March 2025

Generic Sterile Injectable Market (By Product Type: Monoclonal Antibodies, Cytokines, Insulin, Peptide Hormones, Vaccines, Immunoglobulin, Blood Factors, Antibiotics, and Others; By Therapeutic Application: Cancer, Diabetes, Cardiovascular Disease, Central Nervous System, Musculoskeletal System, and Others; By Distribution Channel: Hospitals, Drug Stores, Retail Pharmacies, and Others) - Global Industry Analysis, Market Size, Share, Growth, Trends, Regional Outlook and Forecasts, 2024 - 2033

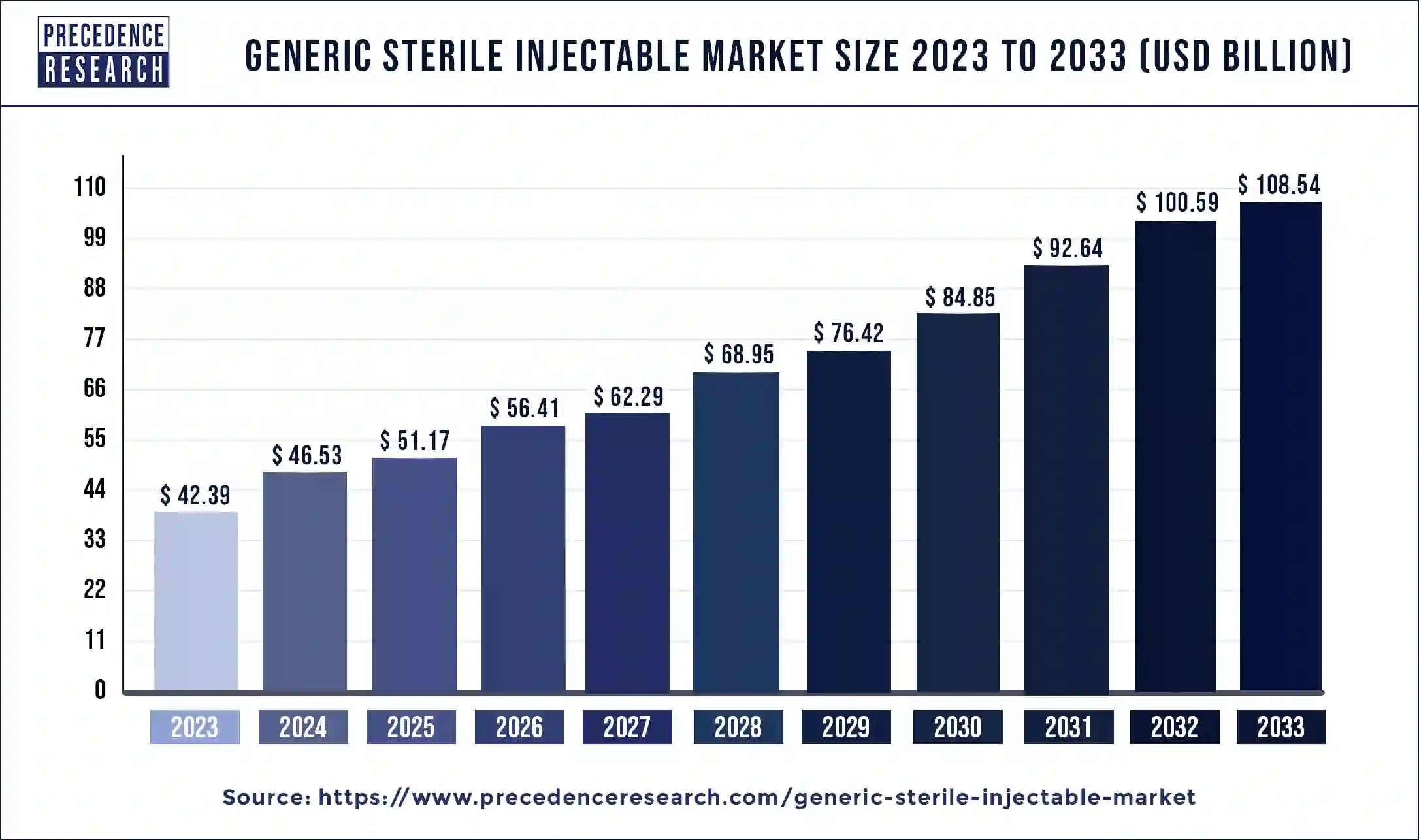

The global generic sterile injectable market size was estimated at USD 42.39 billion in 2023 and it is expected to hit around USD 108.54 billion by 2033, growing at a CAGR of 9.85% during the forecast period 2024 to 2033.

