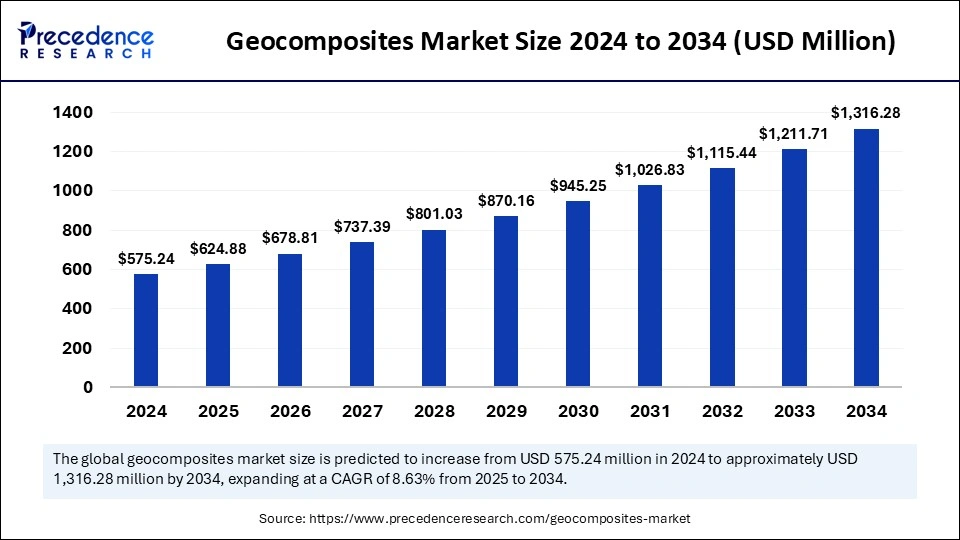

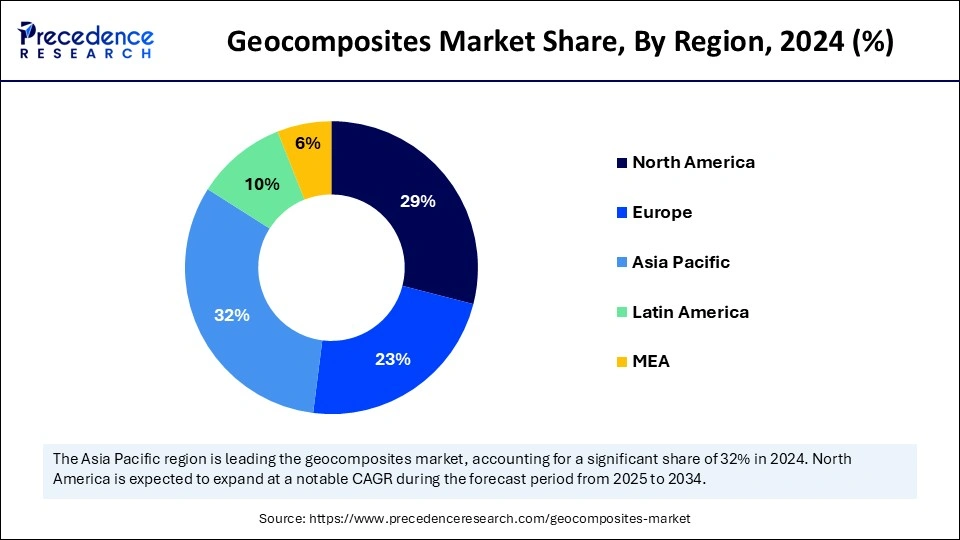

The global geocomposites market size is calculated at USD 624.88 million in 2025 and is forecasted to reach around USD 1,316.28 million by 2034, accelerating at a CAGR of 8.63% from 2025 to 2034. The Asia Pacific market size surpassed USD 184.08 million in 2024 and is expanding at a CAGR of 8.80% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Million), with 2024 as the base year.

The global geocomposites market size was estimated at USD 575.24 million in 2024 and is predicted to increase from USD 624.88 million in 2025 to approximately USD 1,316.28 million by 2034, expanding at a CAGR of 8.63% from 2025 to 2034. The market growth is driven by increasing infrastructure development and the rising adoption of geocomposites in sustainable construction and water management projects.

Integrating Artificial Intelligence technologies in the manufacturing processes of geocomposites optimizes production parameters and identifies inefficiencies. The deployment of automated systems that use AI algorithms streamlines operations while enhancing productivity, thus enabling companies to achieve greater efficiency in scaling operations. AI helps businesses create customized marketing strategies to connect better with their audience, thereby increasing sales. AI-driven quality control systems enable consistent product quality, reducing product defects and waste. Moreover, manufacturers can use AI analytical solutions to predict future demands, optimize supply chain management perations, and deliver superior customer interactions. The analysis of substantial datasets through machine learning algorithms helps businesses find patterns that result in strategic planning.

