February 2025

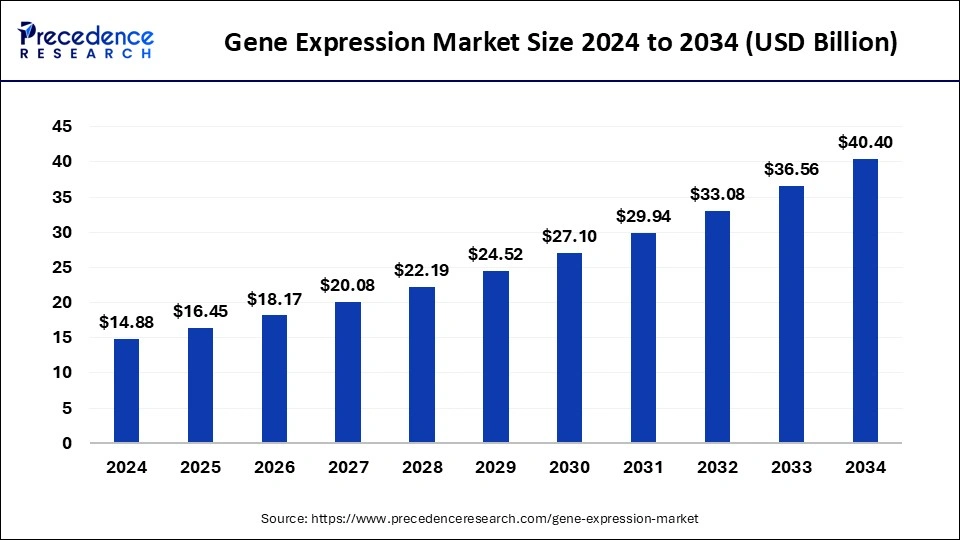

The global gene expression market size is calculated at USD 16.45 billion in 2025 and is forecasted to reach around USD 40.40 billion by 2034, accelerating at a CAGR of 10.50% from 2025 to 2034. The North America market size surpassed USD 6.99 billion in 2024 and is expanding at a CAGR of 10.51% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global gene expression market size accounted for USD 14.88 billion in 2024 and is predicted to increase from USD 16.45 billion in 2025 to approximately USD 40.40 billion by 2034, expanding at a CAGR of 10.50% from 2025 to 2034.

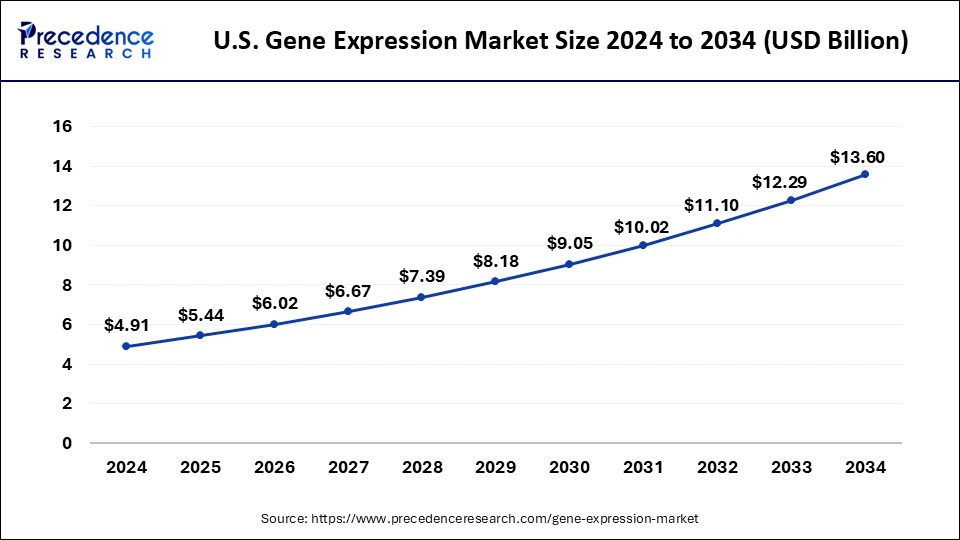

The U.S. gene expression market size was evaluated at USD 4.91 billion in 2024 and is projected to be worth around USD 13.60 billion by 2034, growing at a CAGR of 10.73% from 2025 to 2034.