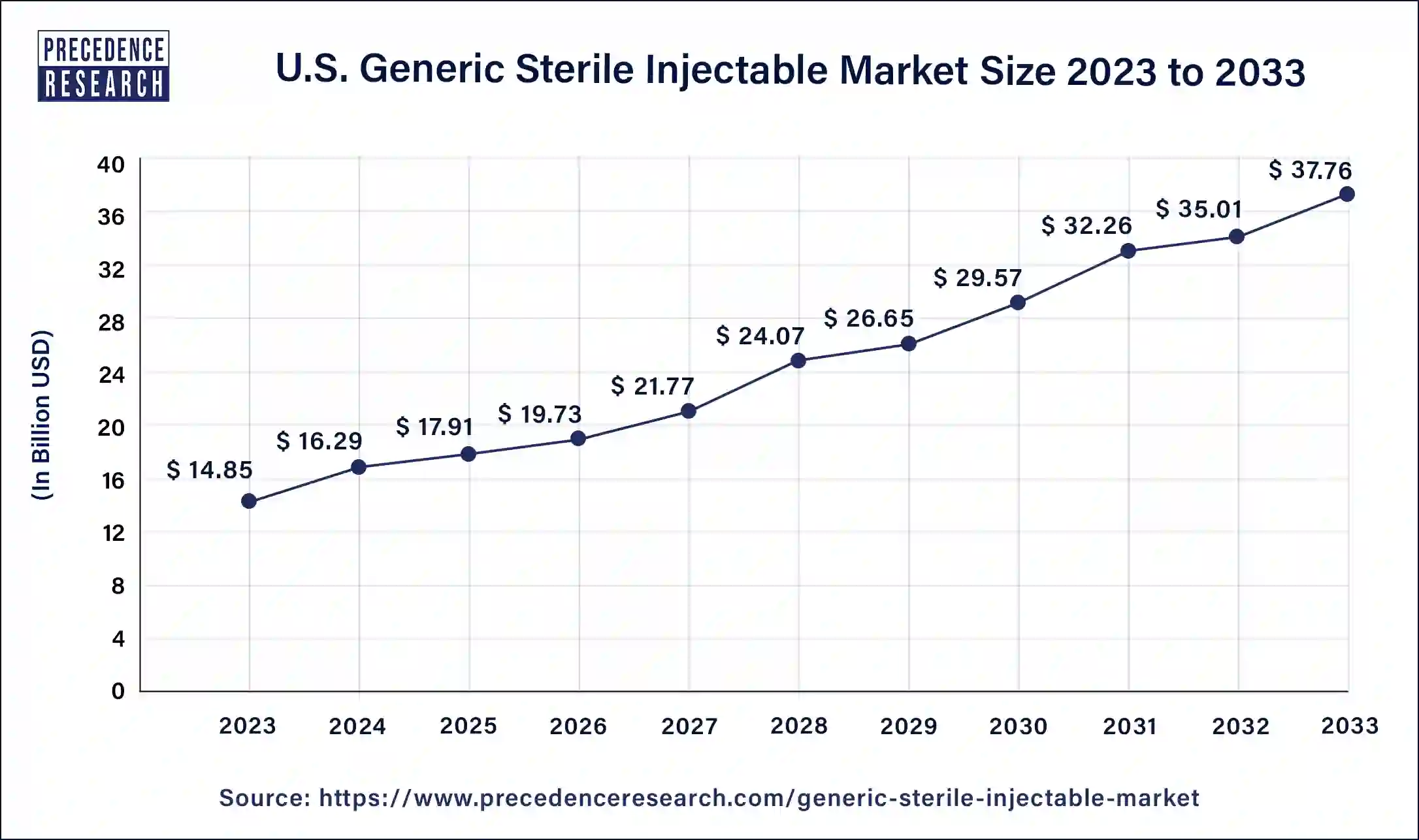

The U.S. generic sterile injectables market size is expected to be worth around USD 37.76 billion by 2033 and is growing at a compound annual growth rate (CAGR) of 9.77% from 2024 to 2033.

