June 2025

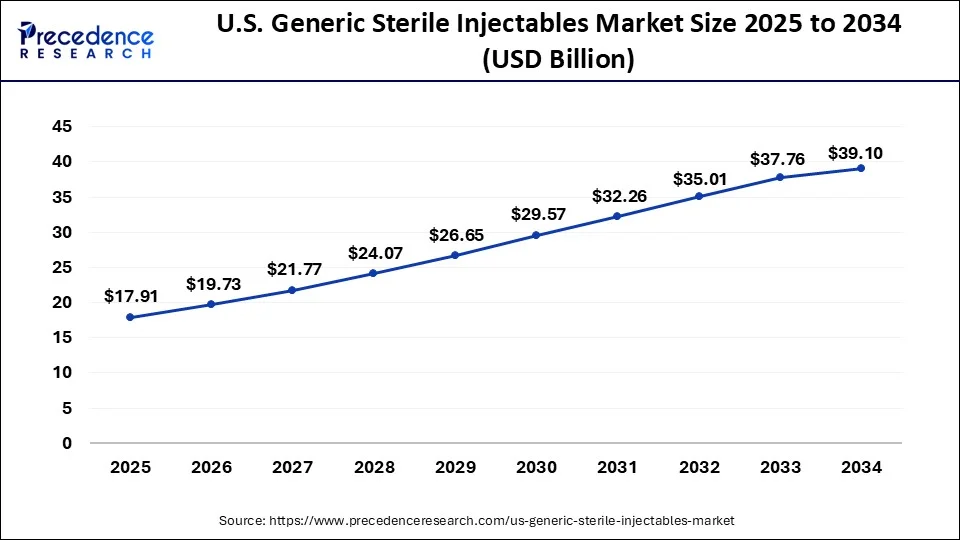

The U.S. generic sterile injectable market market size is estimated at USD 17.91 billion in 2025 and is predicted to reach around USD 39.10 billion by 2034, accelerating at a CAGR of 9.15% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. generic sterile injectables market size was valued at USD 16.29 billion in 2024 and is projected to surpass around USD 39.10 billion by 2034, growing at a CAGR of 9.15% from 2025 to 2033.

Pharmaceutical goods that are comparable to their branded equivalents in terms of active components, dosage form, strength, method of administration, quality, safety, and efficacy are referred to as generic injectables, also known as generic sterile injectable medications. The US generic sterile injectables market offers drugs that are injected and utilized for a variety of therapeutic goals, such as the management of both acute and chronic diseases. After the original brand-name medicine manufacturers' patents expire, generic injectables are made. Other pharmaceutical companies are free to create and produce generic copies of the injectable medication after the patent protection expires. To guarantee their safety, efficacy, and quality, regulatory agencies like the US Food and Drug Administration (FDA) subject these generic versions to stringent testing and approval procedures.

State-wise Insights

California US generic sterile injectables market trends

California is a major contributor to the US generic sterile injectables market. The well-established contract manufacturing facilities for generic sterile injectables help in the growth of the market. The growing population and increasing prevalence of chronic diseases like cardiovascular conditions, diabetes, and cancer increase demand for generic sterile injectables. Access to affordable healthcare and a strong biotechnology sector drive the market growth. The growing shift towards injectable treatments, aging populations, and increasing age-related conditions supports the overall growth of the market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.79% |

| U.S. Market Size in 2025 | USD 17.91 Billion |

| U.S. Market Size by 2034 | USD 39.10 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type, By Therapeutic Application, and By Distribution Channel |

Driver: Rising prevalence of chronic disease

One of the main factors propelling the growth of the US generic sterile injectables market is the rising incidence of chronic illnesses. Chronic illnesses requiring long-term care and medicine include diabetes, cancer, and cardiovascular diseases (CVDs). In the treatment of various ailments, generic injectables like insulin for diabetes, chemotherapeutic medicines for cancer, and antihypertensive drugs for cardiovascular problems are essential.

Moreover, a greater population can obtain generic injectables due to their affordability in areas that have inadequate or expensive healthcare infrastructure. Healthcare systems are also concentrating on striking a balance between cost-effectiveness and quality. Accordingly, generic injectables offer a practical choice as they offer the required medications at a far lower cost than their branded equivalents, enabling more extensive disease control and containment.