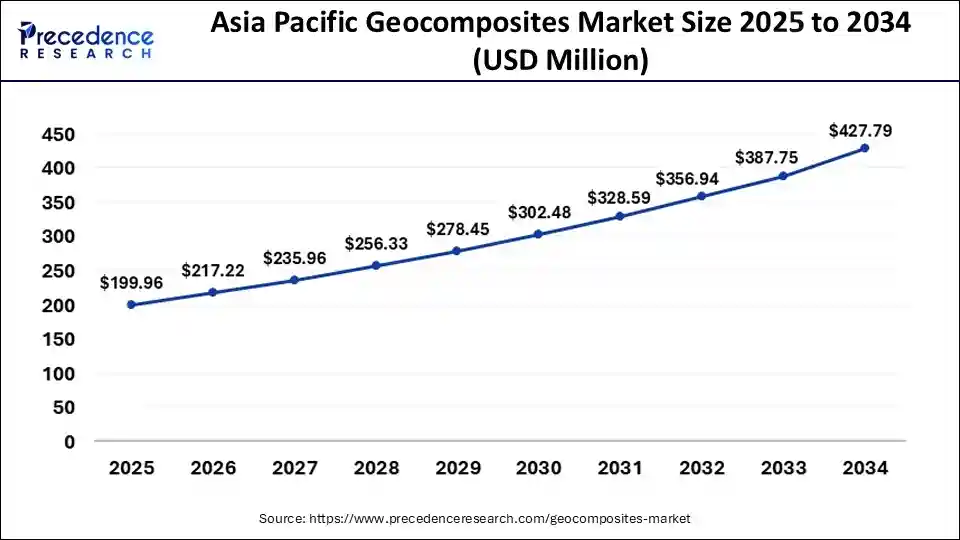

The Asia Pacific geocomposites market size was exhibited at USD 184.08 million in 2024 and is projected to be worth around USD 427.79 million by 2034, growing at a CAGR of 8.80% from 2025 to 2034.

Asia Pacific led the geocomposites market by capturing the largest share in 2024. This is mainly due to the rapid pace of urbanization and increase in infrastructure development, especially in emerging countries like China, India, and Japan. With the increased urban population and per capita income, there is rising spending on construction projects. As geocomposites provide necessary drainage solutions and erosion control in addition to soil stabilization, they are widely used as sustainable construction materials.

China plays a major role in the Asia Pacific geocomposites market. This is mainly due to the expanding highway and railway networks, in which geocomposites are essential in soil reinforcement and erosion prevention. India is also a significant player in the market. The rising smart city projects and highway expansion projects under the government’s Bharatmala Pariyojana project are supporting market expansion. Japan’s strong emphasis on developing flood control systems and disaster-resistant infrastructure to strengthen structures within flood-prone areas is contributing to regional market growth.

Europe is anticipated to witness the fastest growth in the market during the forecast period. The regional market growth can be attributed to the rising number of infrastructure development projects. There is a high demand for sustainable construction materials in the European construction sector. The German government is investing heavily in updating railway infrastructure and flood protection measures, boosting the demand for geocomposites in drainage systems. Furthermore, the Baltic Sea area and other coastal zones depend heavily on geocomposites to execute erosion control procedures, which help counter the effects of shoreline deterioration.

Middle East & Africa is observed to grow at a considerable growth rate in the upcoming period, owing to rapid urbanization and increasing construction activities, especially in Saudi Arabia and the United Arab Emirates (UAE). Environmental regulations within the Dubai Building Code promote sustainable construction through the deployment of environmentally friendly materials, such as geocomposites, to improve sustainability while maintaining structural stability. Furthermore, the rising demand for efficient water management systems and the expansion of the construction sector are likely to boost the growth of the geocomposites market in Middle East & Africa.

The geocomposites market is witnessing rapid growth as the building & construction sector is seeking sustainable materials that provide environmental advantages. Geocomposites harness the capabilities of geosynthetics via engineered connections between geotextiles, geogrids, and geomembranes. They are widely used in civil engineering projects requiring separation and reinforcement, and drainage and filtration functions. Their ability to stabilize soil and reduce erosion, alongside infrastructure longevity extension, makes them essential for modern construction. The rising urbanization and infrastructure development are boosting the growth of the market. With the growth in construction activities, the urgency to control erosion has increased over the years. Furthermore, the municipalities' need for resilient, sustainable infrastructure that withstands environmental impacts supports market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,316.28 Million |

| Market Size in 2025 | USD 624.88 Million |

| Market Size in 2024 | USD 575.24 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.63% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Function, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Investments in Infrastructure Development

The rising investments in infrastructure development projects worldwide are driving the growth of the geocomposites market. According to the World Bank’s 2024 report, global investments through private entities in infrastructure projects in low- and middle-income countries reached USD 86 million in 2024 through 322 ventures distributed across 68 nations. As the construction of roads, highways, and bridges rises, so does the demand for geocomposites due to their cost-effectiveness and durability.