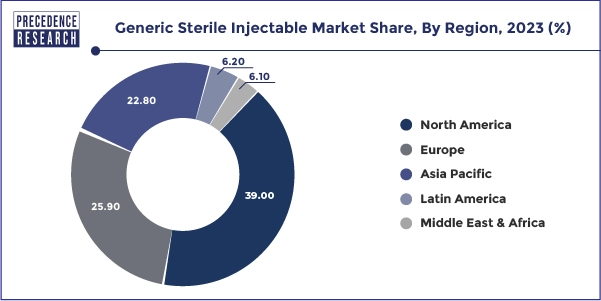

The study report covers key trends and prospects of generic sterile injectable products across different geographical regions including North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa. Geographically, generic sterile injectable market is conquered by North America owing to initiatives by governments and other regulatory bodies, rising geriatric population, growing prevalence of the chronic diseases, and growth in the number of patent expired branded drugs. Asia Pacific generic sterile injectable industry market is estimated to grow at noteworthy growth rate in the next 10 years. The growth is attributed to speedy increase in the prevalence of chronic disease in the countries of APAC owing to changing lifestyle which is creating demand for the generic sterile injectable. Additionally, growing demand for the generic sterile injectable for the end users in LATAM and the countries of Middle East and Africa is anticipated to propel industry growth in the next 10 years.

Key market Insights:

An alternative to the oral delivery mechanism is injectable drug delivery, which easily transports a drug dose through the bloodstream, thereby bypassing first-pass metabolism. There are some medications that would be entirely useless if delivered as capsules, as they would be killed by enzymes that digest food in the stomach. The insulin injection used in diabetes care is an example. Insulin is a protein. Therefore, if given as a tablet, the same enzymes that ferment food in the stomach would be digested. Therefore, as of today, there is no such term as an insulin tablet. Injectable allow the transport, directly into the bloodstream, of drugs manufactured in liquid form. The goal of the delivery of injectable drugs is to optimize patient compliance and reduce the frequency of dose administration without reducing medication efficacy. Due to deep vomiting, unconsciousness or having a cancer lining in the upper part of their dietary canal, it may be impossible to take tablets for certain patients. Therefore, injection options are available for most oral medications. The increasing prevalence of such metabolic disease aids in the overall growth in the sterile injectable market.

COVID-19 Impact on Global Generic Sterile Injectable Market

The outburst of COVID-19 has affected most of the world's main markets, generic sterile injectable market is no exception. The Covid-19 pandemic has influenced leading countries across the world including China, India, the U.S., and other nations. Upsurge in the cost of raw materials and drugs owing to supply chain disruption, lockdown situations has affected growth of the generic sterile injectable industry. The pharmaceutical supply chain is easily broken and the impact of Covid-19 has taken it to the fore once again. However, COVID-19 is gradually solving the problem, with most businesses starting their facilities at full capacity.

Future of Global Generic Sterile Injectable Market

There have been a large many strategic acquisitions in the generic injectable market during the historic period of time. The acquisitions were motivated by the necessity to acquire a product portfolio, production capabilities from current injectable companies in order to consolidate share of the market or accelerate entrance into the lucrative sterile injectable market. Further, growing need for the target product is encouraging new industry players to enter in this competitive industry.

| Report Highlights | Details |

| Market Size | USD 108.54 billion by 2033 |

| Growth Rate | CAGR of 9.85% From 2024 to 2033 |

| Base Year | 2023 |

| Historic Data | 2020 to 2022 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Therapeutic Application, Distribution Channel, Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

| Companies Mentioned | Fresenius Kabi, Baxter, Civica, Pfizer, Mylan, Hikma, Sandoz, Teva, Nichi-Iko, 3M, Merck & Co., Inc., Others |