Restraint: Regulatory complexity and quality control

The licensing process for generic sterile injectables might include a convoluted and stringent regulatory framework. Pharmaceutical firms have challenges in adhering to regulatory standards, including good manufacturing practices (GMP) and strict bioequivalence criteria. Overcoming these regulatory obstacles might require a lot of effort and time.

Furthermore, it is essential to guarantee the sterility and safety of injectable sterile items. It might be difficult to achieve strict sterility requirements and maintain consistent quality in manufacturing procedures. Any breaches in quality control may result in legal action, product recalls, and harm to the producers' brands. Thus, this is expected to hamper the US. generic sterile injectables market over the forecast period.

Opportunity: A rising number of branded medications patents expiring

The US generic sterile injectables market has an excellent possibility when branded injectables' patents expire. Once the patent expires, generic medicine producers are free to make and market copies of the branded product. Moreover, they may manufacture comparable drugs without having to pay for the preliminary research and development expenses, which allows them to pass the savings along to customers in the form of cheaper rates.

Since generic pharmaceuticals are bioequivalent to branded medications that have previously received regulatory clearance, they often gain approval more quickly. This shortens the time to market and increases the number of vital pharmaceuticals available to consumers. Furthermore, the widespread manufacture of pharmaceuticals that were previously prohibited by intellectual property (IP) rules is made possible by patent expiration. Consequently, the expiration of a patent facilitates the growth of the US generic sterile injectables market in the United States, so yielding advantages for both producers and end users.

The monoclonal antibodies segment dominated the US generic sterile injectables market in 2024. Numerous therapeutic fields, such as cancer, autoimmune disorders, and infectious illnesses, have found use for monoclonal antibodies. Healthcare practitioners' acceptance of biosimilars and their availability for a range of therapeutic indications are critical factors influencing the success of generic sterile injectables in this market.

The vaccine segment is expected to grow at a rapid rate over the forecast period. Generic vaccines can help increase access to preventative treatment, especially in areas with low funding. A greater number of reasonably priced generic vaccinations available may improve immunization rates and improve public health outcomes. Thereby, driving the segment expansion.

The cancer segment held the dominating share of the US generic sterile injectables market in 2024. The segment expansion is attributed to the increasing prevalence of cancer in the US Moreover, cancer therapies are quite costly and frequently needed for long-term medication administration and drug combinations. Accordingly, generic injectables provide a reasonably priced substitute for name-brand medications, easing some of the financial strain on individuals and healthcare systems.

Additionally, the oncology industry has seen branded medicine patents expire, providing generic pharmaceutical companies with an opportunity to market their versions of these therapies. Furthermore, the need for generic injectables is being aided by the intricacy of cancer treatment procedures, which frequently need tailored medicines. Furthermore, injectables are more often employed when cancer therapies call for hospitalization or clinical drug administration. Thus, driving the segment growth.

The US generic sterile injectables market is bifurcated into hospitals, drug stores, retail pharmacies, and others. The hospital segment held the largest share of the market in 2023, the segment is observed to sustain the dominance throughout the forecast period. Injectables can be precisely and immediately administered in hospitals, which is especially important in emergency circumstances like intensive care units (ICUs) when prompt intervention can save lives. In addition, they treat a wide range of medical diseases and a large patient volume, including procedures and chronic illness management.

Because of their adaptability, generic injectables may be employed in a variety of departments and are a preferred choice for a wide range of therapeutic applications. In addition, hospitals are equipped with the experienced medical personnel and temperature-controlled storage needed to handle the intricacies of administering injectable drugs. Furthermore, hospitals prefer to use generic injectables due to the growing demand to control healthcare expenses properly.

California US generic sterile injectables market trends

California is a major contributor to the US generic sterile injectables market. The well-established contract manufacturing facilities for generic sterile injectables help in the growth of the market. The growing population and increasing prevalence of chronic diseases like cardiovascular conditions, diabetes, and cancer increase demand for generic sterile injectables. Access to affordable healthcare and a strong biotechnology sector drive the market growth. The growing shift towards injectable treatments, aging populations, and increasing age-related conditions supports the overall growth of the market.

By Product Type

By Therapeutic Application

By Distribution Channel

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2025

April 2024

January 2025

May 2025