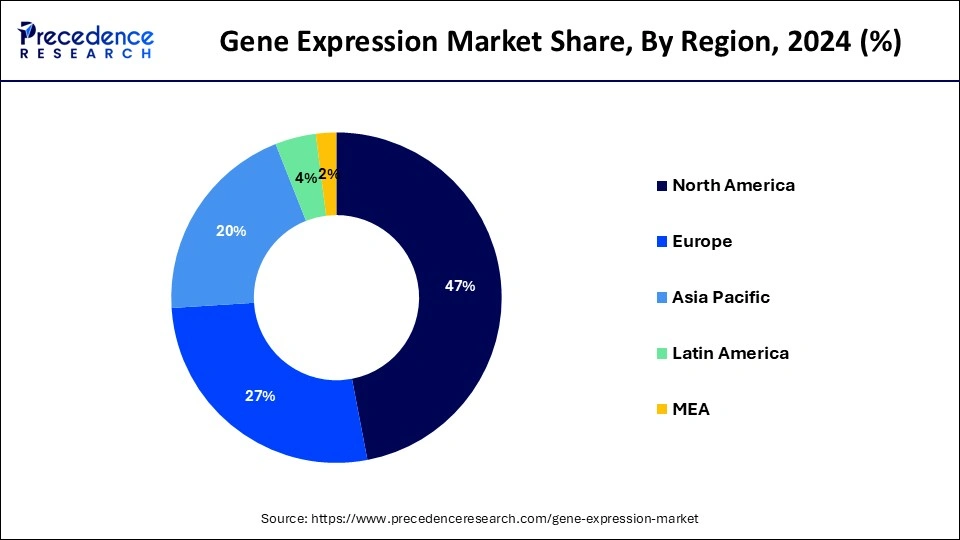

North America dominated the global gene expression market in 2024, the region is expected to sustain its dominance throughout the forecast period. North America is at the forefront of technological advancements in the field of genomics and gene expression analysis. The region is home to many leading biotechnology and pharmaceutical companies, research institutions, and academic centers that drive innovation and development in gene expression technologies.

The availability of state-of-the-art platforms, instruments, and tools for gene expression analysis gives North America a competitive edge in the market. North America has a well-established healthcare infrastructure, including a vast network of hospitals, diagnostic centers, and clinics. These healthcare facilities integrate gene expression analysis into routine diagnostic and treatment practices, further driving the demand for gene expression testing.

North America has been at the forefront of adopting precision medicine approaches, which heavily rely on gene expression analysis. The region has a strong healthcare system and a focus on personalized patient care, leading to increased demand for gene expression testing for disease diagnosis, treatment selection, and monitoring. The widespread adoption of precision medicine in North America drives the demand for gene expression analysis and contributes to the market's dominance.

On the other hand, Asia Pacific is expected to grow at the fastest rate during the forecast period, the region is observed to be the most attractive marketplace for gene expression-related activities. Asia Pacific is home to a large and diverse patient population, presenting significant opportunities for gene expression analysis in healthcare.

The region has a high prevalence of various diseases, including cancer, cardiovascular disorders, and infectious diseases. The growing need for precise diagnosis, prognosis, and treatment in a diverse patient population drives the demand for gene expression analysis in the region.

governments, research institutions, and healthcare providers are investing in precision medicine initiatives, including genomics and gene expression research. The focus on precision medicine and the integration of gene expression analysis into clinical practice contribute to the growth of the gene expression market in the Asia Pacific.

The gene expression market refers to the market for products and services related to the analysis and quantification of gene expression. Gene expression refers to the process by which information encoded in genes is used to synthesize functional gene products, such as proteins or non-coding RNAs, which play essential roles in various biological processes.

The gene expression market encompasses a wide range of products and services that facilitate the measurement, analysis, and interpretation of gene expression patterns. The global gene expression industry serves academic researchers, pharmaceutical and biotechnology companies, clinical laboratories, and other stakeholders involved in understanding gene expression patterns and their functional implications.

The development of new and more cutting-edge technological technologies has significantly increased the precision and dependability of gene expression analysis. Additionally, significant government investments in R&D initiatives and the expansion of its healthcare infrastructure have become important market growth drivers. It is projected that the market for gene expression will expand as a result of the development of technologically sophisticated solutions.

| Report Coverage | Details |

| Market Size in 2025 | USD 16.45 Billion |

| Market Size in 2024 | USD 14.88 Billion |

| Market Size by 2034 | USD 40.40 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.50% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Process, Product, Capacity, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for personalized medicine

Personalized medicine focuses on tailoring medical treatments to individual patients based on their unique genetic makeup. Gene expression analysis plays a pivotal role in identifying specific biomarkers associated with diseases, treatment responses, and prognosis. By analyzing gene expression patterns, researchers can identify gene signatures that correlate with disease subtypes or predict therapeutic outcomes. The demand for personalized medicine drives the need for extensive gene expression analysis to discover and validate biomarkers.