Driver

Diversification of Product Portfolio

In order to serve different therapeutic areas, dosage forms, and market segments, pharmaceutical companies in the generic sterile injectable market diversify their product offerings and examine potential avenues for market expansion into other regions. Generic sterile injectables are in high demand in some areas of the world, thus expanding into those areas can present substantial growth prospects. Invest in the creation and marketing of specialist generic injectables, such as those with intricate formulas, specialized markets, or little rivalry. Work together with other pharmaceutical businesses to gain access to new goods or technology through partnerships, license agreements, or acquisitions. This makes it possible to acquire complementary expertise and expand the product line more quickly.

Restraint

Complex Manufacturing Processes

Generic sterile injectables are made using intricate and strictly regulated manufacturing procedures that guarantee product efficacy, safety, and quality. Microbiological contamination must not be present in sterile injectable goods. To ensure sterility, techniques like autoclaving, filtration, and aseptic processing are employed. In order to prevent product contamination, aseptic processing entails keeping a sterile

atmosphere throughout the production process. The sterile drug product is filled into vials, syringes, or other containers in this process, and they are sealed under sterile circumstances. Throughout the manufacturing process, quality control is included to guarantee that the finished product satisfies the necessary quality standards. This entails checking the purity, potency, sterility, and other quality features of raw materials, in-process samples, and completed goods.

Opportunity

Specialty Injectables

Producing specialty injectables can be more difficult than producing generic injectables because they frequently require intricate formulas or manufacturing procedures. These drugs might be directed towards specific patient groups or uncommon illnesses for whom there are few therapeutic alternatives. Owing to their specific characteristics and possible reduced market share, specialty injectables might face less competition, which would enable producers to charge higher prices than those of conventional generic injectables. Specialty injectables can be profitable for producers even if their prices are usually higher since they can have longer exclusivity periods and larger profit margins, particularly if they are approved as orphan drugs or get other types of regulatory exclusivity.