In addition, the rising worldwide focus on building better transportation, waste disposal, and water management systems drives market growth. Engineers embrace geocomposites over other materials due to their superior drainage capabilities, filtration functions, and soil stabilization properties that result in durable infrastructure. The rapid expansion of urban areas across emerging economies further contributes to market growth since these regions focus on developing infrastructure, including highways and bridges.

Fluctuating Raw Material Prices

Constant fluctuations in the prices of raw materials required for geocomposites hamper the market's growth. Fluctuations in raw materials prices lead to high production costs, reducing profitability for manufacturers. The production of geocomposites requires petroleum-based polymers, reinforcing fibers, and adhesives. These materials are subject to price volatility due to supply chain disruption, increased crude oil prices, and geopolitical conflicts. Price fluctuations in raw materials create manufacturing instability, limiting the market’s growth.

Rising Focus on Sustainable Construction

The rising focus on sustainable construction is expected to create immense growth opportunities in the geocomposites market. Geocomposites are suitable for sustainable building construction due to their durability and environmentally friendly nature. The increasing investments in eco-friendly infrastructure projects are projected to propel the market in the coming years. The rising regulations to reduce carbon emissions are key to boosting the focus on sustainable construction practices. This, in turn, creates the need for sustainable construction materials, including geocomposites, to meet carbon emission targets. The properties of geocomposites, like improved land stabilization and water drainage while protecting against erosion, make them ideal material for sustainable infrastructure.

The geotextile-geonet segment dominated the geocomposites market in 2024. Geotextile-geonet provides excellent drainage properties with affordable cost benefits. These composites have excellent filtration capabilities with superior flow output, which makes them suitable for use in landfills to collect leachate, ensure drainage across roads and railways, and prevent erosion on structures. New construction projects choose geotextile-geonet composites as they excel at maintaining soil stability during water flow management, thus preventing civil engineering structures from failing. The rise in infrastructure development activities bolstered the segmental growth.

The geotextile-geocore segment is expected to grow at the fastest rate in the foreseeable future. The segmental growth is attributed to the rising need for drainage and containment solutions, specifically in highway constructions. Engineers heavily used geotextile-geocore composites for their excellent load support capability and enhanced soil stability, which makes them perfect for demanding reinforcement needs. Furthermore, improvements in manufacturing technologies can boost the production of geotextile-geocore, supporting segmental growth.

The drainage segment held the largest share of the geocomposites market in 2024 due to the rise in investments in infrastructure development. Roads, railways, landfills, and retaining structures require effective water management solutions. Geocomposites are heavily used in drainage systems due to their ability to handle large drainage capacities in a single plane and provide efficient water distribution, which protects against water-related structural damage. The rapid pace of urban development and worldwide infrastructure expansion demand superior drainage systems, bolstering segmental growth.

The separation segment is anticipated to grow at the highest CAGR during the studied years. Geocomposites used for separation applications successfully stop different soil layers from blending, extending the lifespan of infrastructure by preserving each layer's structural integrity. Government agencies and private sectors are investing heavily in infrastructure developments, boosting the market demand for geocomposites for separation systems. Furthermore, the geosynthetics usage in India's urban infrastructure projects has rapidly increased, especially in Western Indian states like Maharashtra and Gujarat, fueling the segmental growth.

The road & highways segment dominated the geocomposites market in 2024. This is mainly due to the rise in road & highway construction and renovation projects. The expansion of road networks received substantial funding from governments and private groups as they sought better connectivity to boost economic development. The U.S. Department of Transportation’s Federal Highway Administration (FHWA) has announced the allocation of USD 61 million in the Fiscal Year 2024 for 12 formula programs. This funding is designated to support essential infrastructure development, such as roads, bridges, and tunnels. Geocomposites are heavily used in modern road construction because they deliver higher durability while boosting structural performance.

The water & wastewater management segment is projected to expand rapidly in the coming years due to rising concerns about wastewater management. Governments in various countries have established rigorous wastewater regulation standards that push industries and municipalities to choose geocomposite solutions as their treatment standard. Geocomposites are used to build reservoirs and canals while creating landfill liners, as they have exceptional drainage, filtration, and reinforcement capabilities.

By Product

By Function

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client