The gene expression market benefits from continuous advancements in technology, such as next-generation sequencing (NGS), microarray technologies, and single-cell analysis. These technological advancements have increased the throughput, sensitivity, and accuracy of gene expression analysis, making it more accessible and affordable.

As the demand for personalized medicine grows, there is a parallel demand for advanced gene expression analysis technologies and platforms, further driving the growth of the gene expression market.

High cost of analysis

Healthcare facilities, such as hospitals and clinics, may face financial constraints when it comes to implementing gene expression analysis in their routine diagnostic procedures. The high upfront costs associated with acquiring the required instruments, reagents, and expertise can make it difficult for healthcare facilities to invest in gene expression analysis. As a result, they may rely on more cost-effective but less comprehensive diagnostic methods, limiting market growth.

The high cost of gene expression analysis may impact its adoption in clinical settings, where cost-effectiveness is a significant factor. Healthcare providers and payers may hesitate to integrate expensive gene expression assays into routine clinical practice, especially if alternative diagnostic methods are more affordable and yield comparable results. This cost consideration can limit the market growth for gene expression analysis in clinical applications.

Rising government’s regulatory and financial support

Government funding agencies and organizations provide grants and funding opportunities to support scientific research, including gene expression studies. Increased government support in the form of research grants and funding programs allows researchers and institutions to invest in gene expression analysis. This funding enables the development of new technologies, the exploration of novel applications, and the advancement of knowledge in the field. It creates opportunities for researchers to conduct gene expression studies and drives the growth of the gene expression market. Government support in the form of streamlined regulatory processes and guidelines fosters confidence and paves the way for the commercialization and widespread adoption of gene expression technologies and products.

The data analysis and interpretation segment is the fastest-growing and is expected to be the largest segment of the global gene expression market. Gene expression data analysis provides valuable insights into disease mechanisms, treatment response, and patient outcomes. Data interpretation helps researchers derive meaningful conclusions from gene expression studies, driving the demand for data analysis tools and services.

Gene expression data analysis requires specialized software and bioinformatics tools. These tools aid in the preprocessing, normalization, statistical analysis, and visualization of gene expression data.

They facilitate the identification of differentially expressed genes, functional annotation, and pathway enrichment analysis.

The reagents and consumables segment is dominating the global gene expression market. Reagents and consumables are essential components in gene expression analysis. They include RNA extraction kits, reverse transcription reagents, PCR reagents, fluorescent dyes and probes, sequencing libraries, and other assay components required for gene expression analysis. These consumables are routinely used in gene expression experiments and are often specific to the particular technique or platform being used. The consistent and routine usage of consumables provides a reliable market base, contributing to their dominance in the gene expression market.

The instruments segment is another fastest-growing segment of the market. This segment includes the instruments and platforms used for gene expression analysis, such as microarray scanners, real-time PCR instruments, RNA sequencing platforms, and gene expression profiling systems. These instruments enable researchers to measure the abundance of RNA transcripts and assess gene expression levels.

The gene expression market also encompasses services and solutions provided by research laboratories, contract research organizations (CROs), and other service providers. These services may include gene expression profiling, data analysis and interpretation, pathway analysis, and customized gene expression studies. Service providers may offer expertise and infrastructure for gene expression analysis, assisting researchers who lack specialized resources or require specific expertise.

The high plex capacity segment dominated the market in 2024, the segment will continue to grow at a significant rate during the forecast period. The high plex capacity segment dominates the gene expression market due to its efficiency, cost-effectiveness, ability to provide comprehensive analysis, exploration of gene networks and pathways, reduction of sample consumption, technological advancements, and compatibility with multi-omics integration. These factors make high plex capacity assays attractive to researchers seeking a comprehensive view of gene expression patterns and efficient utilization of resources.

The pharmaceutical and biotechnology companies segment had the largest share of the market in 2023, the segment is anticipated to sustain its position during the forecast period. Pharmaceutical and biotechnology companies heavily rely on gene expression analysis to drive their research and drug development efforts. Gene expression analysis helps identify potential drug targets, understand disease mechanisms, evaluate treatment responses, and assess drug safety and efficacy. These companies invest significant resources in gene expression analysis to support their research and development pipelines, making it the leading segment in the market.

The diagnostic center's segment is expanding at a robust rate. The rising demand for precision medicine and proper clinical applications is fueling the growth of the segment in the market. The clinical relevance and utility of gene expression analysis position diagnostic centers as key players in the gene expression market.

By Process

By Product

By Capacity

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

February 2025

November 2024