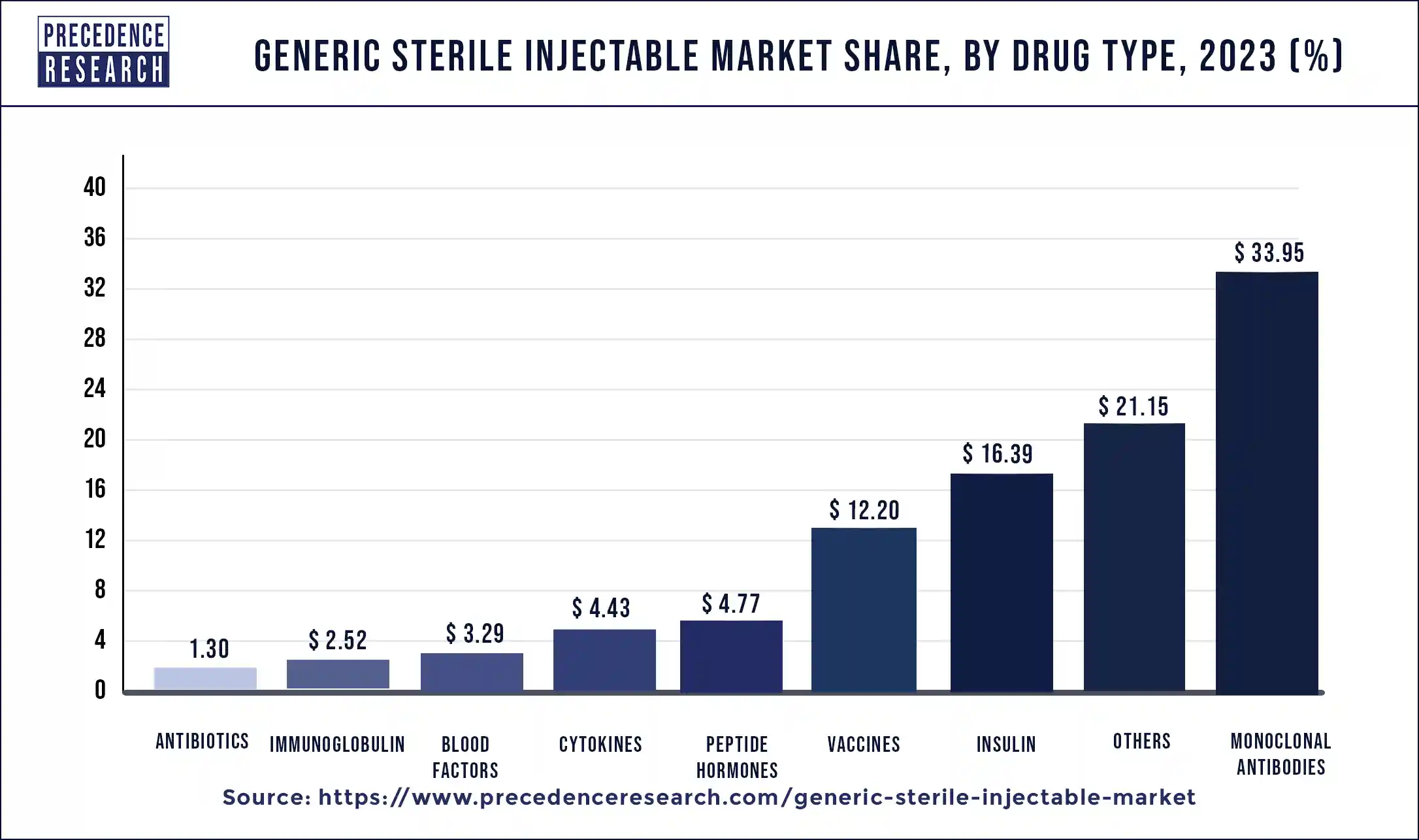

The monoclonal antibodies segment held the largest share of the market in 2023. The approval and commercialization of generic monoclonal antibodies products have received support from regulatory agencies throughout different areas, as long as the goods fulfill safety, effectiveness, and quality standards. The introduction of generic manufacturers into the antibodies’ sector has been made easier by this support. Owing to technological and manufacturing advancements, generic producers may now develop medicines that are just as effective and of similar quality as their branded equivalents. This has helped patients and healthcare professionals accept and use generic monoclonal antibodies.

The insulin segment, in 2023, held a notable share in generic sterile injectable market. The demand for insulin products has been mostly driven by the rising incidence of diabetes worldwide. The demand for insulin products is always high since diabetes is still a major global health concern. The market has become more accessible for generic manufacturers as a result of the patents for some branded insulin products expiring. The market is expanding as a result of the heightened competition and the release of generic insulin. In many cases, generic insulin products are more affordable than branded insulin, which increases accessibility for both patients and healthcare systems. This aspect of affordability drives the demand for generic insulin in the market for sterile injectables.

Generic Sterile Injectable Market By Drug Type, 2020-2023 (USD Million)

