whereas the manufacturing units were shut down. The pandemic period changed consumer behavior, where people were conscious about the food items they were buying. The changed consumer behavior impacted the demand for new gelatin products. Due to the disrupted supply chain, the import and export of raw materials required for the production of gelatin were affected.

However, the demand for well-being and nutrition products boosted during a specific phase of the pandemic (mid-2020 and at the start of 2021) owing to the increased awareness of self-health care among the population. The rise in demand for products that boost immunity has positively impacted the gelatin industry. The demand led to the invention and production of new well-being products in which gelatin was used, as it is known for its excellent nutritious values. Moreover, the increased demand for preserved food products during the lockdown period has shown significant growth in the market, as gelatin is considered a thickening agent for preserved food products. The negatively impacted market is likely to surge after the pandemic due to increased demand for gelatin-based products in the pharmaceutical and food & beverage industries.

Based on the source, the gelatin market includes bovine, porcine, chicken, and marine. By source, the porcine segment will likely dominate the overall market. Porcine gelatin comes from pigs and is considered an excellent source of protein. It is used in the production of various medicines as well as food products. In recent years, the utilization of porcine gelatin for nutritional beverages consumed by the sports sector has increased. Bovine gelatin is the second largest leading segment in the market. Bovine gelatin is widely used as a protein-gelling agent in the production of vitamin capsules and cosmetic products.

Marine gelatin, mainly acquired from fish, is another fastest-growing segment owing to its high calcium and nutrient content. Marine gelatin is widely used in the production of well-being products. High-quality amino acids and proteins provided by marine/fish gelatin have boosted the segment's growth in the global gelatin market. Population suffering from protein deficiency demands fish gelatin-based products.

The gelatin market is segmented based on application into food & beverage, pharmaceuticals, and nutraceuticals. Among all, the food & beverage segment holds the largest revenue share of around 57% in 2023. Rapidly increasing use of gelatin in bakery products, jellies, marshmallows, yogurt, and other food products has propelled the growth of the food & beverage segment in the market. Gelatin is directly obtained from animal tissues that are a high source of protein and other nutritional values.

Thus, the rising demand for well-being products (powders, capsules, or drinks) with nutritional values of gelatin has surged the growth of the nutraceutical segment in the global gelatin market. The pharmaceutical industry uses various gelatins to form shells for capsules to prevent the content in capsules from contamination. The surging demand from pharmaceutical companies for gelatin will likely boost the pharmaceutical segment in the upcoming years.

Based on type, the gelatin market is segmented into type-A and type-B. Type-A gelatin is the fastest-growing segment of the market. Type-A gelatin is derived from pig skin, and type-B gelatin is usually derived from beef skin. Type-A gelatin carries better storage stability than type-B gelatin. Thus, the utilization of type-A gelatin by most end-users has made the type-A segment grow faster. Type-A gelatin is widely used in the food industry.

Based on function, the gelatin market is segmented into stabilizing, thickening, and gelling. Thickener gelatin provides better liquid viscosity and does not change the product's characteristics. Considering the benefits of thickeners, the thickening segment holds a significant share of the market. Gelatin for thickening is widely used in the production of cosmetics. Gelatin is also used as a stabilizer to reduce the melting speed of any product.

Gelatin, as a stabilizer, also prevents the deformation of products. Gelatin is widely used as a gelling agent in food, medication, and cosmetics. Gelatins provide desired texture to the product when used as a gelling agent. The growing demand from the food & beverage segment for gelatin is likely to grow the gelling component during the forecast period of 2024-2034.

By Source

By Application

By Type

By Function

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

September 2024