| Drug Type | 2020 | 2021 | 2022 | 2023 |

| Monoclonal Antibodies | 10,762.8 | 11,832.8 | 13,040.6 | 14,396.2 |

| Cytokines | 1,419.4 | 1,557.4 | 1,710.7 | 1,882.0 |

| Insulin | 5,338.5 | 5,822.6 | 6,357.7 | 6,951.4 |

| Peptide Hormones | 1,584.7 | 1,717.0 | 1,862.2 | 2,022.3 |

| Vaccines | 4,015.5 | 4,364.5 | 4,748.8 | 5,173.8 |

| Immunoglobulin | 853.7 | 919.4 | 991.1 | 1,069.6 |

| Blood Factors | 1,107.3 | 1,194.0 | 1,289.9 | 1,395.5 |

| Antibiotics | 437.3 | 472.1 | 510.6 | 553.1 |

| Others | 6,909.0 | 7,516.4 | 8,194.8 | 8,948.1 |

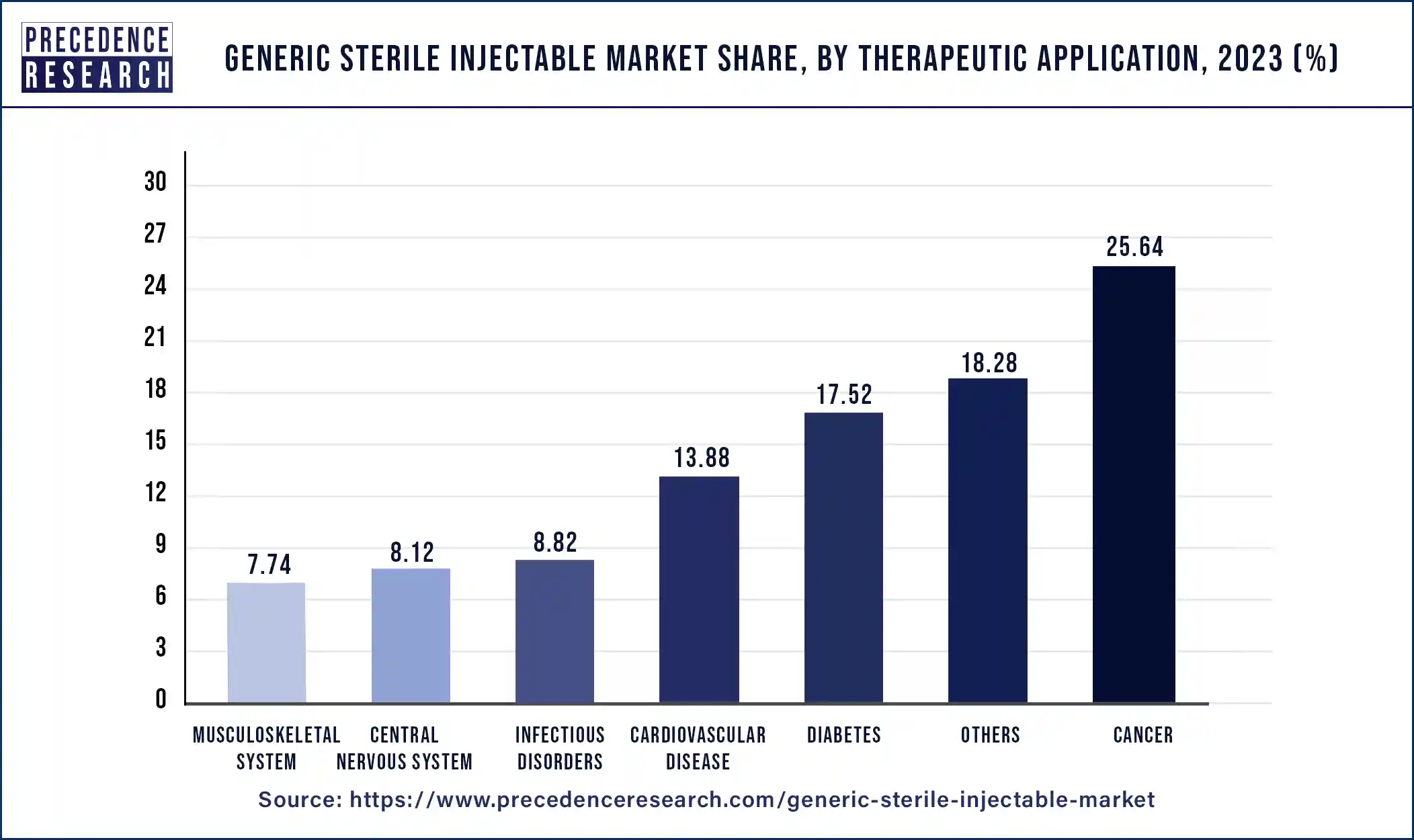

The cancer segment led the market in 2023. Cancer treatment can be expensive, placing a significant financial burden on patients and healthcare systems. Generic sterile injectables offer a more affordable option compared to branded medications, making them preferred choices for cost-conscious healthcare providers and payers. The supply chain for sterile injectable medications in the cancer segment is well-established, with established manufacturing facilities, distribution networks, and regulatory compliance standards. This ensures reliable access to generic cancer drugs, further solidifying their dominance in the market.

The diabetes segment is observed to grow at a notable rate during the forecast period in the generic sterile injectable market. Millions of people worldwide suffer from diabetes, a chronic illness. The need for drugs to treat diabetes is rising along with the condition's prevalence. For those with type 1 diabetes and frequently for those with type 2 diabetes who need insulin therapy, insulin is an essential drug. Because generic sterile injectable insulin is so important for controlling blood sugar levels, there has been a constant need for it. Numerous branded injectable diabetic drug patents have either expired or are about to expire. This has made it possible for generic manufacturers to enter the market with less expensive options, increasing competition and bringing down prices.

Generic sterile injectable drugs are less expensive than their branded equivalents. For diabetic patients who need to handle other medical costs in addition to frequent injections, this affordability element is very important. Patients now have easier access to these drugs thanks to improvements in the efficiency and quality of generic sterile injectable production brought about by technological advancements in manufacturing. Particularly developing areas are seeing advancements in the availability of necessary pharmaceuticals and the infrastructure supporting healthcare. The availability of generic, sterile injectable diabetes medicines is part of this expansion of healthcare services. Regulatory bodies, including the FDA in the US, have been expediting the clearance of generic medications, including sterile injectables, by simplifying procedures.

Generic Sterile Injectable Market By Therapeutic Application, 2020-2023 (USD Million)

| Therapeutic Application | 2020 | 2021 | 2022 | 2023 |

| Cancer | 8,059.7 | 8,885.6 | 9,820.3 | 10,872.4 |

| Diabetes | 5,655.2 | 6,185.9 | 6,774.1 | 7,428.8 |

| Cardiovascular Disease | 4,590.8 | 4,977.7 | 5,408.4 | 5,885.0 |

| Central Nervous System | 2,716.1 | 2,934.7 | 3,177.4 | 3,445.0 |

| Infectious Disorders | 2,927.3 | 3,172.7 | 3,442.3 | 3,739.5 |

| Musculoskeletal System | 2,517.2 | 2,747.1 | 3,001.5 | 3,283.9 |

| Others | 5,962.0 | 6,492.3 | 7,082.5 | 7,737.5 |

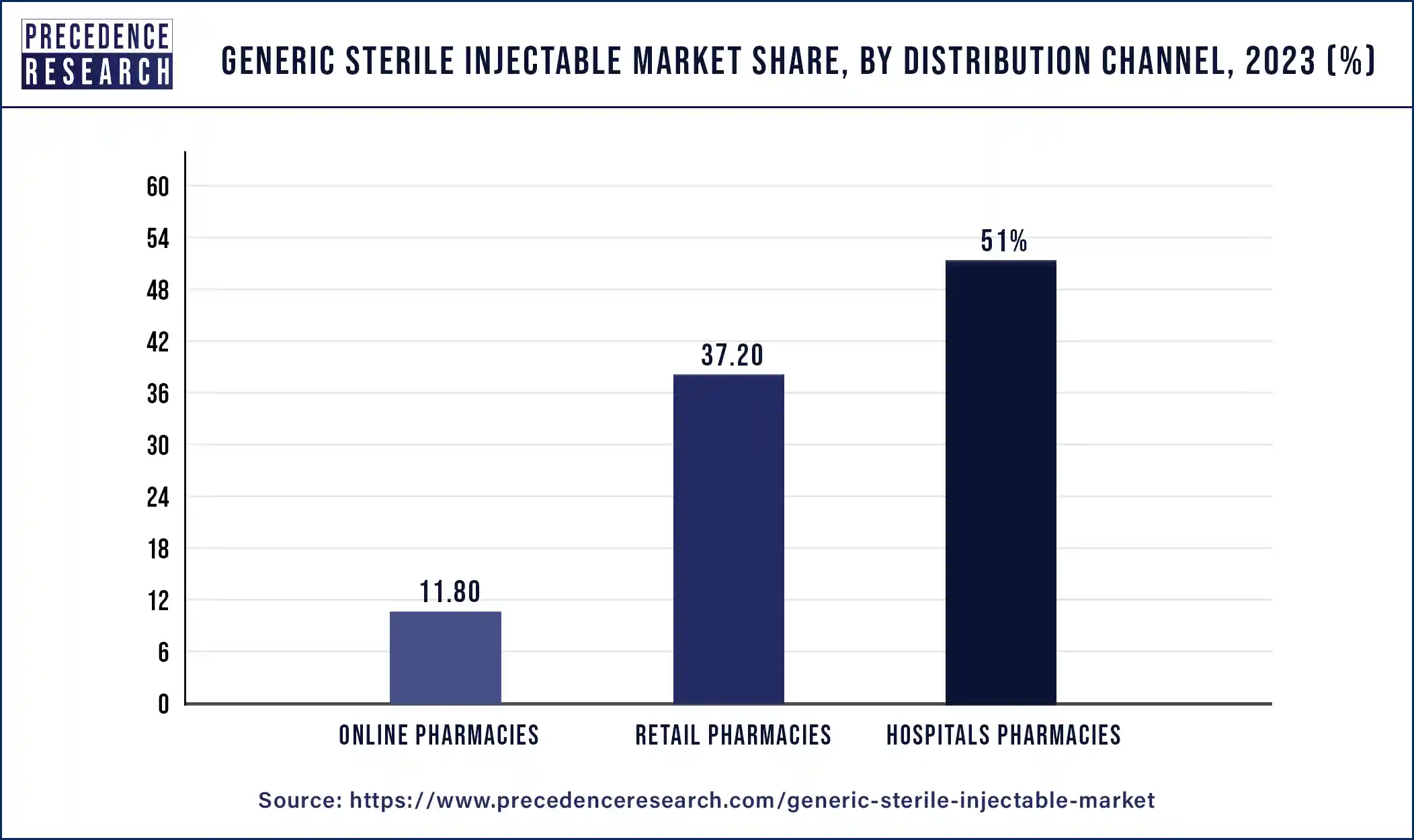

The hospitals segment holds the largest share in generic sterile injectable market. Generally speaking, generic medications are less expensive than their name-brand equivalents. Using generic sterile injectables can assist hospitals, which frequently have limited resources, save expenses without sacrificing the quality of patient treatment. Hospitals serve a lot of patients with all kinds of illnesses, many of which need injectable drugs to be treated. Generic sterile injectables are readily available, ensuring that hospitals can effectively serve the demands of their patient population. Hospitals are encouraged to include generic sterile injectables in their treatment procedures by government programs including formulary inclusion and generic substitution laws, which aim to increase the usage of generic drugs.

Generic manufacturers may release their versions of branded sterile injectables into the market after their patents expire, giving hospitals further access to reasonably priced pharmaceuticals. To provide patient care, hospitals need a steady supply of pharmaceuticals. Because they come from a variety of sources, generic sterile injectables lower the possibility of shortages brought on by hiccups in production or delivery. A broad spectrum of medicinal categories, such as antibiotics, anticoagulants, analgesics, and cancer medications, are covered by generic sterile injectables. Hospitals are able to efficiently treat a wide range of medical disorders because of this diversity. Strict regulatory standards are in place to guarantee the safety, effectiveness, and quality of generic sterile injectables. Hospitals can add these drugs to their formularies with confidence because they comply with regulations.

Generic Sterile Injectable Market By Distribution Channel, 2020-2023 (USD Million)

| Distribution Channel | 2020 | 2021 | 2022 | 2023 |

| Hospital Pharmacies | 16,579.9 | 18,078.0 | 19,754.7 | 21,620.7 |

| Retail Pharmacies | 11,967.4 | 13,103.7 | 14,365.3 | 15,771.4 |

| Online Pharmacies | 3,880.9 | 4,214.4 | 4,586.5 | 5,000.0 |

The companies focusing on research and development are expected to lead the global generic sterile injectable market. Leading competitors contending in global generic sterile injectable market are as follows:

For the better understanding the recent situation of the global generic sterile injectable market and for most policies of the country, Precedence Research forecast the future evolution of the generic sterile injectable industry. This research study offers qualitative and measureable insights on generic sterile injectable market and valuation of market size and development trends for global market segments.

Major Market Segments Covered:

By Drug Type

By Therapeutic Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

February 2024

February 2024